Survey at a Glance:

Beyond the Basics: Key Information Shoppers Look for in Product Reviews is based on a survey of 11,165 consumers across the United States. Here’s a snapshot of our key findings.

- 58% of consumers say a star rating alone isn’t as valuable as a star rating with an accompanying review.

- 99% of shoppers look beyond basic summary information to read the actual review content at least sometimes; 88% do so regularly or always.

- 62% of shoppers who spend $2,001+ per month always go beyond basic review information to read the content of reviews, compared to 41% of those who spend $1-$250 per month.

- Top reasons consumers read raw content of reviews include learning about negative experiences (84%), use cases (78%), and performance claims (73%) and sizing information (70%).

- 97% of shoppers actively seek out longer, more detailed reviews at least sometimes; 68% do so always or regularly.

- Categories where review length matters most: consumer electronics and appliances (86%), health and beauty (73%), clothing, shoes and accessories (71%), and home decor and home improvement (67%).

- 94% seek out visual content within reviews at least sometimes; 58% do so always or regularly.

- User-generated visual content is important across all categories. But it’s especially impactful for clothing, shoes, and accessories (76%), home decor and home improvement (67%), consumer electronics and appliances (64%), and health and beauty (56%).

- Nearly a quarter (24%) of Gen Z shoppers won’t purchase a product if there is no visual content from people who previously bought it.

- 77% of shoppers find it useful to be able to filter reviews based on different factors (ie star rating, reviewer demographics, etc.).

- 61% of consumers actively seek out one-star reviews.

- Over half (55%) of consumers seek out reviews that have been voted or tagged as “helpful” by other shoppers; 73% of Gen Z shoppers do so.

- 72% find a review search feature to be useful.

Introduction

The Power of Reviews is Clear

By now, one thing is crystal clear: consumers depend on reviews when shopping for just about anything. A whopping 99.9% consult this content when shopping online – and 57% do so when shopping in brick-and-mortar stores.

Not All Reviews are Created Equal

But not all reviews deliver the same amount of value to shoppers. While one review might provide rich, relevant insights that help shoppers make smart purchase decisions, another might leave them with more questions than answers.

What sets some reviews apart from the rest?

Shoppers Look for Multiple Factors When it Comes to Product Reviews

The reality is: consumers look for several factors when it comes to reviews. In our last report, we focused on two of those key factors: recency (in other words, how recently a review was written) and volume (how many reviews are available for a given product).

When it Comes to Reviews, Quality is Key

In this report, we zero in on yet another top factor that matters to shoppers: review content quality. In other words: specifically what type of review content leads shoppers to follow through on purchasing a product.

And as it turns out, there are many elements to consider.

In this report, we’ll share key findings from our latest survey. We’ll explore:

- The importance of review quality

- What shoppers look for in review content

- How the absence (or presence) of certain elements impacts purchase behavior

- How shoppers engage with reviews to find the content that fits their needs

Start Collecting and Displaying Better Quality Reviews

Based on our findings, we’ll also share tips for generating higher quality reviews that meet the standards of modern shoppers, as well as best practices for displaying this content in a way that satisfies shoppers – and boosts conversion.

Who We Surveyed

This research is based on a survey conducted in February 2022 of 11,165 US consumers. Here’s a closer look at who we surveyed.

Generations

(1997-present)

(1981-1996)

(1965-1980)

(1946-1964)

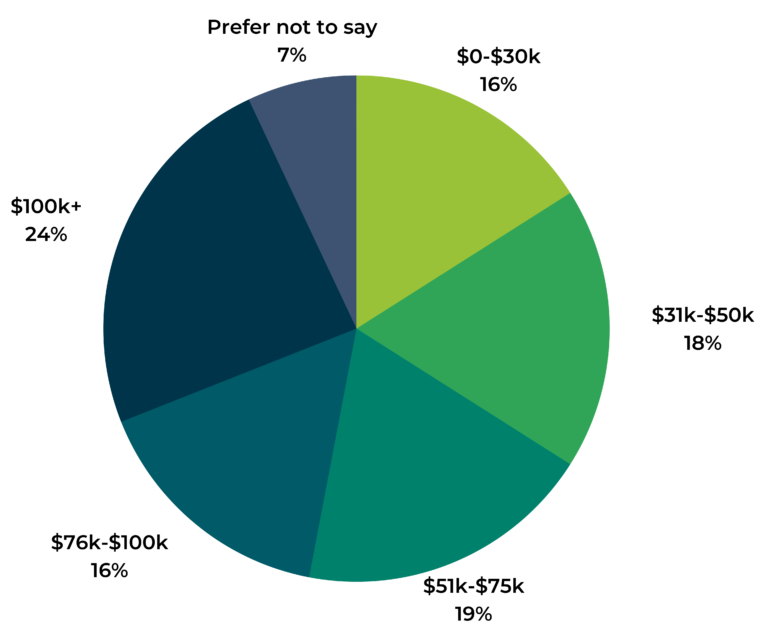

Household Income

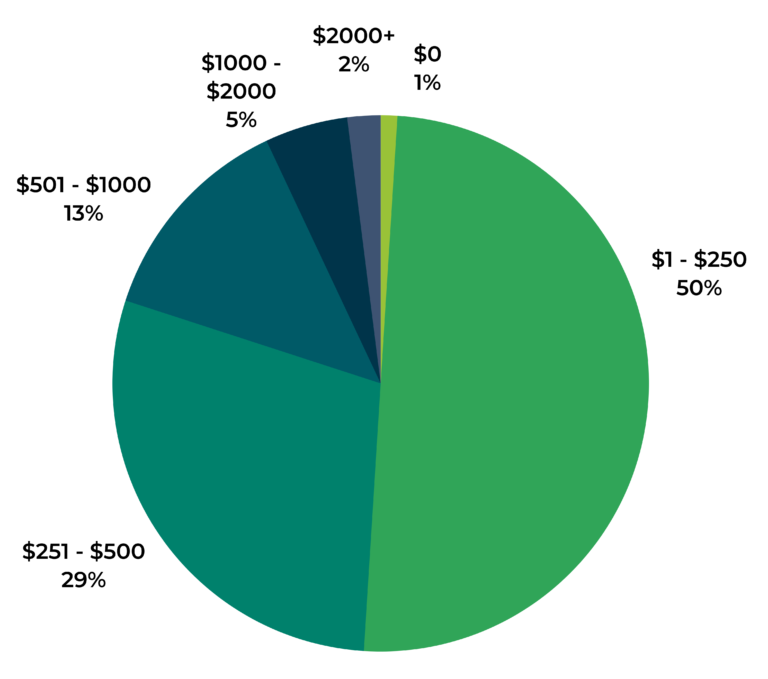

Average Monthly Online Spend

When it Comes to Reviews, Consumers Go Beyond the Basics

Today, nearly all shoppers turn to reviews when shopping online – and over half (57%) do so when shopping in brick-and-mortar stores. But just how deeply are consumers diving into the content of reviews?

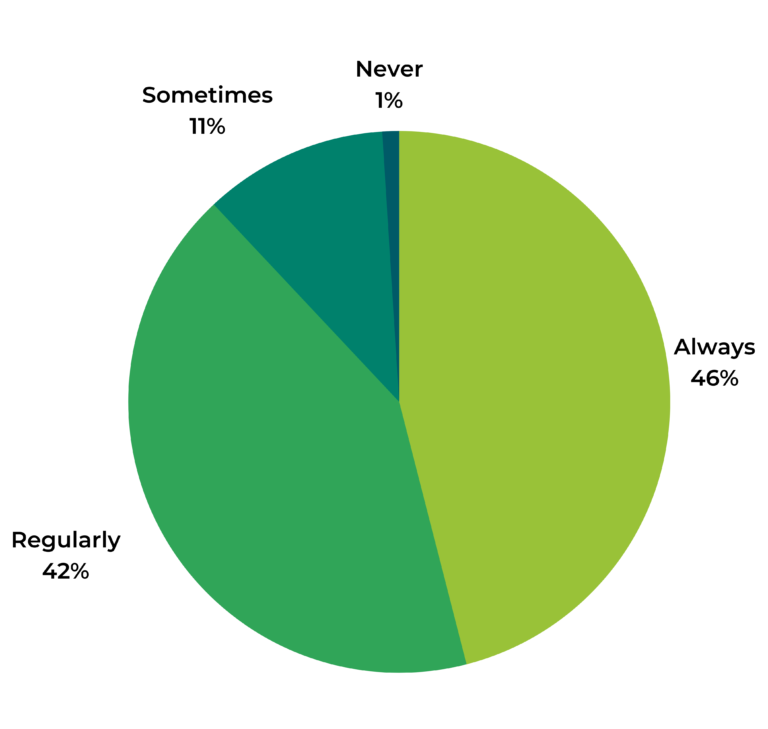

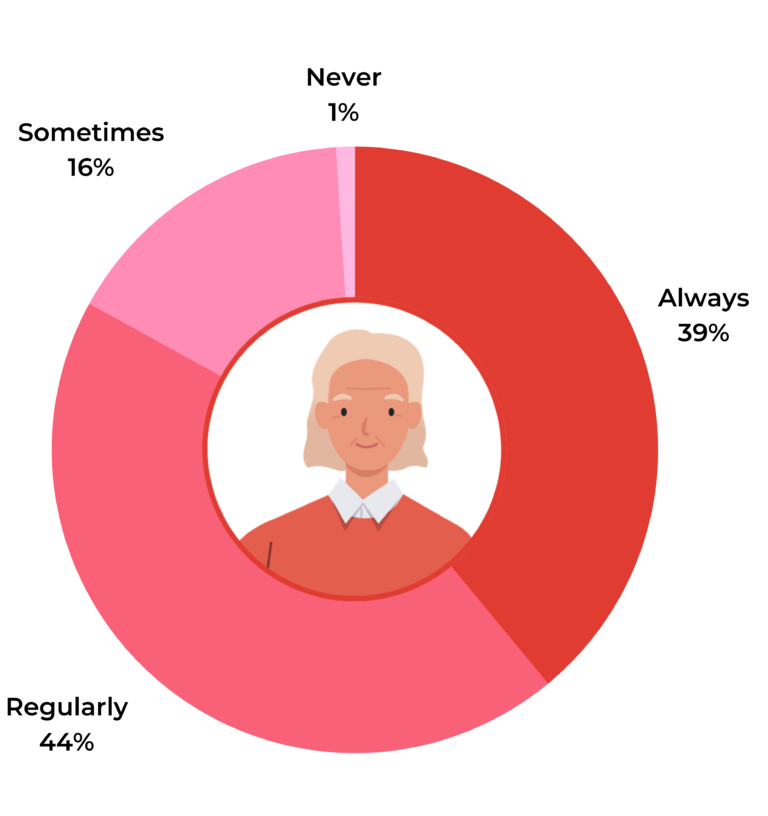

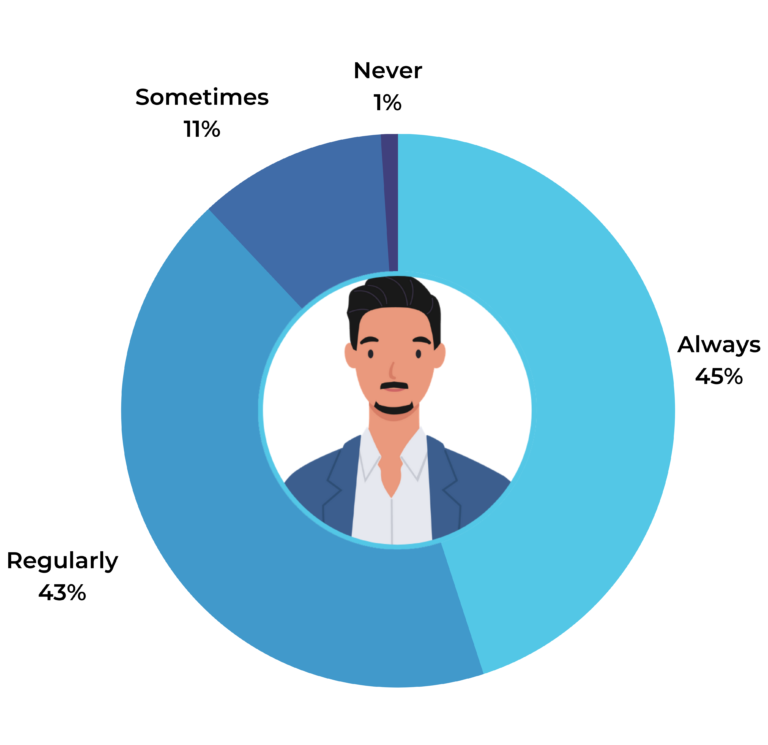

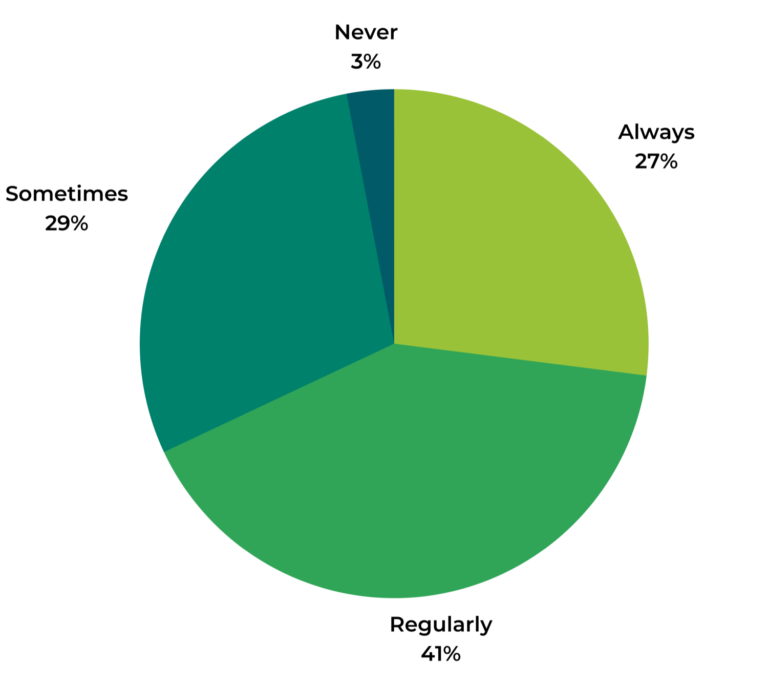

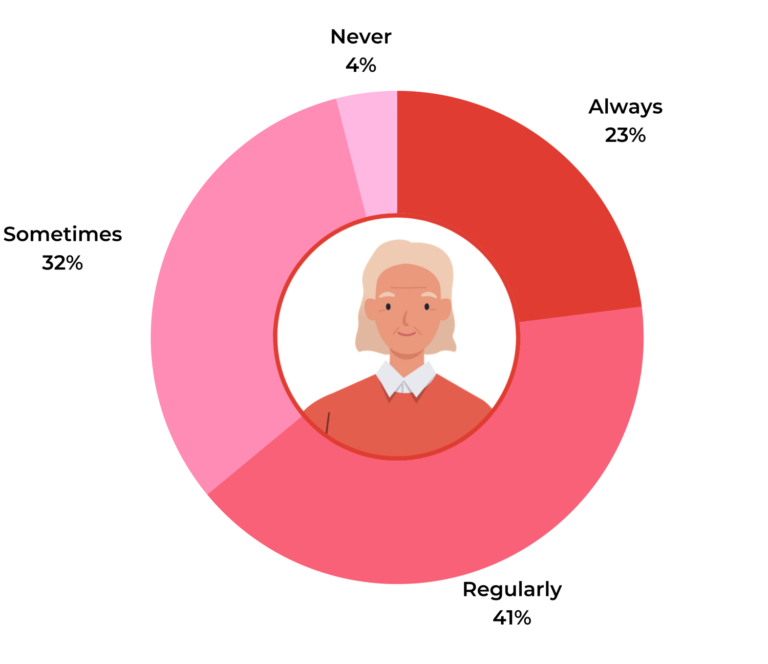

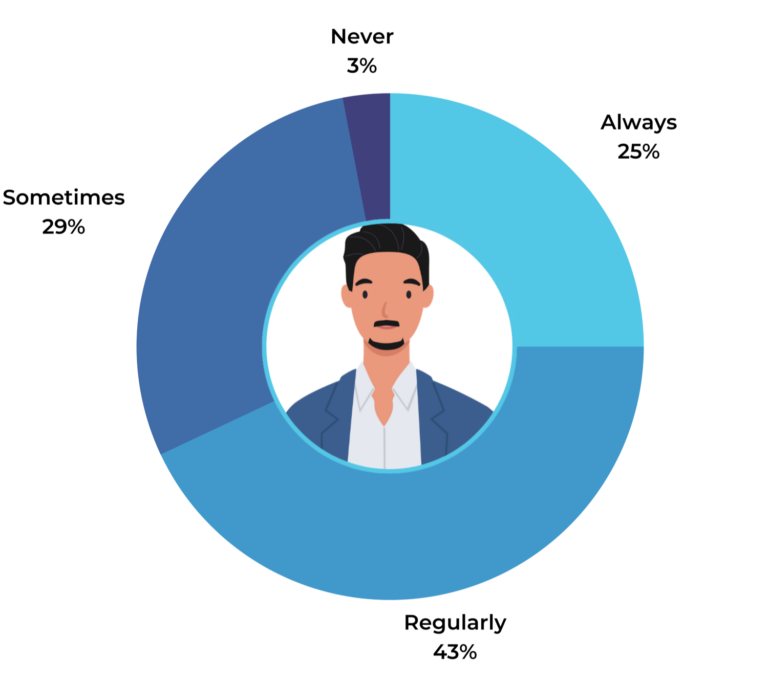

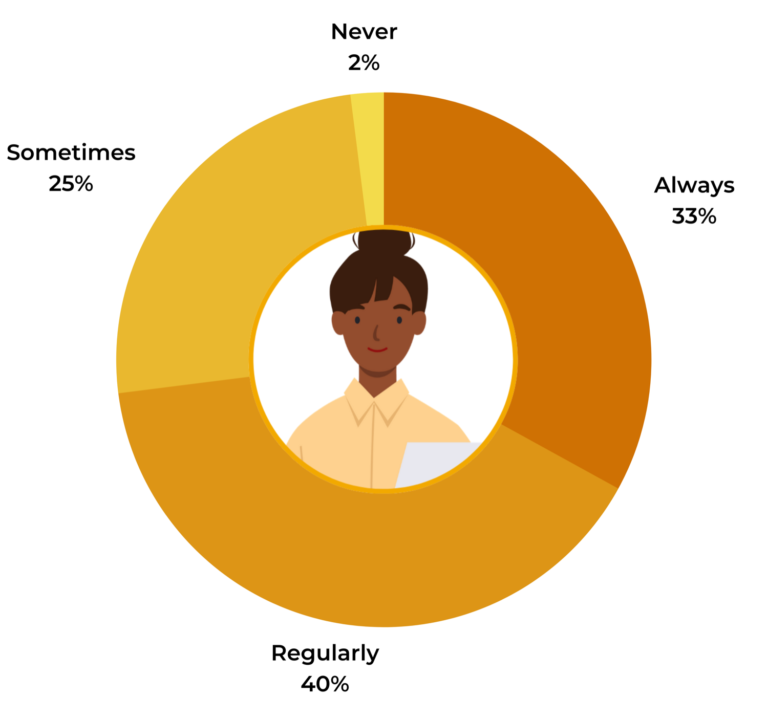

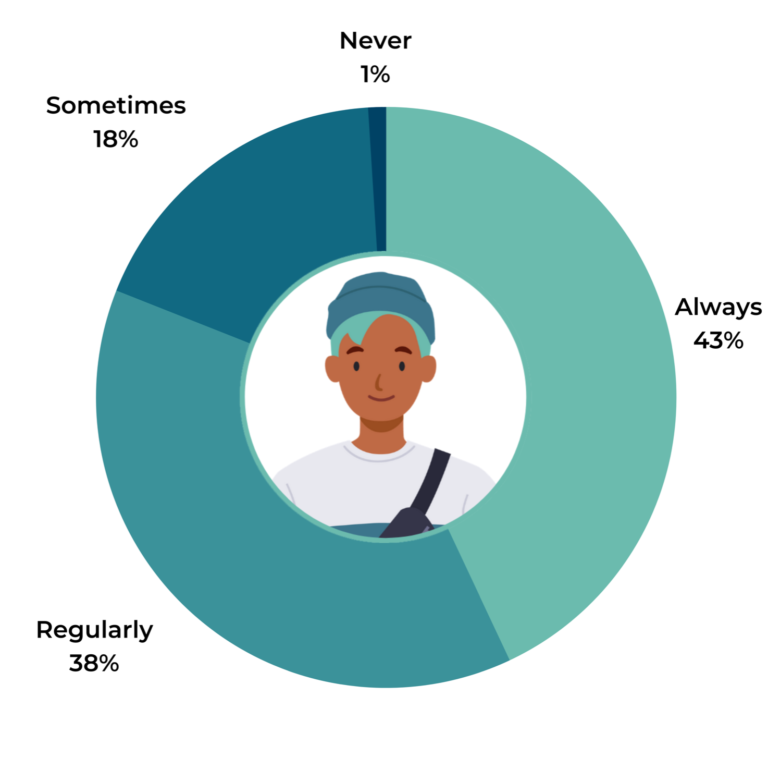

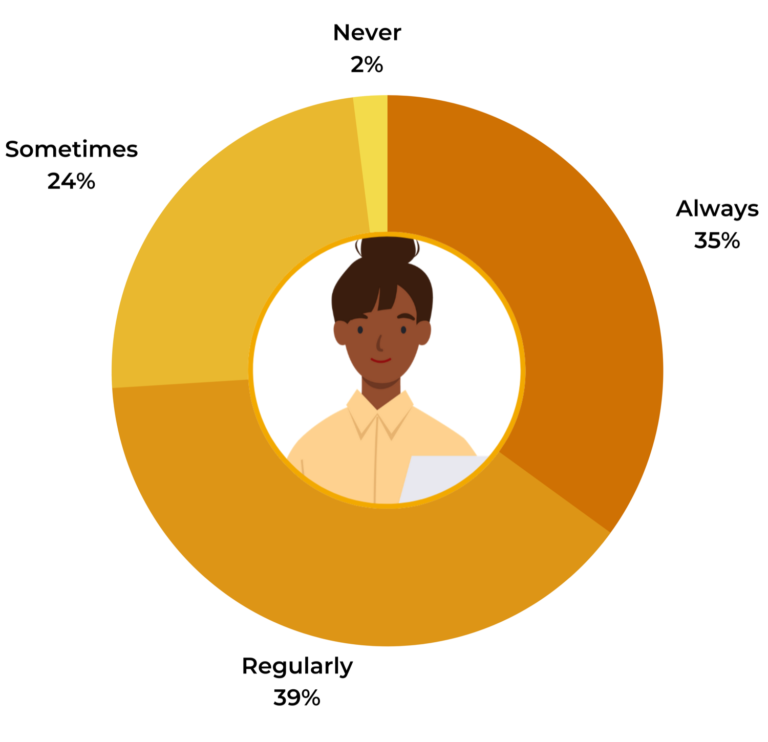

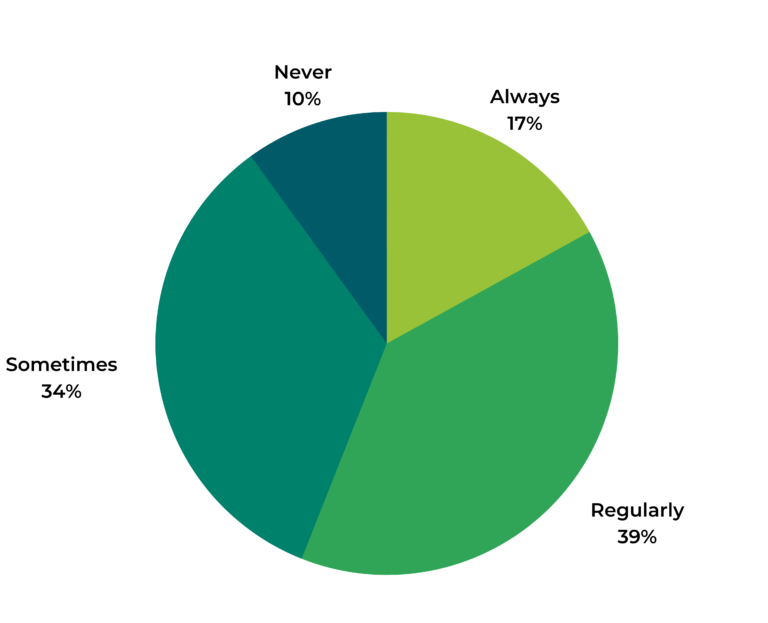

Most Consumers Look Beyond Basic Information

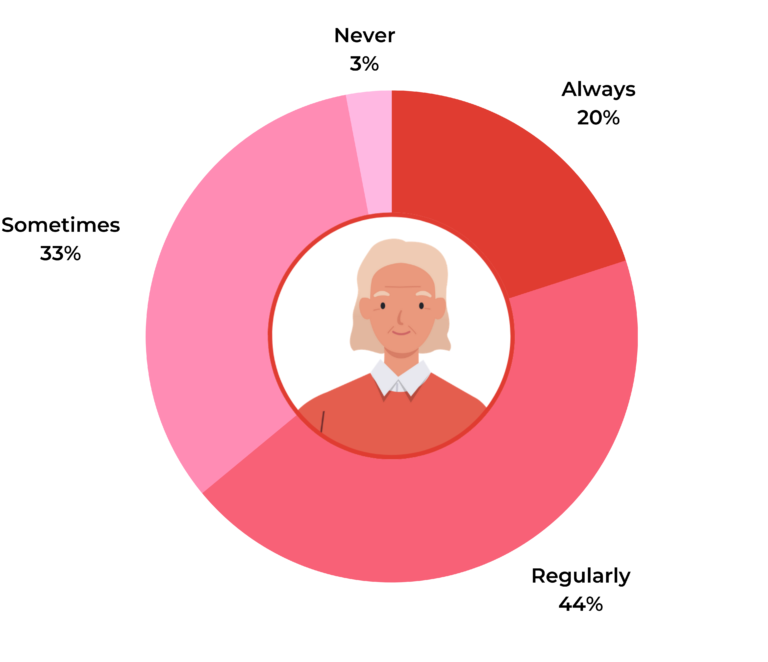

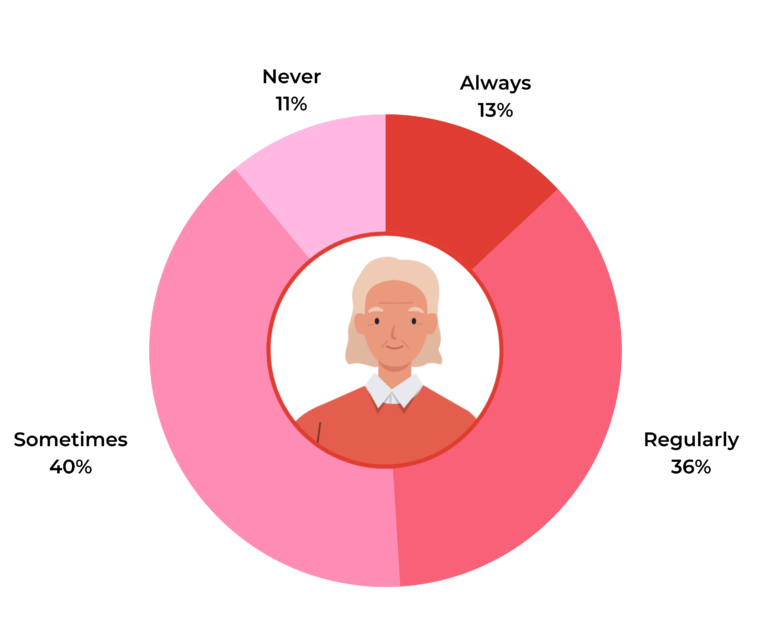

Basic information – such as the number of reviews and average star rating for a given product – is a great starting point for consumers looking for feedback from others like them. But when browsing reviews, nearly all shoppers (99%) look beyond this basic information and read the actual review content at least sometimes. 88% do so regularly or always.

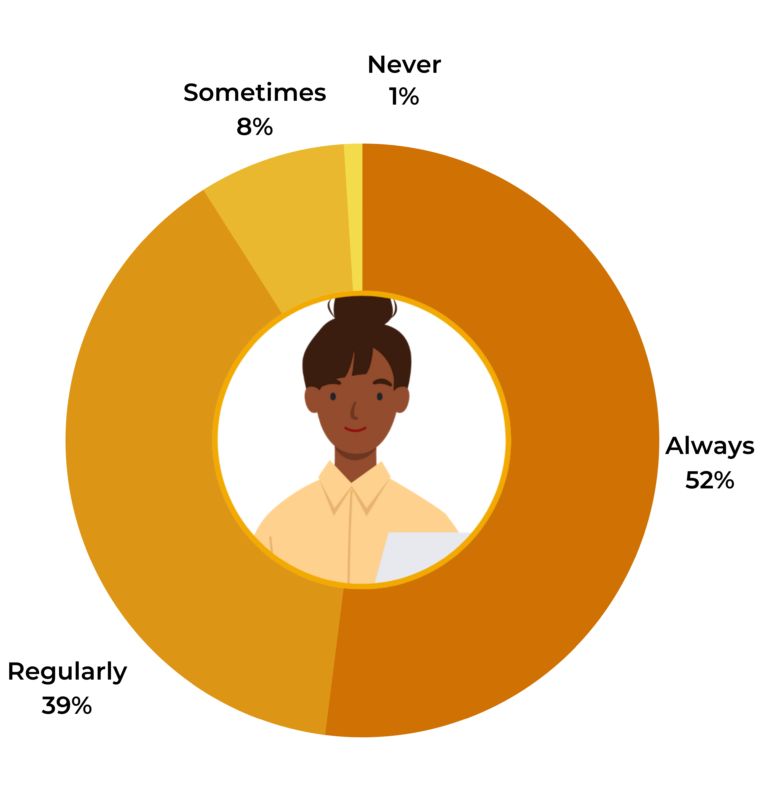

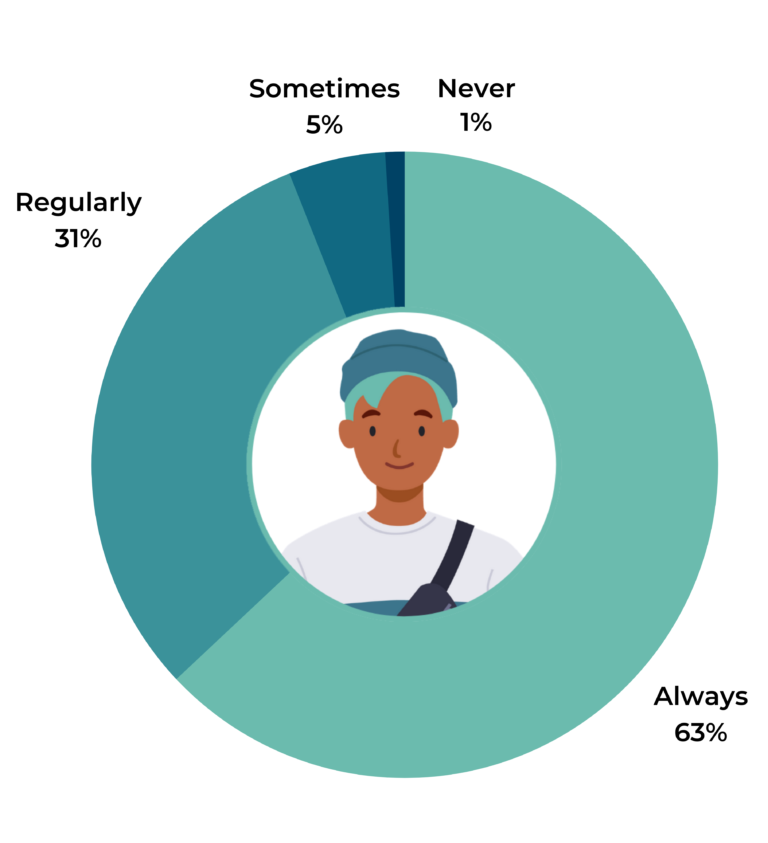

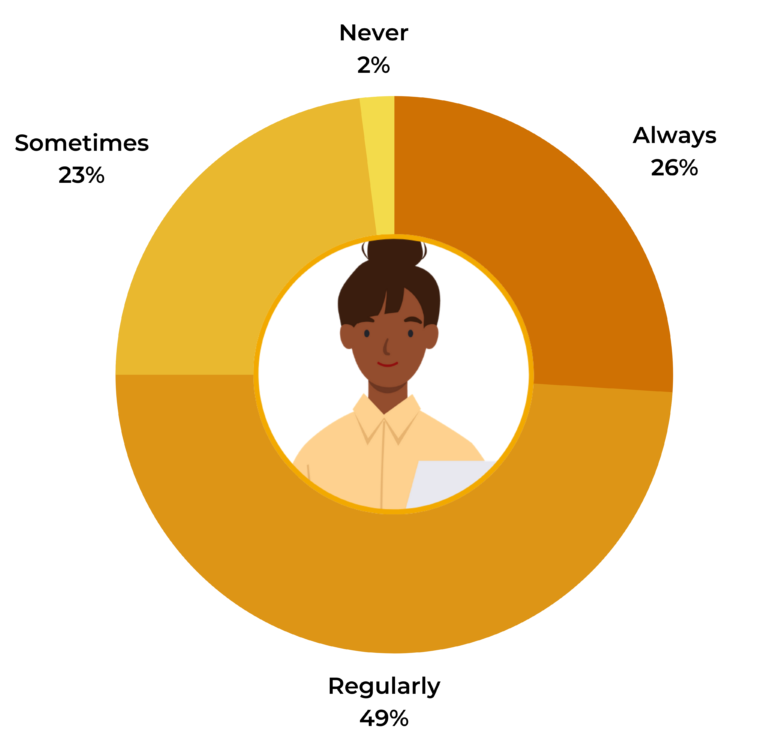

Of note, younger consumers are more likely to indicate they always go deeper. 63% of Gen Z shoppers and 52% of Millennials always read the content of reviews, compared to 45% of Gen X’ers and 39% of Boomers.

Bigger Spenders Read Review Content in More Detail

Interestingly, the greater the monthly online spend of a shopper, the more likely they are to dive deep into review content. 62% of shoppers who spend $2,001+ per month always go beyond basic review information to read the content of reviews, compared to 41% of those who spend $1-$250 per month.

Consumers Search for Wide Range of Information in Review Content

The vast majority of consumers dig deeper than the basics to read the actual content of reviews. But why?

The top reason is to learn about negative experiences other consumers have had with a given product – so they can determine whether they can live with this “worst case scenario.” 84% of consumers indicate this is a reason they read the content of reviews.

78% of shoppers read reviews to ensure a product has been used in the same way they intend to use it, and 73% consume this content to check that the product performs as claimed by the manufacturing brand.

Other top reasons for reading reviews are to get sizing information when shopping for clothing and shoes (70%), gauge long-term durability (64%), find photos of the product being used by a real-life shopper (57%), and determine value for money (57%).

Consumers Value Various Review Details

A given review might include many details, including a title, written commentary, demographic information of the reviewer, and user-submitted visual content – among other things. Which of these details do shoppers value most?

Consumers place the highest value on visual content within reviews; 65% of shoppers indicate this content is useful. 59% of shoppers value longer, more descriptive reviews and 57% appreciate stories that relate to how they plan to use a given product. Here’s the full breakdown:

Shoppers Want Ratings AND Reviews

Star ratings are one indicator of quality. But ratings only tell one part of the story. Modern consumers want to understand the “why” behind a specific rating.

Ratings Alone Aren’t as Valuable as Reviews

Today, some retailers, including Amazon, allow shoppers to submit a star rating for a product – without an accompanying written review. This is a quick process, and there’s no doubt it enables retailers to amass a high volume of ratings quickly.

Our previous research found that star ratings are one of the top factors consumers consider when reading reviews. But our most recent survey found that on their own, they’re often not enough. 58% of consumers indicate a star rating alone isn’t as valuable as a star rating accompanied by a written review.

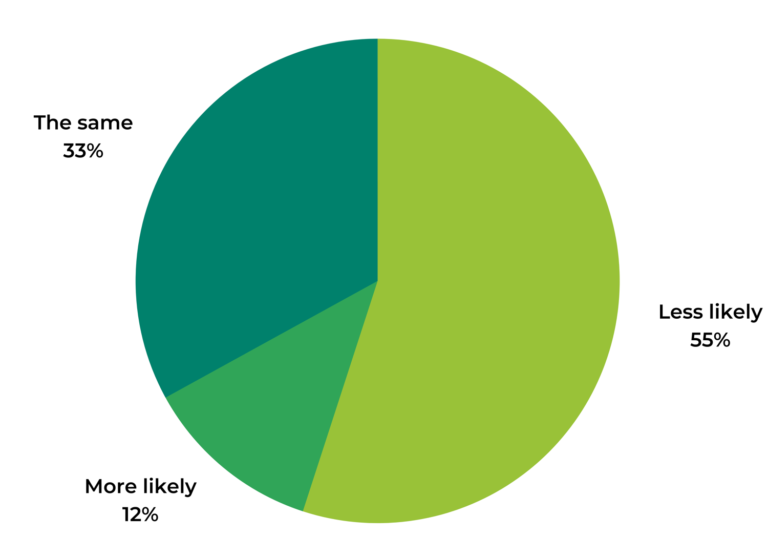

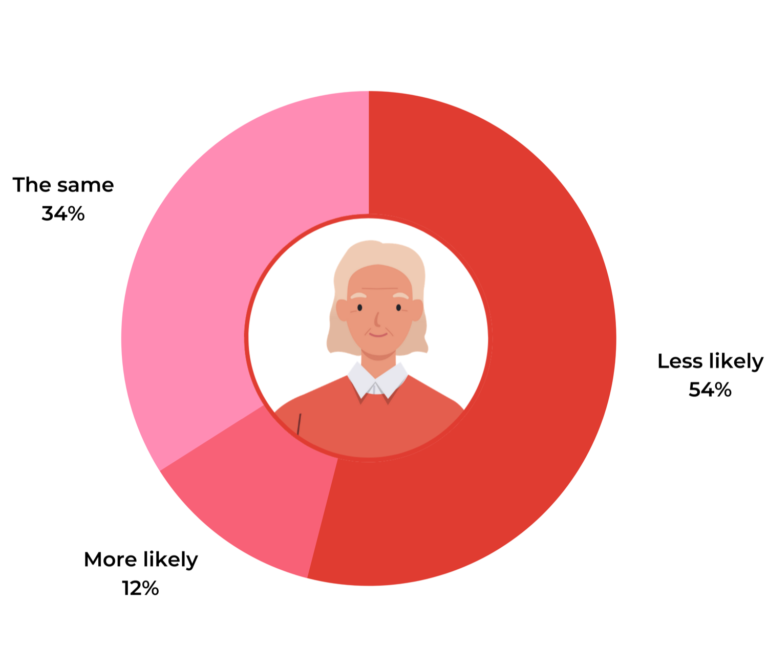

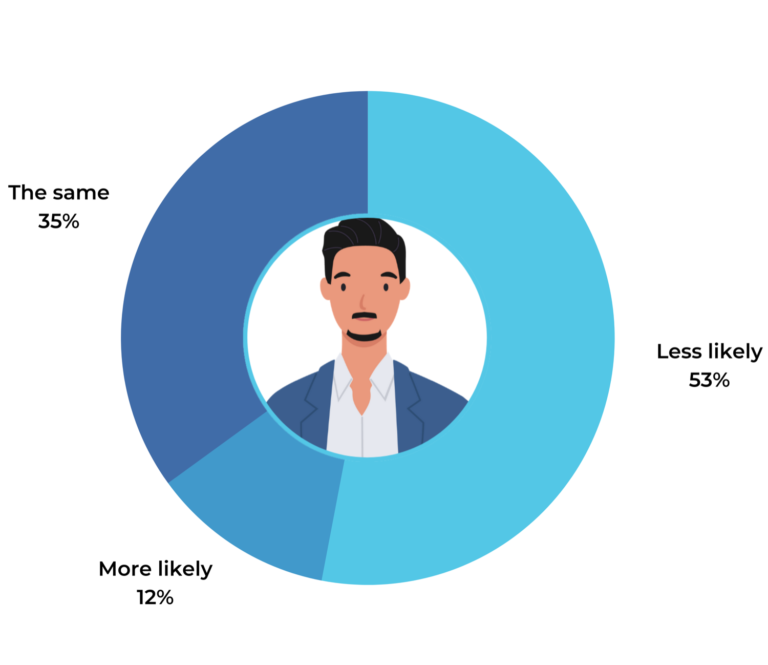

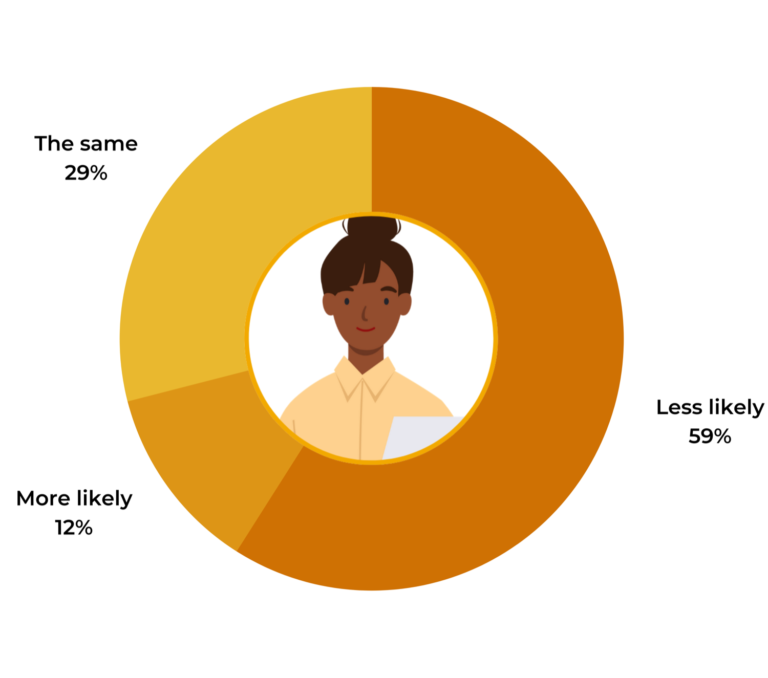

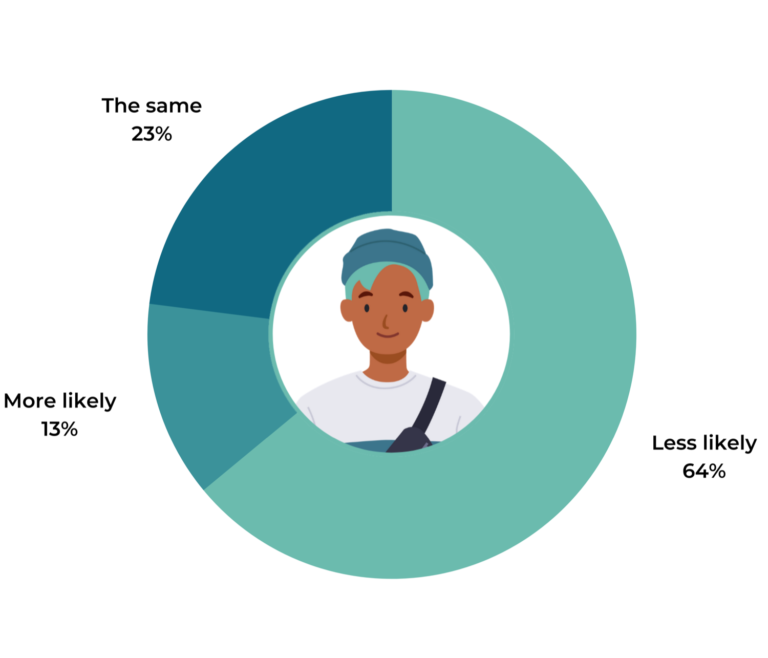

A lack of written reviews to accompany star ratings is especially detrimental when a consumer is considering a new product or brand. Over half (55%) of consumers indicate they’d be less likely to buy a new (or new to them) product or brand if there were star ratings – but no written reviews alongside those ratings.

This isn’t surprising. Consumers take a risk when purchasing a product or brand they have no experience with. Star ratings can certainly help boost their confidence. However, the real value lies in being able to read about the experiences of other consumers who have purchased and used the product.

Of note, younger consumers are more likely to be deterred by a lack of written reviews to accompany star ratings. 64% of Gen Z shoppers and 59% of Millennials are less likely to buy a new (or new to them) product if there aren’t written reviews to accompany ratings. In comparison, 53% of Gen X consumers and 54% of Boomers say this is the case.

Allowing consumers to submit ratings only can certainly increase your volume quickly – and this undoubtedly has some value. However, you should always aim to also collect written reviews too. Consumers value this content – especially when they’re branching out to new products and brands.

Review Length is a Key Consideration

It’s easy to assume that longer, more detailed reviews are more helpful than shorter ones. For example, a review that simply reads “great toy!” isn’t as helpful as one that elaborates on the great features of that toy – and why it is (or isn’t) a great fit for a specific type of child.

But how often do consumers pay attention to review length? And are there certain circumstances when length is especially important?

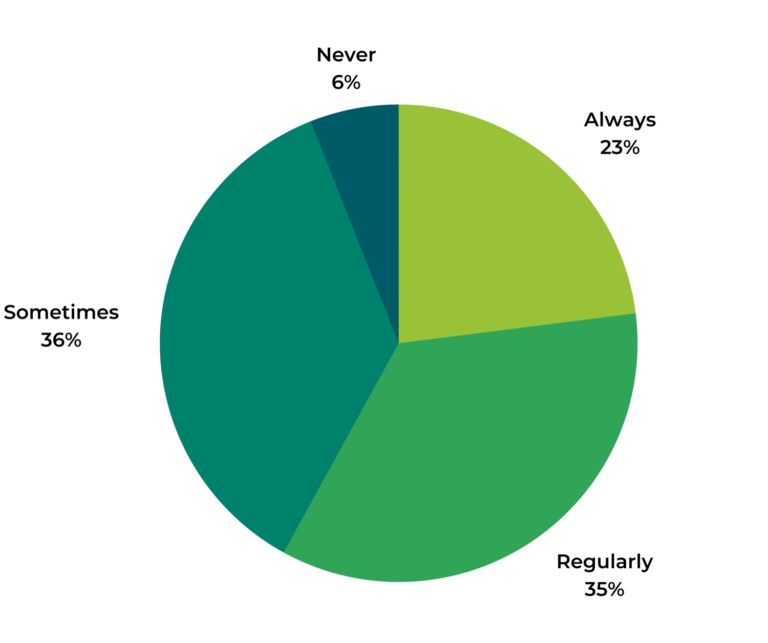

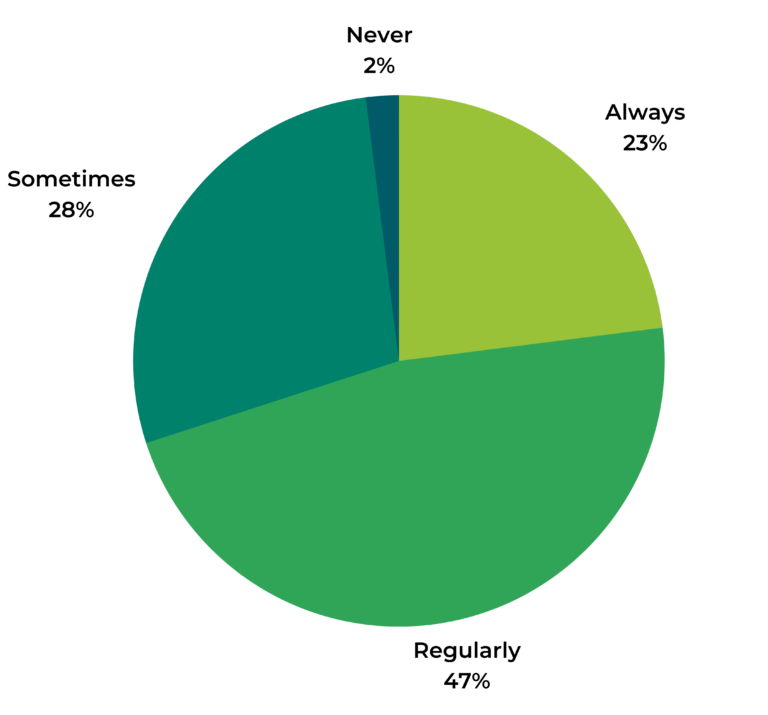

Review Length Matters

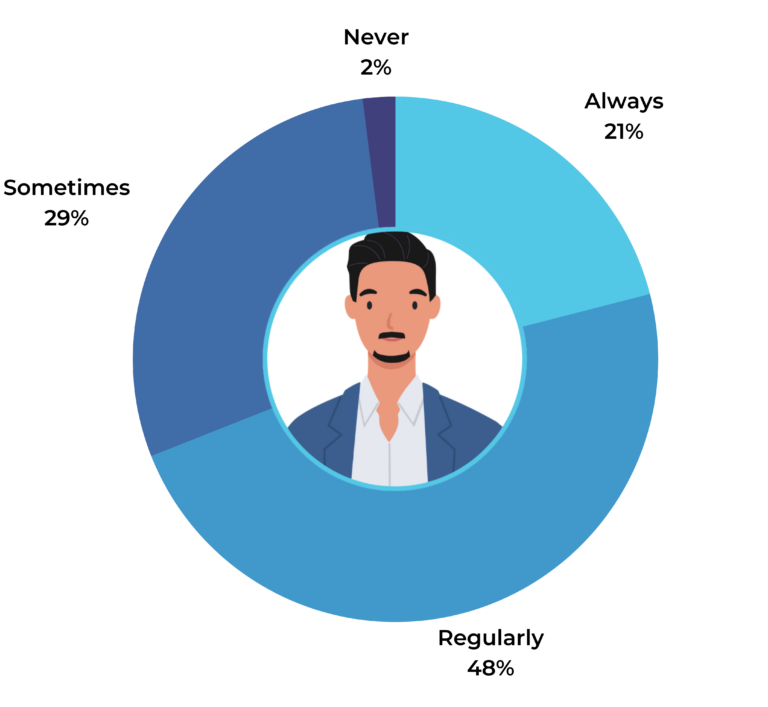

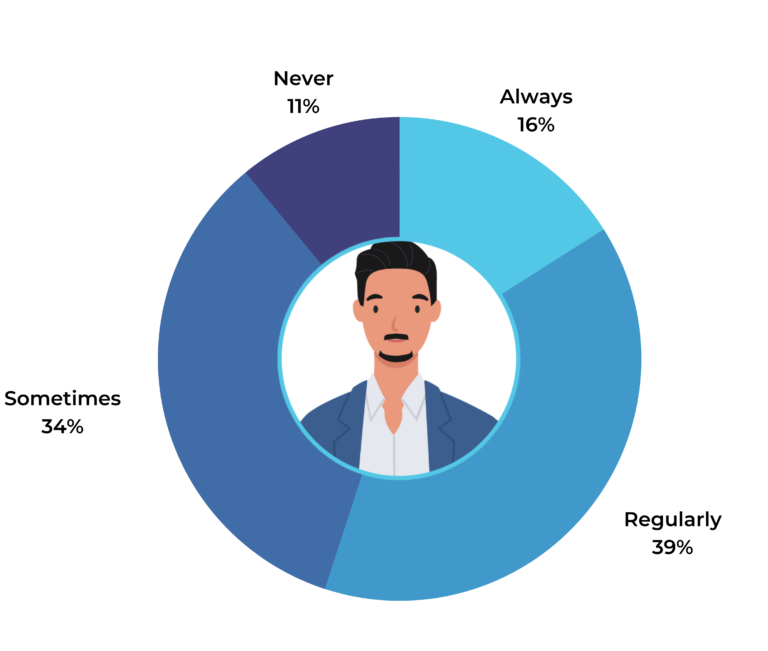

Nearly all consumers – 97% – actively seek out longer, more detailed reviews; 68% always or regularly do so.

Review length and detail is especially important for younger shoppers. 81% of Gen Z’ers and 73% of Millennials always or regularly seek out reviews that are longer in length and contain more details. In comparison, 68% of Gen X’ers and 64% of Boomers seek out longer, more detailed reviews.

In addition, the greater a consumer’s average online monthly spend, the more likely they are to always seek out longer, more detailed reviews. 39% of consumers who spend more than $2,001 online per month always seek out long, detailed reviews, compared to 25% of shoppers who spend $1-$250 online per month.

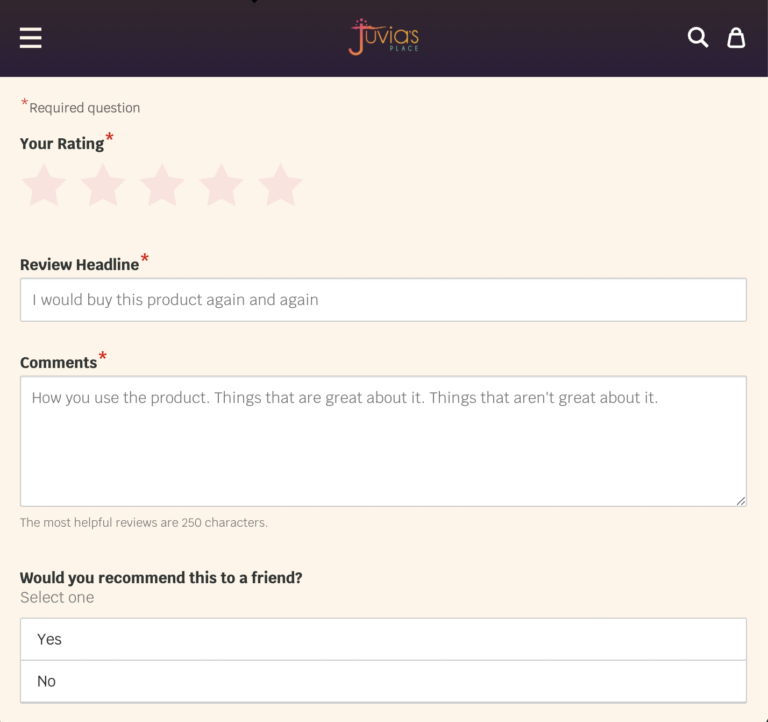

Consumers of all ages and spending levels are actively seeking out longer, more detailed reviews. And the presence of more detailed content helps them make better purchase decisions. Consider including prompts in your write-a-review form that encourage shoppers to include plenty of details in their reviews.

Review Length Matters Across Product Categories

Just about all consumers seek out longer, more detailed reviews. But does longer content matter more for certain product categories?

Length matters across a wide array of categories. However, there are certain categories where lengthy reviews are more commonly sought after.

Consumer electronics and appliances is the category that tops the list; 86% of consumers seek out longer, more detailed review content when purchasing these types of products. This makes perfect sense.

Electronics and appliances are typically higher priced items, and there’s risk involved with purchasing an expensive item. Reading detailed reviews helps those shopping for appliances and electronics understand how a given product has worked for real people. Then, they can better determine if the product is a good fit for them.

Other categories where review length is particularly important include health and beauty (73%), clothing, shoes, and accessories (71%) and home decor/home improvement (67%). It’s not surprising; products in these three categories are highly personal.

Consumers want to ensure a given product has worked well for others like them. For example, a consumer shopping for face cleanser wants to be sure a certain product works well for others with a similar skin type. And a consumer shopping for furniture may seek out detailed reviews for a dresser to ensure others have used it in a similar manner: for a nursery in a small apartment.

While longer reviews are particularly important for certain product categories, it’s important to note that a significant portion of consumers seek out more detailed review content across all product categories. Be sure your shoppers can find detailed reviews, regardless of product category.

Poor Grammar Can Impact Trust

We know from previous research that nearly a third (32%) of consumers consider grammar and spelling when reading a review. How does poor grammar impact review quality?

Poor Grammar Negatively Impacts Trust

Just over half (54%) of consumers say that incorrect grammar, punctuation or spelling causes them to question the validity of a review. Of note, older shoppers are more likely to find poor grammar a cause for concern. 57% of Boomers and 56% of Gen X’ers indicate that incorrect grammar, punctuation or spelling causes them to question the validity of a review, compared to 50% of both Millennials and Gen Z shoppers.

It’s important to remember that consumers value reviews because they offer authentic third-party guidance. An isolated spelling error isn’t going to have much of an impact, and in fact can even help promote the concept of authenticity. But too many grammatical issues is likely to have the opposite effect.

User-Generated Imagery Is Now Essential

Many brands and retailers allow consumers to submit photos or videos as part of a review. And as we mentioned previously, 57% of shoppers specifically seek out visual content submitted by other consumers within individual reviews.

But how often do consumers seek out user-generated visual content in reviews? And how does the presence (or absence) of this content in reviews impact purchase behavior?

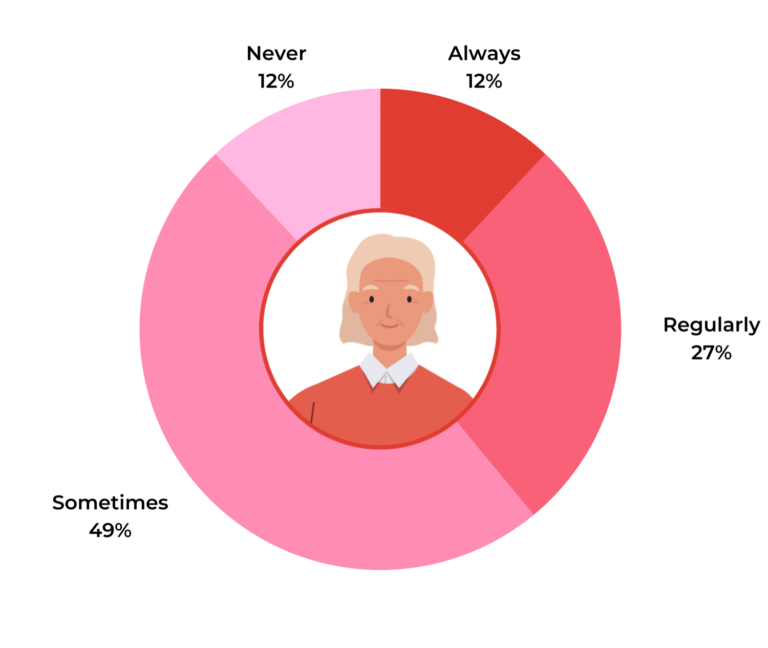

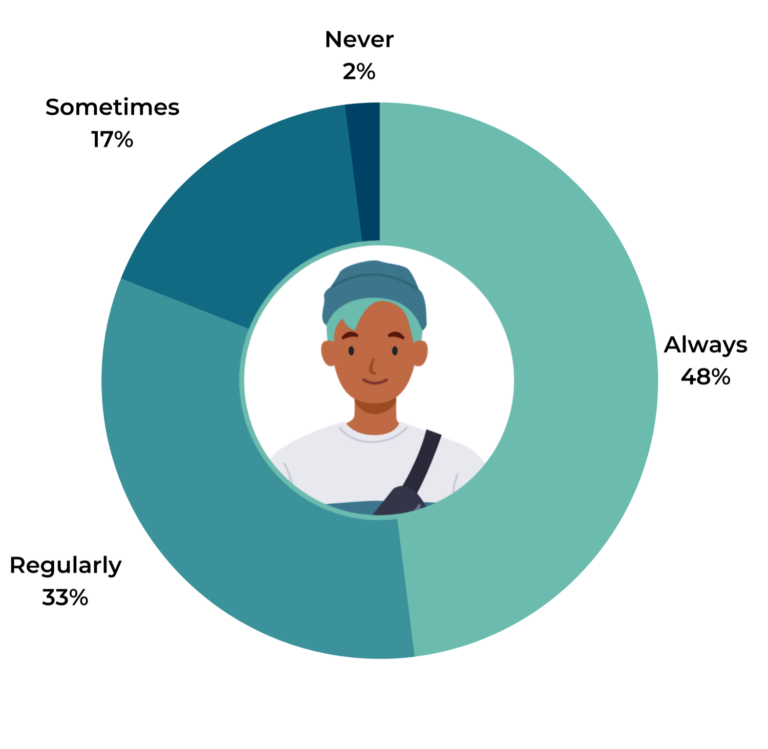

Most Consumers Seek out Visual Content within Reviews

Visual content – including photos and videos – can help consumers understand product features in a way text alone can’t. This is especially true when that visual content was taken by a real customer in real-life situations. User-generated content is authentic in a way brand content is not, and shoppers value it.

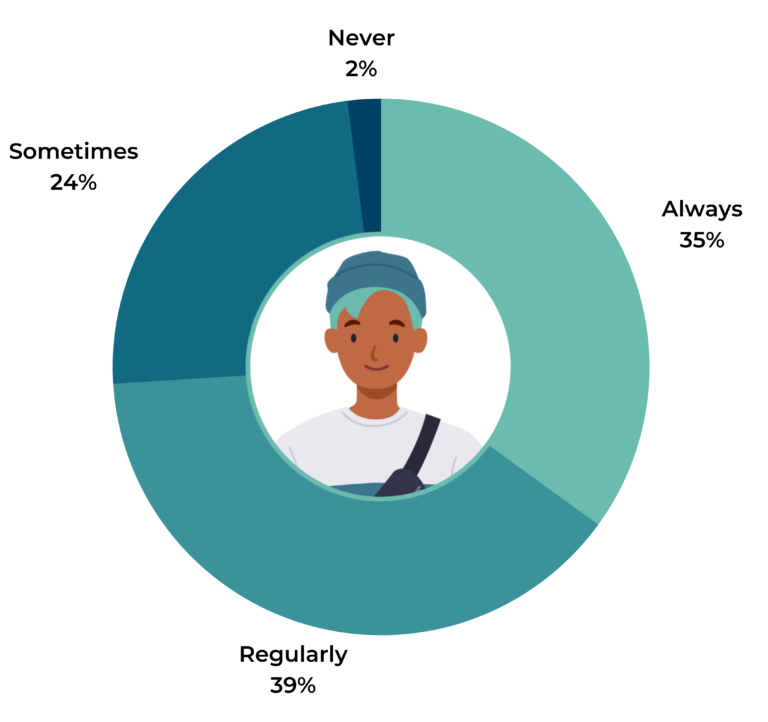

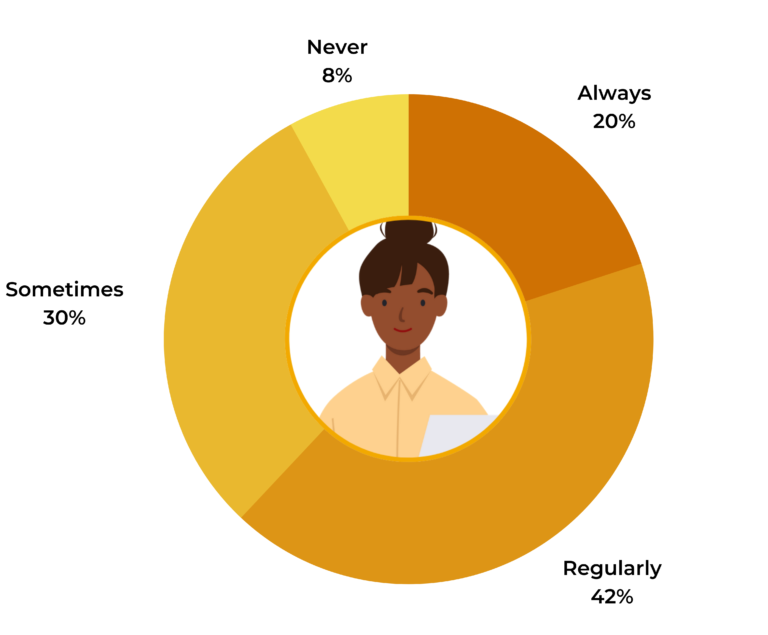

In fact, the majority of consumers – 94% – seek out visual content within reviews at least sometimes. 58% do so always or regularly.

Of note, younger shoppers are more likely to always seek out visual content in reviews, when compared to older shoppers. Nearly half (48%) of Gen Z’ers always seek out user-generated visual content in reviews and 35% of Millennials do so. In comparison, 20% of Gen X’ers and 12% of Boomers always seek out imagery within review content.

In addition, a higher monthly spend is correlated with an increased frequency of seeking out user-generated visual content. 35% of consumers who spend $2,000+ online each month always seek out visual content within reviews, compared to 20% of those who spend $250 or less monthly.

The presence of authentic, user-generated visual content adds to the quality of a given review, and consumers of all ages and spending levels actively seek it out. Make it easy for your customers to submit photos or videos of your products “in the wild” – right alongside their written reviews.

User-Generated Visual Content Matters Across Product Categories

Clearly, consumers seek out user-generated visual content within reviews. But are there certain circumstances when this content is particularly important?

As it turns out, consumers find it useful to find “real life” photos and videos across many product categories. However, there are some categories for which this content is particularly important.

The Absence of User-Generated Visual Content Can Deter Some Shoppers

We know the majority of shoppers actively seek out user-generated visual content in reviews. What happens when they come up short?

12% of consumers indicate that if they can’t find photos of a product submitted by fellow consumers, they simply won’t buy it. This number is significantly higher – 24% – among Gen Z shoppers.

Although the absence of user-generated visual content won’t deter the majority of shoppers according to these numbers, its presence is proven to boost conversion. Our analysis of activity on 1.5MM online product pages from more than 1,200 brand and retailer sites found that there’s a 91.4% lift in conversion among site visitors who interact with user-generated photos and videos on a product page.

So if you’re not collecting and displaying visual content from your shoppers, you’re leaving money on the table.

How Consumers Engage with Reviews to Surface Relevant Content

Most shoppers go beyond the basics and consume the actual content of reviews. And as we’ve explored, they do so to find many different types of information.

However, consumers don’t read every single review available for a product to find what they need. Instead, they sift through reviews to find the content that’s most relevant to them.

How do consumers navigate review displays to find what they’re looking for? Let’s explore.

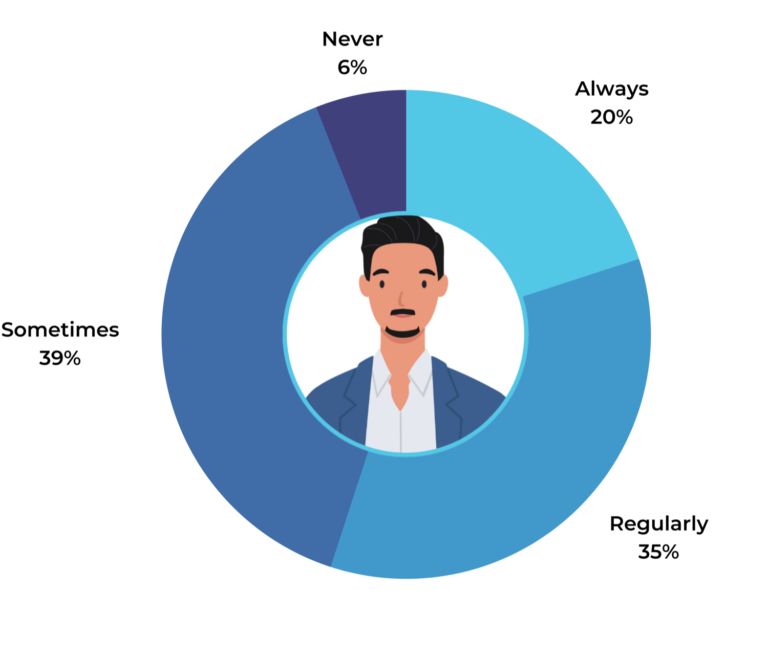

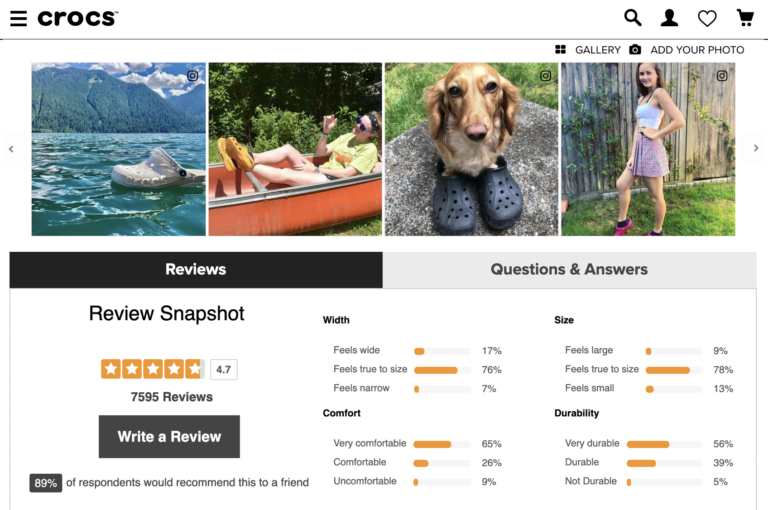

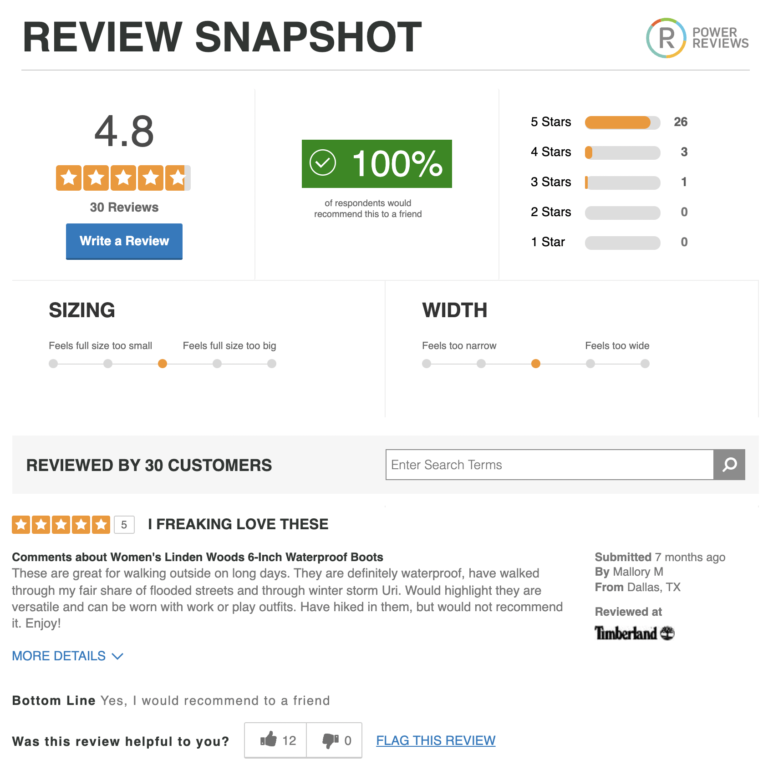

The Review Snapshot is a Jumping Off Point

Often, product pages on brand and retailer sites feature a display that summarizes all review content available for a given product. At a minimum, such a display typically includes the number of reviews available for a given product – as well as the overall star rating.

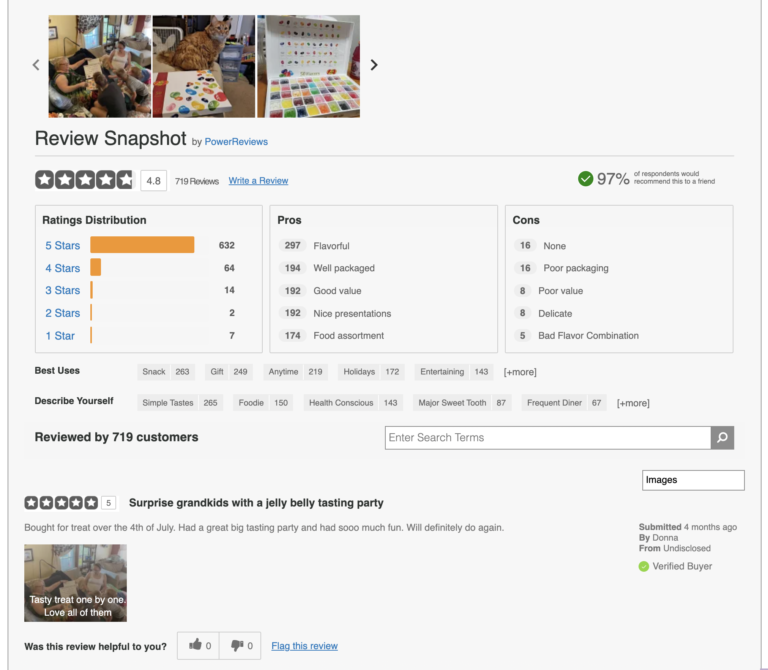

Sometimes, however, a display also pulls out specific trends and themes from reviews to give shoppers a snapshot of what they can expect from a given product.

When there are specific trends and themes pulled out of the review content as part of a review snapshot, 98% of consumers read it at least sometimes. 70% do so regularly or always.

Gen Z shoppers are the group most likely to always interact with review snapshots that pull out common themes from reviews, if such a snapshot is available. 35% of Gen Z’ers always do so, compared to 26% of Millennials, 21% of Gen X’ers, and 20% of Boomers.

If you’re not already, consider enhancing your overall review display to pull out trends from feedback shared in reviews. Consumers across age groups read these snapshots – and their presence can entice shoppers to learn more about a product.

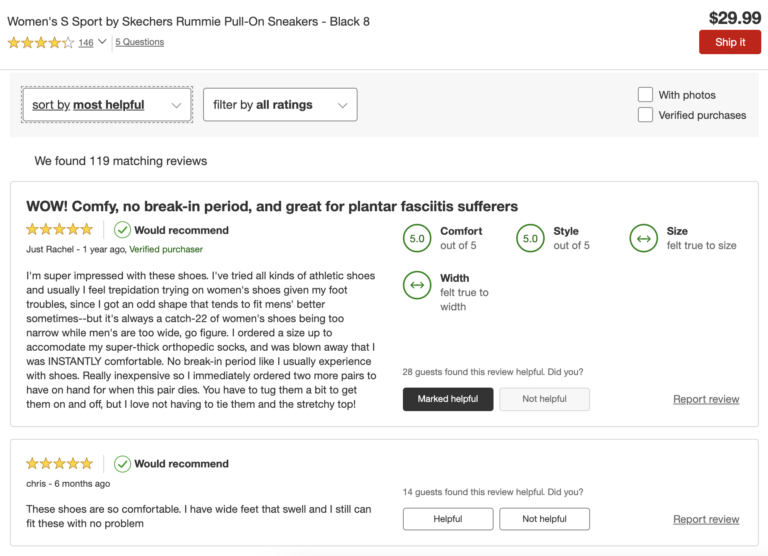

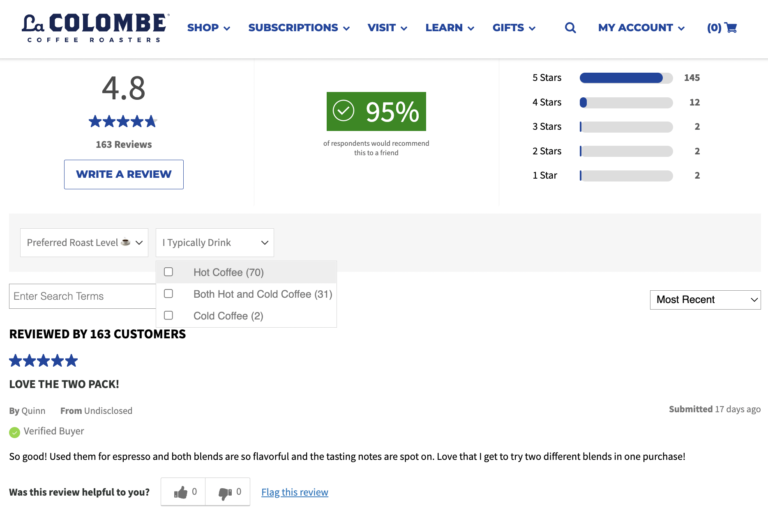

Most Consumers Filter Review Content

Some brands and retailers provide shoppers with the ability to filter reviews to quickly surface relevant content. For example, a health and beauty brand might allow shoppers to filter reviews by factors like skin type, age, skin tone, and whether the review includes visual content.

Over three-quarters (77%) of shoppers find filtering options useful when browsing review content. This number is even higher among younger consumers. 86% of Gen Z’ers and 85% of Millennials think review filtering is useful. In comparison, 77% of Gen X’ers and 66% of Boomers find this capability useful.

Consumers Seek Out Negative Review Content

As we mentioned earlier, a top reason consumers read the content of reviews is to learn about negative experiences fellow consumers have had with a product – and then determine whether they can live with those “worst case scenarios.”

How do they uncover these worst case scenarios? By reading negative reviews. In fact, 61% of consumers actively seek out one star reviews when consuming review content.

Finding one-star reviews is especially important for younger consumers. 73% of Gen Z shoppers and 68% of Millennials seek out one-star reviews, compared to 59% of Gen X’ers and 53% of Boomers.

In addition, those who spend more online are more likely to seek out one-star reviews. 71% of shoppers who spend $2,001 or more each month explicitly seek out one-star reviews, compared to 57% of those who spend between $1 and $250 monthly.

Consumers value negative reviews. If they’re not able to find any, it can raise their suspicions. In fact, 42% indicate they’re suspicious when a product has an average rating of five out of five. This number is even higher – 48% – among Gen Z consumers.

When it comes to reviews: if it looks too good to be true, it probably is too good to be true. Even the very best products can’t satisfy the needs of every single shopper, and consumers know it. Failing to display negative reviews for a product can make shoppers suspicious that you have something to hide. Again, authenticity is key.

Resist the temptation to delete negative reviews. This content helps shoppers make informed purchase decisions – and it shows them you’re a brand they can trust.

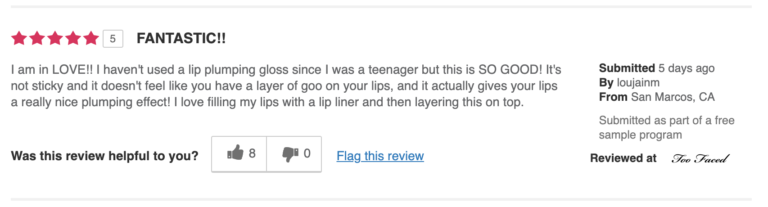

Helpful Votes are Valuable to Shoppers

Many brands and retailers give shoppers the ability to indicate when a review is helpful to them. For example, our friends at Ulta allow visitors to click a thumbs up icon to indicate a review was helpful in their purchase journey.

These same brands and retailers often let shoppers sort review content by helpfulness, which displays the content with the most helpful tags or votes at the top.

Allowing shoppers to easily find reviews that their peers found helpful is a good move on the part of businesses. After all, 55% of consumers actively seek out reviews that have been voted or tagged as “helpful” by other shoppers. This number is significantly higher – 73% – among Gen Z shoppers.

Consider giving your site visitors the opportunity to indicate when a review was particularly helpful to them. This information will help future shoppers find the content they’re looking for – and make better purchase decisions.

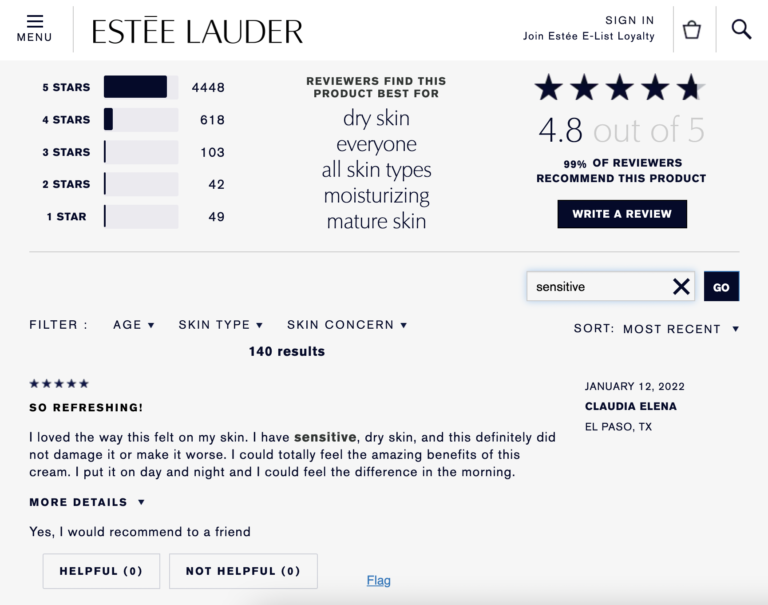

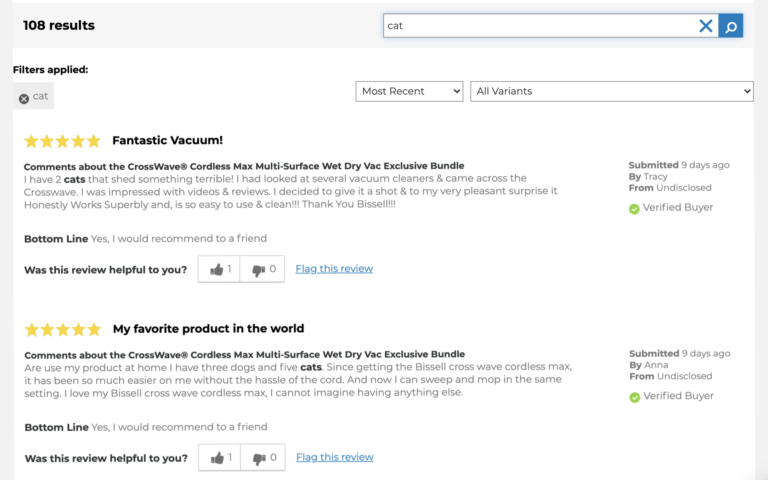

Search Features Enable Shoppers to Quickly Surface Relevant Review Content

Many customer-centric brands include a search feature on their review displays that allows shoppers to find reviews that speak to the things that matter most to them in their product search. For example, a consumer with sensitive skin may be considering a moisturizer. She wants to find out how the product has worked for others with a similar skin type. So she searches for “sensitive” and finds reviews written by others with sensitive skin.

As it turns out, consumers appreciate the ability to easily search reviews for specific words or phrases. Nearly three-quarters (72%) find a search option useful when browsing review content. This number is especially high – 79% – among Gen Z and Millennial shoppers.

In addition, consumers who spend more online each month are more likely to value a review search option than those with lower monthly spending. 83% of those spending $2,001+ each month find a search feature useful, compared to 68% of consumers who spend $1-$250 monthly.

A large portion of consumers find a review search feature useful. But how often do they actually use it, when it’s available?

Nine in ten shoppers indicate they use a search option to search review content at least sometimes. And over half (56%) do so regularly or always.

Interestingly, younger shoppers are more likely to always leverage the review search feature, when it’s available. 29% of Gen Z’ers and 20% of Millennials always use the search option to find more detailed information when reading reviews, compared to 16% of Gen X’ers and 13% of Boomers.

Clearly, shoppers are fans of the search feature of review displays. But what are some of the topics they’re searching for?

Product sizing and quality are two of the most common types of queries.

Consumers have grown accustomed to turning to Google to search for anything to quickly get relevant results. They want to be able to do the same thing with reviews.

If you’re not already, consider adding a search feature to your review display. It’ll make it easy for your shoppers to find the content more relevant to their needs – and it’ll boost conversion. Our recent analysis found that there’s a 202.9% conversion lift when visitors use the search feature in a review display!

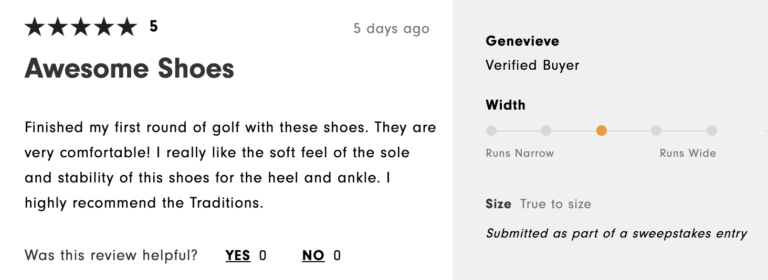

The Source of a Review Impacts a Shoppers’ Perception of the Content

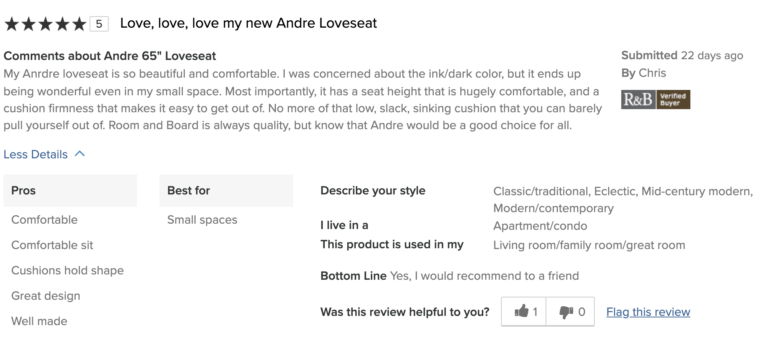

Product reviews come as a result of a handful of different interactions. For example, some purchase the product themselves while others may receive a product for free as part of a product sampling campaign. In order to maintain transparency and preserve trust, brands and retailers often add badges or tags to indicate who wrote a given review.

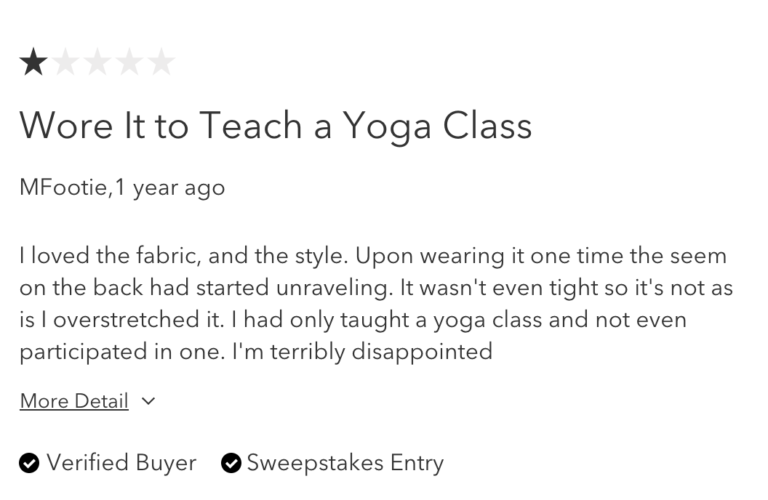

For example, it’s clear this review was written by someone who is verified as having purchased the product.

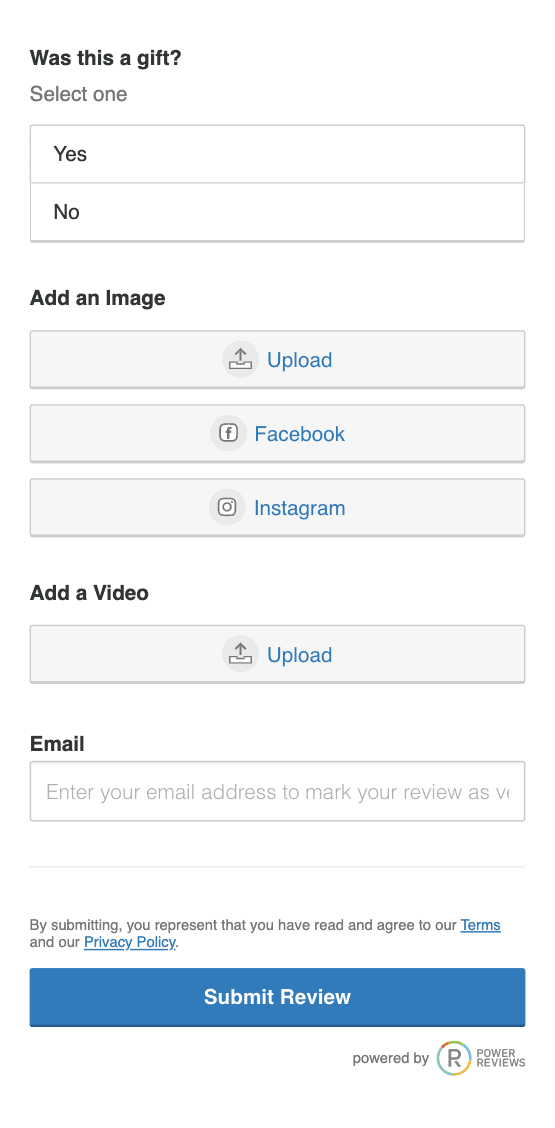

While the consumer who submitted this review is a verified buyer – and received an entry into a sweepstakes in exchange for their review.

87% of shoppers take note of these badges. And certain tags positively impact how shoppers perceive a given review.

For the sake of transparency, be sure to appropriately badge reviews. Doing so is an important way to preserve trust – and it can actually boost shoppers’ confidence in your review content.

Five Key Takeaways

Consumers read the content and details of reviews. And they look for many things when they do. It’s essential to make it as easy as possible for your shoppers to find what they’re looking for. If you don’t, they’re likely to pass up your brand for one that better meets their needs and expectations.

Here are our top five takeaways from our latest survey.

Star ratings are a great starting point. But for most shoppers, they’re simply not enough.

In fact, the vast majority of consumers – 99% – go beyond the basics and read the content of reviews. And 97% explicitly seek out longer, more detailed reviews.

Of course, generating reviews is important. But make sure you’re getting plenty of detailed reviews. One way to do this is to add a review meter to your write-a-review form, which is essentially a green bar that grows as the consumer types. Some brands also include text letting shoppers know the length of the most helpful reviews.

In addition, consider including prompts in your write-a-review form that can help shoppers go beyond the basics – and get their creative juices flowing. For example, this form encourages review writers to include commentary about how they use the product, what they love about it, and what isn’t so great.

When asking for reviews post purchase, be sure to time the ask appropriately. You need to strike the balance between allowing shoppers the time to use the product sufficiently while being close enough to the purchase for it to be fresh in their mind. Here are some tips.

A top reason shoppers seek out reviews is to find photos from others like them, using the product in real life. What’s more, 94% seek out visual content within reviews at least sometimes.

Be sure shoppers can find ample user-generated visual content. If you’re not already, start collecting photos and videos as part of your review generation processes. Shoppers should be able to submit imagery directly from their desktop, mobile device, or social media accounts.

In addition, experiment to see if asking for photos and videos before or after a written review generates the best results. And, if visual content is a top priority, consider allowing shoppers to submit this content without an accompanying review.

The review overview – or snapshot – is a shopper’s first exposure to review content on a product page. Some snapshots are basic, including simply an overall star rating and review content. However, others are more detailed, pulling out specific trends and themes from the review content itself.

When there’s a more detailed snapshot, 98% read it at least sometimes. And a detailed snapshot can entice shoppers to dig more into the content of reviews.

Consider enhancing your review snapshot to pull out trends from feedback shared in reviews, specific to your product category. This information can help shoppers determine if they should dig further – or take their search in a different direction.

For example, if you’re a clothing brand, you can pull in themes about size and fit.

And regardless of product type, you can pull in pros and cons, aggregated from reviews.

Shoppers read the content of reviews to find feedback on many topics, including negative experiences, use cases, and quality – among others. But they’re not reading every single review that’s available. Instead, they use a variety of features and capabilities (when they’re available) to surface the content that’s most relevant to them.

Make it as easy as possible for shoppers to find what they’re looking for in reviews. For starters, allow them to filter content based on star rating; 61% of shoppers actively seek out one-star reviews. In addition, enable shoppers to filter content based on other factors that make sense for your brand. For example, this coffee brand allows site visitors to filter reviews based on whether the consumer who wrote the review typically drinks hot or iced coffee.

In addition, add a search feature to your review display, allowing shoppers to easily uncover reviews that address the words and phrases they search for. Nearly three-quarters (72%) of shoppers (and 79% of Millennials and Gen Z’ers) find a search option to be useful when browsing reviews.

Best practices are a great place to start when you’re looking to accelerate your review collection and create compelling UGC displays (here are some aggregated examples). However, each business is different. And there’s no one-size-fits-all strategy that works for all brands and retailers.

It’s essential to regularly measure the performance of your UGC program – both from a collection and display perceptive. With regular measurement, you can uncover opportunities to optimize your program – and yield even better results.