Reviews provide important feedback for brands, helping them shape and improve their products. Having review content on your website is also good for SEO, providing fresh content to Google and lifting organic traffic by 20% on average. Most importantly, customers who interact with reviews are 115% more likely to convert.

The ROI of UGC is clear.

But for non-ecommerce brands without checkout data, the path to collecting reviews isn’t.

If you don’t collect orders like a traditional ecommerce site, there’s no automatic way of sending a follow up email with your customers to solicit reviews.

The challenge of review collection affects a large number of non-ecommerce companies, from B2B brands who primarily sell to contractors to those who sell primarily through large retailers. You may be a food and beverage brand, a home supply company, or a personal care brand.

If your website showcases your products with a button that says “Find a Store” instead of “Checkout Now,” we’ve got good news.

You don’t need a transactional website to collect reviews. There are plenty of success stories from non-ecommerce brands who collect real, positive reviews from their customers, brand advocates, and fans. You just have to get a little creative.

8 Creative Ways Non-Ecommerce Brands Can Collect More Review Content

What’s the #1 thing non-ecommerce brands can do when it comes to collecting reviews? Make sure your customers know that you have a website (we know, it seems obvious), that your website offers the ability for them to write reviews, and that you want their feedback.

Are you ready to collect reviews for your non-ecommerce brand? Get started with these eight proven strategies.

1. Leverage Your Email Marketing

Again, one of our biggest tips is simply to let your customers know that you want reviews. What better place to do that than in your email communications?

Ask for reviews in your email marketing newsletters. This campaign from sports drink brand BodyArmor collected over 1,000 reviews in just five days!

Ready-made cocktail brand BuzzBallz took a similar approach, offering free merch to the first 50 people to leave a review.

To ensure authentic reviews, send these emails to verified customers in your CRM. Offer an incentive for writing a review, or just let people know their feedback can help others. Then, include a link that takes them straight to your review form.

2. Create a Landing Page Just for Reviews

Don’t know which customers bought which products? Take a cue from Skippy Peanut Butter. They put all four types of peanut butter they sold on one landing page and added a “Write a Review” link beneath each one.

This approach is really effective because you can send customers straight to this page and they don’t have to navigate. There’s just one call to action for them, and one link for you to include in your emails.

3. Use QR Codes to Gather Reviews

When it comes to getting reviews, QR codes are a brand’s best friend. Use promotional labels with QR codes to drive customers to your site to leave a review.

For example, you can attach a promotional card insert or tag to your product that has a QR code on it, or print the QR code on the product packaging itself. When customers scan it, they’re taken directly to your review form.

You can also print QR codes on cards you hand out at different events with a note like “Let us know what you think.” Get inspired with these business-sized cards from gluten-free bread brand Canyon Bakehouse.

QR codes make it easy for your customers to leave feedback. They don’t have to type anything in; they can just scan the code and leave their feedback right there on the spot.

4. Exchange Coupons for Reviews

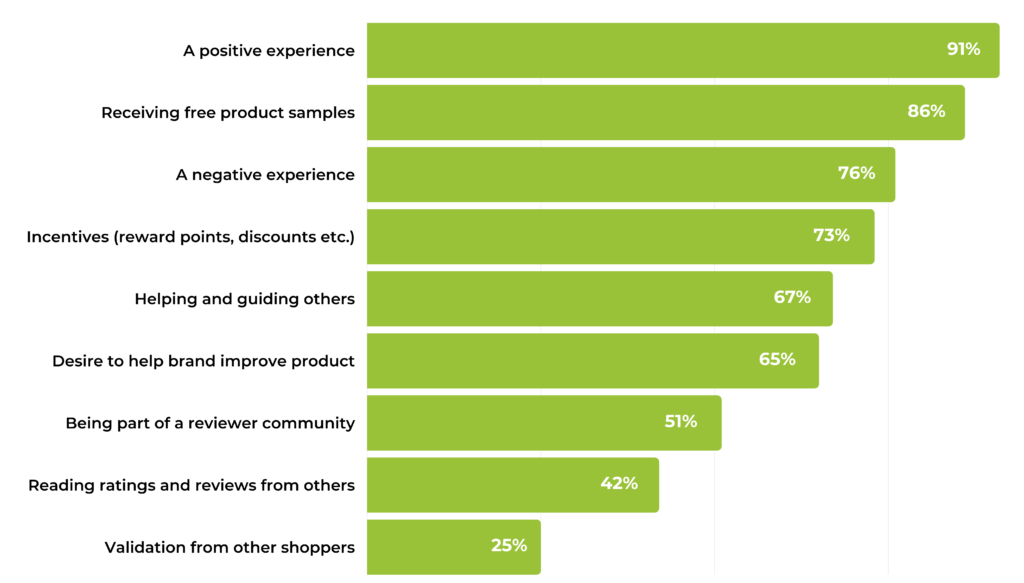

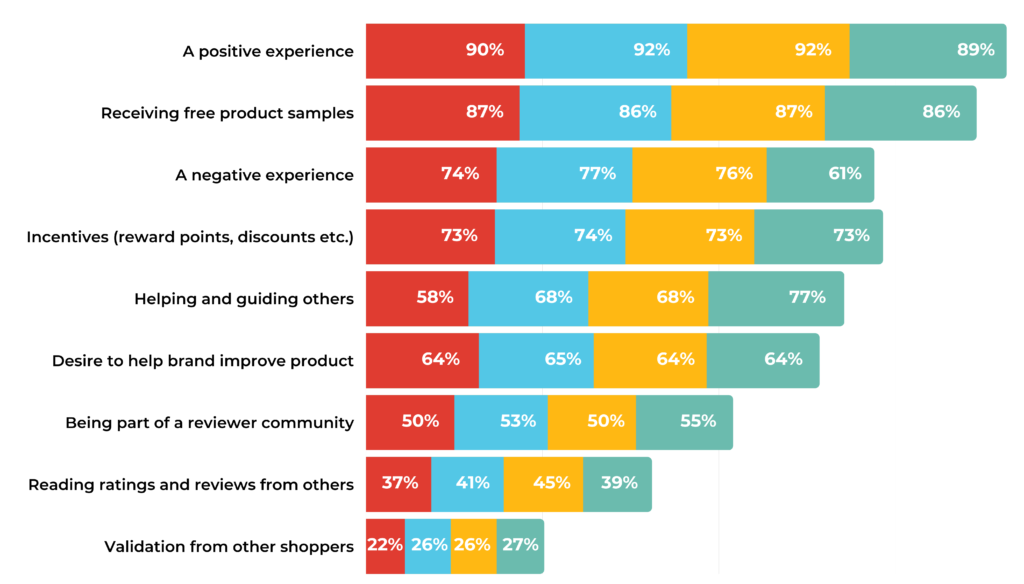

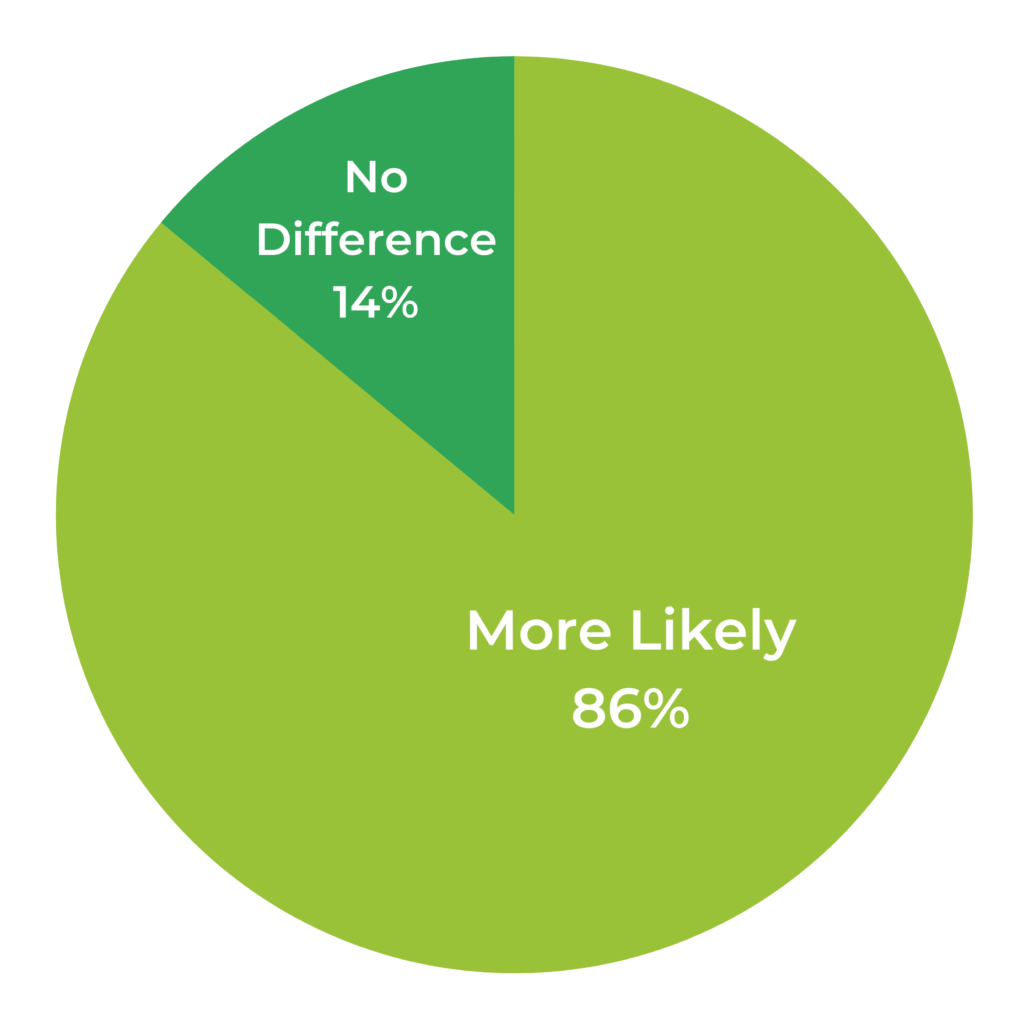

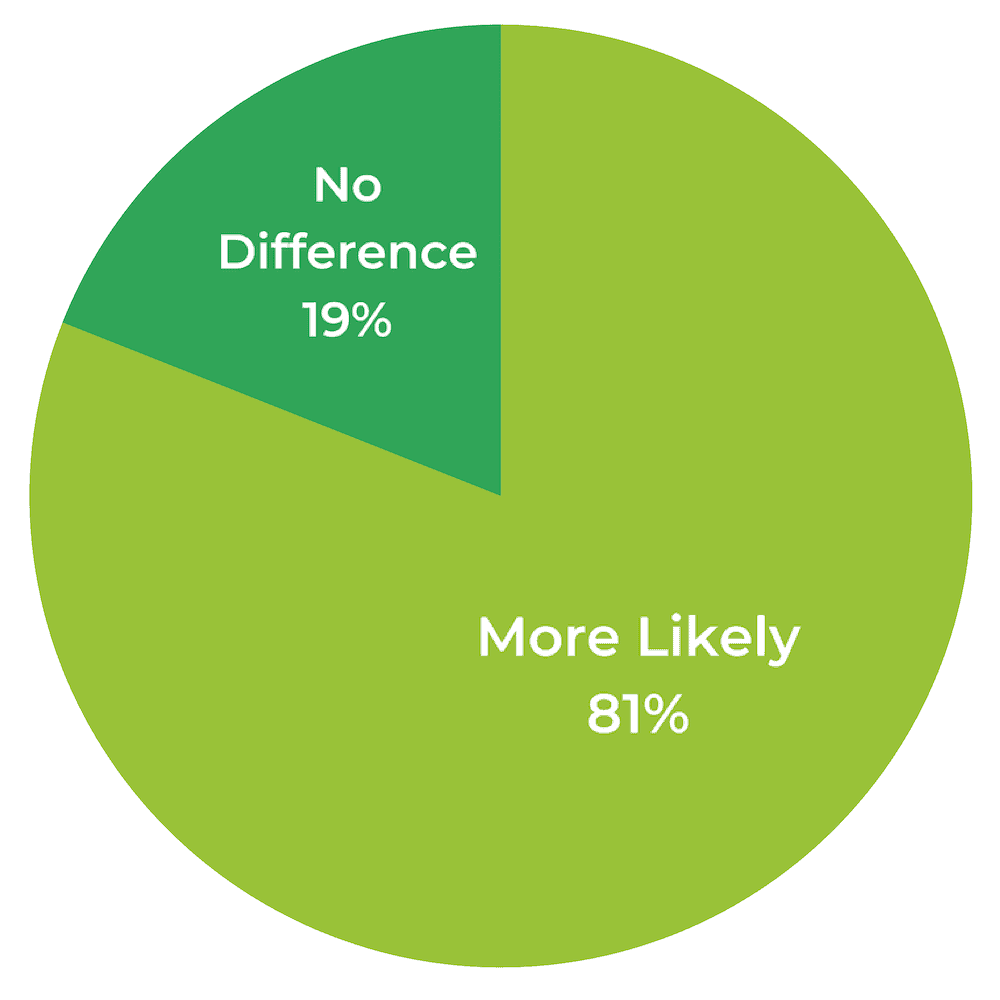

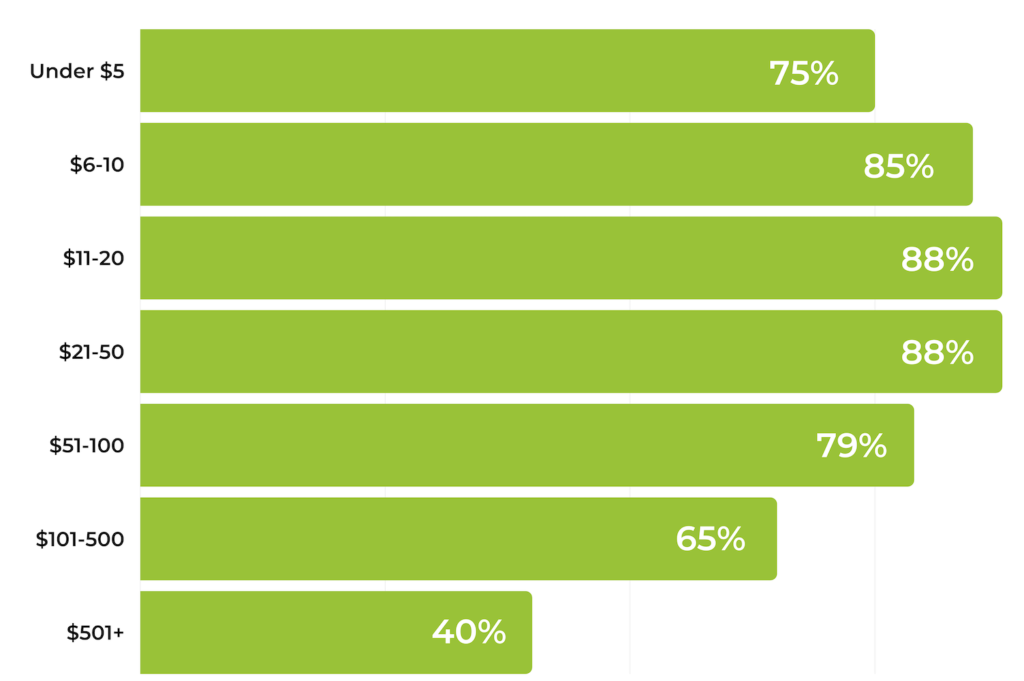

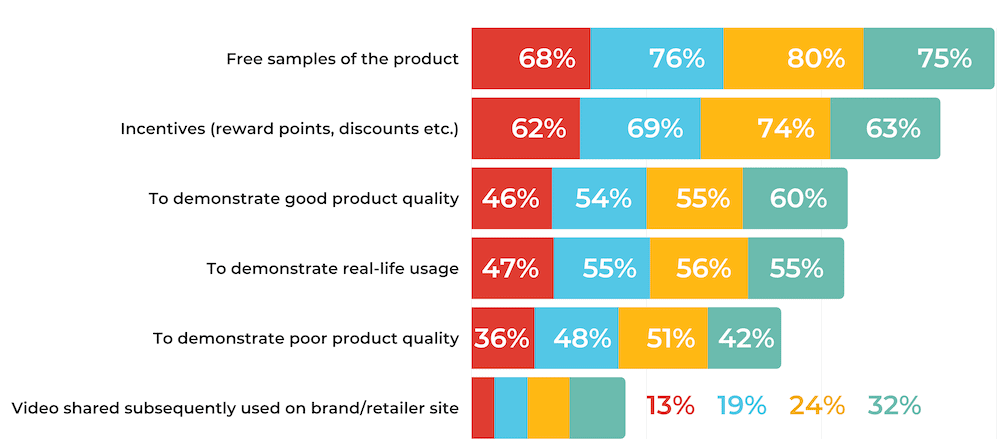

Coupons are a great way to get people to try your products. They’re also a great way to get people to review your products. 68% of shoppers who receive a digital coupon are likely to leave a review. That number goes up to 76% for shoppers who receive a physical coupon.

Many non-ecommerce brands use this strategy to drum up reviews for new products. For example, organic dairy company Horizon Organic invited customers to sign up to leave a review. Once they signed up, they received a coupon to use on their purchase of cheese sticks, a new product that needed reviews.

This approach builds loyalty, as customers feel like they’re part of the process of helping you towards a successful launch. When customers know you need their feedback, they’re often happy to give it.

5. Pair Product Sampling with Review Requests

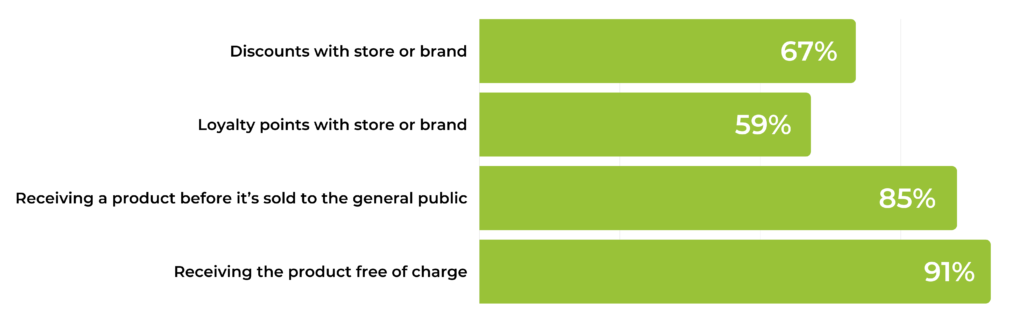

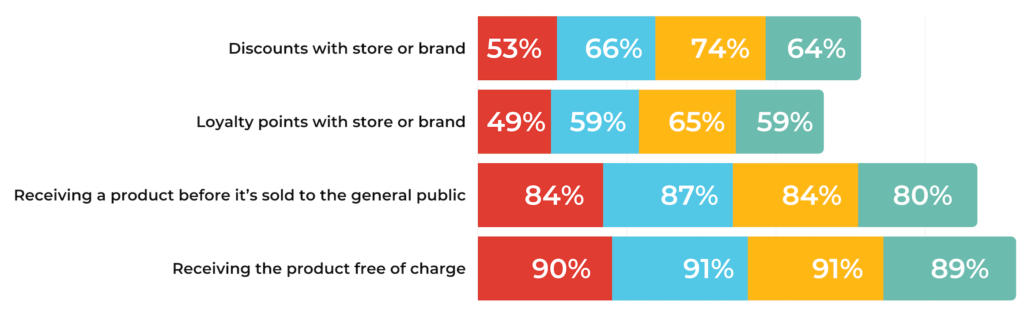

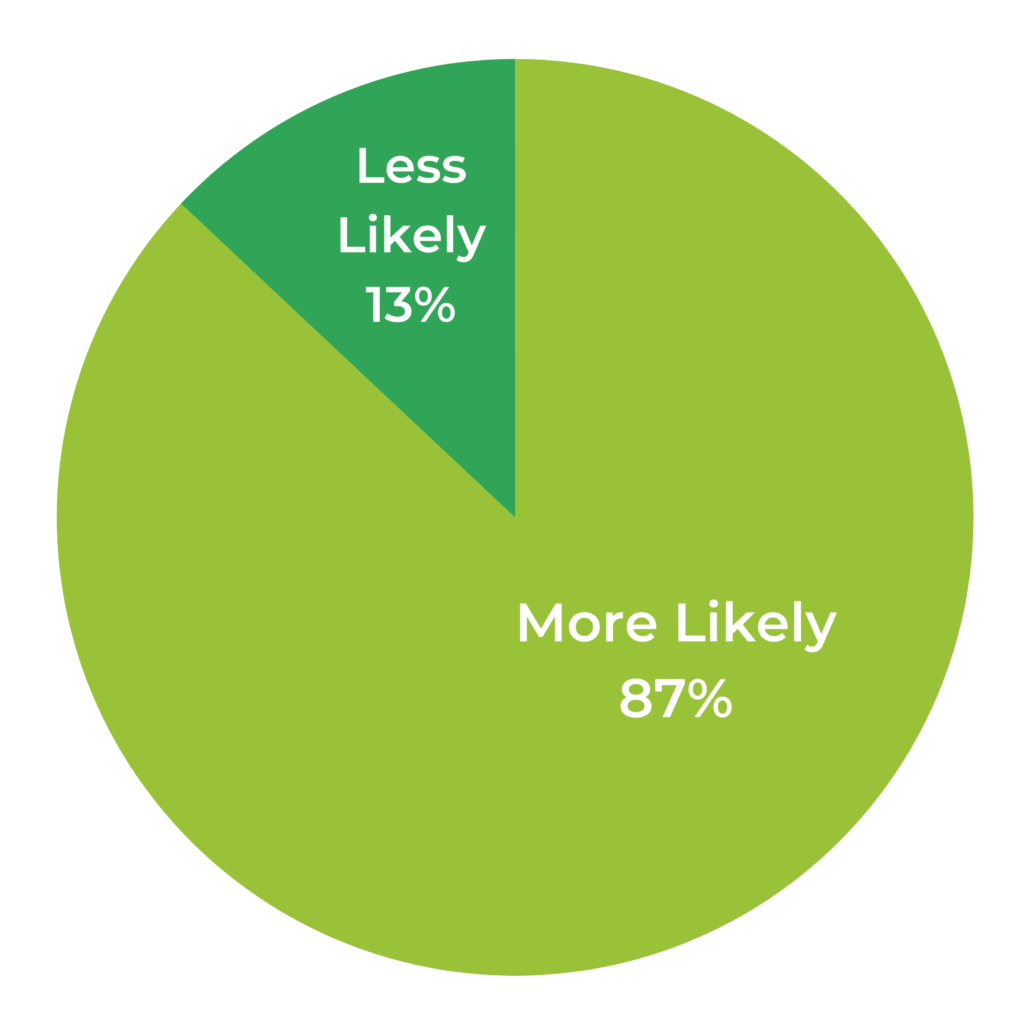

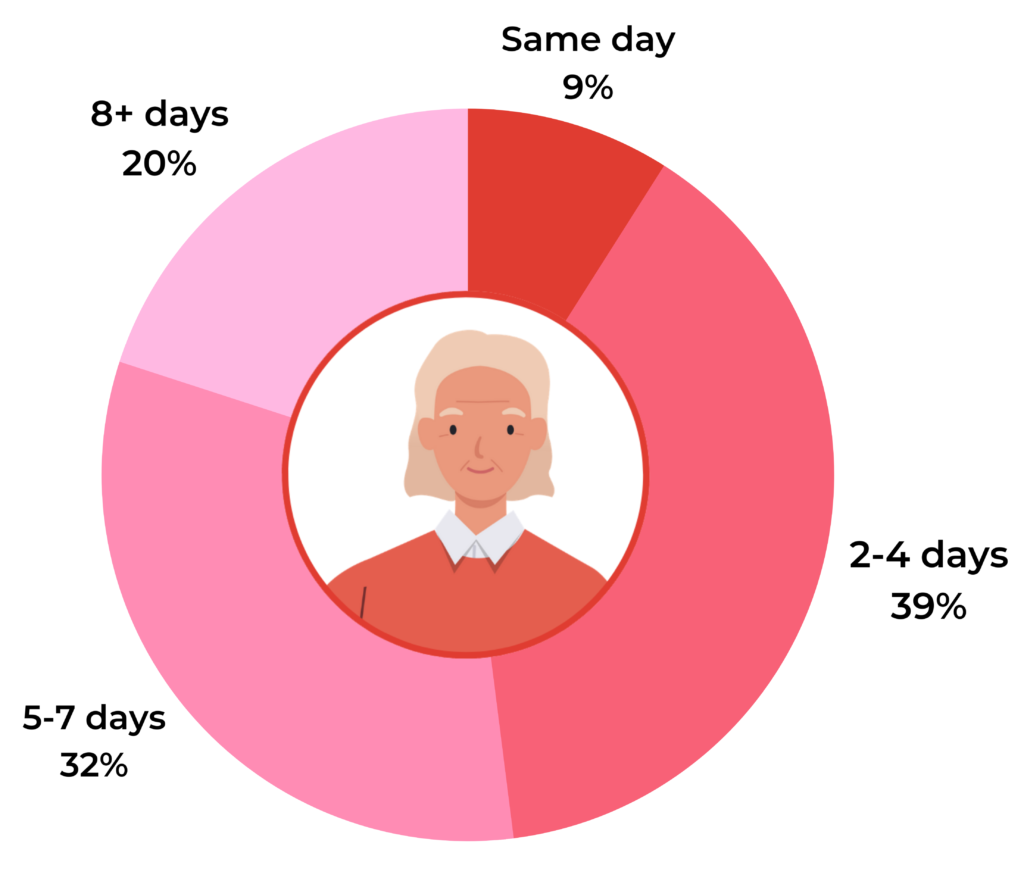

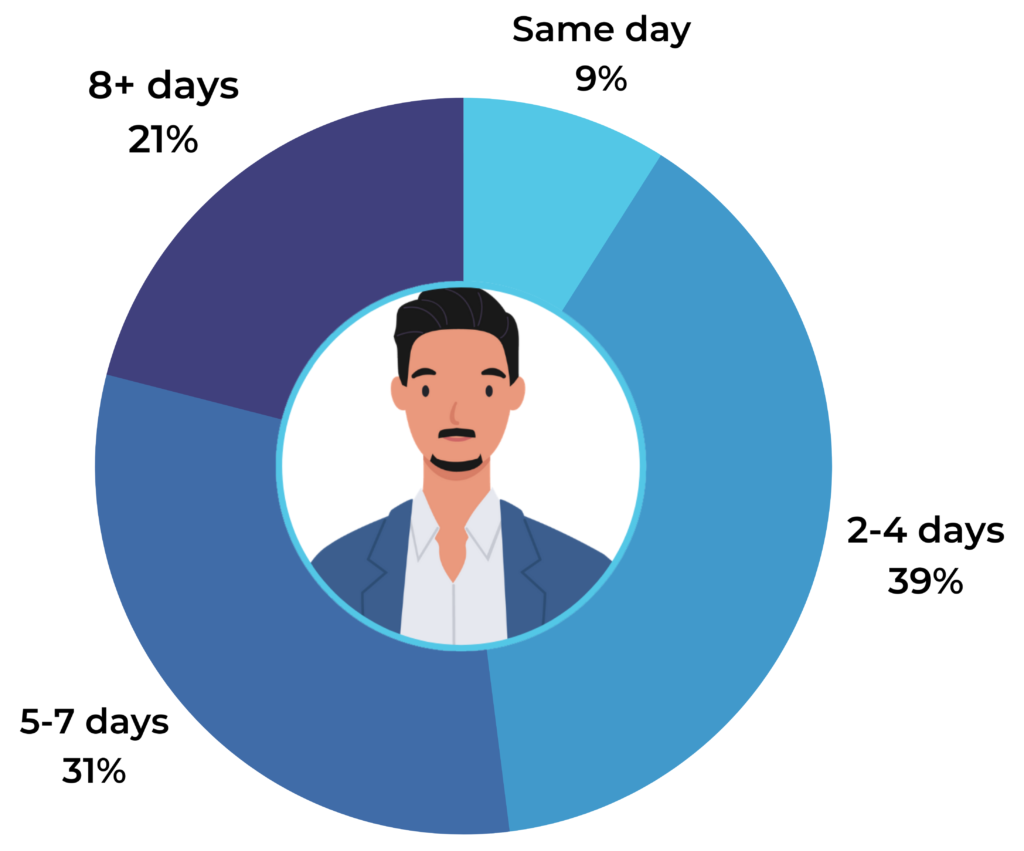

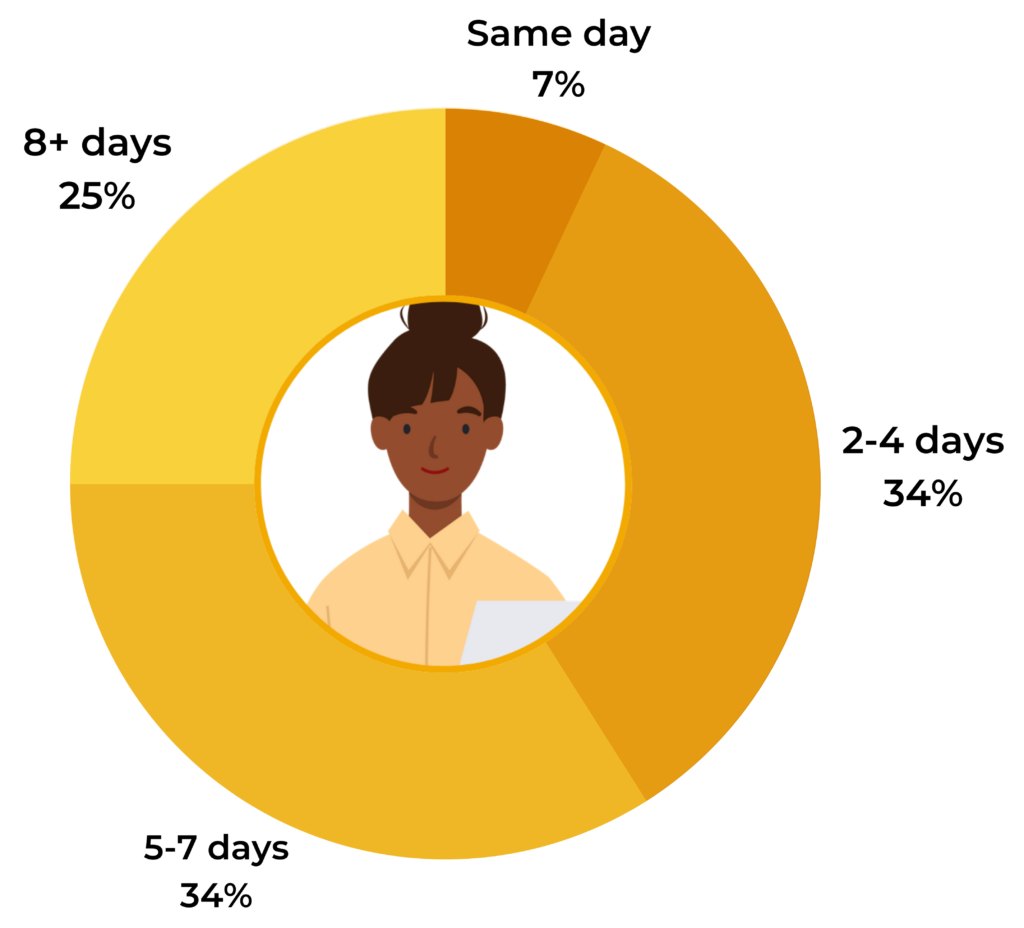

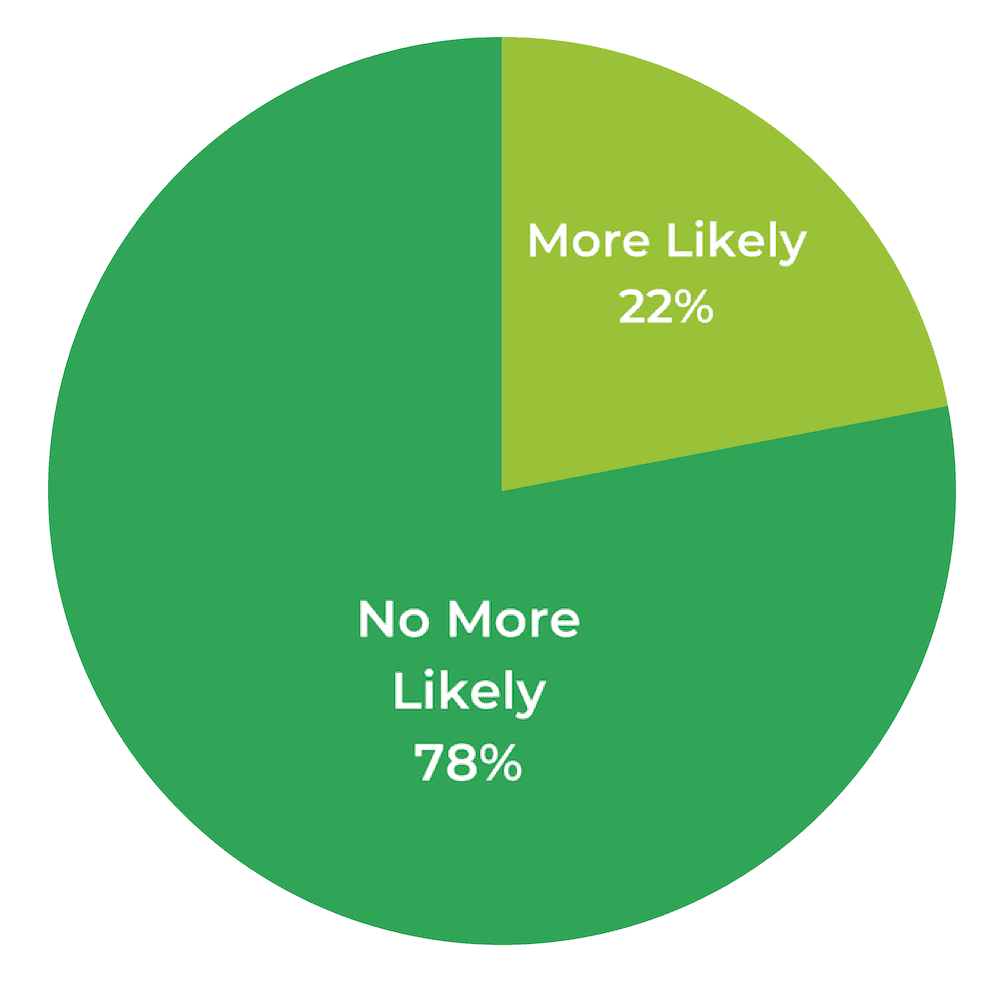

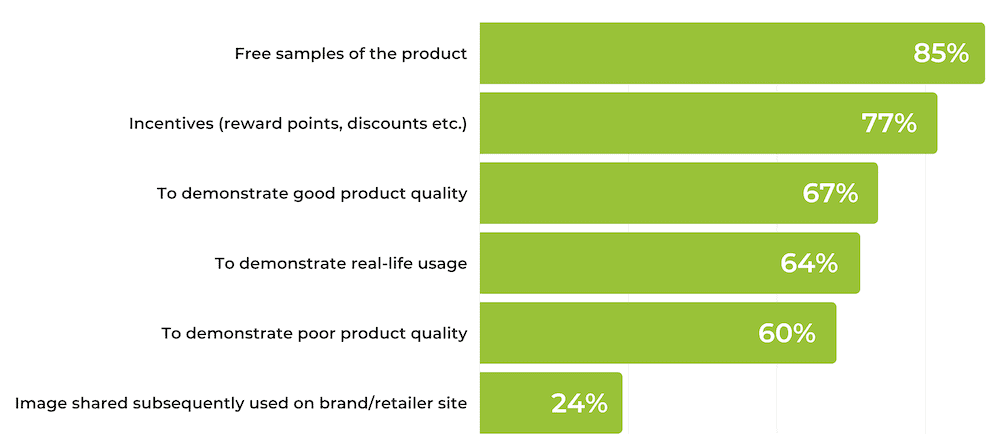

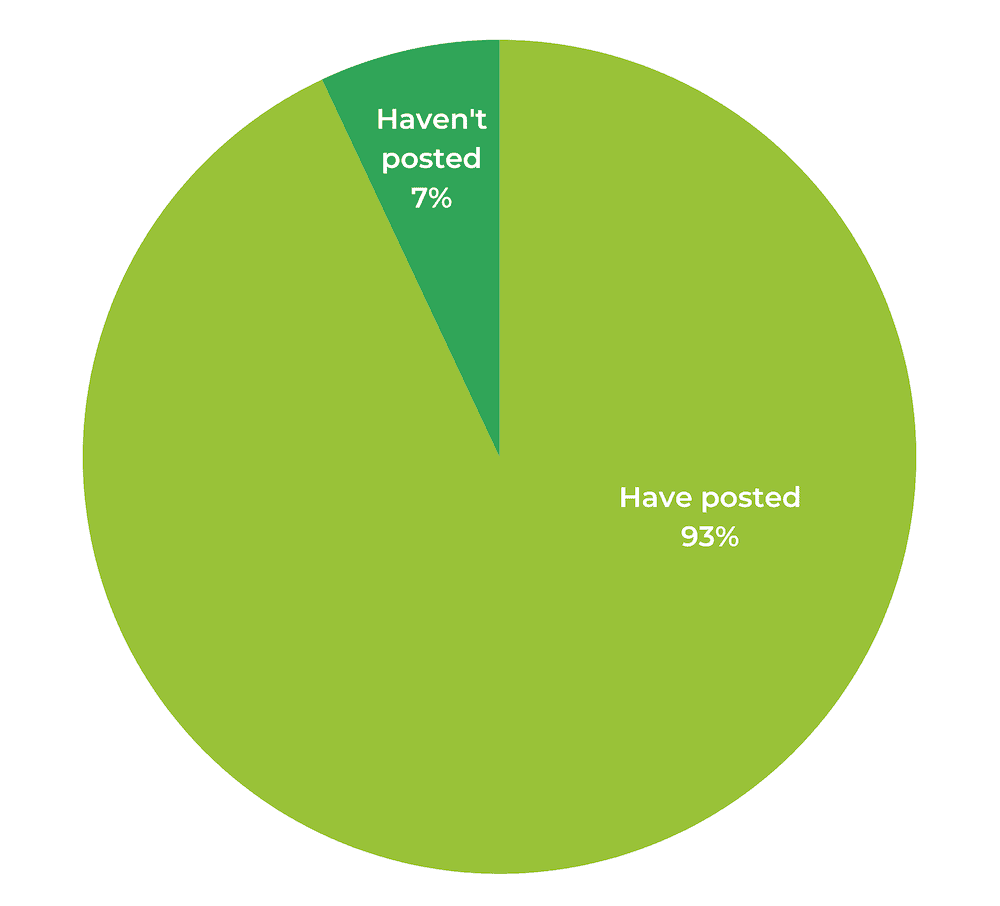

If you thought our statistics on coupons were impressive, wait until you hear about our research on product sampling. Brands who send customers a physical product see an 85% average review submission rate.

So, share product samples with your brand advocates and customers. Add a QR code on the product packaging or as a product insert and ask for feedback in that way. The key is letting customers know about the ability to write a review on your site. This will drive traffic and prompt them to share their feedback.

For example, Hormel sent five packs of their Compleats entrees to customers with clear, two-step instructions. Try them all, and then leave a review!

Like with coupons, asking for reviews with your product samples invites customers to be a part of your success. This earns reviews, builds loyalty, and drives more purchases!

6. Follow Up on Product Registrations and Warranties

One challenge non-ecommerce brands face in collecting reviews is knowing whether a customer has actually purchased the product.

If this sounds familiar, consider asking for reviews on printed receipts, emailed receipts, and even your product warranties and registrations. For example, Simonton, a non-ecommerce brand that sells windows and doors, follows up with each customer who registers their product and asks them to leave a review.

7. Run a Sweepstakes or Giveaway

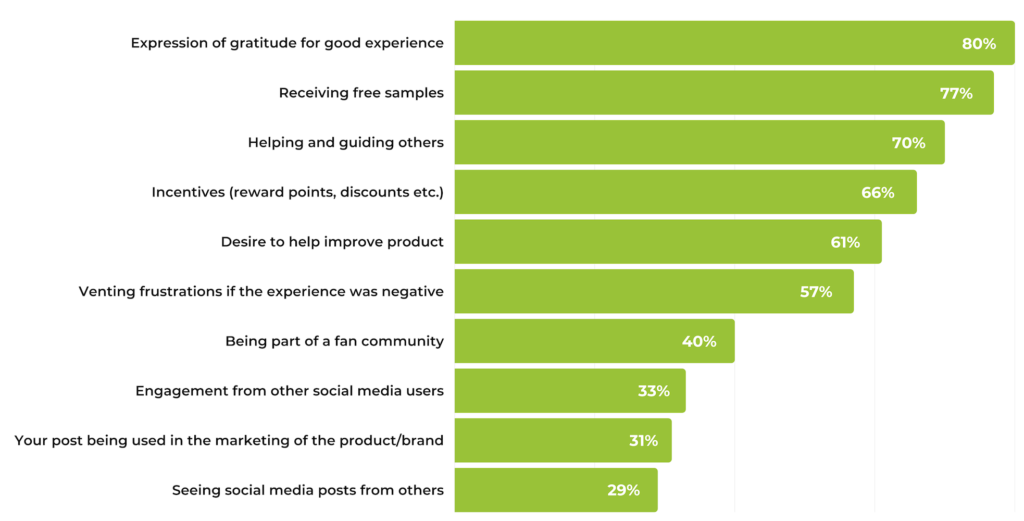

55% of customers who don’t write reviews say they need an incentive to leave a review. Enter sweepstakes and giveaways to save the day. Target specific products for a review generation campaign, and then promote your contest via email and social media communication.

Offering an incentive is always a surefire way to get people to write reviews. Here are a few examples from The North Face and Duraflame.

After one PowerReviews client implemented a sweepstakes, they saw a 290% increase in collection rates — in just 45 days! They now run sweepstakes sporadically throughout the year and have more than doubled the amount of reviews they collect than they did previously.

8. Ask for Reviews on Social Media

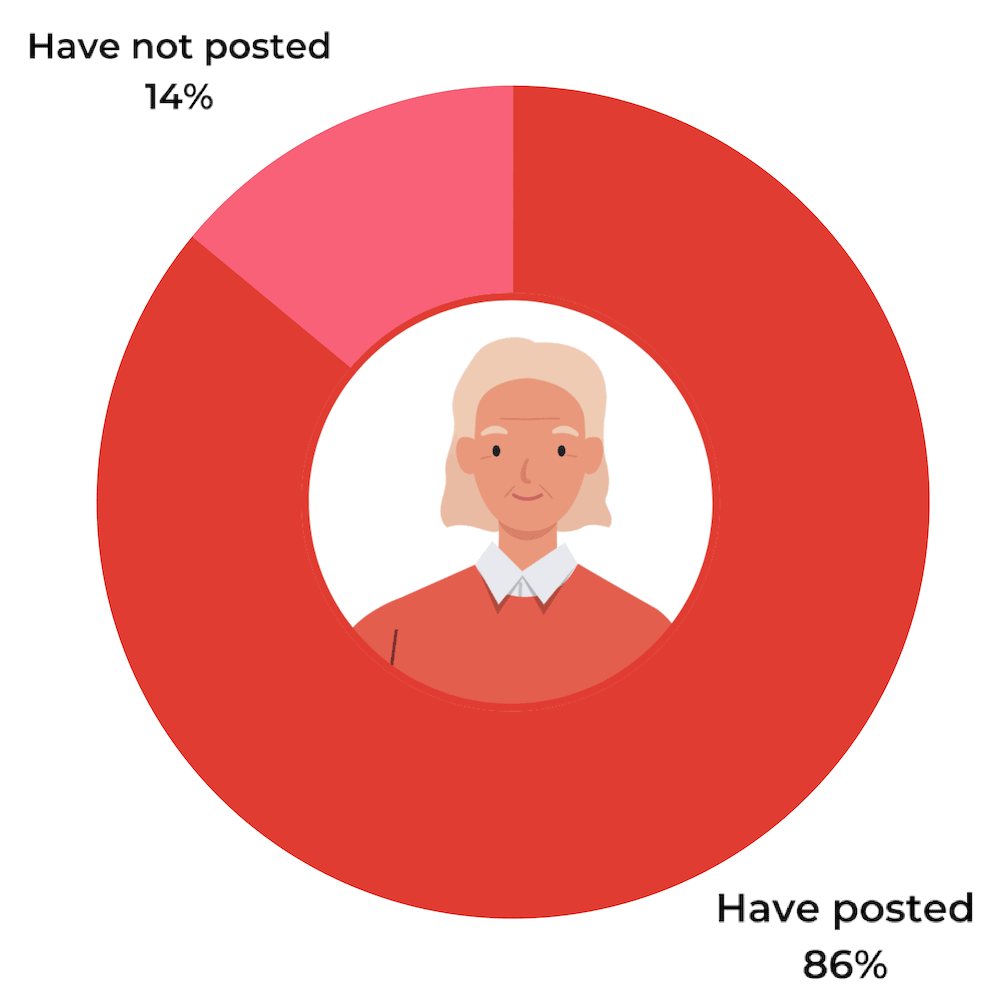

When people rave about your products on social media, it’s the perfect time to ask them to leave a review. These customers were already excited enough to write a positive comment, so they obviously love the product. They may just need an extra push to write a review. That’s where you come in.

If you respond and say thank you and ask them to leave a review (with a link that takes them directly there), they’re probably going to because you engaged with them and they love your product.

Proactively reaching out to customers can quickly increase your review count. Make this a part of your customer service routine on social media, like men’s care brand Just for Men does:

Regularly ask for reviews in posts across your social media channels, like the below example from Exmark Mowers.

You can also include swipe up links in your Instagram Stories to your Write a Review form, asking customers to engage. Explain the value of reviews, and people may just respond.

Start Collecting Reviews Now

Since they purchase your products elsewhere, a lot of customers don’t even know that non-ecommerce brands collect reviews. Letting them know that you do collect feedback, and that you want theirs, can be a powerful first step in generating positive reviews.

Don’t wait. Try one (or all) of the strategies above and start collecting reviews for your brand.