Survey at a Glance:

The Importance of Review Recency and Volume Among UK Shoppers is based on survey responses from 3,265 consumers in the UK from July 2022. Here’s a preview of our key findings.

- 73% consider the average rating when reading review content.

- Review recency (72%) and review volumes (also 72%) are of comparable importance.

- Authenticity (71%) is another critical factor for consumers (check out our complementary study on this topic).

- When reading reviews, 99% of consumers consider when they were written at least some of the time.

- While recency matters across all products, it’s particularly important for consumer electronics and appliances (70%), clothing, shoes, and accessories (61%), and health and beauty (58%).

- 69% of shoppers are more likely to buy a product with fewer, but newer reviews than one with a higher volume of older reviews.

- 54% of shoppers in the UK say that ideally, they’d be able to find review content for a specific product that was written within the past month.

- 56% would be likely to consider a different product if the one they were interested in only had old reviews (published a year or more ago).

- 99% of shoppers consider the number of reviews available for a product at least sometimes when reading reviews.

- Review volume matters for all product categories. However, it’s especially impactful for consumer electronics and appliances (80%), clothing, shoes, and accessories (65%), and health and beauty (64%).

- 80% of consumers are less likely to buy a product if it has no reviews.

- About a third (32%) of shoppers want to be able to find at least 101 reviews for a given product.

- The greatest portion of shoppers – 75% – read between one and 25 reviews for a given product.

Introduction

Ratings and reviews were once considered a “nice to have.” But today, they’ve become an essential tool consumers depend on whether they’re shopping online, in-store, or some combination of the two. In fact, research tells us ratings and reviews have become THE most important factor impacting purchase decisions.

Collecting reviews and prominently displaying that content is a great start. But the reality is, it might not be enough to meet shoppers’ expectations.

That’s because shoppers consider many factors when reading reviews – which are outlined in the graph below. Brands and retailers must provide reviews that address as many as these factors as possible if they expect to boost shoppers’ trust – and their likelihood of making a purchase.

We have always known average rating is important to shoppers – but review content and review volume are evidently as important. Review authenticity is similarly in the same ballpark (we did another study on that topic, so don’t cover that here).

In this report, we zero in on review volume and review recency. We’ll explore the importance shoppers place on each factor, how they impact purchase behaviour, and what consumers expect in terms of each factor.

Review recency: How long ago a review was written

Methodology

This report is based on the analysis of a survey of 3,265 consumers in the UK fielded during the month of July 2022. Here’s a closer look at who we surveyed.

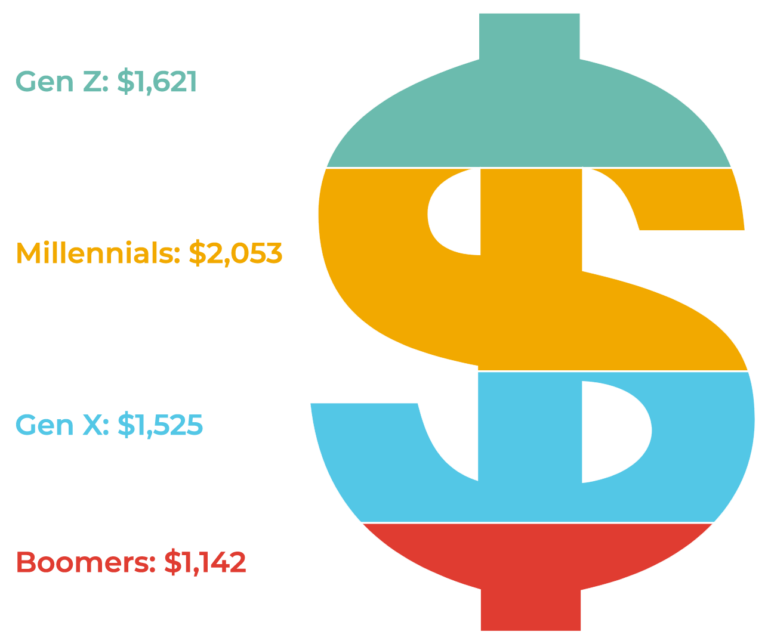

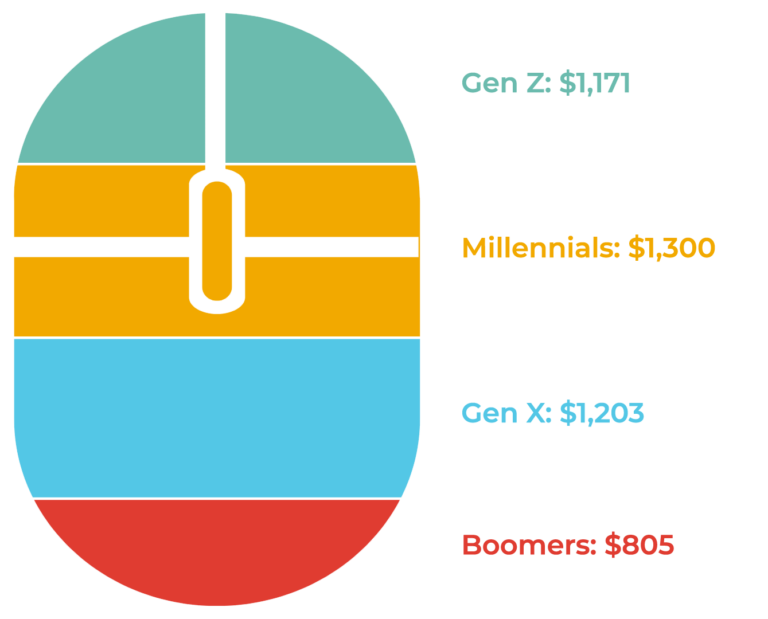

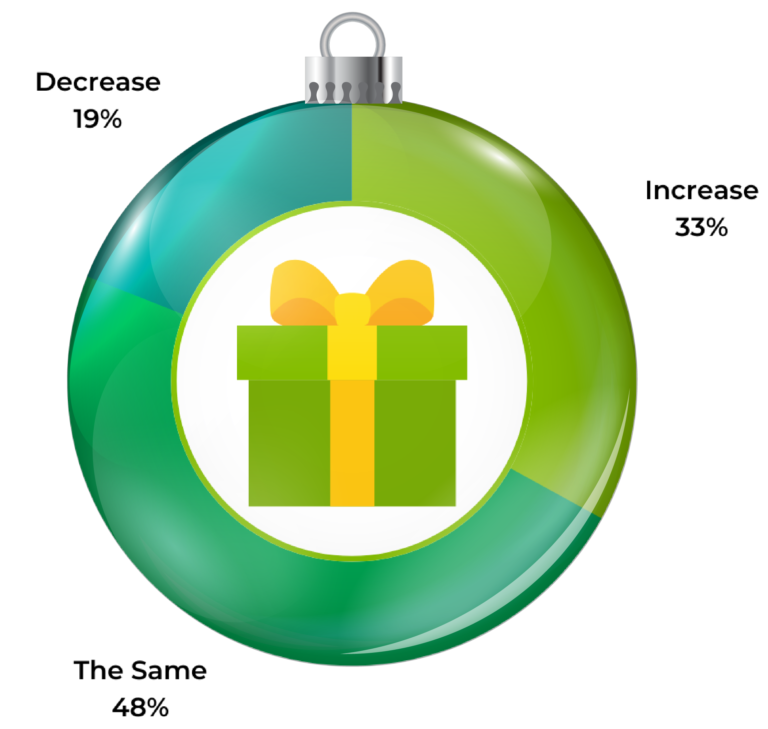

Generations

(1997-present)

(1981-1996)

(1965-1980)

(1946-1964)

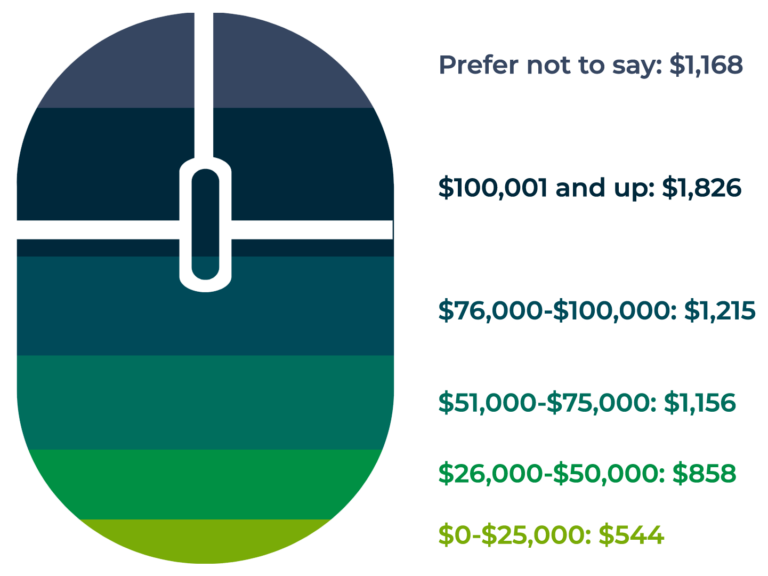

Household Income

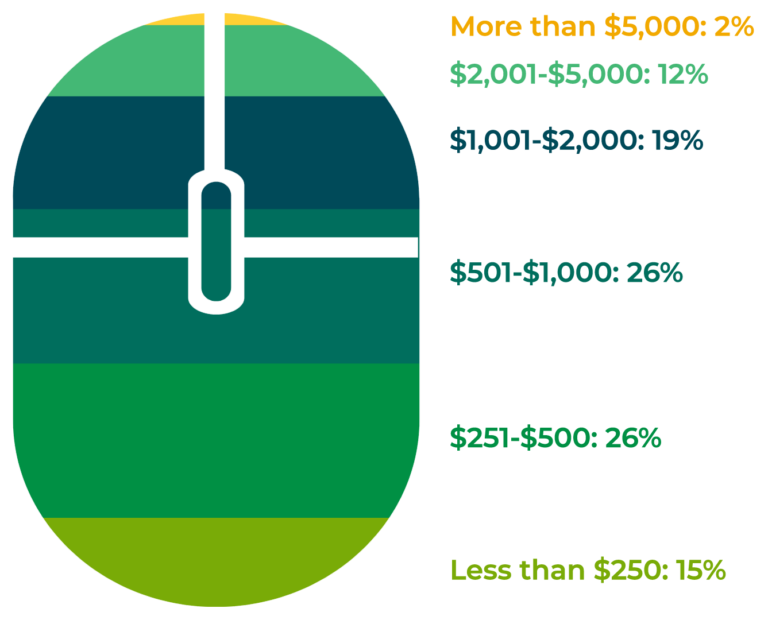

Monthly Online Spend

The Importance & Impact of Review Recency

Review recency is a top consideration among shoppers in the UK. And, it’s a factor that has a significant impact on purchase behaviour.

Recency is a Key Consideration When Reading Reviews

Nearly all (99%) of shoppers consider when a review was written when reading this content. Many do so even more frequently.

In addition, 97% of shoppers consider review recency to be at least somewhat important. Over half (56%) consider this factor to be very important.

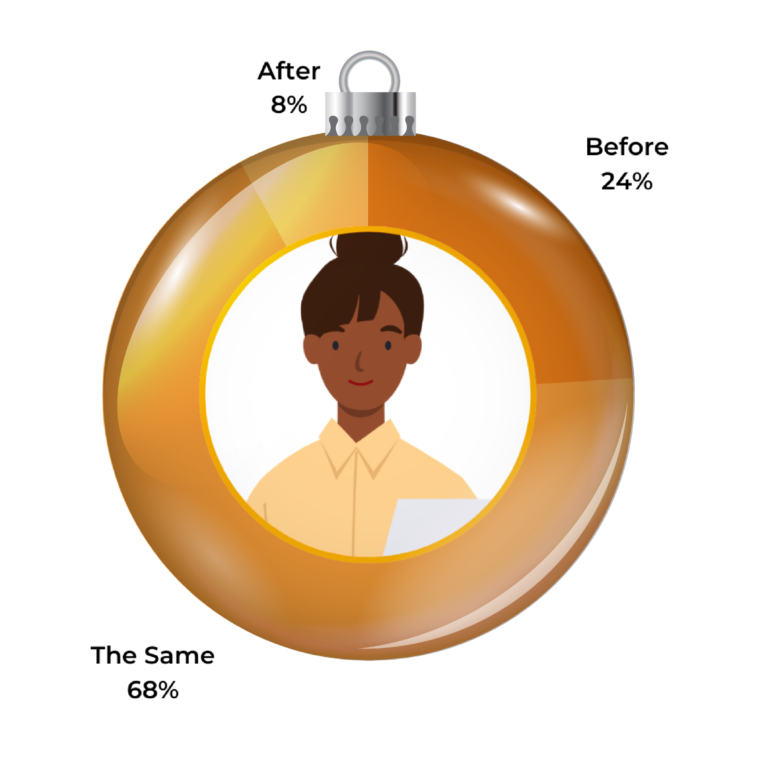

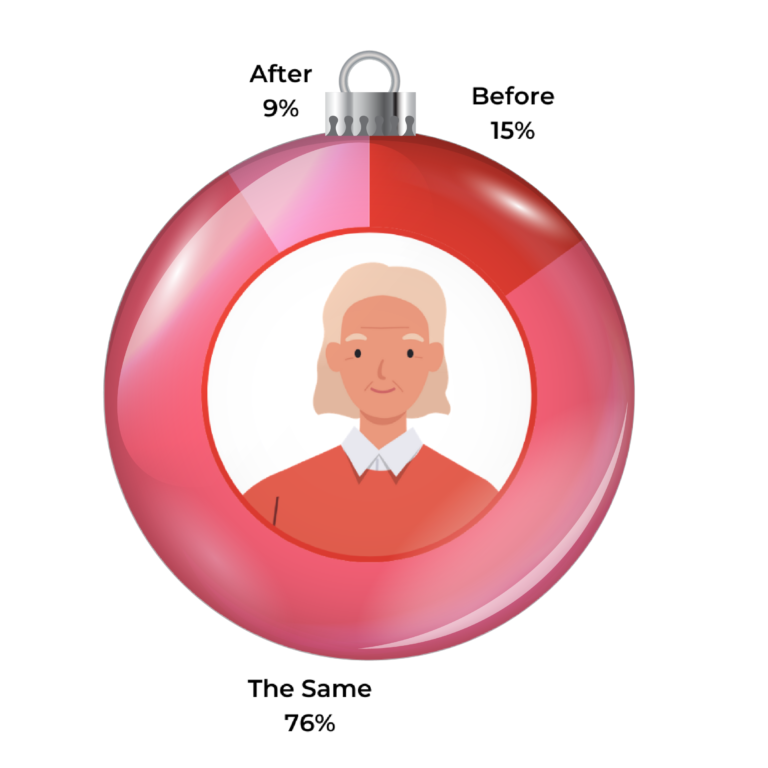

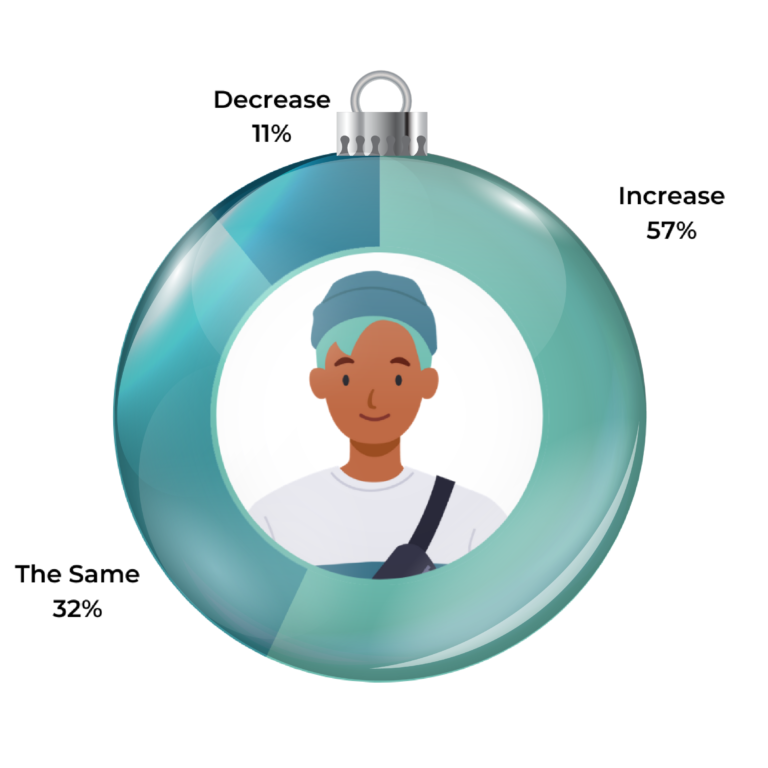

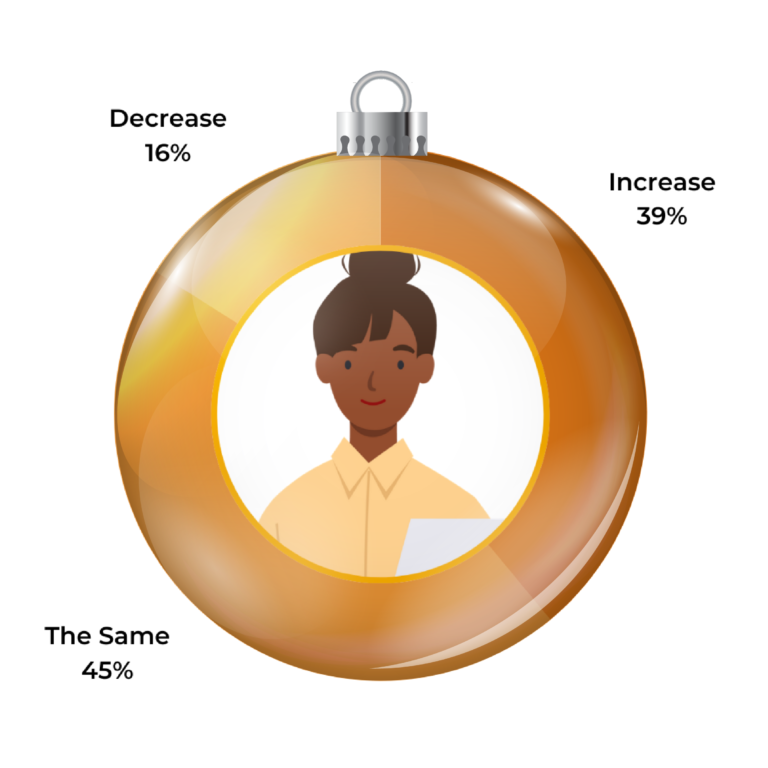

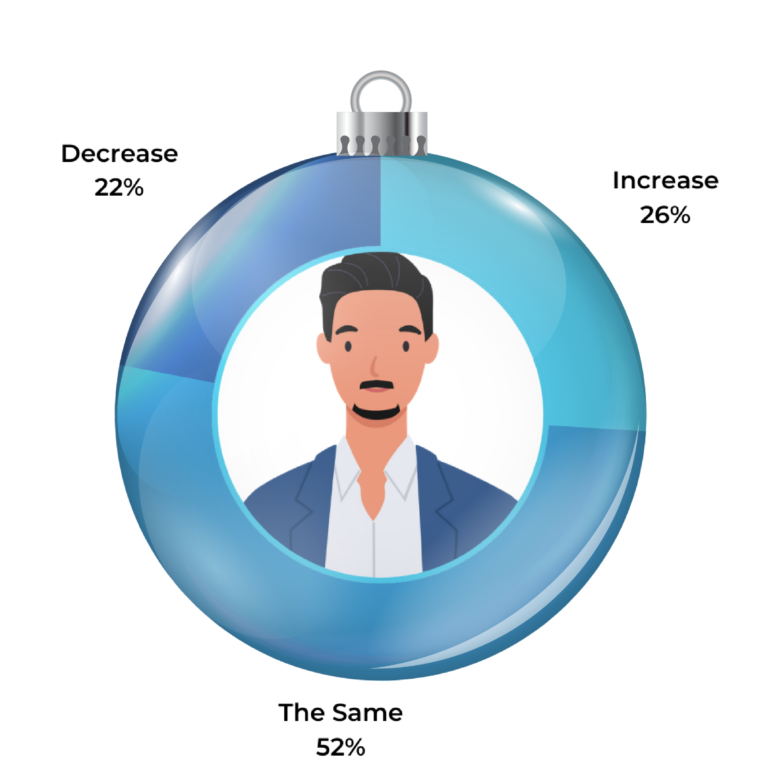

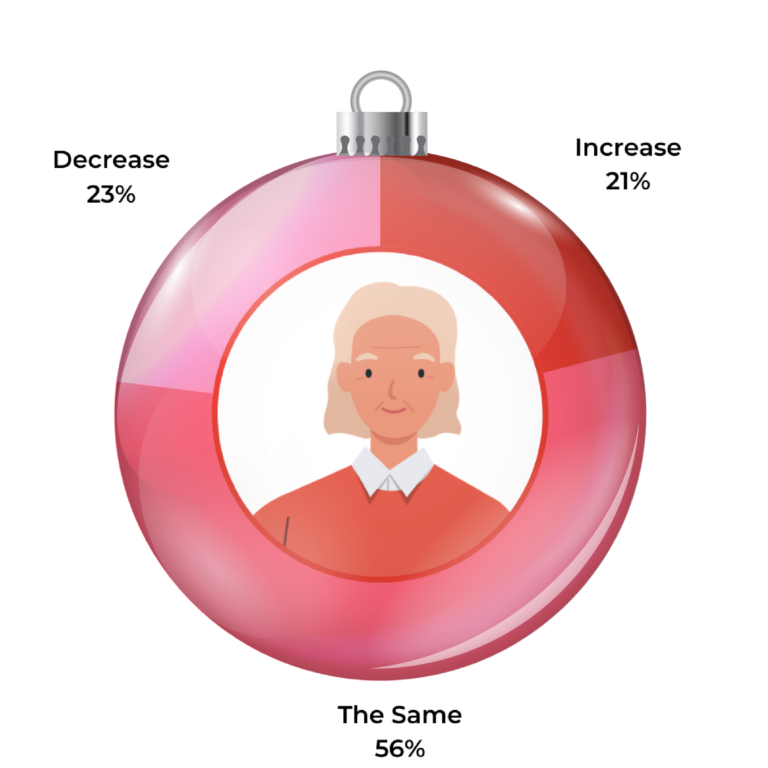

Of note, younger shoppers are more likely to place importance on recency than their older counterparts.

Why is review recency so important to shoppers in the UK? While there are many reasons, the top response – selected by 66% of those we surveyed – is that recent reviews are a more accurate indicator of the quality of a given product.

Review Recency Matters Across Myriad Product Categories

There are some product categories for which recency is especially important to consumers. These include consumer electronics and appliances (70%), clothing, shoes, and accessories (61%) and health and beauty (58%).

But make no mistake: a good portion of consumers consider review recency for all of the product categories we asked about.

For Many Shoppers, Review Recency Trumps Quantity

Review quantity is another top factor consumers consider – and one we’ll explore in more detail later on in this report. However, many shoppers value recency more than quantity.

61% of shoppers say that they’d be more likely to buy a product with fewer, but newer reviews than one with a higher volume of reviews – all of which are older than three months. Interestingly, older shoppers are more likely to indicate this is the case.

Consumers Have High Expectations for Recent Reviews

When reading reviews, recency is a top consideration. But just how recent must review content be to satisfy shoppers’ expectations?

Over half (54%) of shoppers say that in an ideal world, they’d be able to find review content for a specific product that was written no more than a month ago.

Stale Reviews Can Deter Shoppers

Over half (56%) of shoppers indicate that if all reviews for a product were published a year or more ago, they’d be more likely to consider purchasing a different product with more recent reviews.

Younger shoppers are more likely than older shoppers to pass up products with only stale reviews available.

Review Volume Expectations & How It Impacts Purchase Behaviour

Review volume – in other words, the quantity of reviews for a given product – is another top consideration for shoppers. In this section, we’ll dig into the importance shoppers place on review volume, as well as their expectations.

Review Volume is a Factor Consumers Consider Often

Nearly all shoppers – 99% – consider the quantity of reviews available for a product at least sometimes when reading reviews. Of note, younger shoppers consider review volume more frequently than their older counterparts.

Review Volume Matters Across Many Product Categories

Similar to review recency, volume matters across all product categories we asked about. However, there are certain categories for which volume is especially important.

The top three are consumer electronics and appliances (80%), clothing, shoes, and accessories (65%), and health and beauty (64%). Incidentally, these are the same categories for which recency is most important.

The Absence of Reviews Deters Shoppers

Consumers have come to depend on reviews. So it’s probably not surprising that 80% of consumers indicate that if there were no reviews available for a given product, they’d be less likely to buy it.

Younger shoppers are more likely than older shoppers to pass up a product if it has no reviews.

Consumers Want a High Volume of Reviews – But They Read Far Fewer

The largest portion of consumers – 24% – indicate that in an ideal world, a product would have between 51 and 100 reviews. However, just under a third (32%) want to be able to find 101 or more reviews for a given product.

However, most consumers will settle for less than ideal. In fact, over half (53%) indicate that the minimum number of reviews a product needs for them to feel comfortable purchasing it falls between one and 25.

Most Consumers Read 25 or Fewer Reviews

While consumers ideally want a large volume of reviews, many actually read far fewer. The greatest portion of shoppers – 75% – read between one and 25 reviews when considering a product.

Why, then, do they want to find a large volume of content? Because this increases the likelihood that they’ll find content that speaks to their unique needs and use cases.

4 Key Takeaways for Brands & Retailers in the UK

Consumers consider many factors when reading reviews. Chief among them are recency and volume. As such, brands and retailers must focus on providing shoppers with a high volume of recent reviews across all products.

Here are our four key takeaways for brands and retailers, based on our latest survey.

When reading reviews, 99% of customers consider when they were written at least sometimes. And, 97% consider review recency to be at least somewhat important. What’s more, for many shoppers, recency trumps review volume.

Brands and retailers across all product categories must focus on keeping their reviews fresh.

Over half of consumers in the UK want to be able to find review content that was written within the past month. And if a product comes up short, they’re likely to look for a different option. Over half (56%) of shoppers say that if all reviews for a product were a year or older, they’d be likely to consider a different product with more recent reviews.

Brands and retailers must make it a priority to consistently generate a steady stream of reviews across the entire product catalogue. Doing so ensures shoppers can always find a high volume of review reviews to fuel informed purchase decisions.

Nearly all (99%) consumers who read reviews consider the quantity available for a given product at least sometimes. And if there are no reviews available for a product, 80% say they’re less likely to buy it.

As such, brands and retailers must aim to generate a significant number of reviews – regardless of product category.

In an ideal world, consumers expect a large volume of reviews. A third (32%) want to be able to find at least 101 reviews for a product.

However, they’re often not reading that many reviews. Most read 25 or fewer when considering a product.

A high volume of reviews increases the chances a shopper will find content that’s relevant to them. Be sure your review display includes sorting, filtering, and search capabilities to help these shoppers quickly unearth the content that’s relevant to their needs and use cases.