Power Points

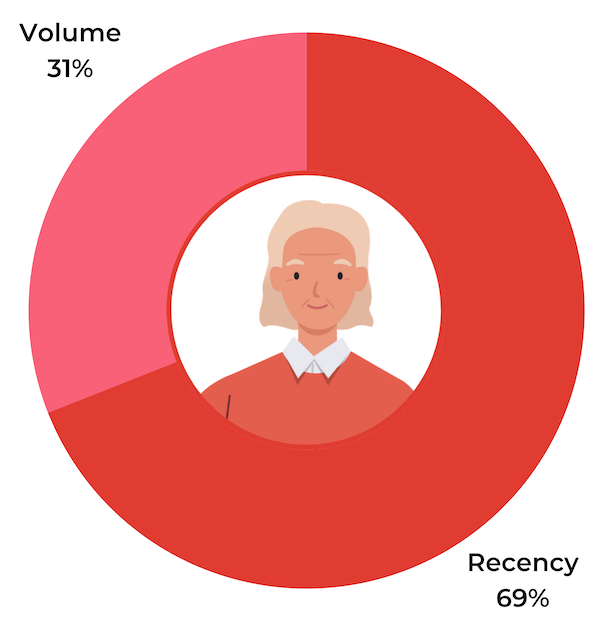

- 64% of consumers say they’re more likely to buy a product with fewer, more recent reviews than if it has a higher volume of reviews published three or more months ago. This number is even higher – 69% – among Boomers.

- Over a third (38%) of consumers will not purchase a product if the only reviews available were published three months or more ago, including nearly half (44%) of Gen Z and 40% of Millennials.

- 62% of consumers will not purchase a product if the only reviews available were published a year or more ago. This number is even higher – 66% – among Gen Z and Millennials.

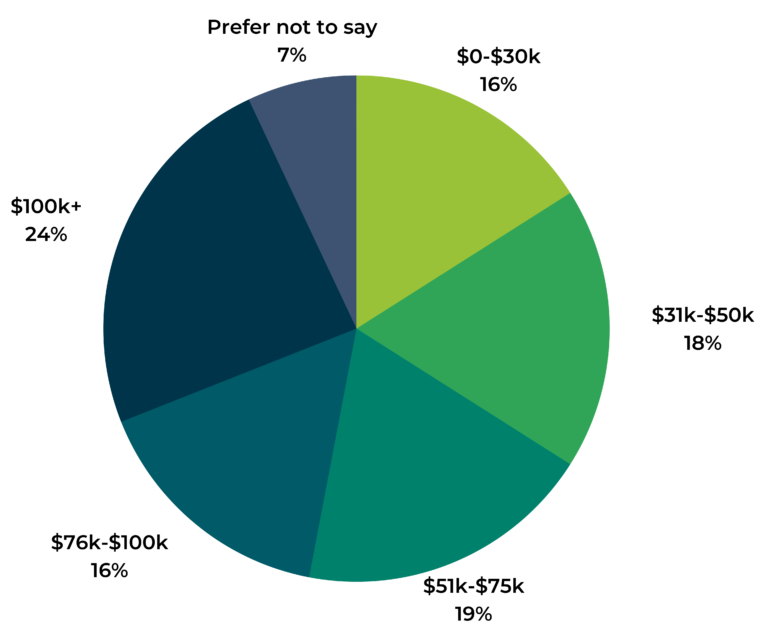

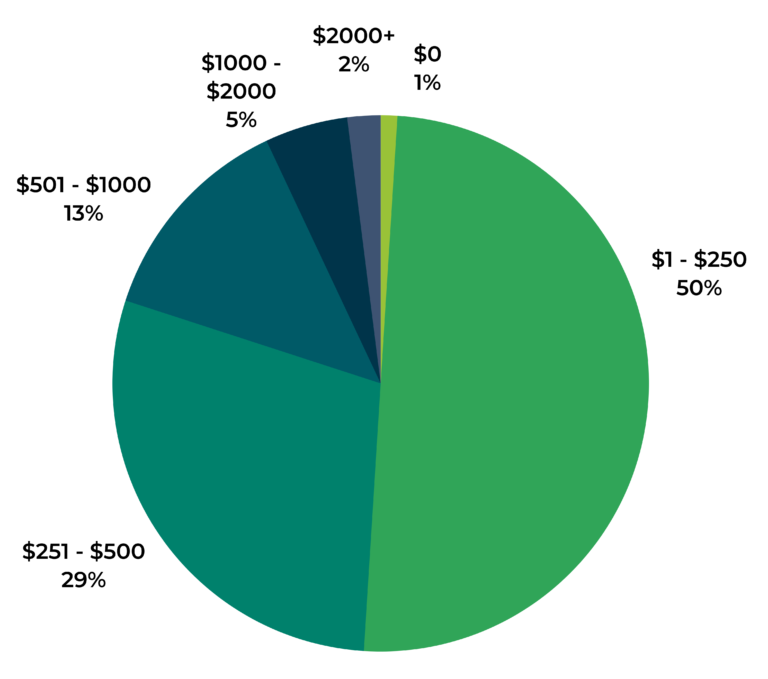

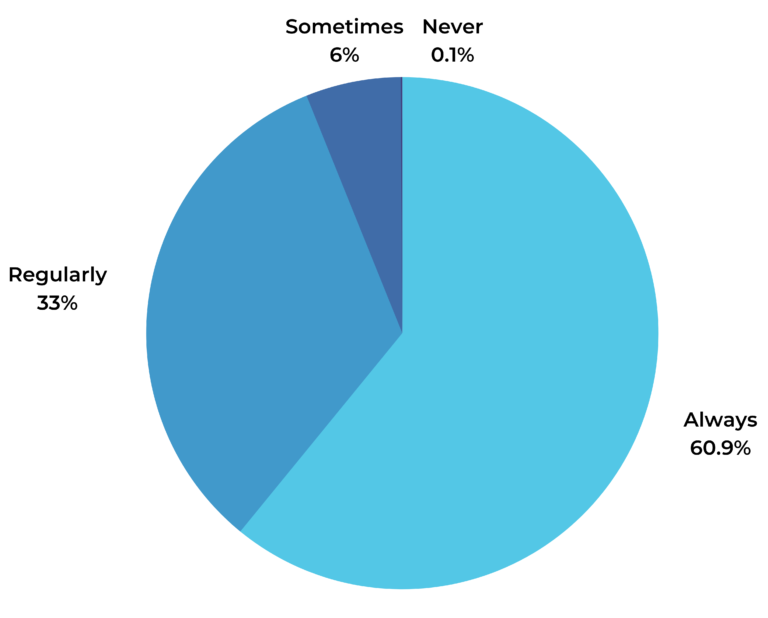

97% of consumers consider review recency to be at least somewhat important when considering a purchase, according to our recent survey of more than 9,000 consumers and analysis of activity across 1.5MM+ ecommerce product pages on 1,200+ brand and retailer sites.

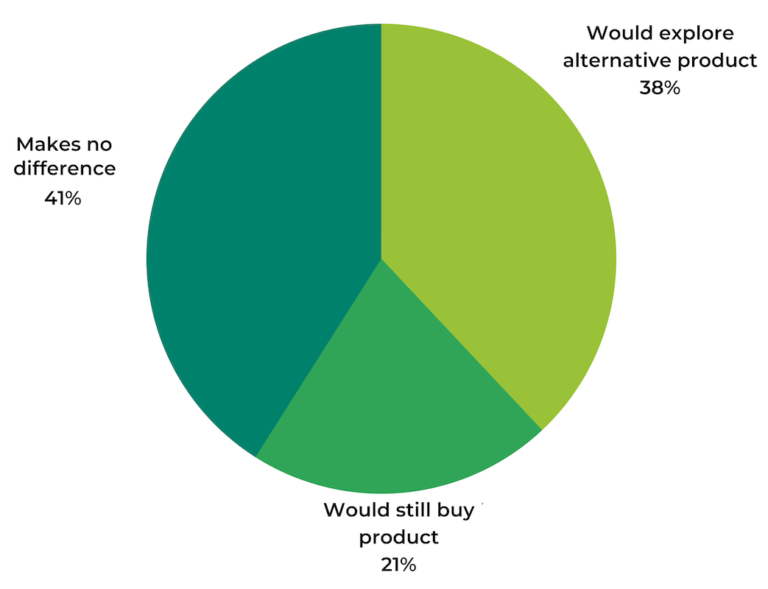

Review recency, or how recently a given review was published, matters a lot to consumers. Across the board, an overwhelming number of consumers told us they expect to see recent reviews for a product — or they’ll seek out an alternative from a competitor. If the only reviews available for a product were published three months ago or more, for example, 38% of consumers will explore a competitive product. If the only reviews are from one year ago, that percentage increases to 62%.

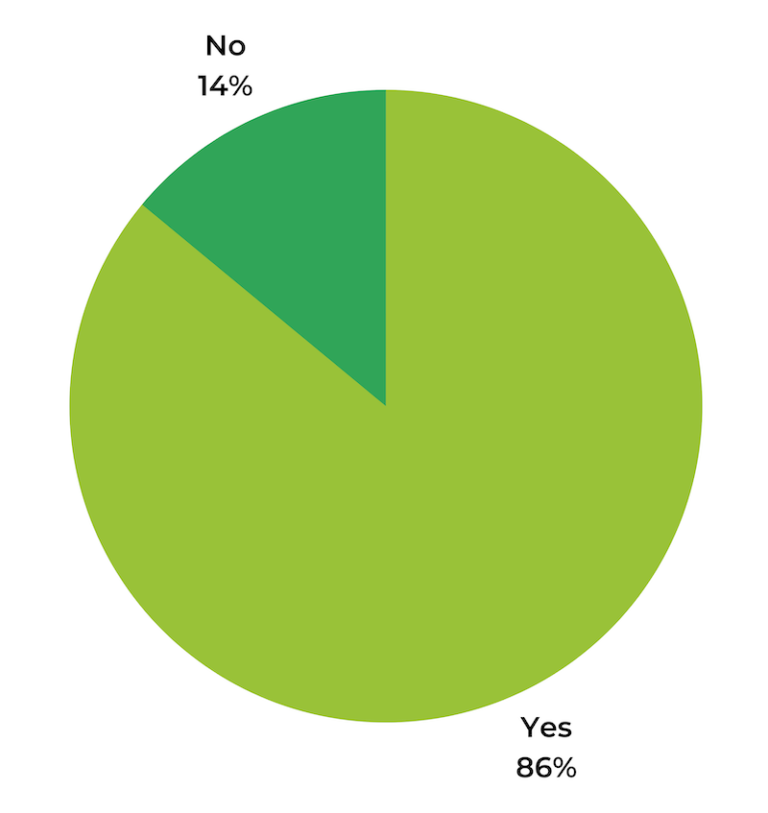

According to our analysis, review recency becomes even more important in certain situations. For example, 86% of shoppers feel that review recency is more important when considering a new product or brand they haven’t purchased before. And consumers value review recency most in categories like Consumer Electronics, Health and Beauty, and Clothes, Shoes, and Accessories.

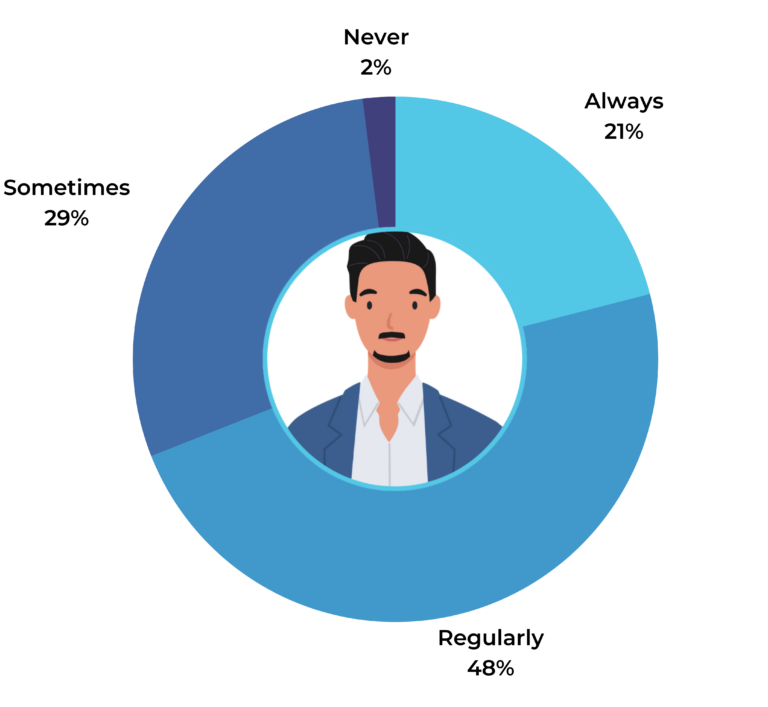

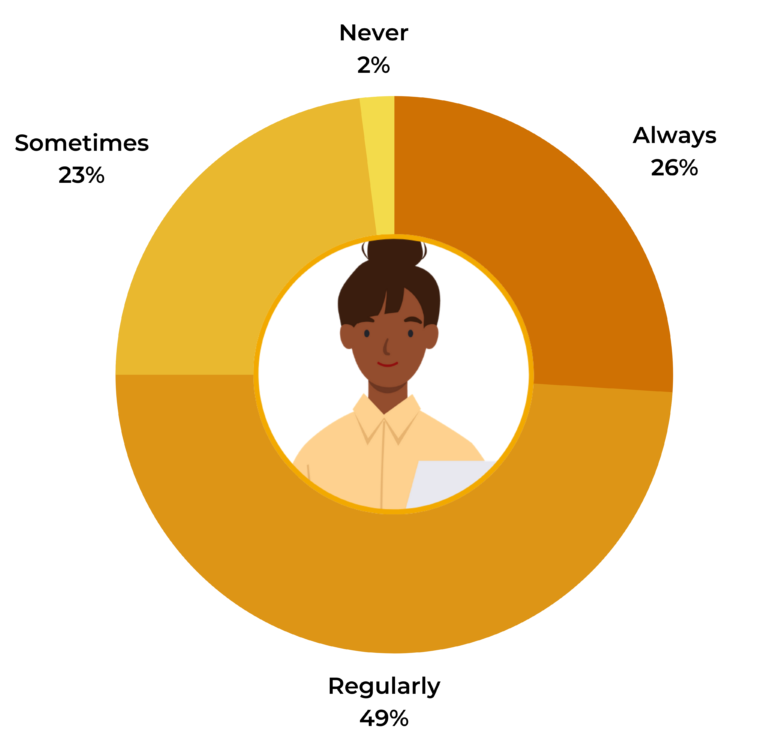

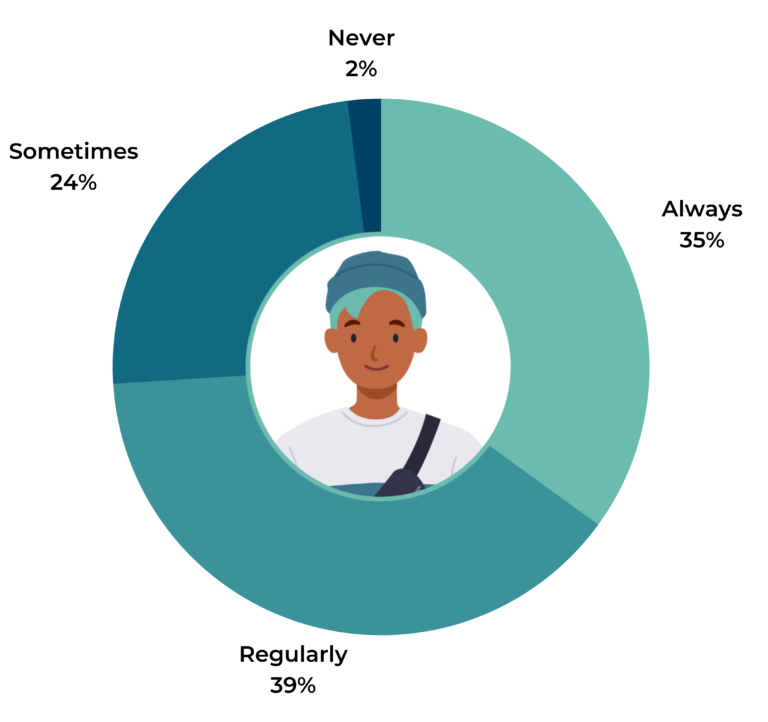

This got us thinking: does review recency matter more to different subsets of consumers? More specifically, how do different generations value review recency?

Read on as we share the answers to those questions, and proven best practices for ensuring your consumers find the reviews they’re looking for — no matter their age.

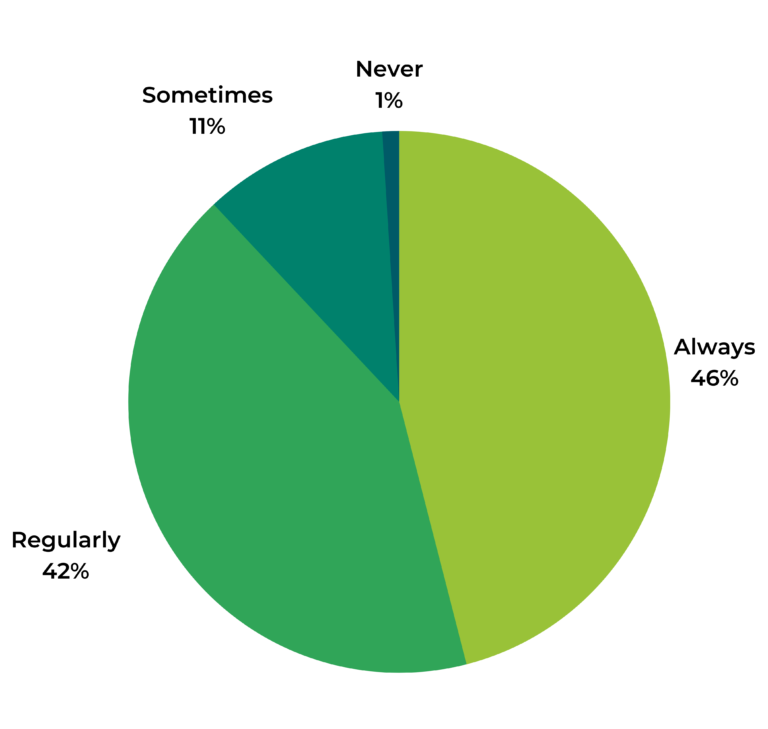

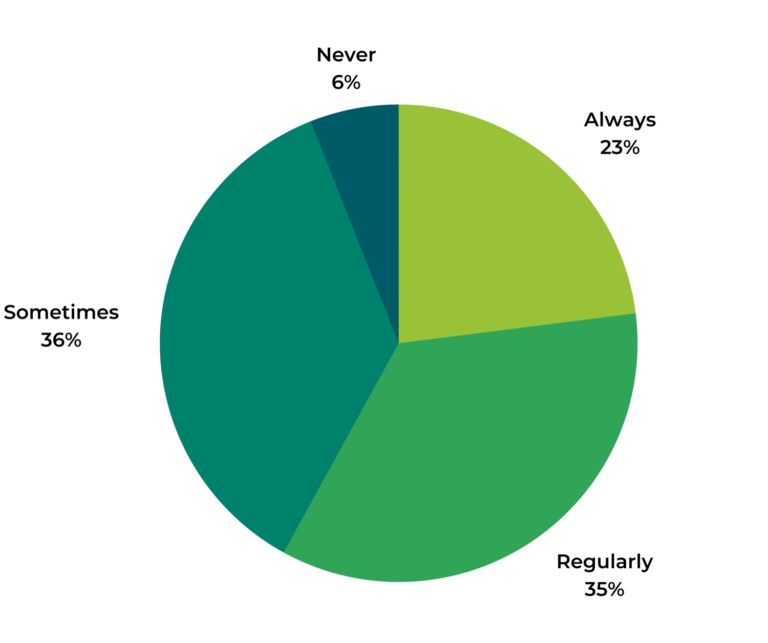

Survey Demographics

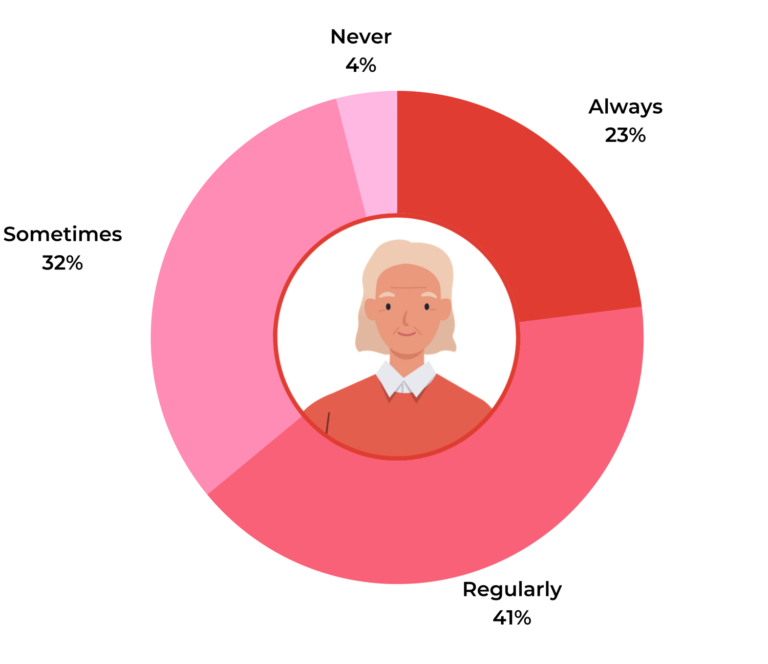

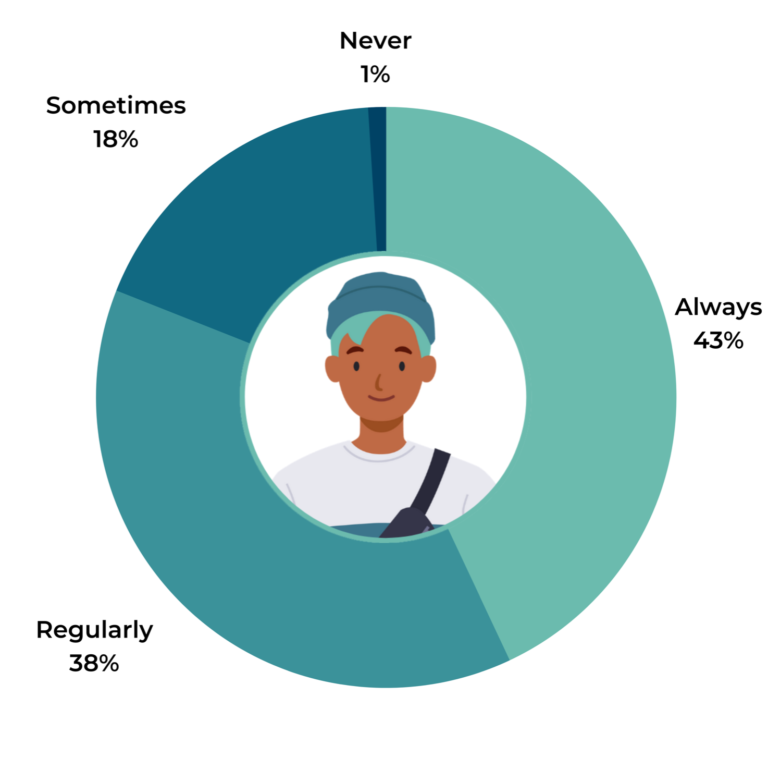

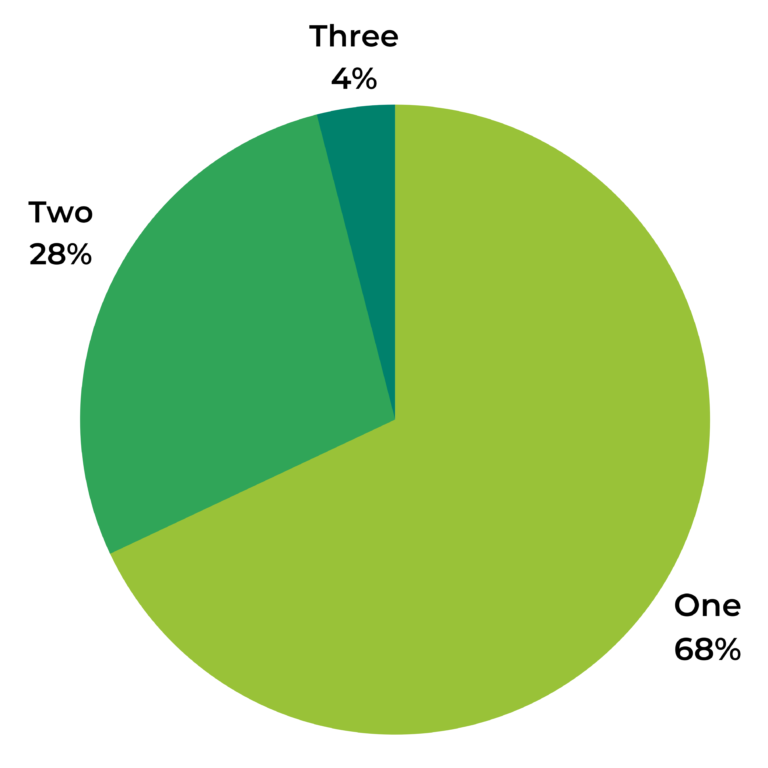

(1997-present)

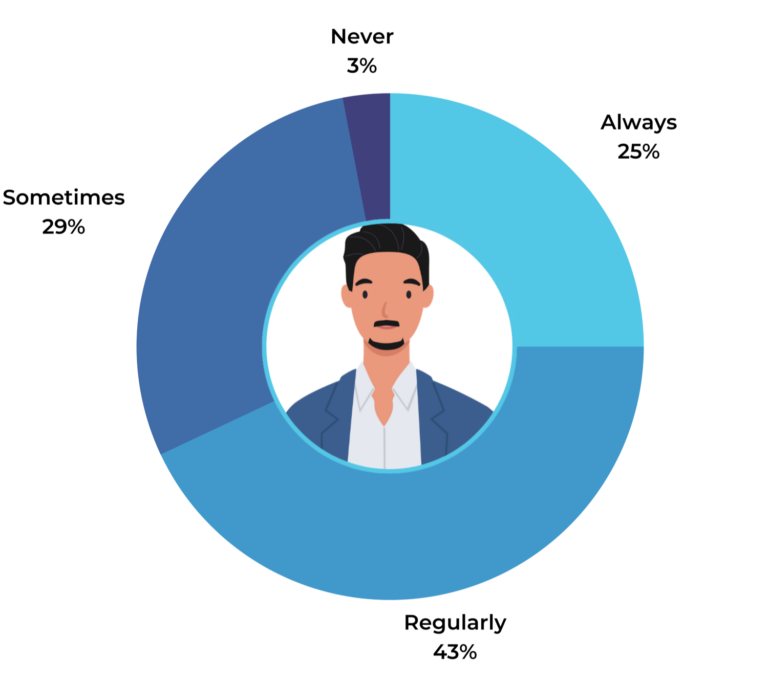

(1981-1996)

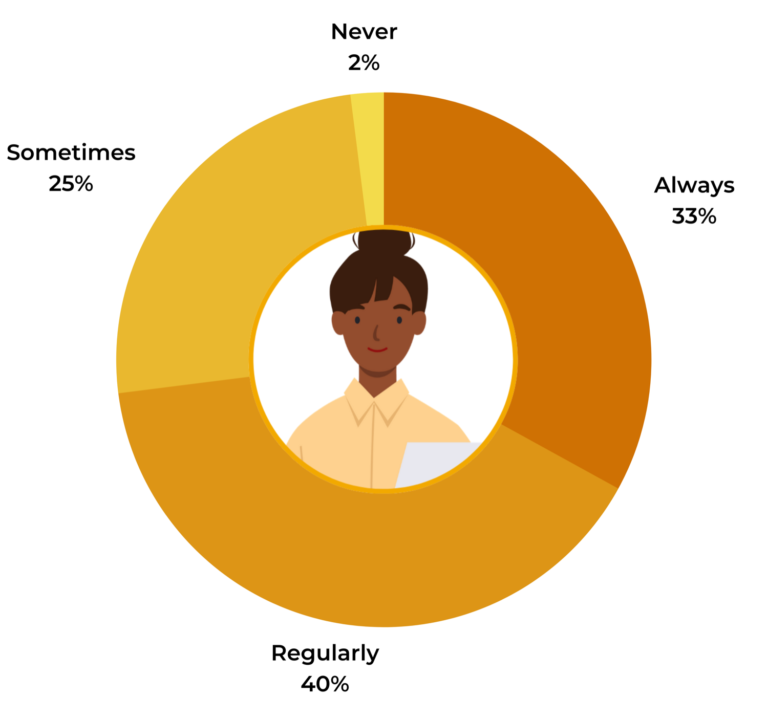

(1965-1980)

(1946-1964)

Across Generations, Review Recency Tops Volume

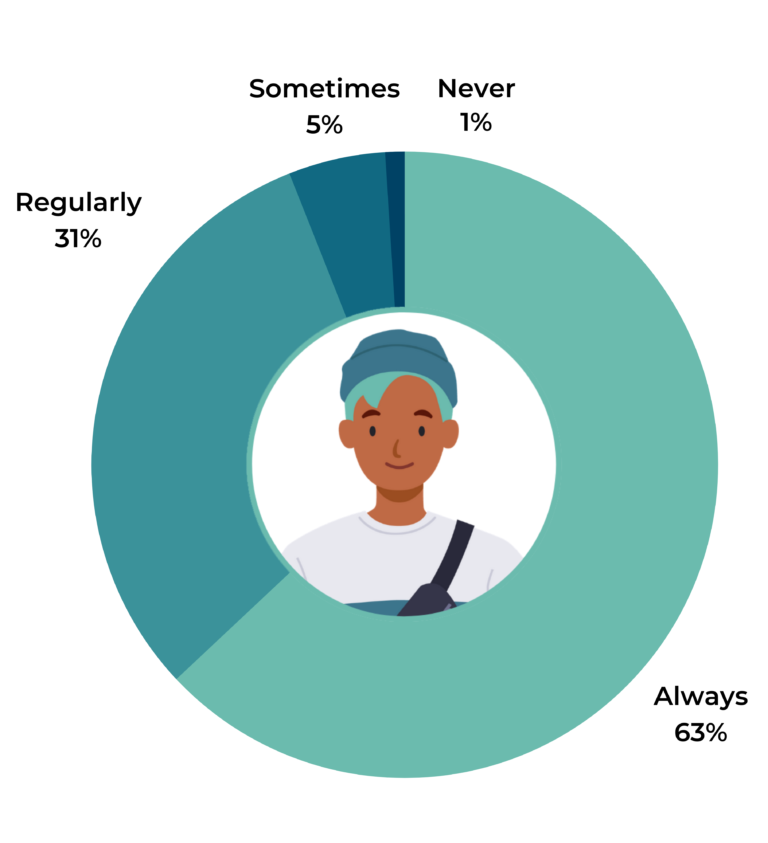

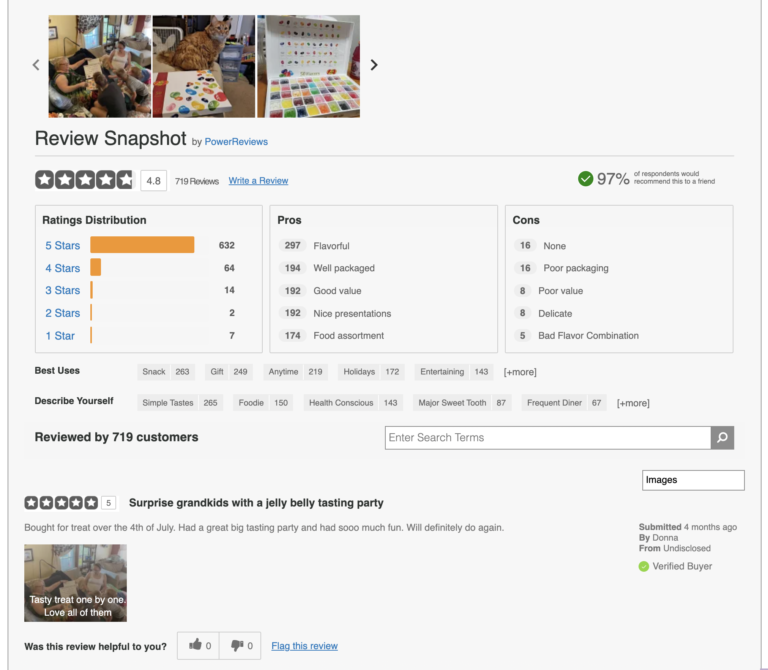

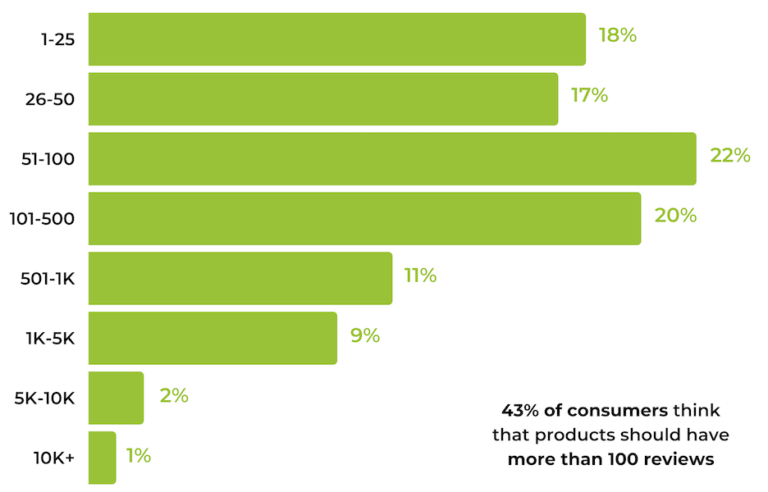

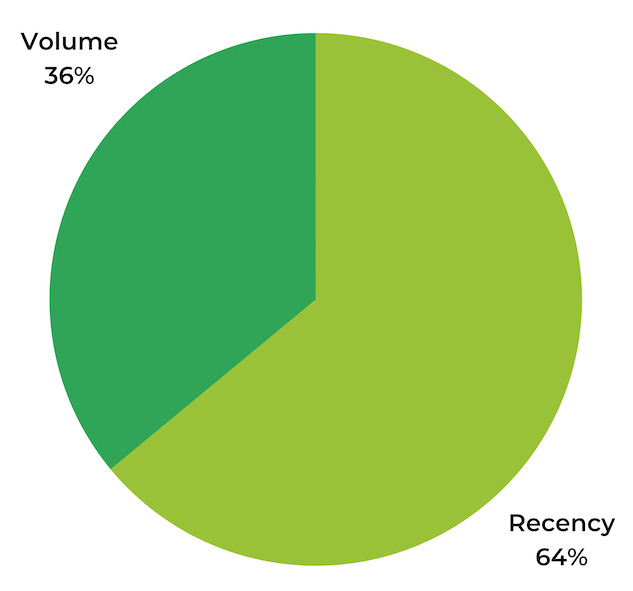

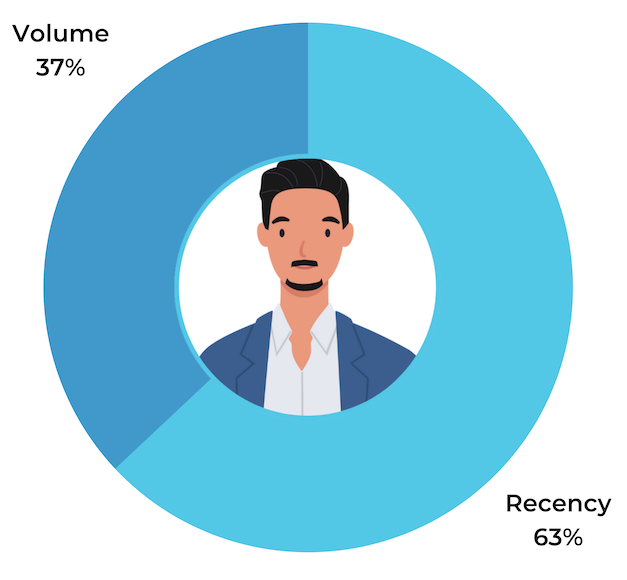

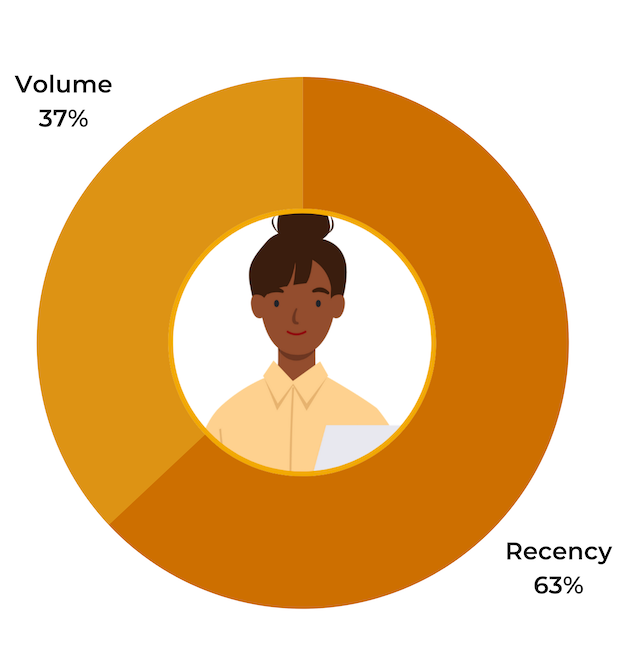

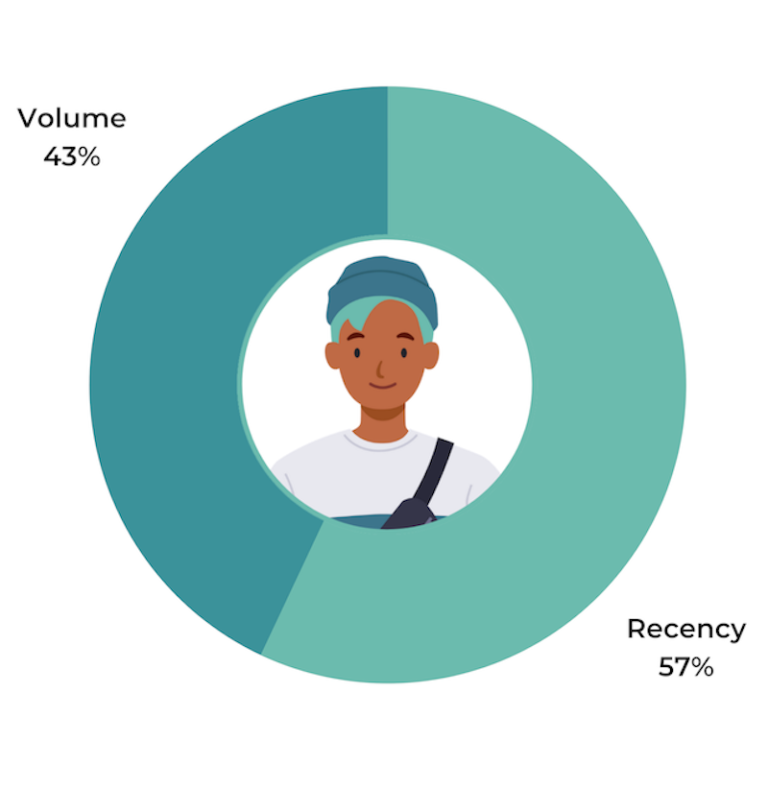

As we mentioned earlier, nearly all (97%) of consumers consider review recency to be at least somewhat important, including 61% who consider it to be very important. While many consumers also value a high quantity of reviews, the majority of consumers told us that when forced to choose between the two, they would choose to see more recent reviews.

In fact, 64% of consumers told us that they would rather buy a product with fewer, but more recent, reviews than one with a higher number of reviews that were all three months or older. Overall, nearly twice as many consumers said that they value review recency over volume.

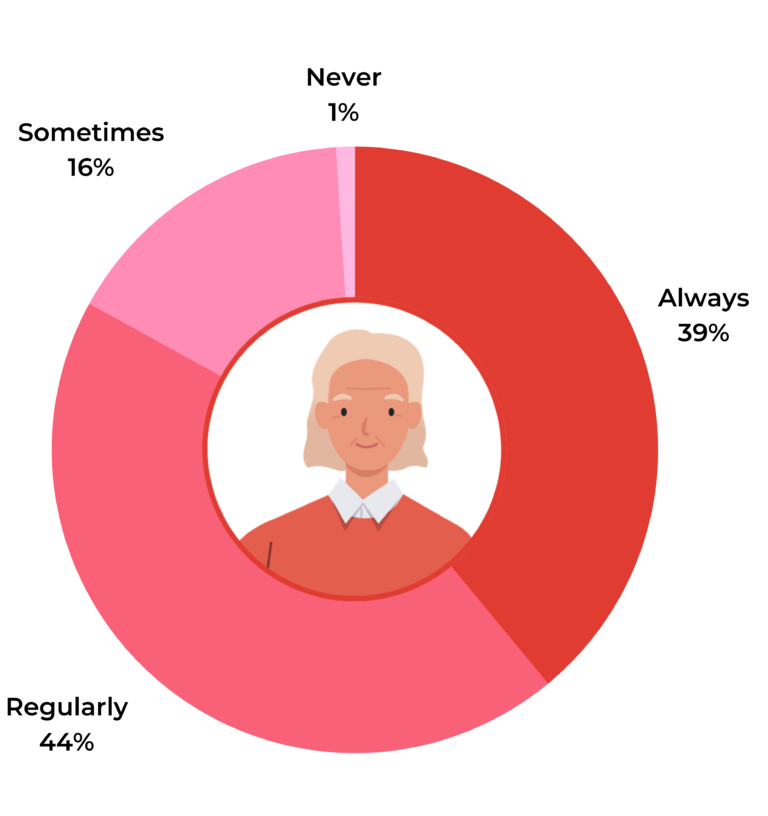

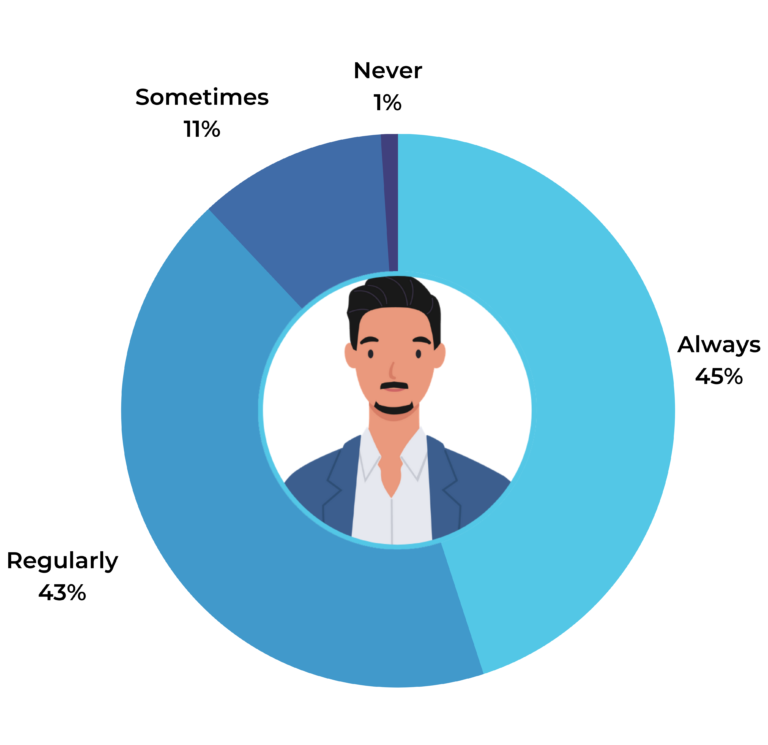

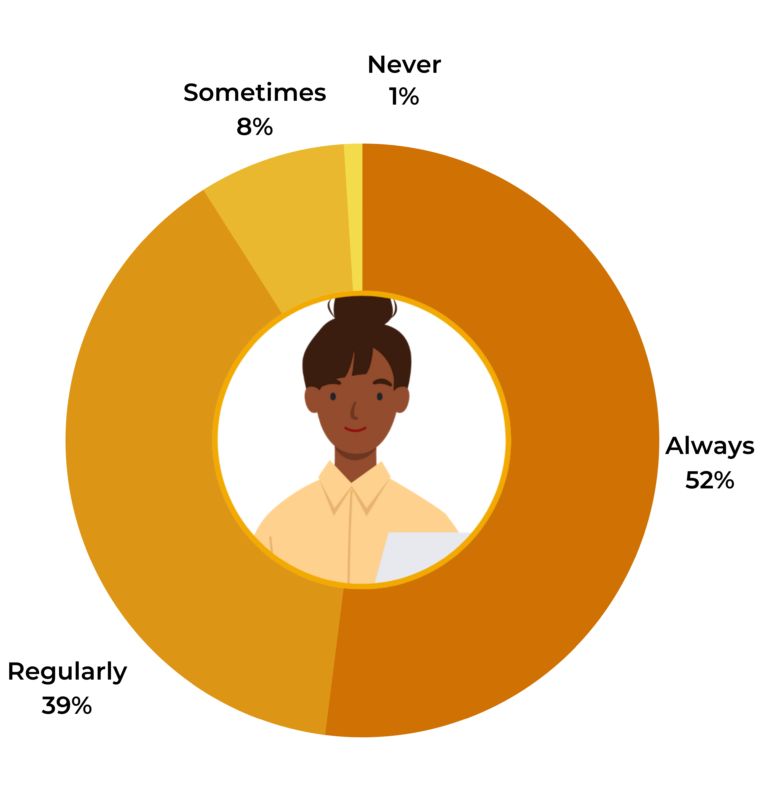

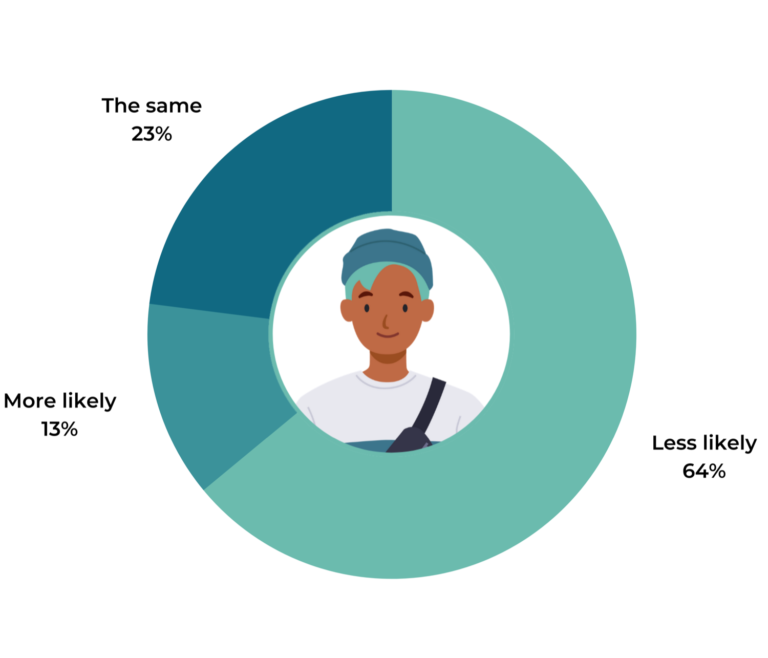

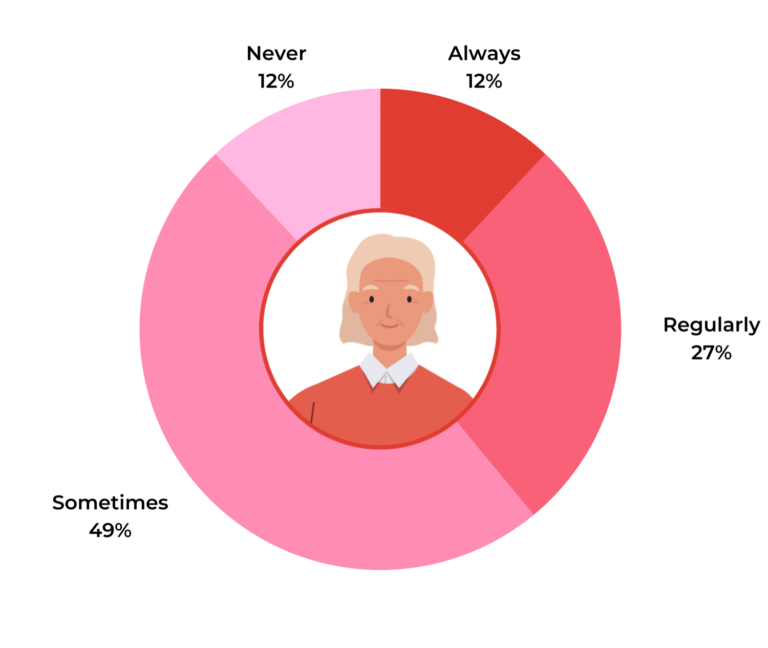

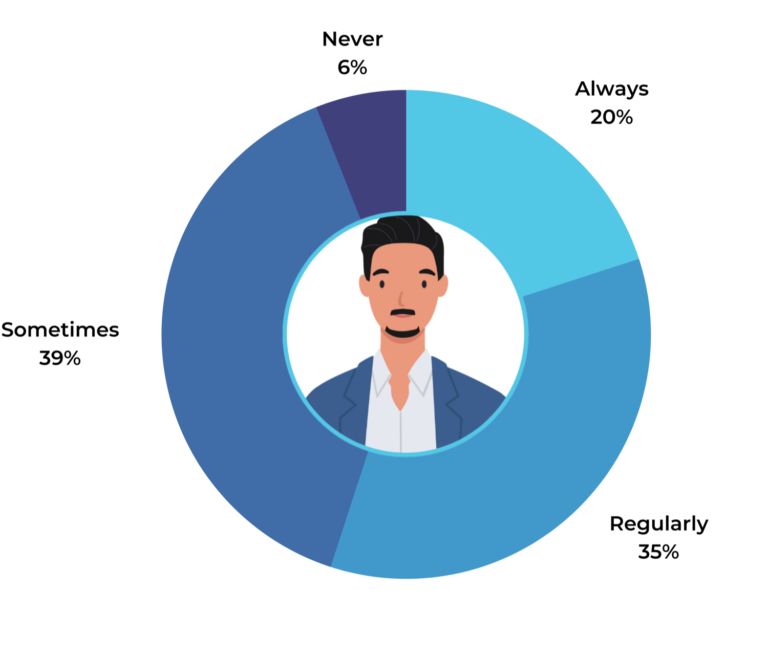

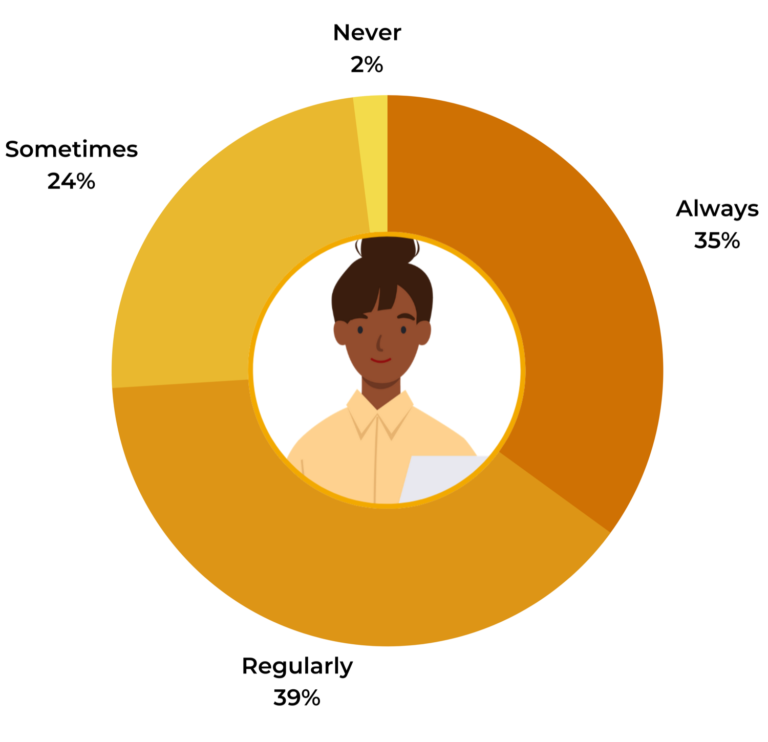

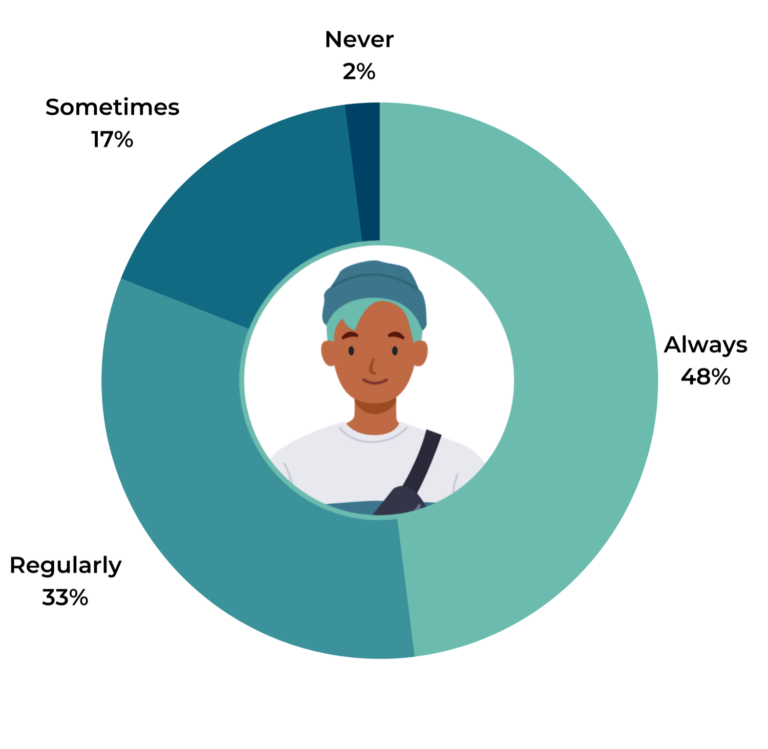

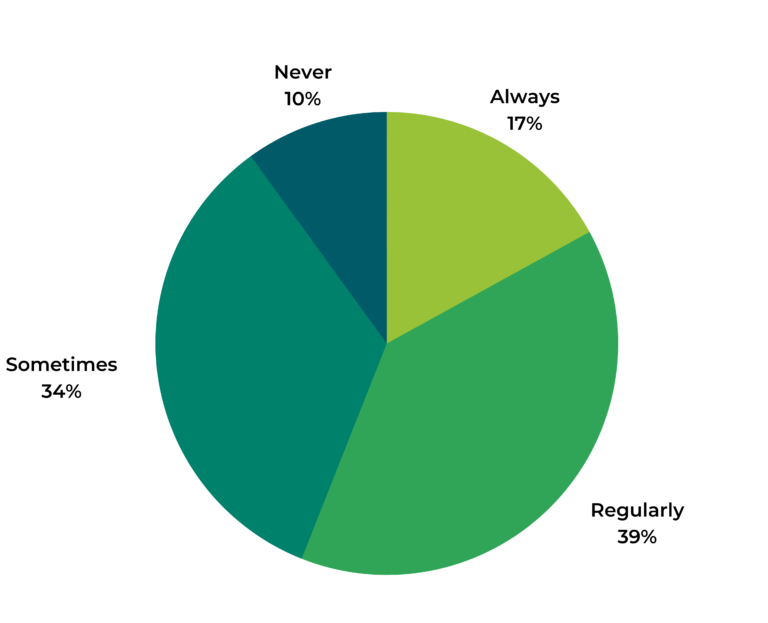

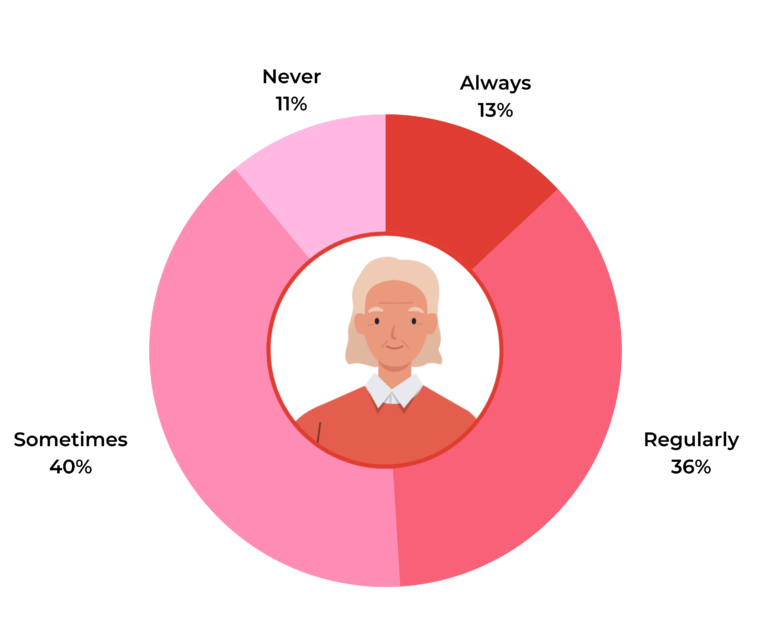

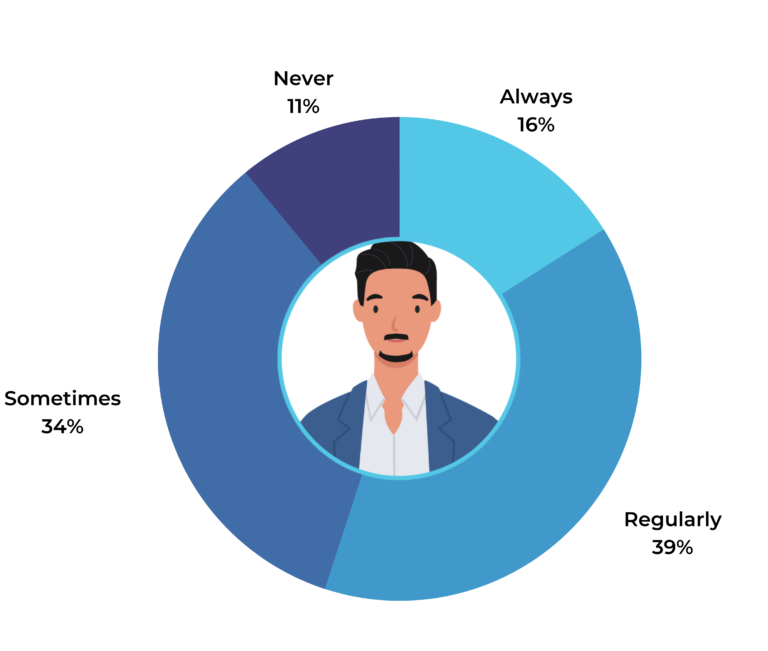

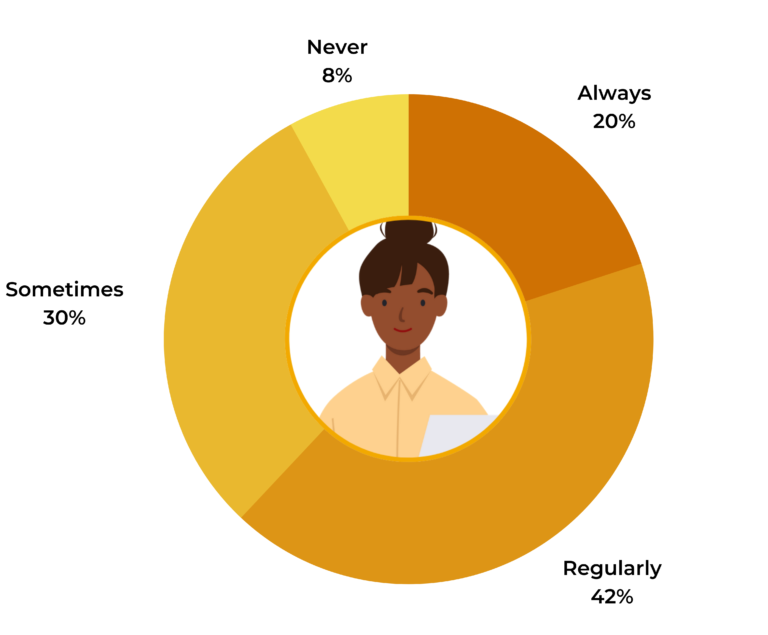

Interestingly, the older the consumer, the more likely they are to value review recency over volume. At 69%, Boomers were the most likely to say that review recency is more important than review volume. At 57%, Gen Zers were 12 percentage points less likely to value review recency over volume. Gen Xers and Millennials landed somewhere in the middle, with 63% valuing review recency over volume.

Without Recent Reviews, Younger Shoppers Are Likely to Shop Elsewhere

Review recency is so important to shoppers that it influences their purchasing behavior. If shoppers can’t find recent reviews for a product, they are more likely to consider a competitive product that has fresher content.

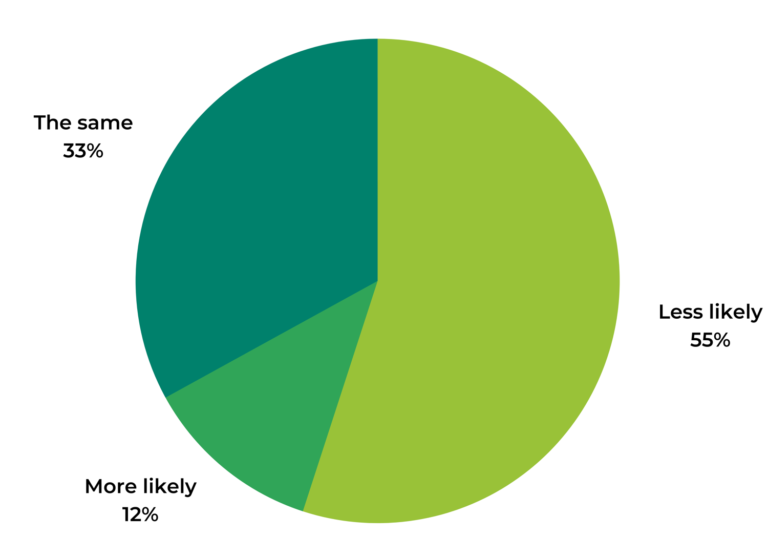

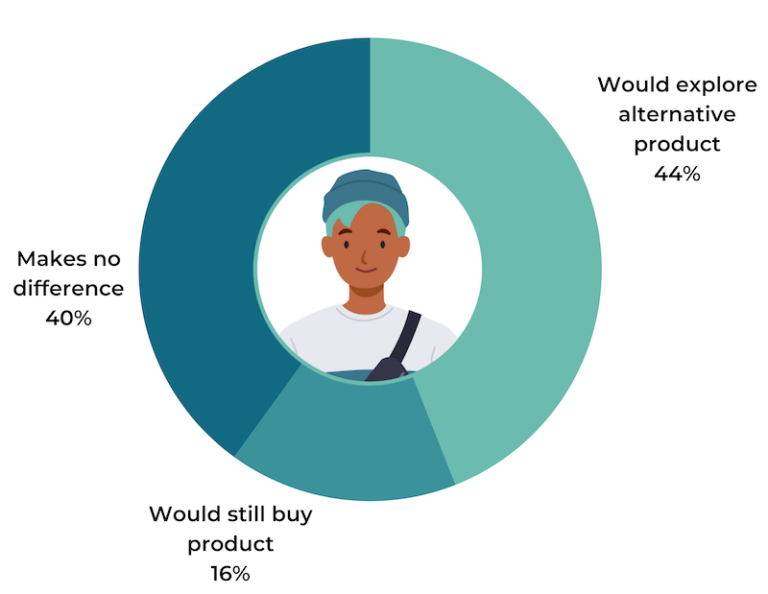

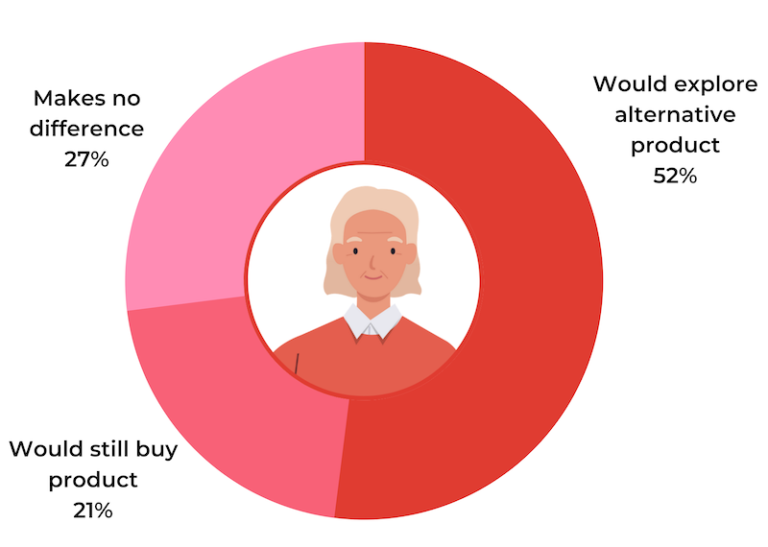

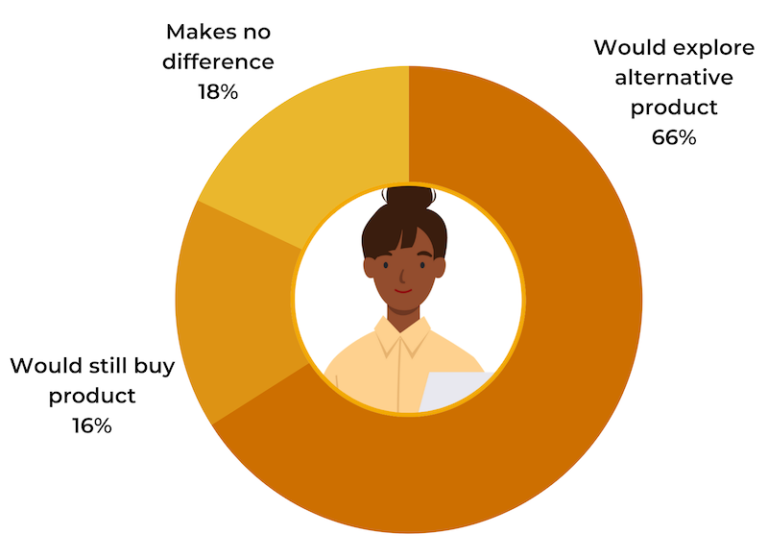

We posed a hypothetical to consumers: If all the reviews on a product you are considering were published three months ago or more, how would that affect your purchasing behavior? Overall, roughly four in ten (38%) consumers said it would make them more likely to explore an alternative product. Only 21% said they would still buy the product.

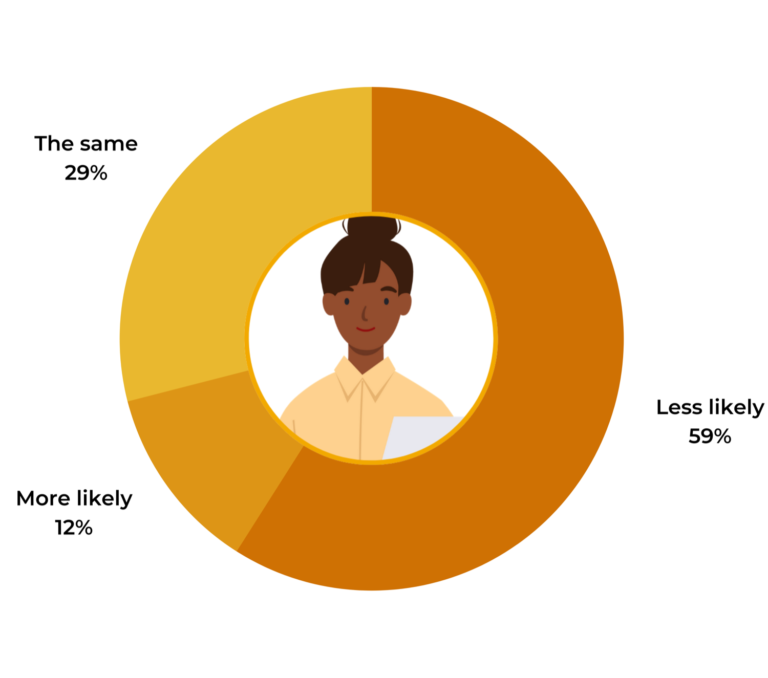

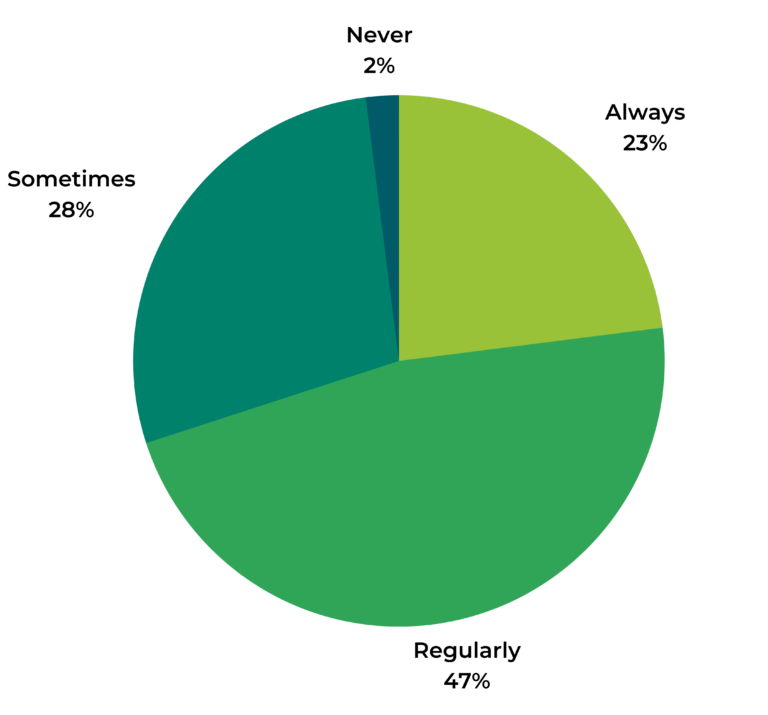

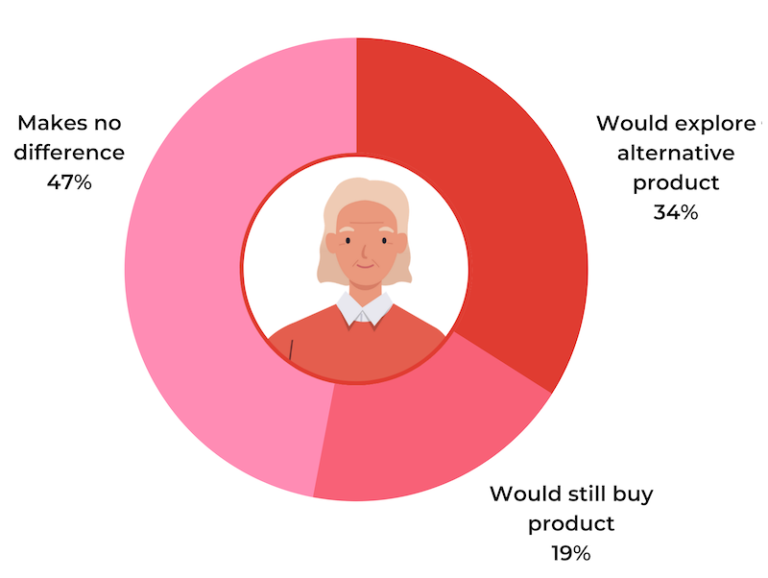

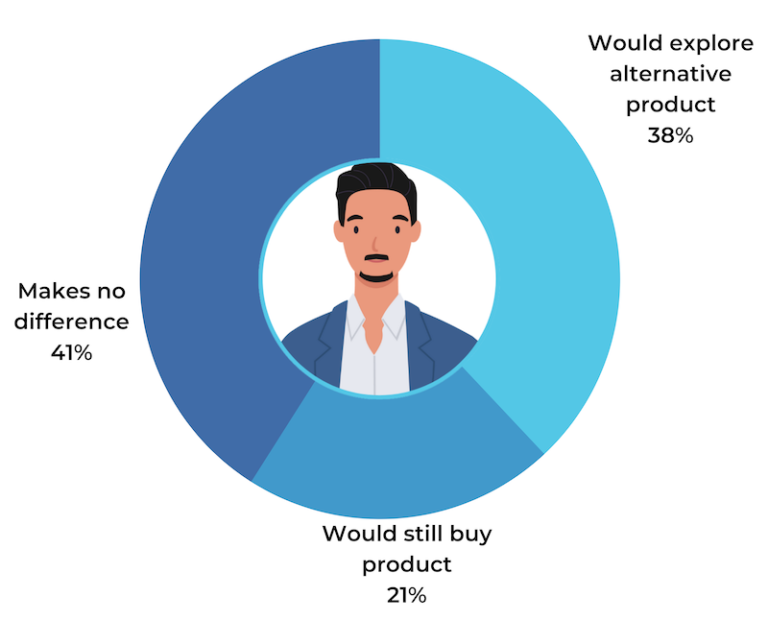

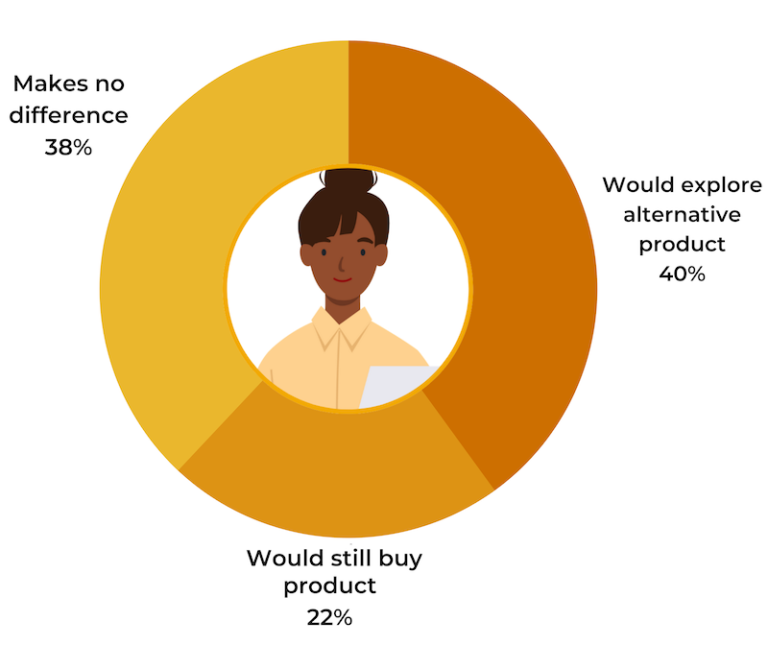

A lack of recent reviews is most likely to drive comparison shopping among younger consumers. If the product they’re considering buying only has reviews from three months ago or more, nearly half (44%) of Gen Zers would explore an alternative from a competitor. Millennials were close behind, with 40% saying they would consider a competitive product.

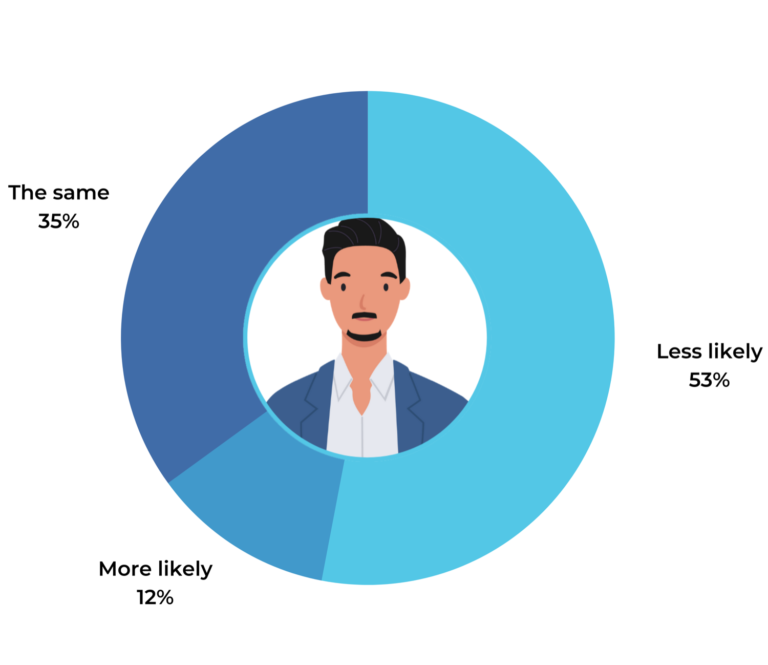

Interestingly, despite being the generation most likely to value review recency over volume, Boomers were the least likely to explore an alternative product if the product they were considering only had reviews that were published three months ago or more. Even so, one-third of Boomers said they would consider a competitive product, a not-insignificant percentage.

Generational Comparison: Most Consumers Would Pass up a Product if All Reviews Were a Year or Older

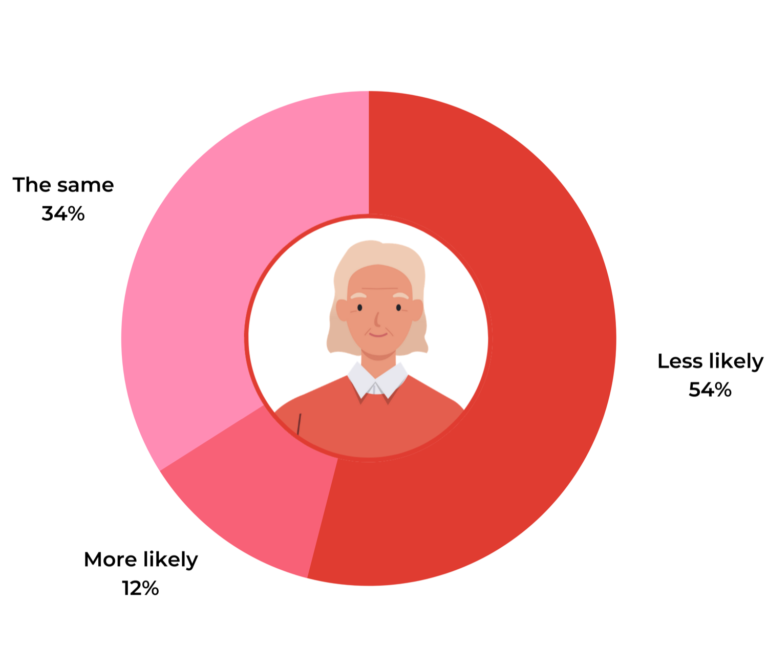

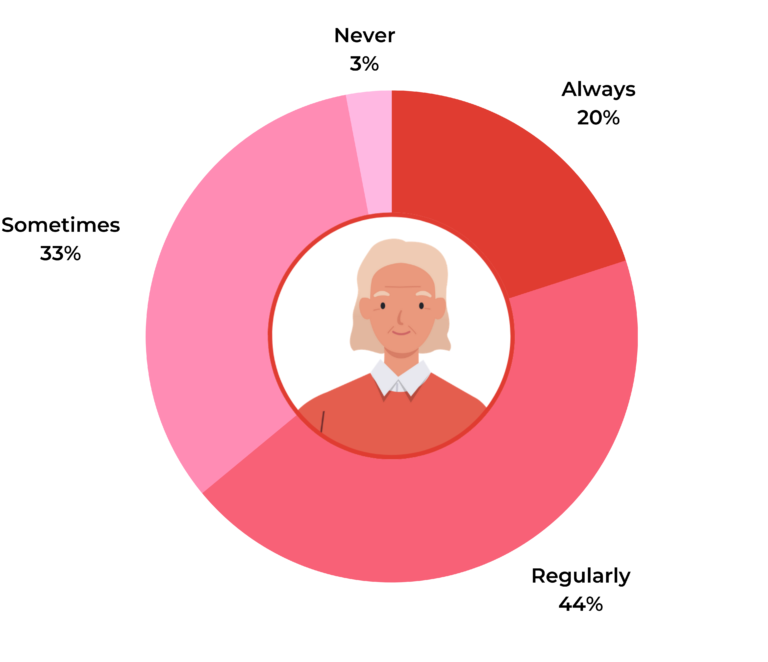

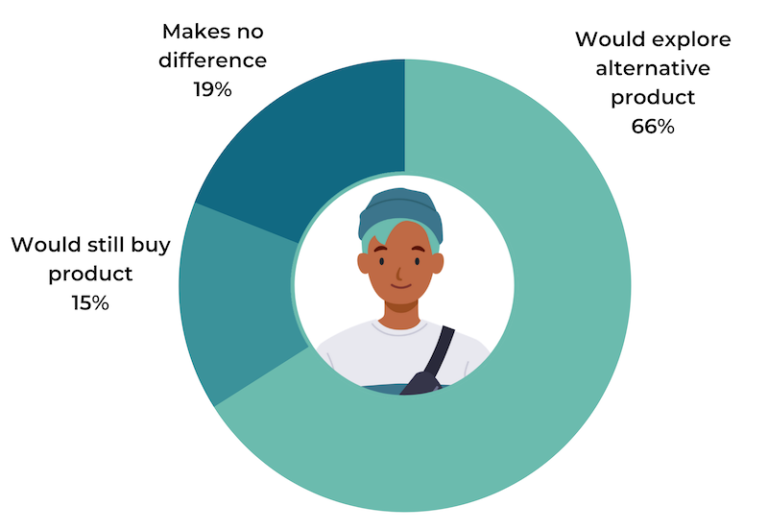

The older the reviews are, the more likely consumers are to go with a different product instead. When we asked consumers the same question, but increased the age of the reviews from three months to one year, the percentage of shoppers who would consider an alternative product from a competitor increased significantly across generations.

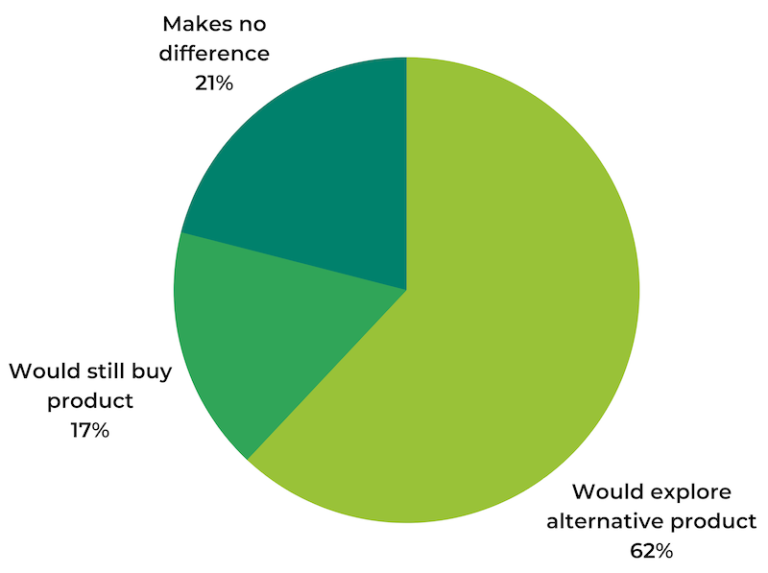

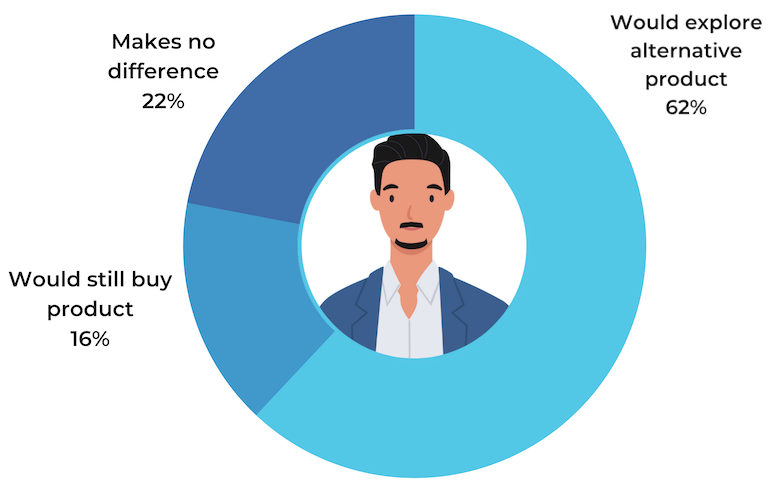

If all the reviews for a product were published one year ago or more, 62% of consumers (regardless of age) would explore an alternative product — a 63% increase from the 38% who said the same thing when the reviews were three months old.

When we break it down by generation, a majority of every age group indicated that they would consider an alternative product, including Boomers. At 66%, Gen Z and Millennials were still the most likely to start comparison shopping if there weren’t any recent reviews for a product they were considering.

Gen Xers experienced the largest increase in consumers who said they would look into a competitive product. 62% of Gen Xers said they would, a 63% increase from the 38% who said the same when the reviews were three months old.

How Age of Reviews Affects Purchasing Behavior

When we compare both of these findings side by side, we see a clear relationship between the age of available reviews and a consumer’s likelihood to consider an alternative product from a competitor. The findings are undeniable: the older the available reviews are for a product, the more likely a consumer is to shop elsewhere.

How to Consistently Generate Fresh Review Content: Three Tips for Brands and Retailers

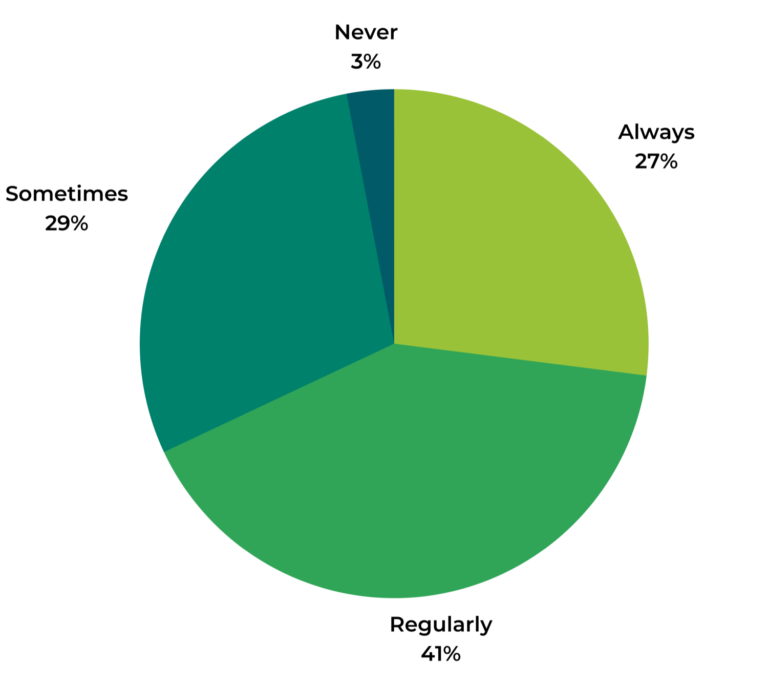

In today’s competitive retail landscape, having recent reviews is no longer optional. It’s essential if brands and retailers want to convert more customers and avoid losing them to a competitor. How recent is recent enough? The vast majority (77%) of consumers expect to find reviews that were published within the last three months, including 44% who want to be able to find reviews written within the past month.

Based on these findings, we share our top three recommendations for brands and retailers below.

1. Know Your Users

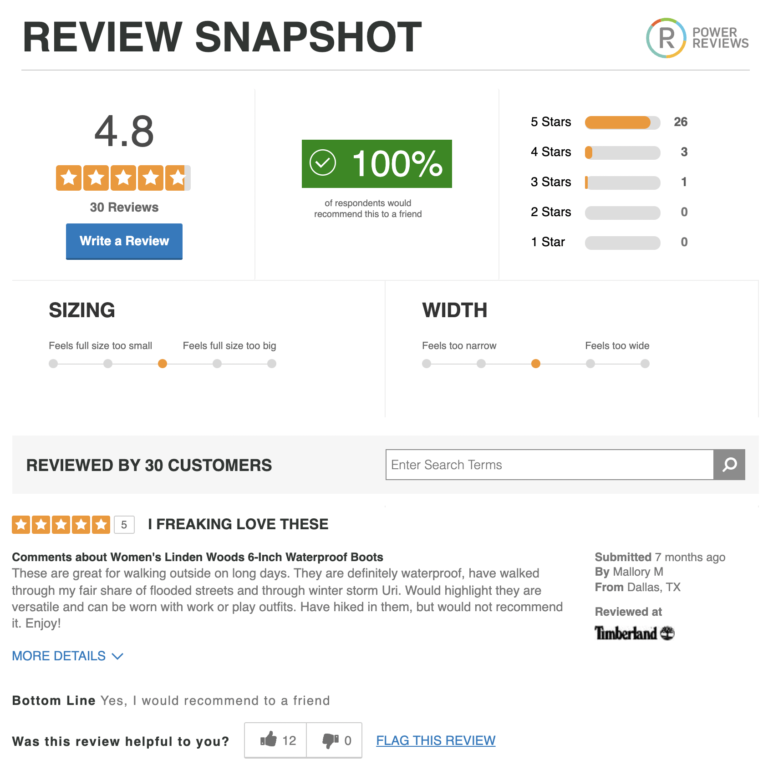

Review recency and volume are both generally valued highly by consumers, and they both have a conversion impact. However, some generations care more about one over the other. So, if your brand caters primarily to one generation, make sure your review displays are sharing the information they’re looking for.

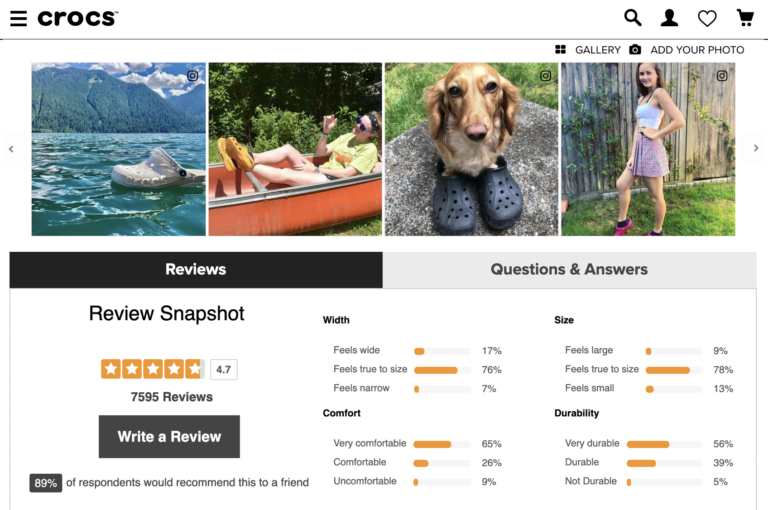

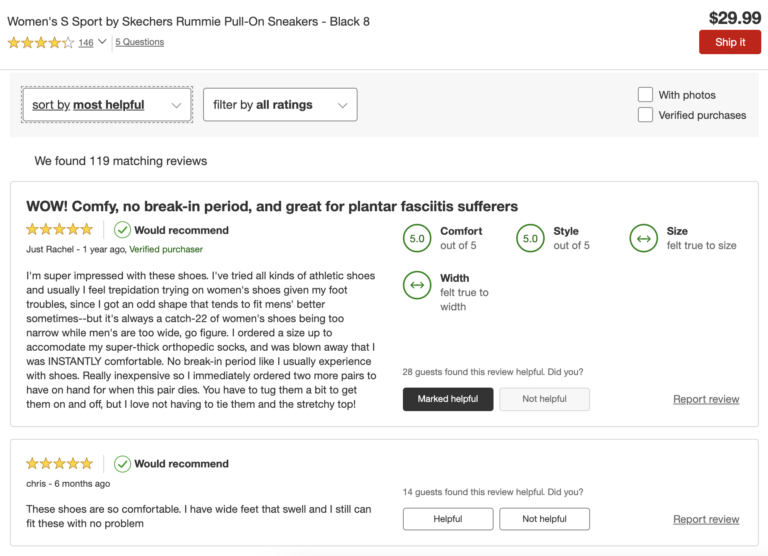

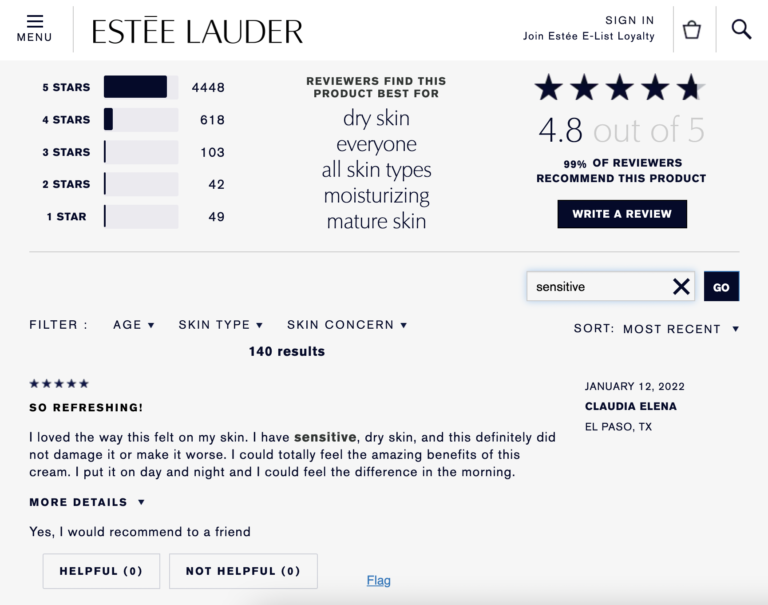

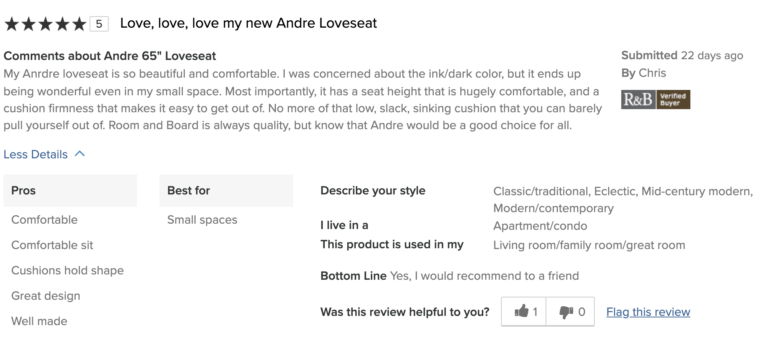

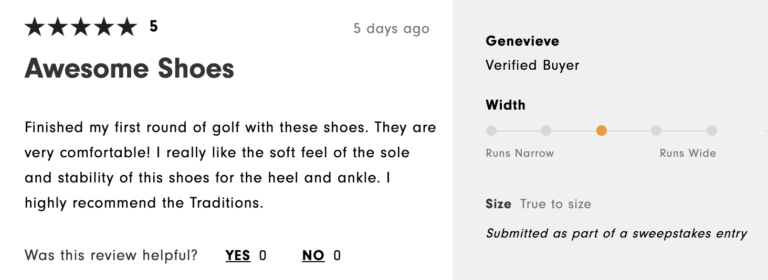

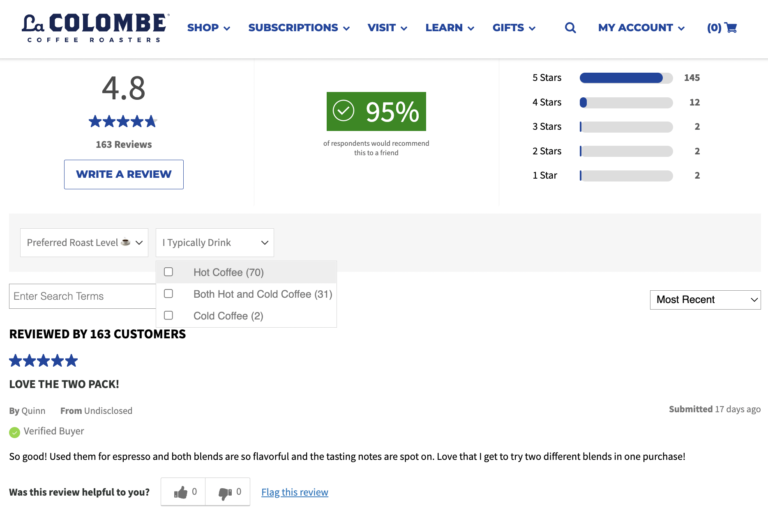

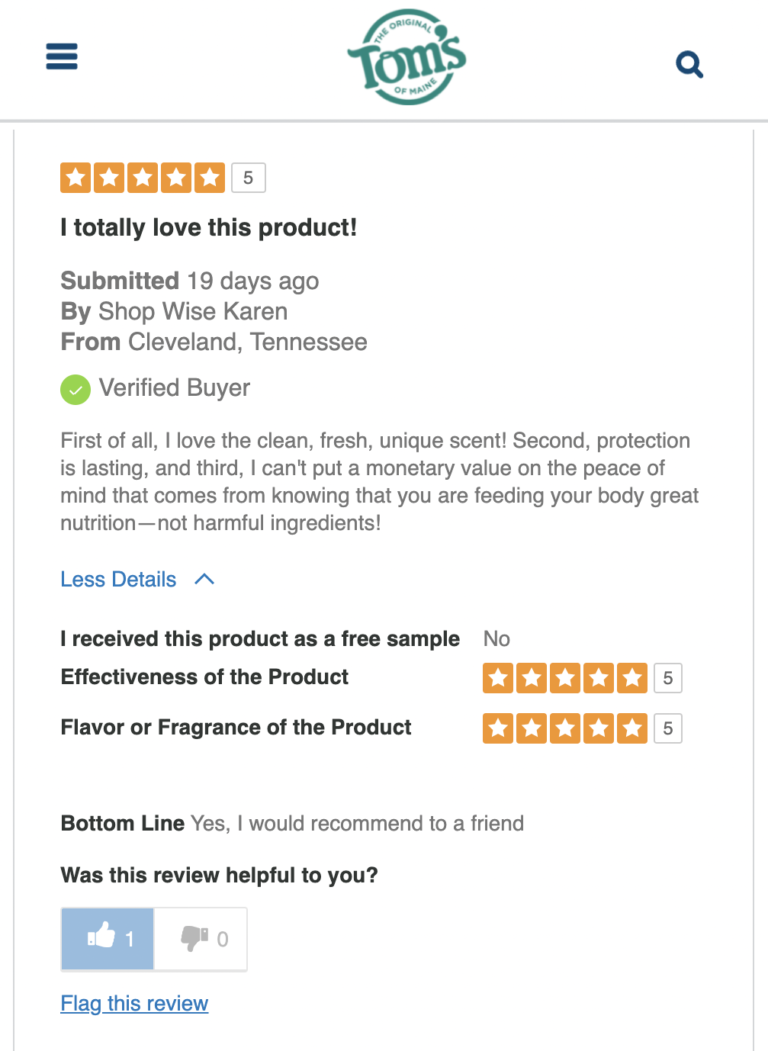

For example, if Boomers represent a majority of your customers, you need to prominently display the dates a review was written in a spot that’s easily noticeable alongside each review. You may also want to default your review display to sort by Most Recent, rather than Most Helpful. Here’s an example from Wander Beauty:

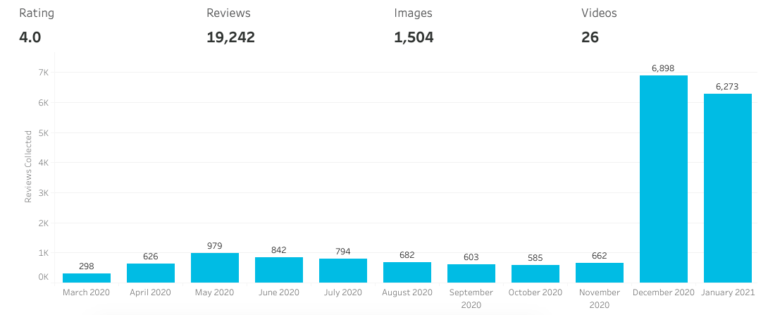

2. Consistently Drive New Review Content

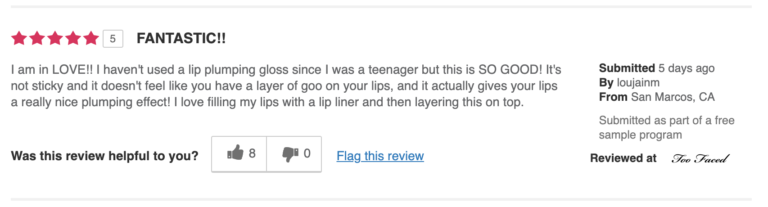

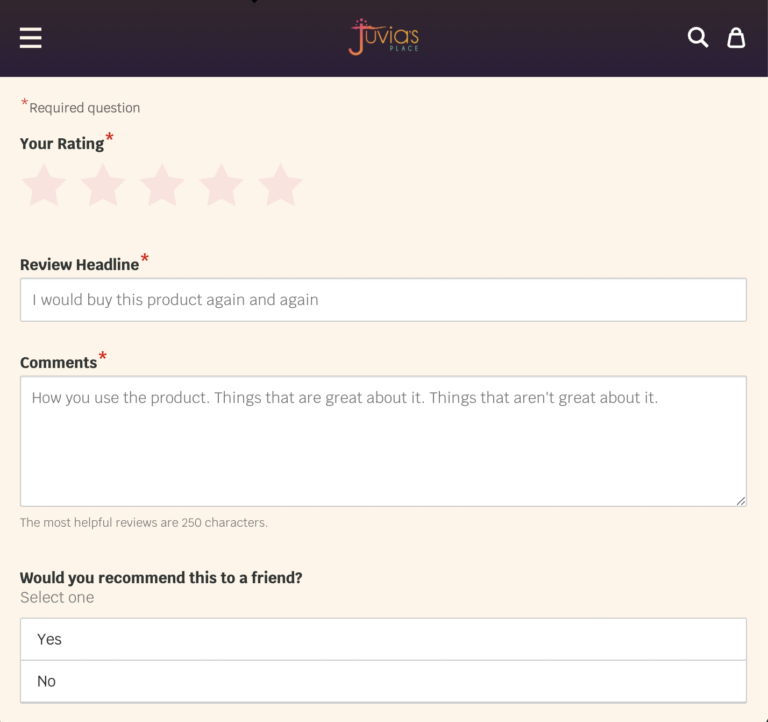

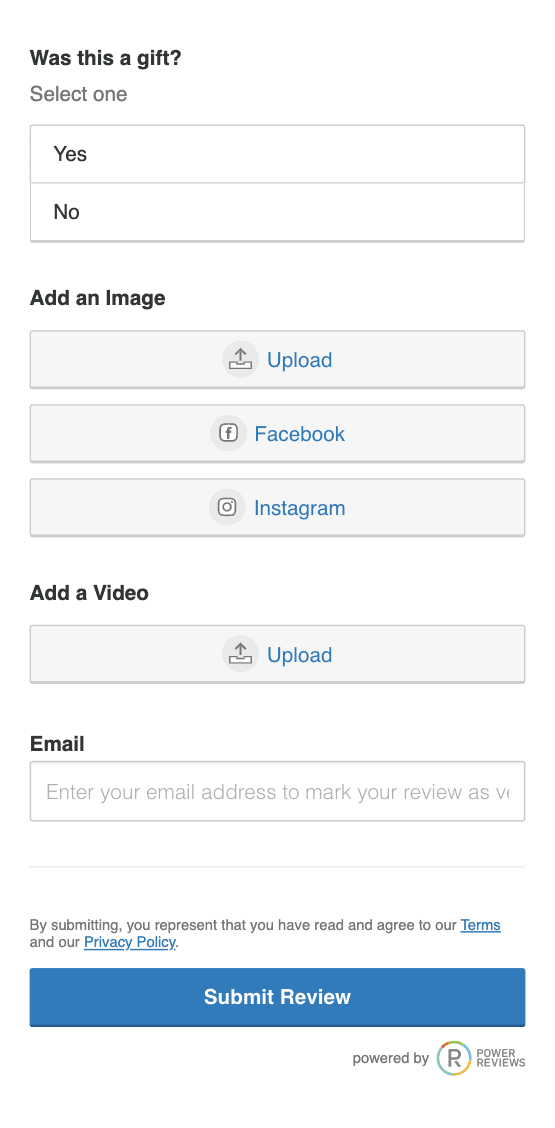

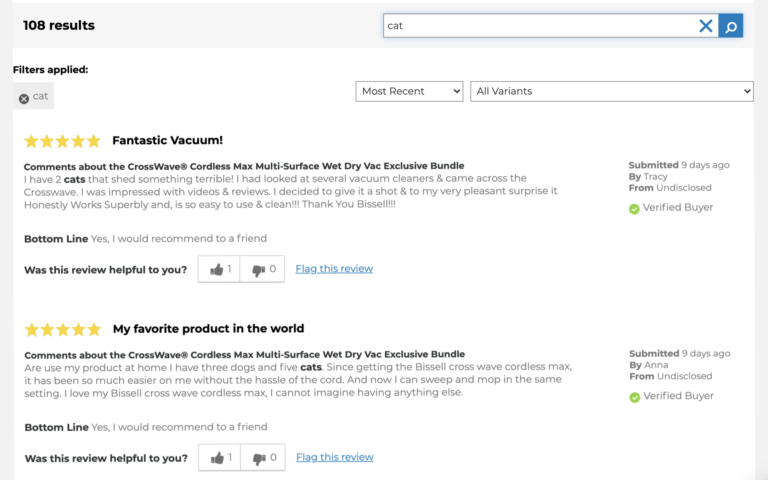

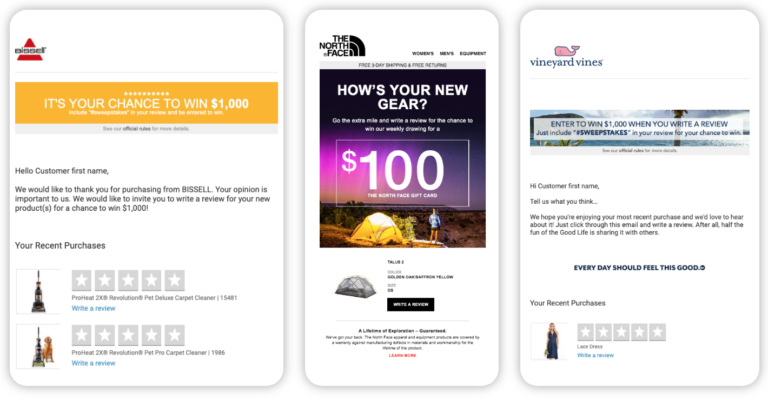

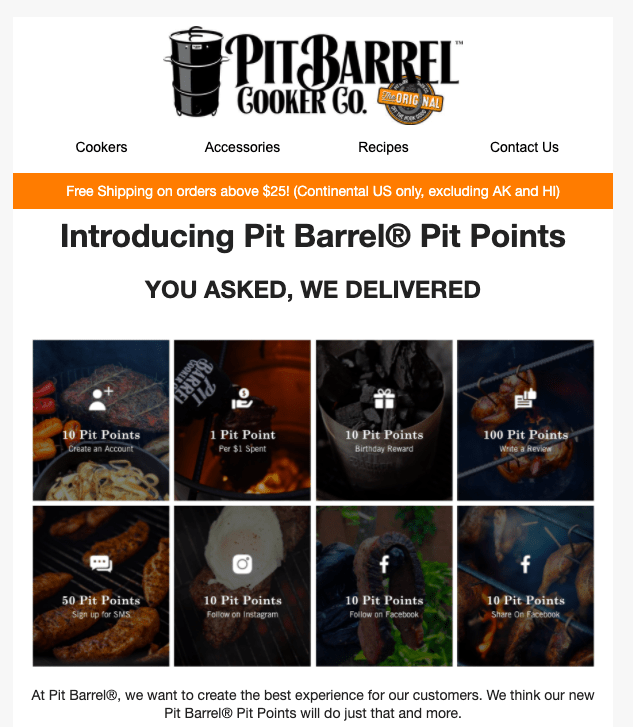

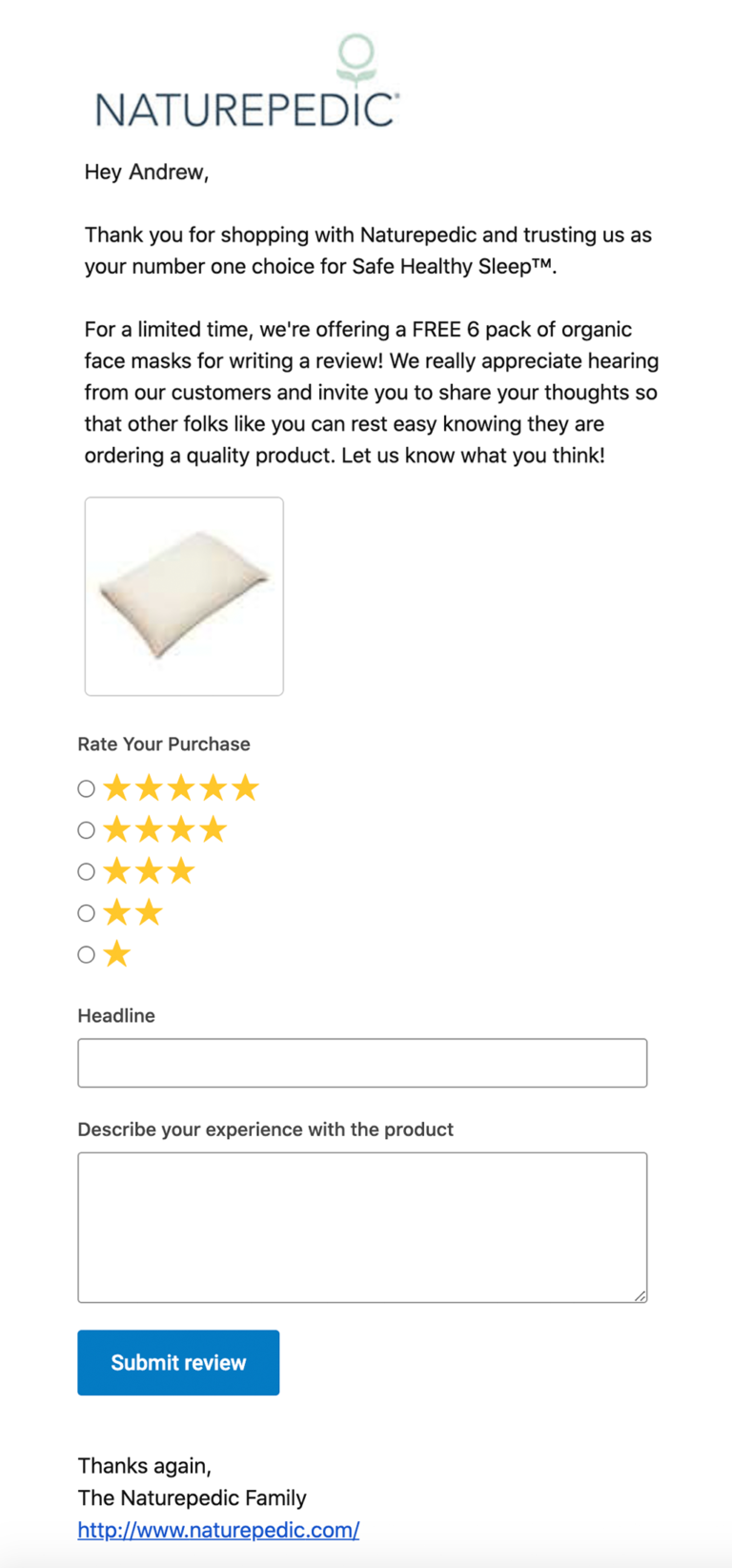

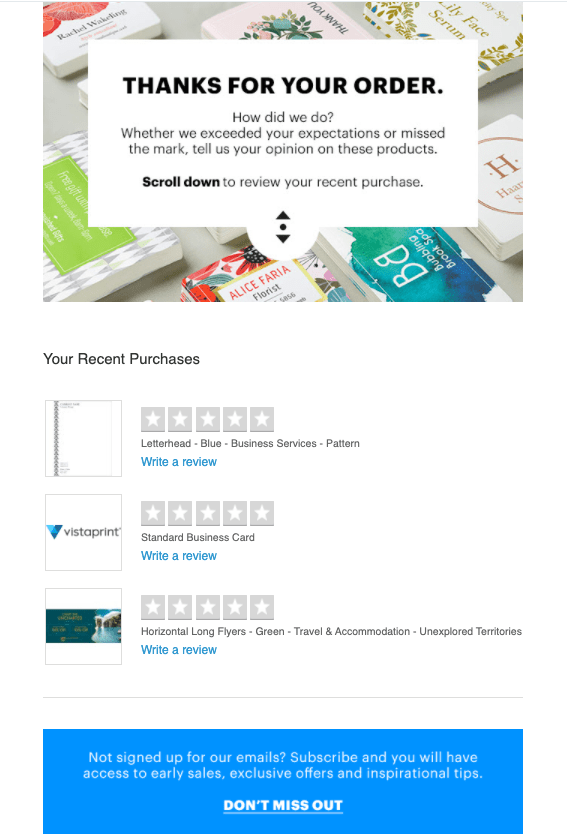

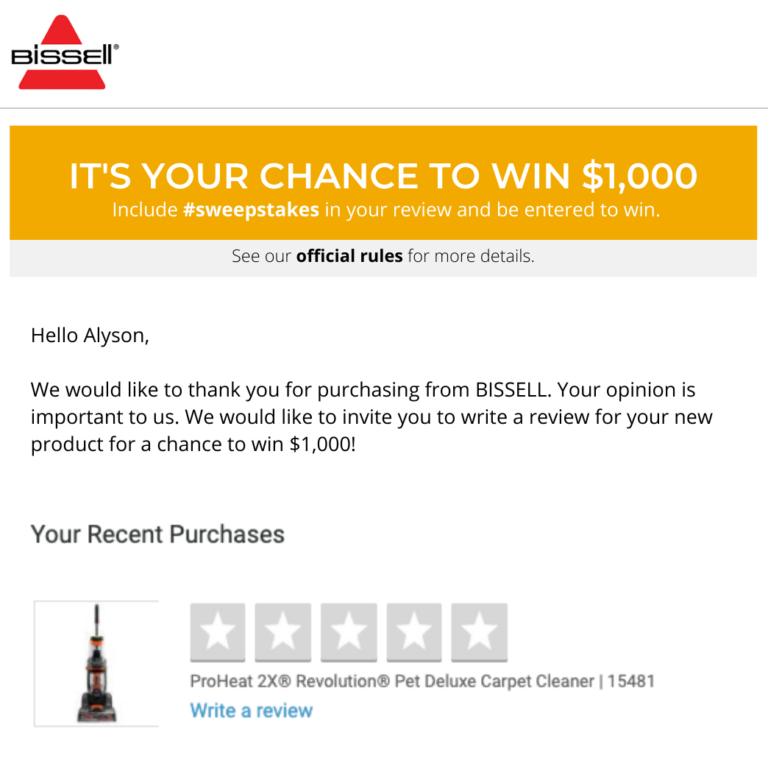

To ensure shoppers always have recent reviews to read, brands and retailers must make it a priority to consistently generate new review content. There are dozens of ways to collect new reviews, but one of the best ways is to follow up with verified purchasers after they’ve bought something.

Send emails to your customers 7 to 21 days after their purchase and ask them to write a review. Include the products they purchased in the body of the email, and enable review collection from the email itself. Our research has found that nearly 80% of all review content is generated from email requests like these.

If you need to augment organic collection methodologies, “Receipt. Review. Collect.” taps into receipt uploads from an army of 12 milllion consumers across multiple retailers and marketplaces (Amazon, Target, Kroger and Albertsons grocery stores and many many more) to generate a regular stream of review content from actual verified buyers.

3. Keep an Eye on Review KPIs

Some products invariably generate fewer reviews than other products. That’s why it’s so important to monitor your review KPIs for all of your products, especially overall review volume and the date of the most recent review.

When the most recent review for a product passes the threshold of 90 days — or, ideally, 30 days — it’s time to implement a review generation campaign.

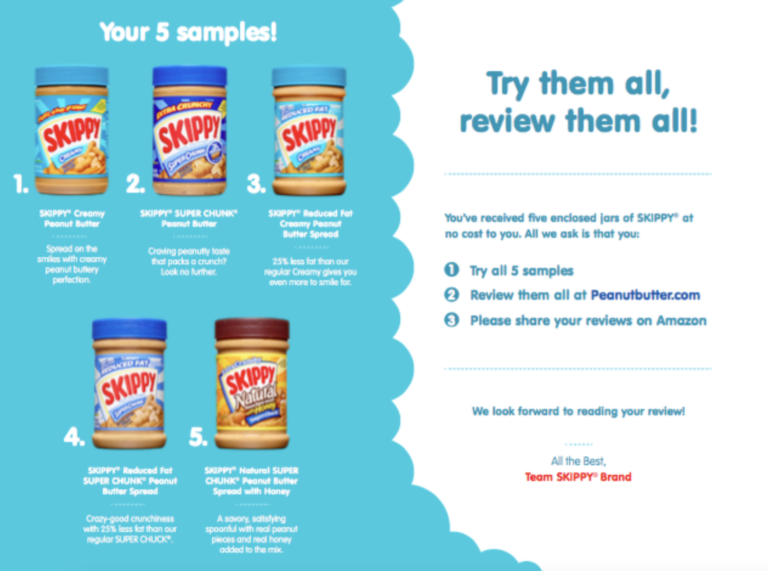

While this article is about review recency specifically, make sure you do whatever you can to launch products with new reviews. Obviously, this is a little bit of a chicken and egg scenario so it’s easier said than done. Product sampling is one commonly used solution for this problem.

Don’t forget: When a shopper is exposed to a product page with 1 or more reviews, conversion lifts by 52.2%. Translation: it’s critical to launch new products with reviews.

New Reviews Never Get Old

No matter their age, all consumers prefer recent reviews — and the more recent, the better. However, there are key generational differences in how consumers value review recency. By understanding these differences, brands and retailers can better serve their customers and win more sales.