The Ratings & Reviews specialist doing more with UGC to grow your business

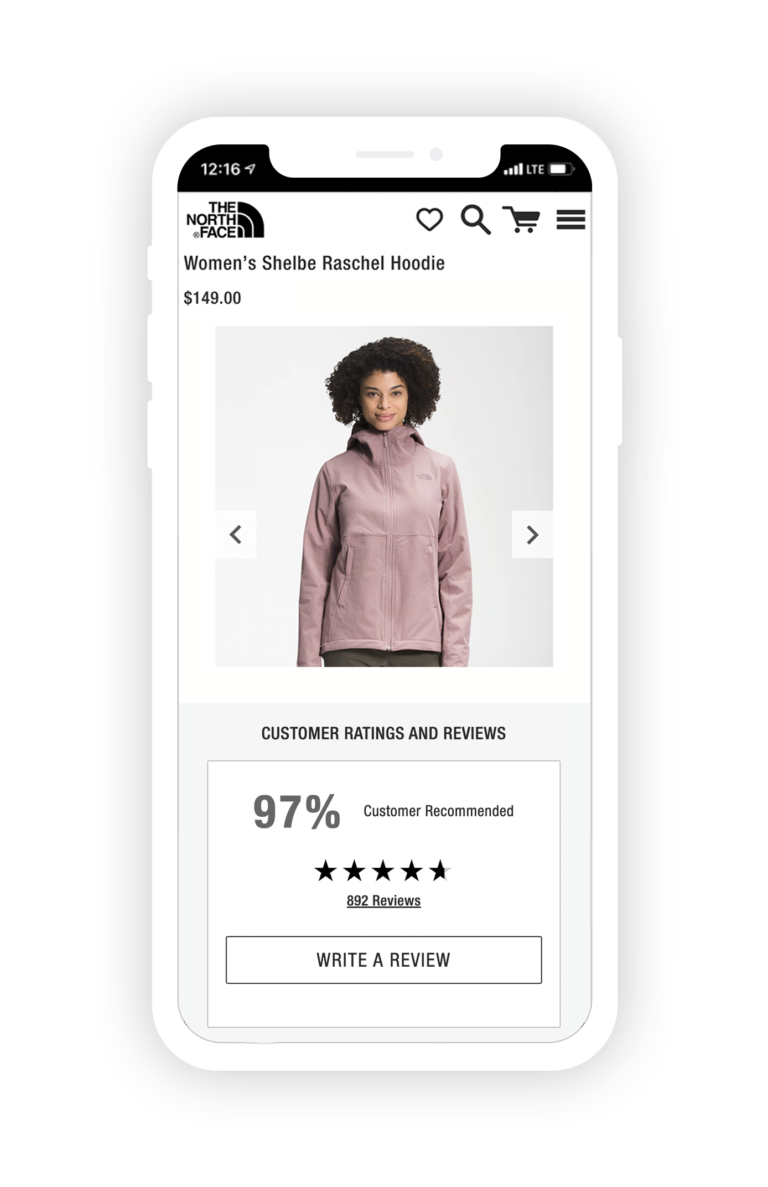

Maximize conversions by creating the best Ratings and Reviews program.

Build a conversion-focused UGC collection strategy.

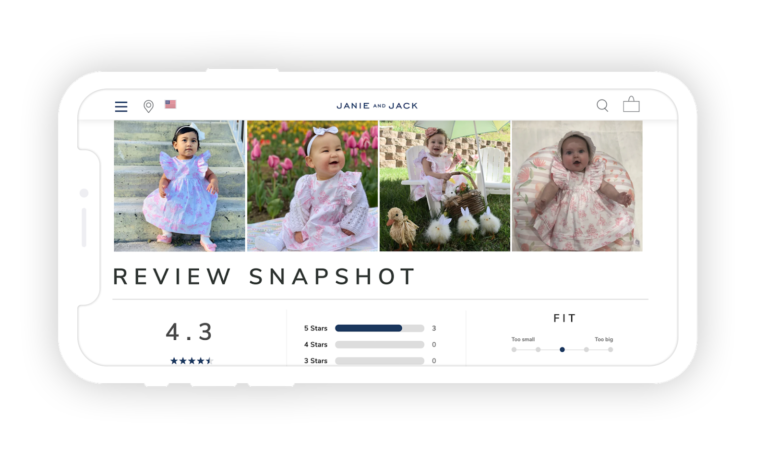

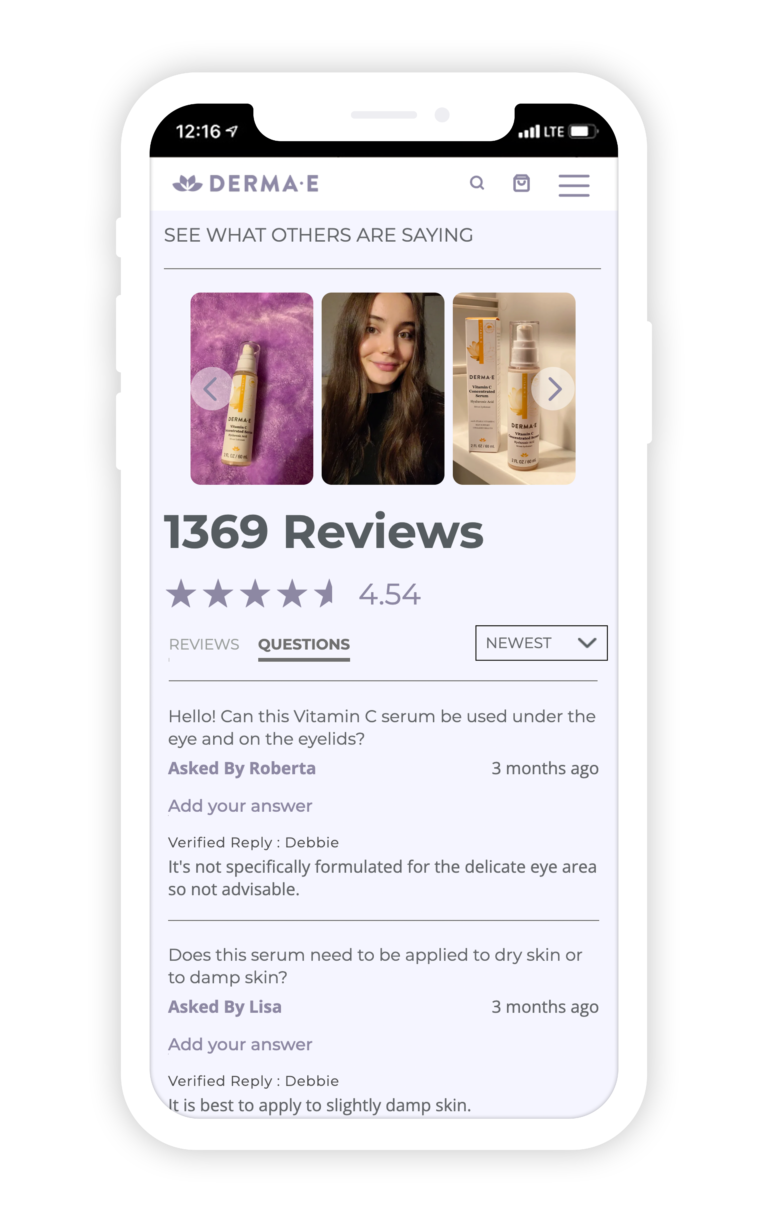

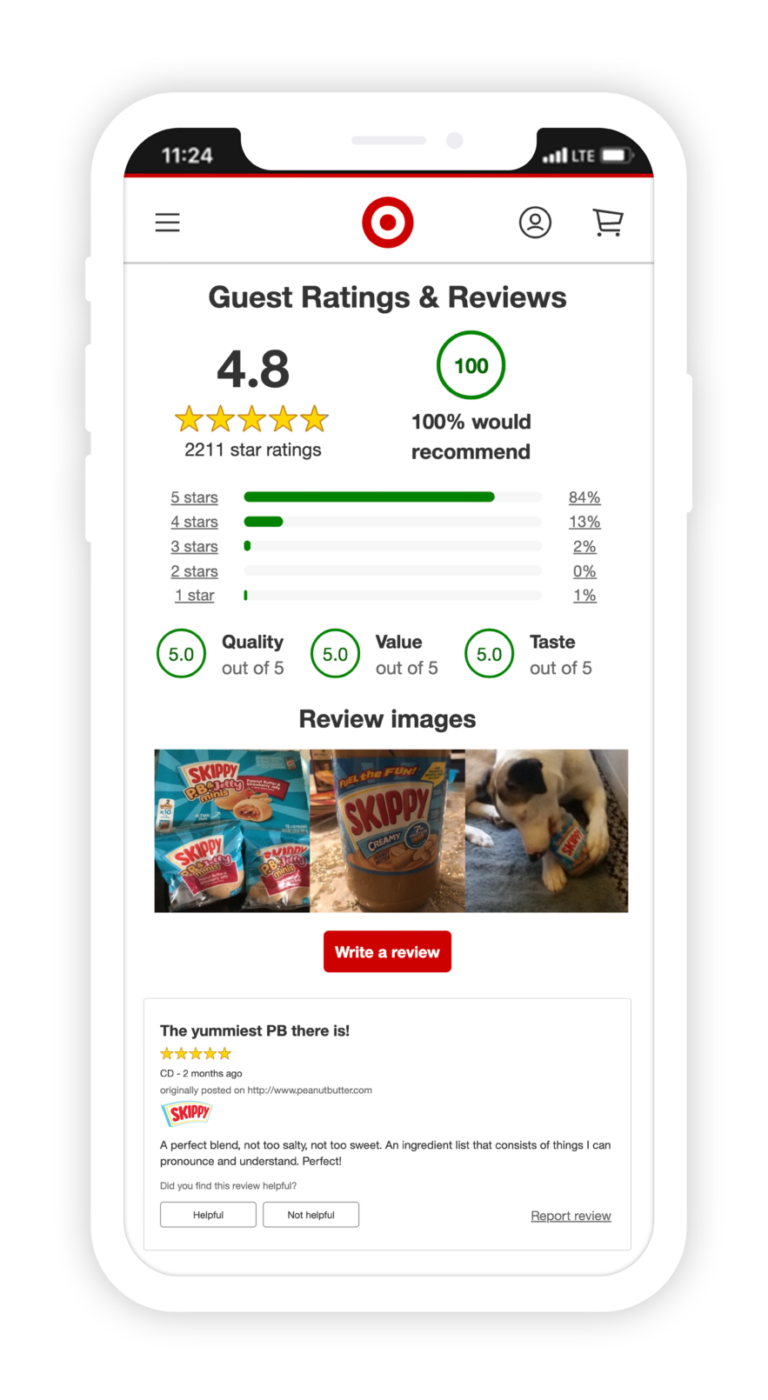

Flexible, brand-aligning displays to ensure you maximize the value of the UGC you collect.

Whether you’re a brand looking to get more UGC out or a retailer looking to bring more UGC in, we syndicate more content to more places.

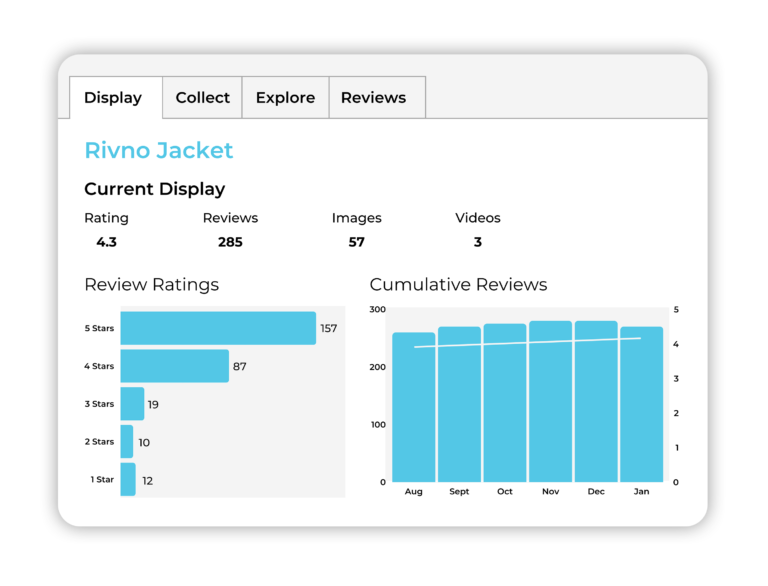

Do more with your UGC: Understand, benchmark, and enhance product experience and positioning.

Our people are data-driven UGC experts and know how to get you to the next level

| G2 Relationship Index Rankings | ||

|---|---|---|

| Company | Score | |

| PowerReviews | 9.44 | |

| Major Competitor 1 | 8.69 | |

| Major Competitor 2 | 8.47 | |