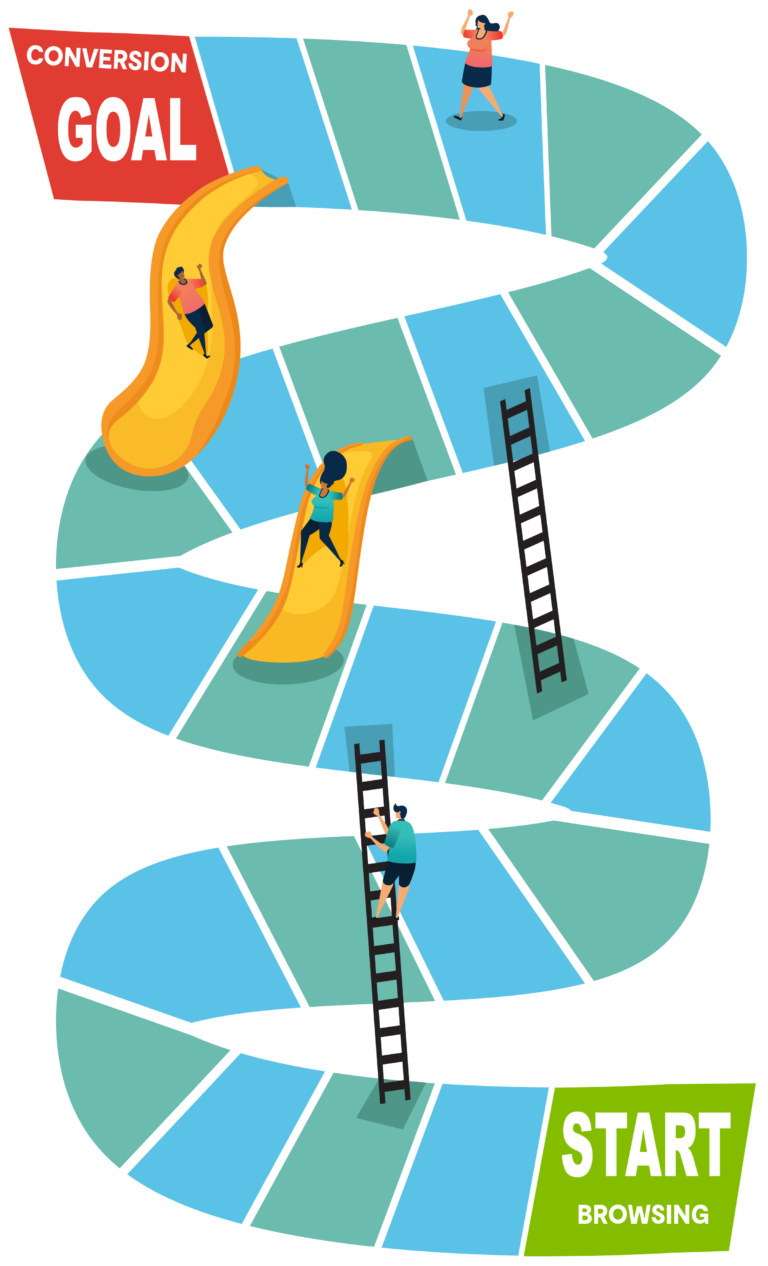

How to get shoppers from start to finish –browsing to conversion.

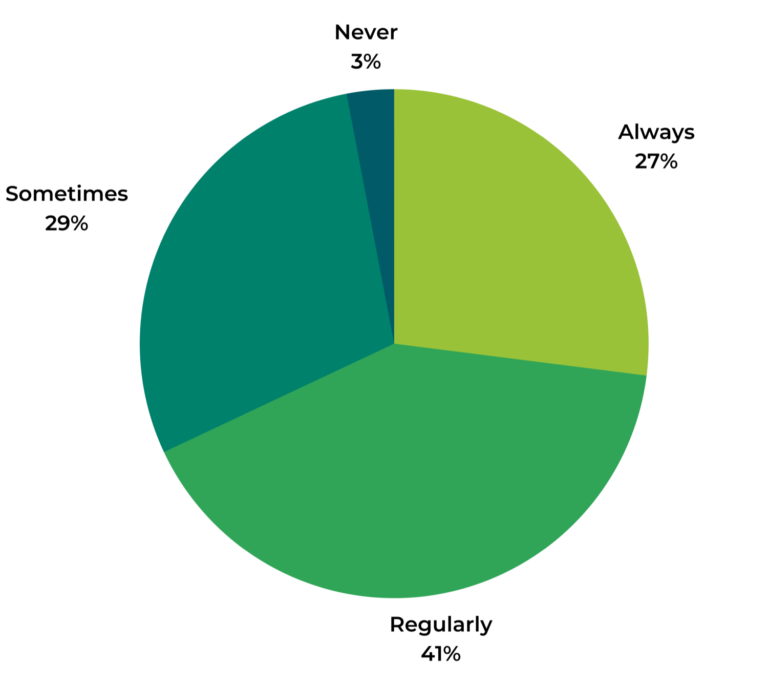

Like a game of chutes and ladders, the modern customer journey is full of twists, turns and multiple channels. Below are some quick tips for brands based on our recent customer journey survey of ~13,000 US consumers.

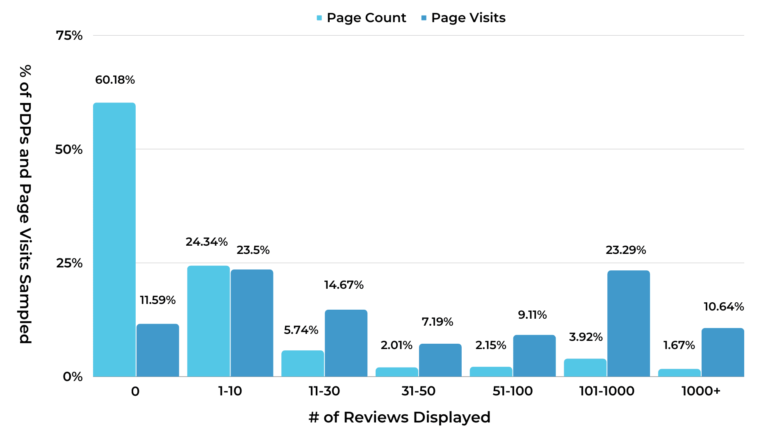

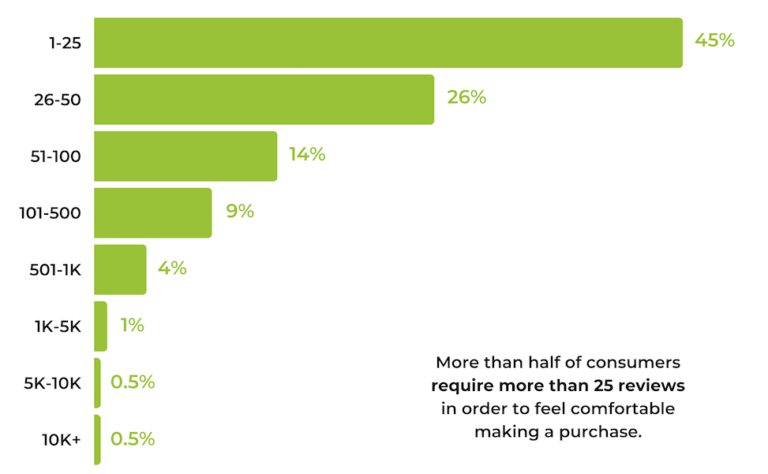

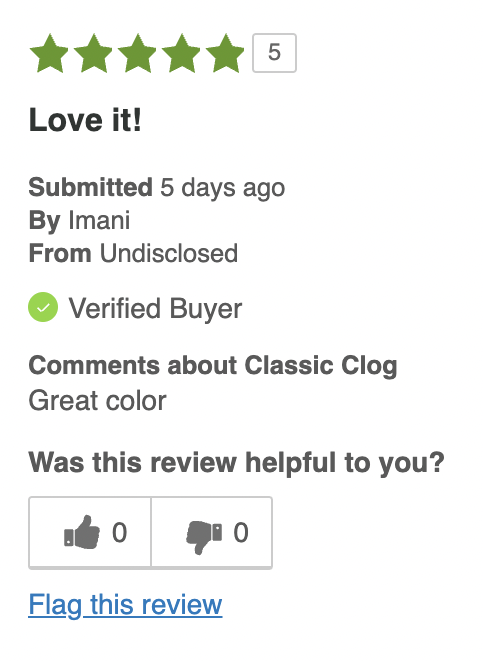

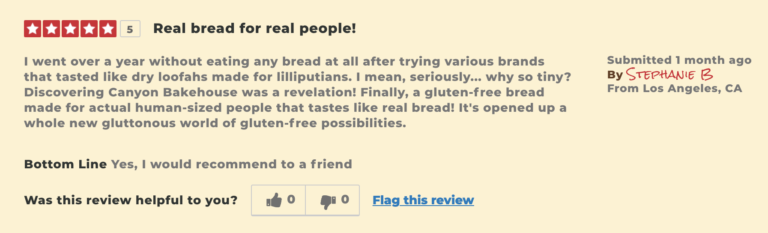

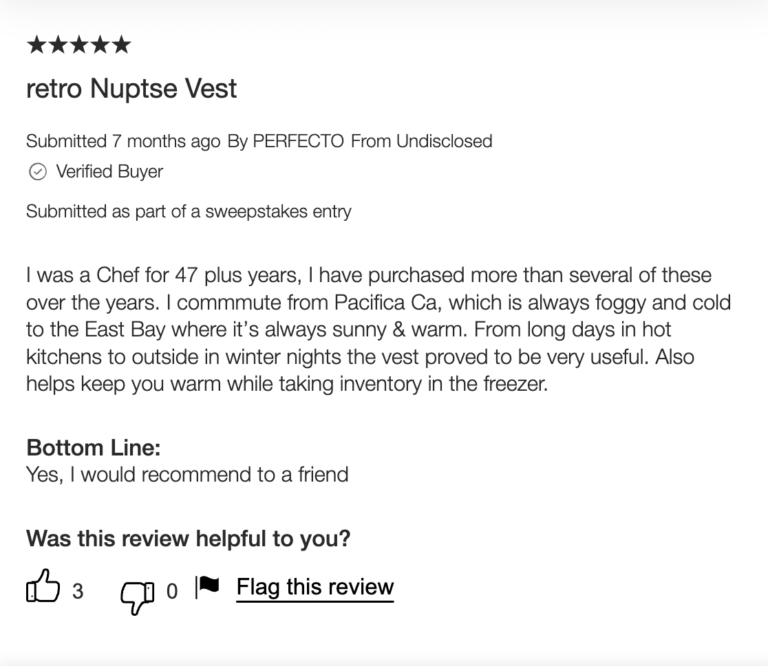

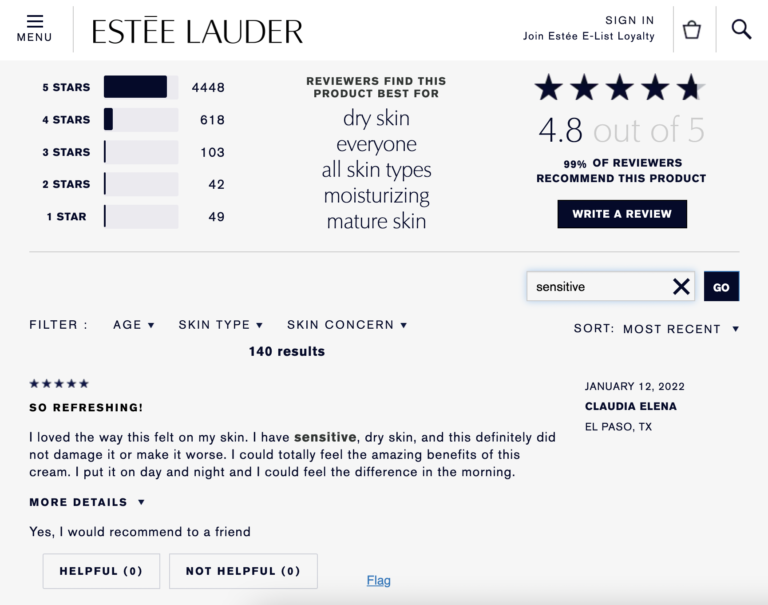

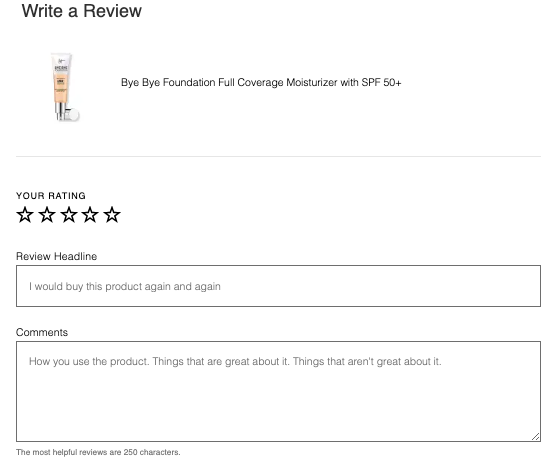

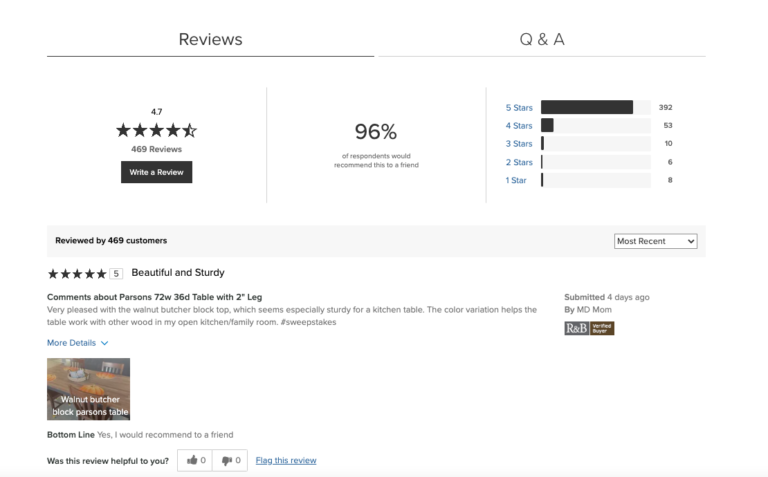

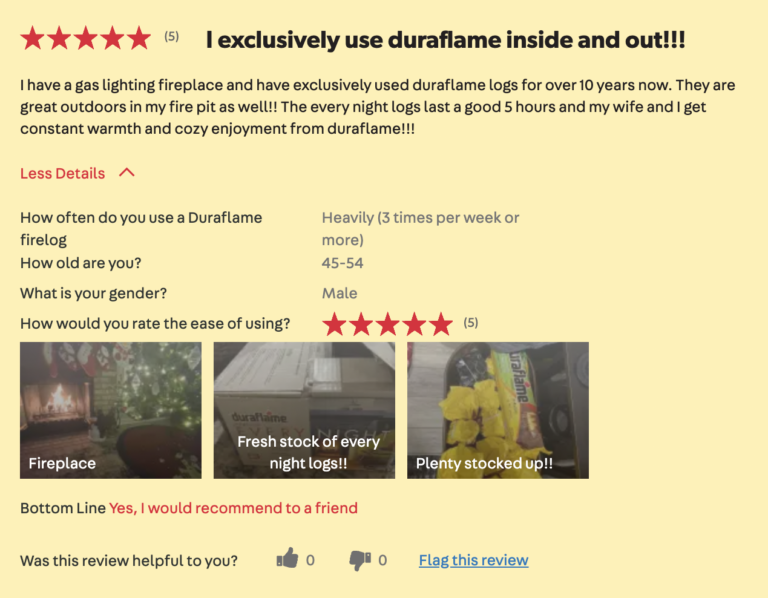

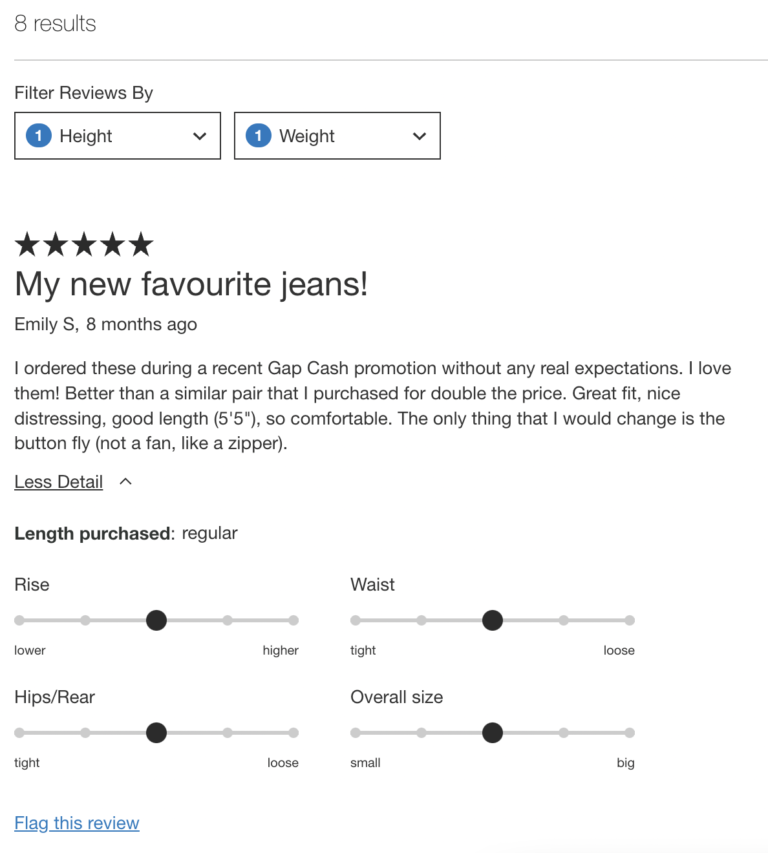

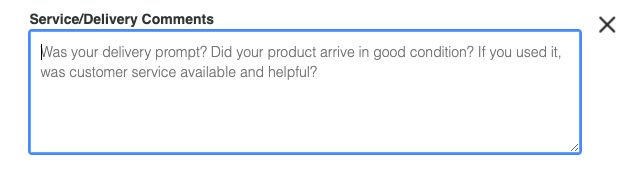

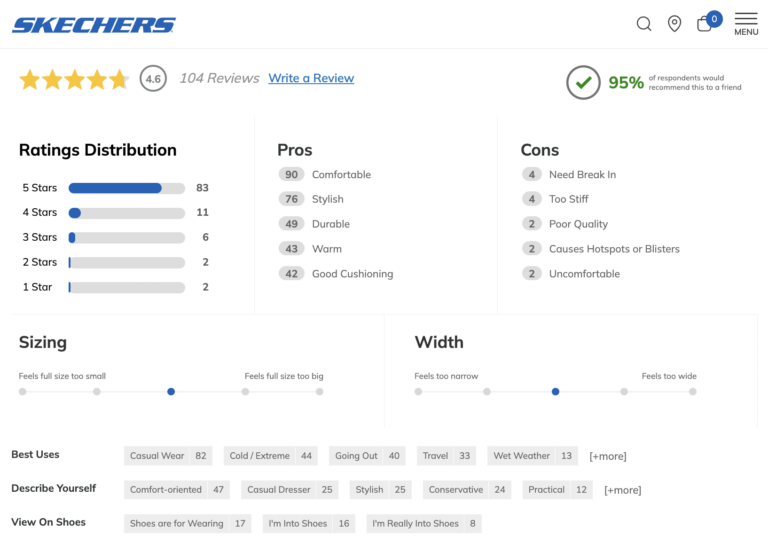

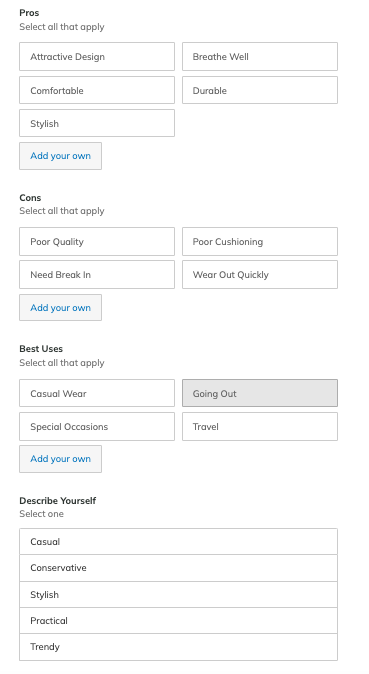

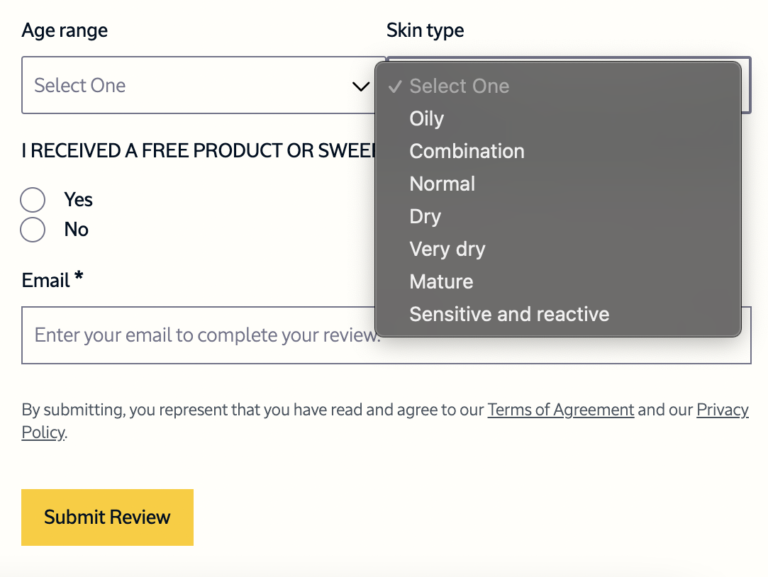

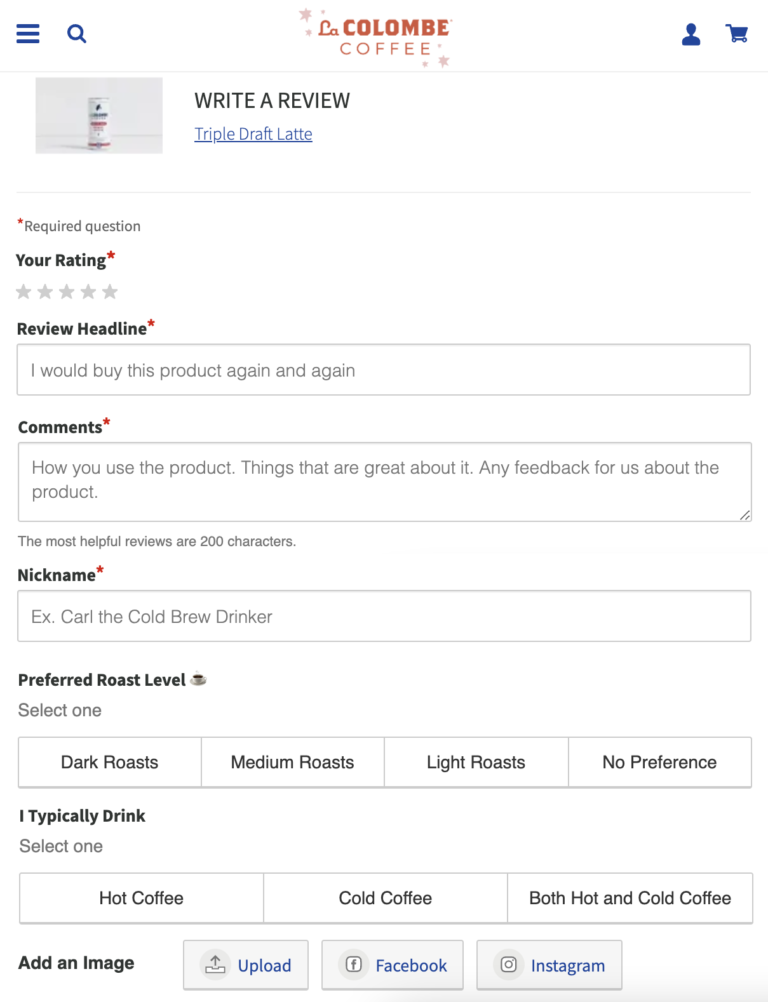

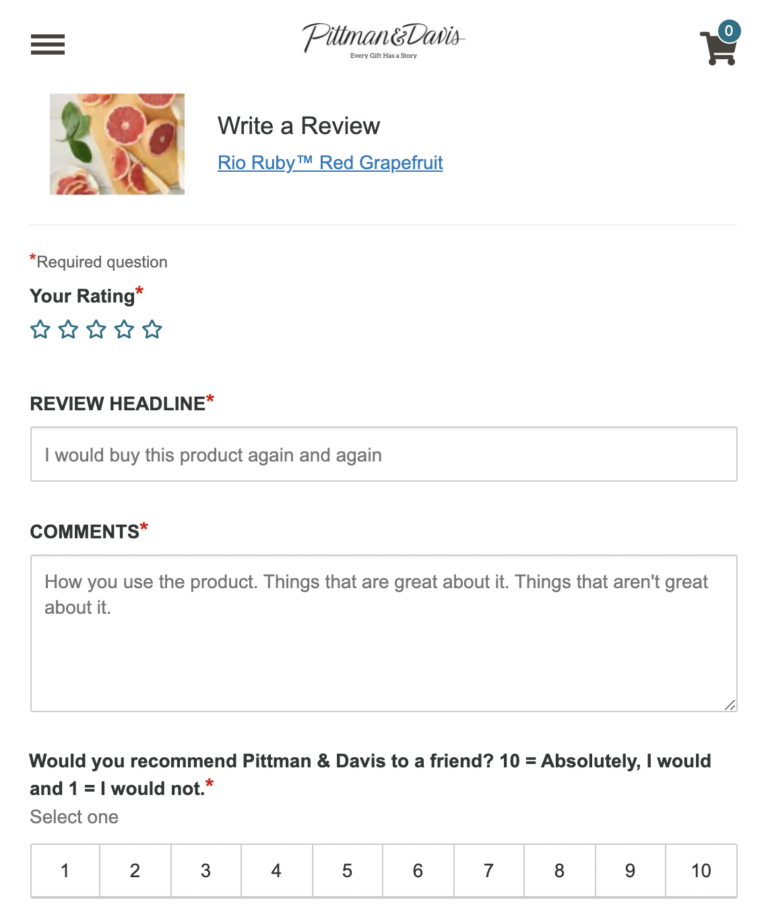

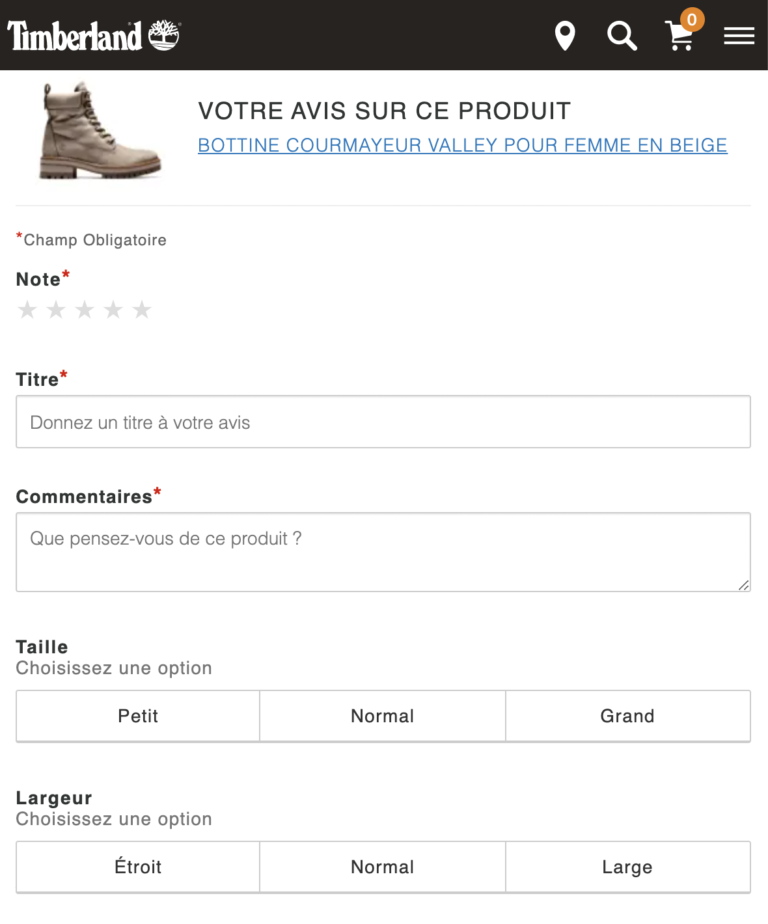

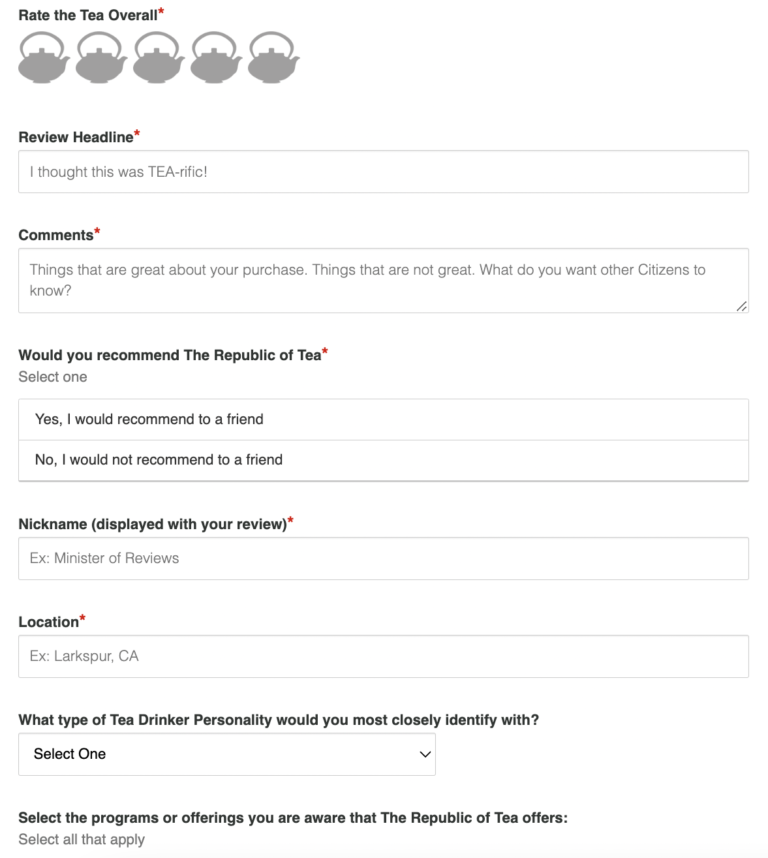

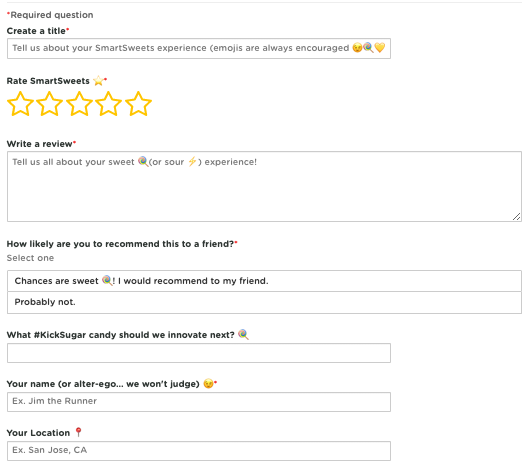

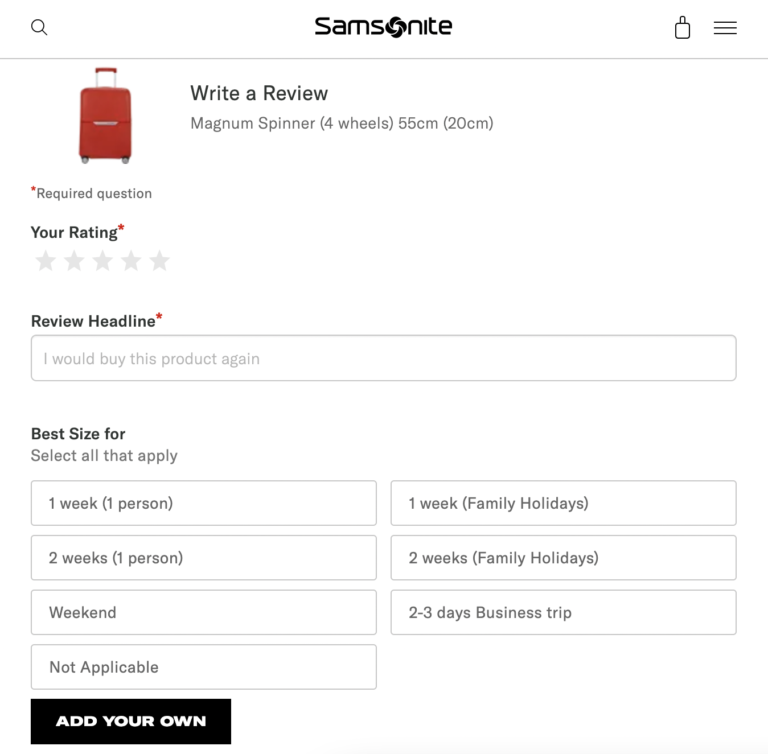

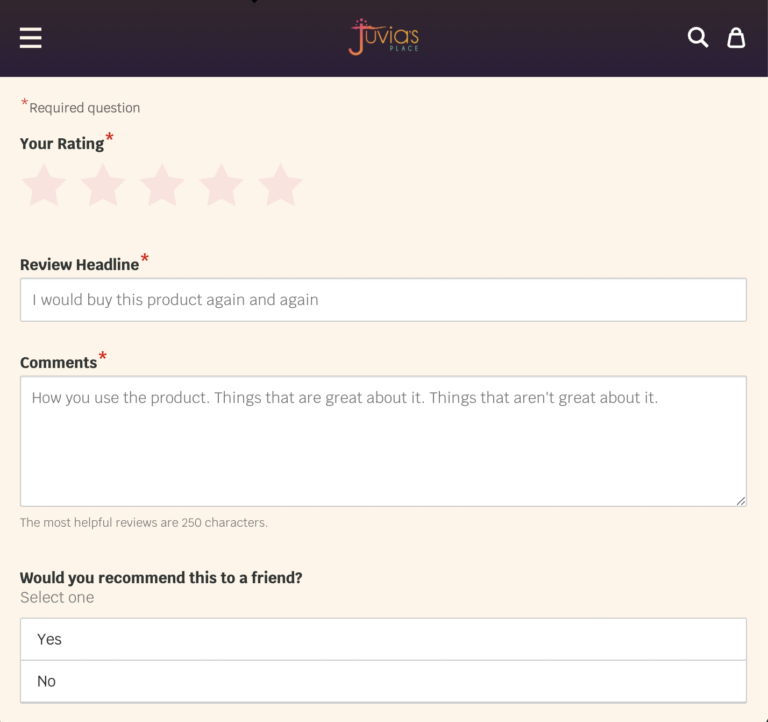

Brand site lacks review coverage.

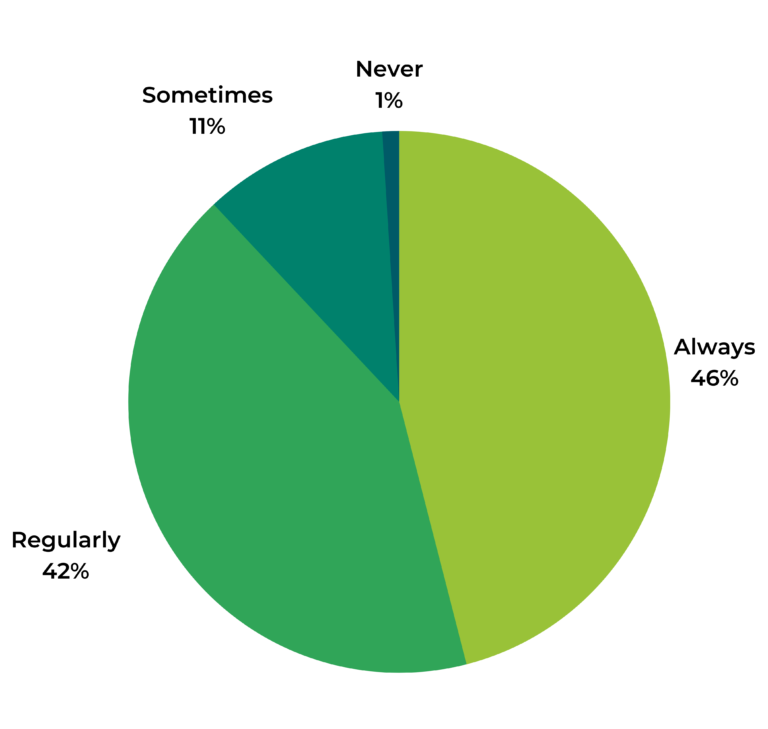

86% of shoppers won’t purchase products online without reading reviews.

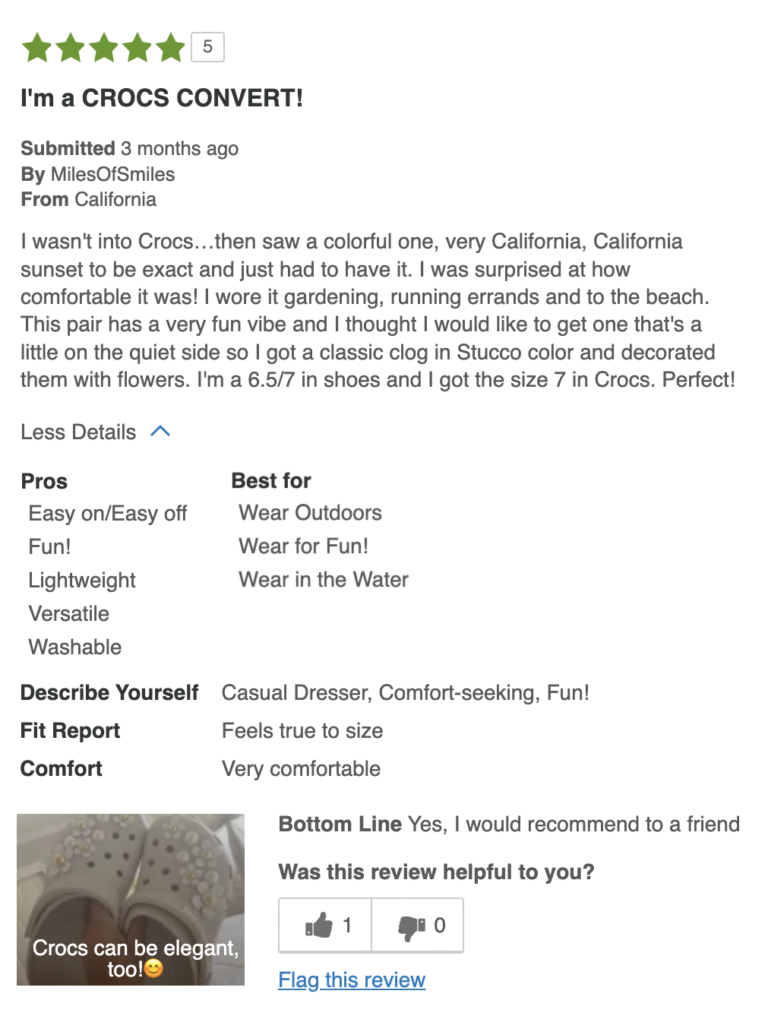

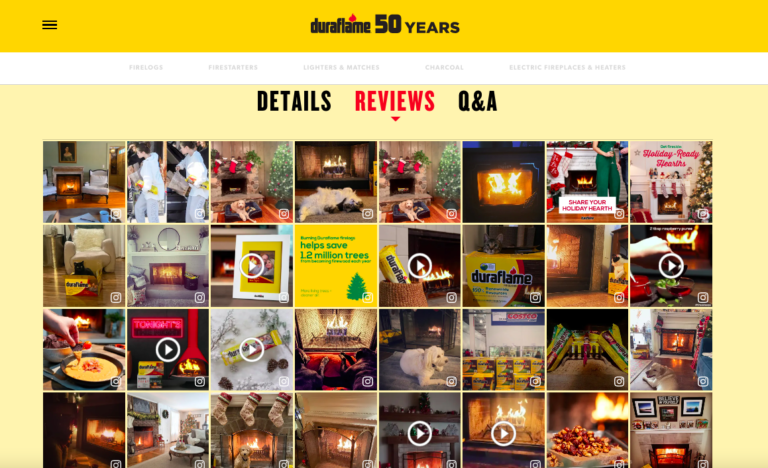

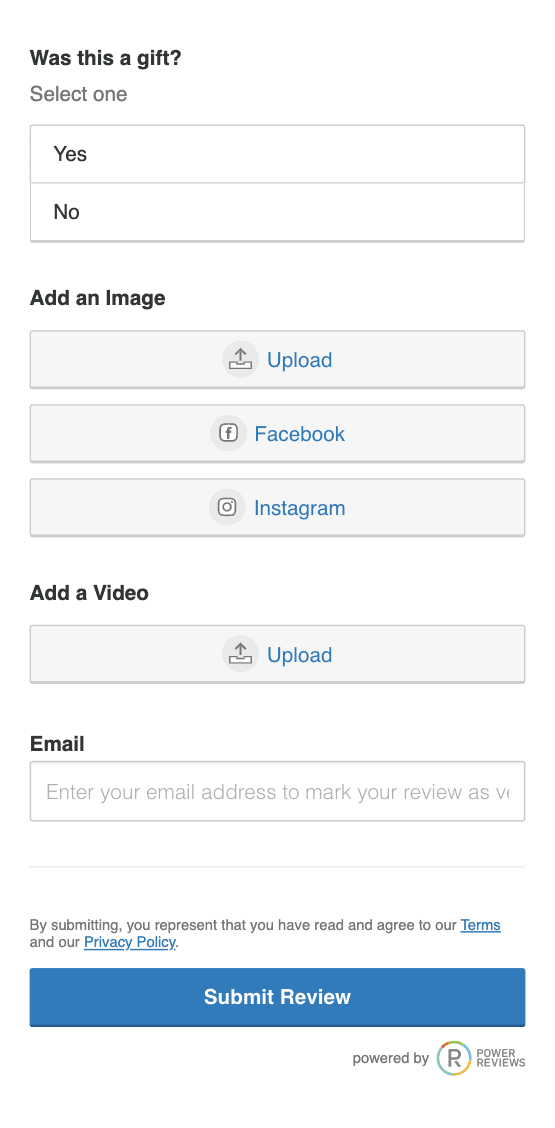

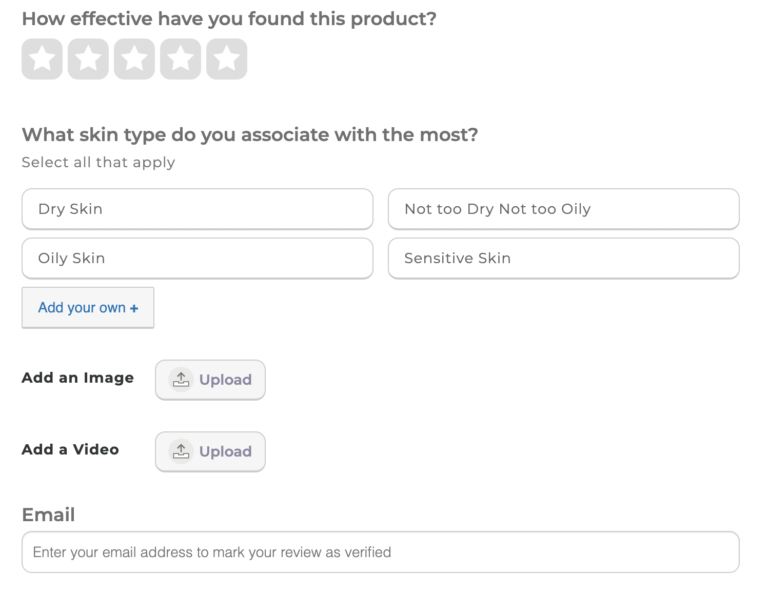

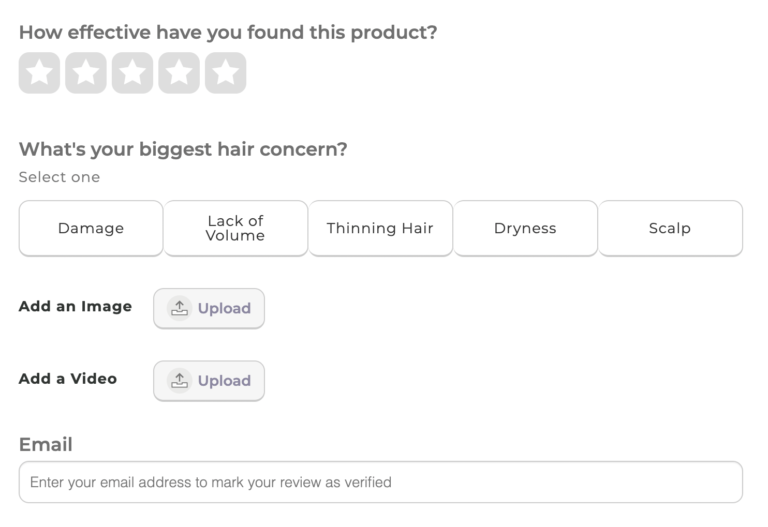

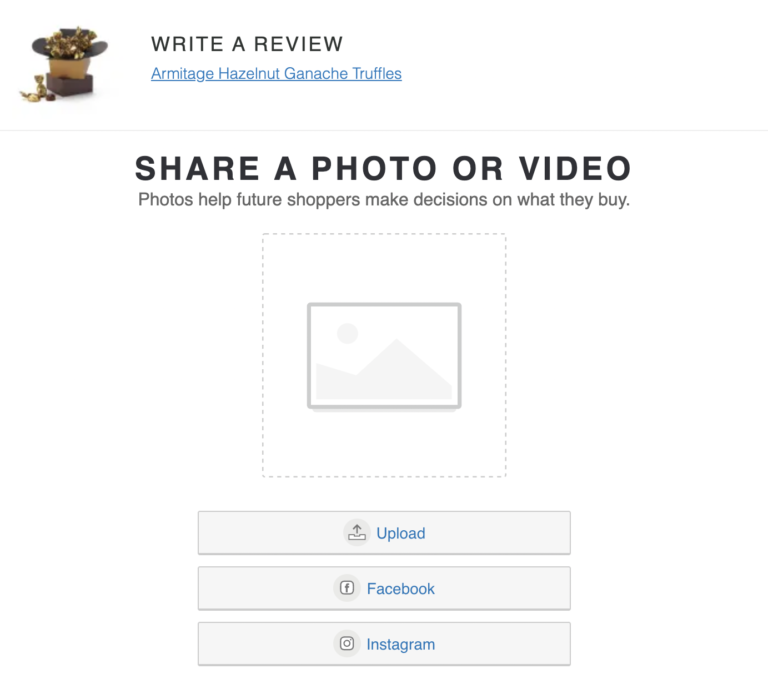

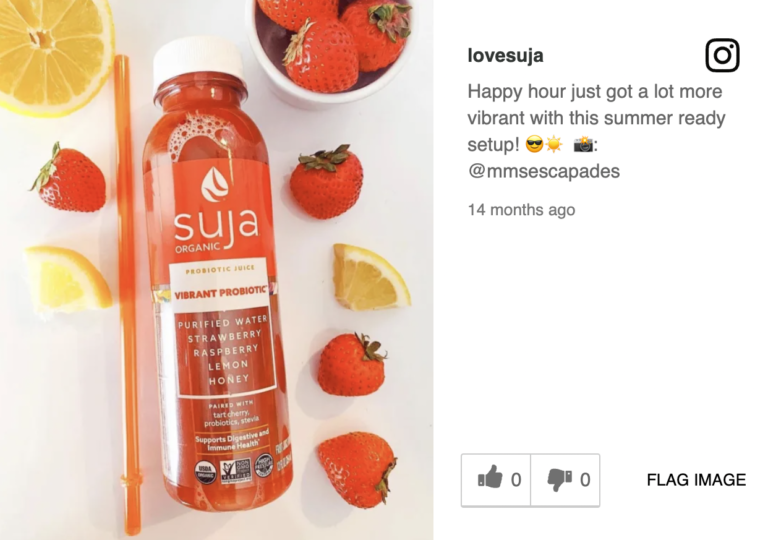

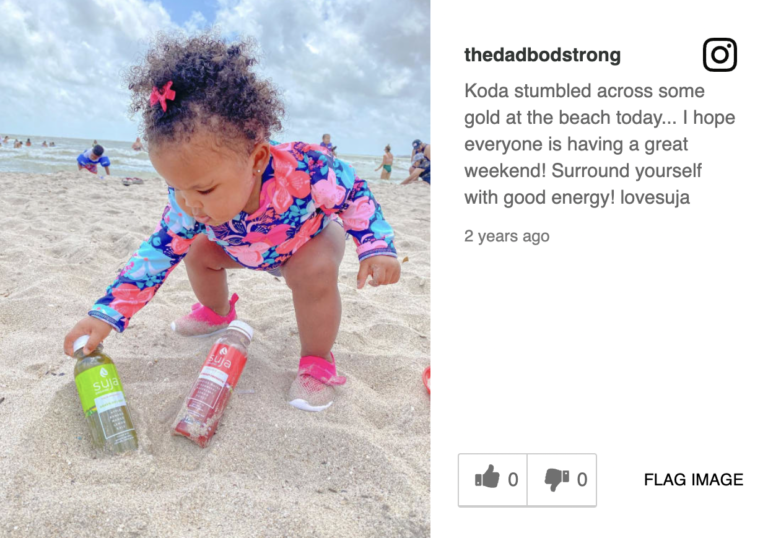

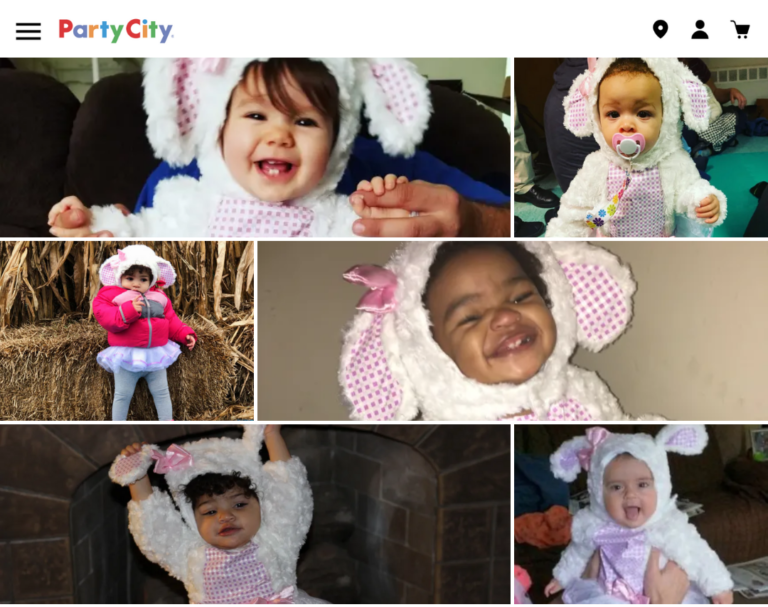

Lack of customer pictures and videos.

49% consider customer-generated imagery when viewing a product page.

Infusing digital marketing with promotions, as well as ratings and reviews content.

76% of customers click on ads with discounts and promotions, and 47% click on ones showcasing positive reviews.

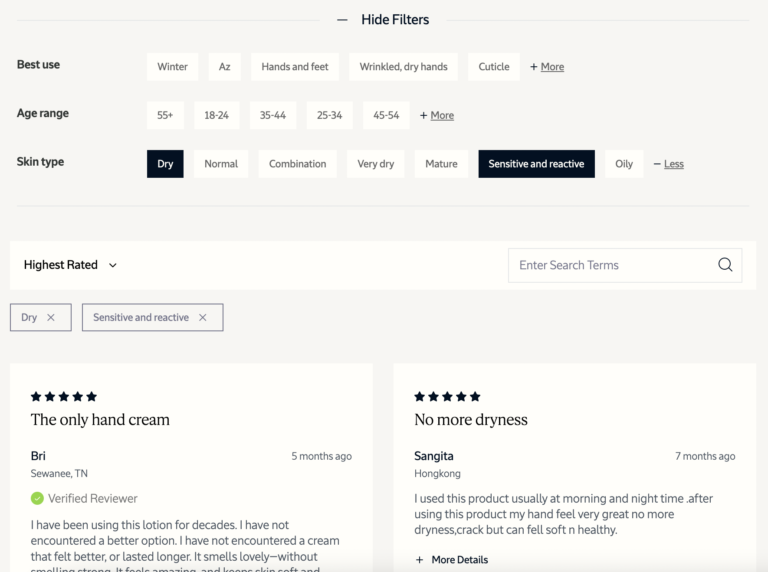

Having review coverage across retailers.

89% of shoppers begin their product search on Google, 88% on Amazon.