Survey at a Glance:

- Consumer interest in free shipping and returns is at an all-time high. Consumers said that free shipping (96%) and free returns (76%) are important consideration factors when shopping online.

- Higher-income households are more likely to be interested in returns than lower-income households. 83% of consumers with a HHI > $100,000 reported that returns are important vs. 75% of consumers with a HHI <$25,000.

- Return behavior hasn’t changed since the COVID-19 pandemic. 72% of shoppers said they return products purchased online at about the same rate as they did prior to the pandemic.

- Clothing (88%), shoes (44%), and electronics (43%) top the list of the most returned product categories.

- The top three reasons people gave for returning an item was that it didn’t fit (70%), the item was damaged or defective (65%), or the item didn’t match the description (49%).

- Access to UGC has a significant impact on a customer’s likelihood of returning an item. Two in three shoppers agreed that they would be less likely to return a product if they had been able to view user-submitted reviews, Q&A, or image and video prior to purchasing.

The COVID-19 pandemic changed a lot of things, especially in retail.

The makeup of the type of products people purchased changed dramatically, with groceries and household supplies experiencing unprecedented demand while other industries suffered. Shoppers now prefer to shop in stores with comprehensive cleaning policies, curbside pickup, and BOPIS, all things they may not have cared about prior to 2020. And, they rely on reviews more than ever when making purchasing decisions.

As we head into the fall of 2021 and look toward 2022, inquiring retailers want to know: how else have shoppers’ habits changed? Has the pandemic impacted return rates? What makes a shopper return something, and what can retailers do to prevent it? (Hint: UGC goes a long way toward preventing returns.)

We surveyed 7,668 shoppers from age 18 to 80 to find out.

Free shipping still tops consumer demand, followed by free returns

We know that product and price are persuasive when it comes to getting a shopper to click “Buy Now.” (We also know that ratings and reviews are the single most influential factor when considering an online purchase.)

But, after the basics, what matters most to people when shopping online? Is it free shipping, or an excellent returns policy?

As you might have guessed, free shipping reigns supreme. At 96%, nearly all shoppers consider free shipping to be important. At 79%, free returns was second most important.

Free returns are generally quite popular, across both income buckets and generations. However, there is a clear correlation between household income and interest in free returns. The more money you make, the more likely you are to be interested in a free returns policy.

The takeaway? Luxury retailers catering to higher-income shoppers should consider implementing a free returns policy, if they don’t have one already. It’s possible that high-income households have more discretionary income to spend on nice-to-have items, and they want the option to return the item if they change their mind, while lower-income households could be primarily online shopping for necessities that they don’t plan on returning.

Returns are just as common as ever

Clearly, customers like the option of being able to return a purchase, especially if they can do so for free. You might think, then, that they frequently take advantage of return policies.

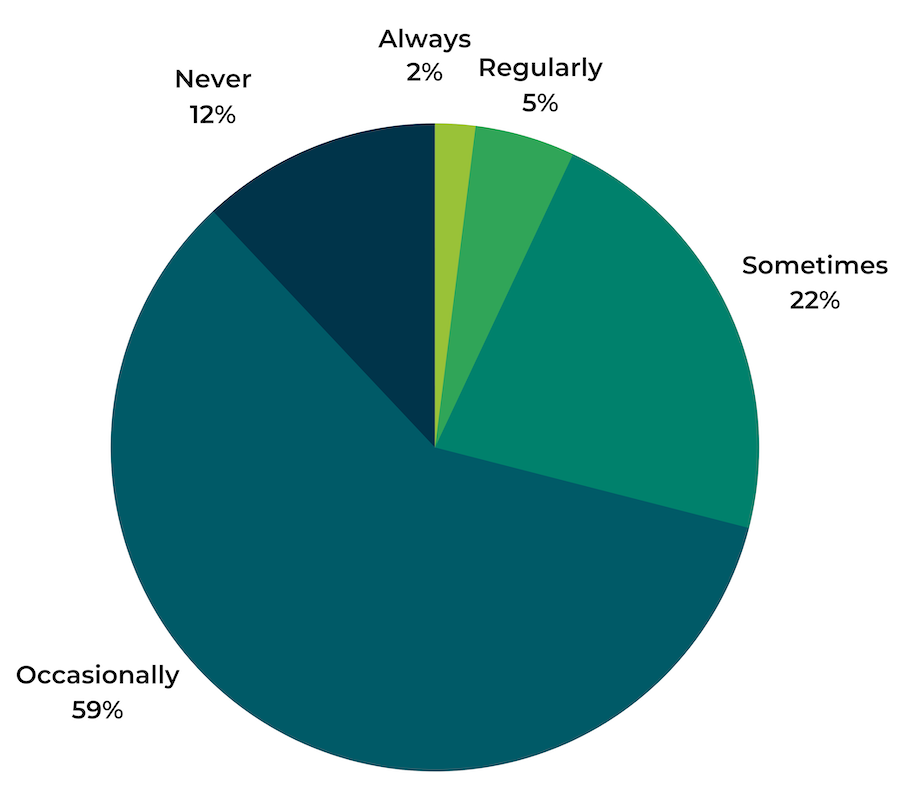

They do. 88% of consumers report they make returns at least “occasionally.” This aligns with industry reporting that says returns were up 70% year-over-year in 2020.

Only 12% of shoppers said they “never” return a product. Gen Z were the most likely to say they would never return something, with 1 in 5 Gen Zers (20%) saying so, compared with only 12% of all shoppers.

At 22%, those making under $25K were also the most likely to say they would never return something, while those making over $100K were the least likely (only 5%). This isn’t a surprise, considering the stronger preference for free returns among those with high household incomes.

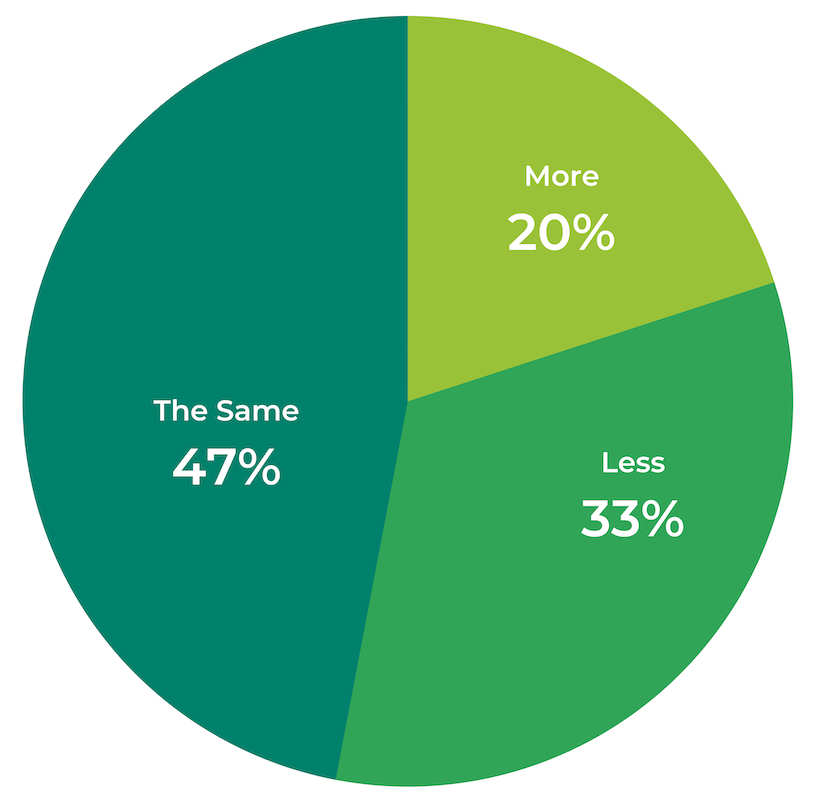

Interestingly, a near-majority of shoppers said they return products they purchase online at about the same rate they do for items they purchased in store. Only 20% of shoppers said they returned products purchased online more often than those they purchased in-store.

Perhaps unsurprisingly, at 28%, Gen Zs were the most likely to say they returned items they purchased online more frequently, and Boomers, at only 13%, were the least likely to say so.

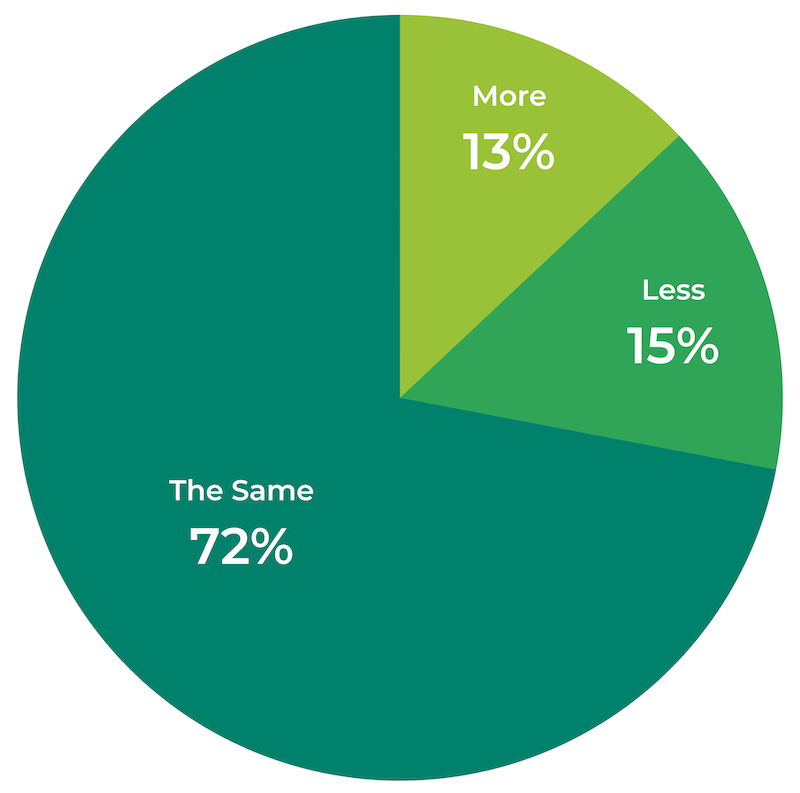

Fortunately for retailers, the majority of people say the frequency with which they return items purchased online has not changed since the start of COVID-19 pandemic. Among those who do return items more or less frequently, the responses were fairly equally split.

Although, there were a few outliers. Both Gen Zs and those with household incomes under $25K were significantly more likely to say they return online purchases less often now, at 24% (compared with 15% across all respondents).

Apparel, shoes, and electronics top the most-returned product categories

Some retailers are more susceptible to returns than others, due to the type of products they offer. At 88%, clothing was far and away the most common type of product people returned. Coming in second and third place were shoes (44%) and electronics (43%).

To reduce returns in these top categories, the answer may be as simple as UGC — user generated visual content, specifically.

These top product categories exactly match the product categories where consumers most value user-generated images, including clothing (78%), electronics (70%), home and garden (62%) and health and beauty (60%). By generating more images and videos from customers, retailers can help lower return rates for products in these categories.

“Poor fit” is the most common reason for making a return

We also asked our survey respondents why they return items.The most common reason people gave was that an “item didn’t fit,” at 70%. Given that clothing represented 88% of all returns, this number makes sense.

Bracketing, or buying multiple sizes of the same item, is a big hurdle for these retailers — leading to higher return rates, driving up costs, and tieing up inventory that could otherwise be sold.

The next two common reasons for returns were the “item was damaged or defective,” at 65%, followed by the “item not matching the description,” at 49%.

UGC: A retailer’s answer to lower return rates

Even though returns may not be a regular occurrence for most shoppers, each return they do make comes at a significant cost to the retailer.

Experts estimate the average return costs a retailer between 15% to 30% of the original purchase price. Cumulatively, returns cost retailers $550 billion every year.

Given these numbers, it’s obviously in a retailer’s best interest to lower return rates when they can. This is especially true for retailers in product categories that have high return rates, like clothing and shoes.

Overwhelmingly, shoppers said that having access to user-generated content — including reviews, Q&A, and images and video — would have made them less likely to return a product.

In fact, across the board, two-thirds of shoppers agreed that they would be less likely to return a product if they had been able to read or view this type of content prior to purchasing.

UGC even more influential for younger shoppers

As we reviewed the data, a clear trend emerged: the younger a consumer is, the more likely they are to be swayed by UGC. This is especially true for image and video.

For example, user-generated image and video content has the biggest impact on Gen Zs. 82% of Gen Zs agreed that viewing UGC imagery prior to purchasing a product online would make them less likely to make a return.

When it came to reviews, Millennials and Gen Zs were equally likely to agree that reviews would make them less likely to return a product, but there was still a big jump between younger and older generations.

When it came to Q&A content, there was less of a stark difference between the generations, but you can still see a clear preference for UGC among younger consumers compared to older ones.

Are you set up to lower returns?

The COVID-19 pandemic changed a lot about how we browse and buy, but one thing’s for sure: returns are a necessary evil for brands and retailers. Fortunately, they have a highly effective tool at their disposal to reduce return rates, and increase conversions at the same time: user-generated content

Our results demonstrate how shoppers who consume ratings and reviews, Q&A content and user-generated imagery and video before buying an item are less likely to return it. This is a fact clearly evident in the data.

However, UGC also incorporates another critical element that can also reduce return rates – something we haven’t explored at length here: the consumer insight in the actual reviews themselves. By treating your UGC as a consumer insight channel, you can get to the bottom of why your customers feel compelled to return items in the first place.

So – instead of treating UGC purely as an online conversion mechanism – think about how you can further maximize its potential. Display it in a way that facilitates in-depth and accurate buyer research prior to purchase and then extensively analyze the information it contains to drive impactful product improvements.