Over the last month, we’ve been analyzing consumer activity across more than 1.5MM online product pages from more than 1,200 retail/brand sites.

Between February 24 2020 and March 24 2020, we specifically looked at review submission levels, review length and sentiment, overall conversions/sales and review consumption.

Given this has been quite possibly the most disruptive retail and ecommerce month of all time, the results are – as you can imagine – very revealing.

The surge in online traffic and sales volumes have been well documented. But what impact has COVID-19 had on rating and review trends? And what do these say about broader market trends?

Consumer review behavior:

Key trends in COVID-19 era

01

02

03

Order volume and conversions are up but traffic stable

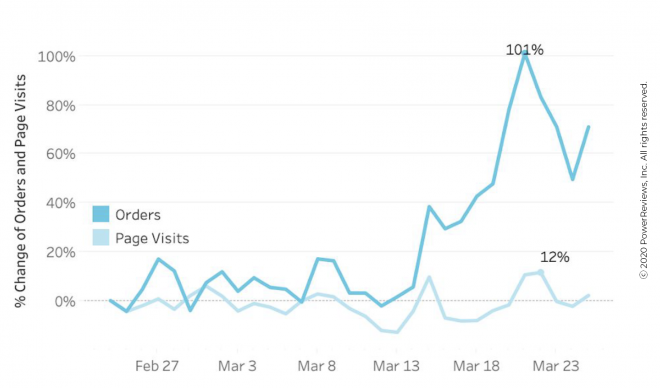

Unsurprisingly and as reported widely elsewhere, our data reveals that online purchase levels are way up on normal during these times of social distancing.

However, product page traffic has been steady – noteworthy given the perception people have been living their lives online over the past few weeks. But shoppers are being way more decisive: conversion rates on March 21 were 101% the level they were less than a month earlier. We attribute these trends to consumers buying lower consideration products so spending less time browsing. This is a time when people are focusing on things they need vs things they want (e.g toothpaste instead of a sofa upgrade).

Traffic steady but conversions skyrocket

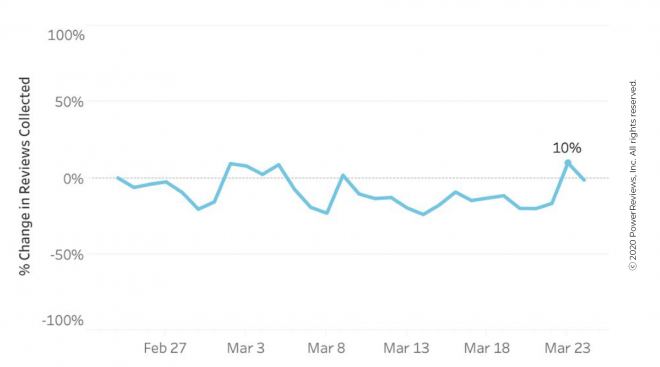

Review submission levels and sentiment stable but review length shortens

The COVID-19 pandemic has had little impact on consumer motivation to provide reviews, nor the underlying sentiment when doing so. We are not able to attribute any variation in either submission levels or overall ratings accompanying each review.

However, we did notice a significant difference in review length – with a 22% fall between February 24 and March 22. We believe this is either because consumers do not have the time time due to increased stress and/or greater need to multitask throughout this period.

Review volume stable

Review length falls significantly but sentiment stable

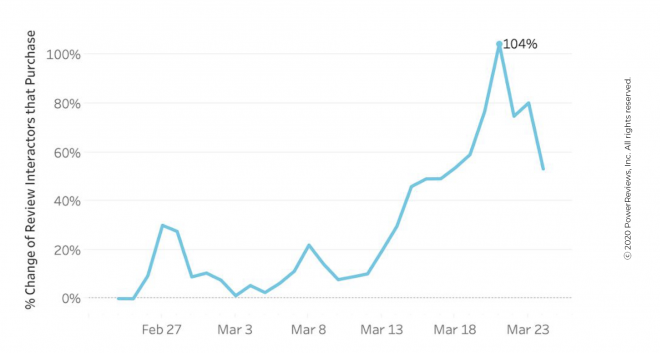

Review engagement surges

Reviews have become even more important in the COVID-19 era. Consumers are interacting with review content (sorting, filtering etc) before converting at as much as double the rate they were at the backend of February.

This is clear evidence that shoppers are now seeking significantly greater validation for their purchases, most likely because low inventory levels are forcing them to buy products they hadn’t previously before.

Review engagement increases significantly

Summary

Ratings and review content is having greater impact on consumer behavior in the COVID-19 era, providing the validation and social proof necessary to drive sales. According to our figures, conversions and review engagement peak within the same two day period (March 21st and 22nd 2020).

But it’s not just the fact that both these metrics increase that is significant, it’s the extent to which this is the case. Both conversions and review engagement more than doubled in less than a month.

However, review length is down in the same period. Given broader consumer trends of high conversion levels and the fact that review submission lags behind time of purchase, the next month represents an excellent opportunity to generate deep and impactful review content from your customers.