MARCH 31, 2021—CHICAGO—US grocery consumers have flocked online at a rate never seen previously due to the Covid pandemic — with time savings being the primary motivating factor rather than Covid-related safety concerns.

However, the store is far from dead. Consumers are increasingly favoring a blended store-online grocery shopping approach.

These are just a few of the key insights from a new consumer survey from PowerReviews, a leading provider of ratings and reviews and User-Generated Content solutions.

The PowerReviews Evolution of the Modern Grocery Shopper study draws on survey responses from 7,916 grocery shoppers across the country, surveyed in February 2021. Key findings include:

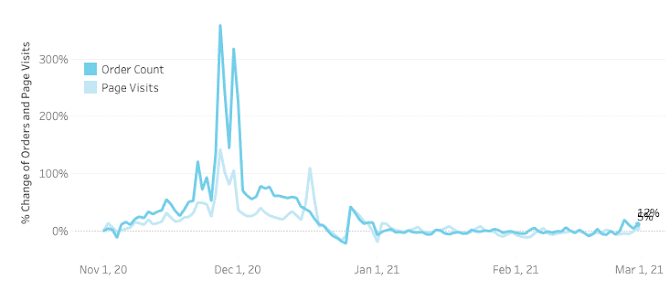

More grocery shopping is happening online than ever before

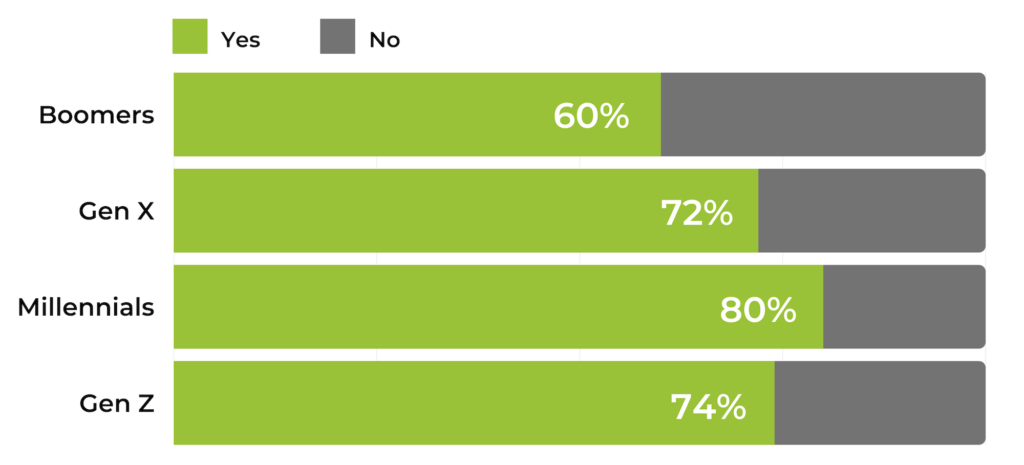

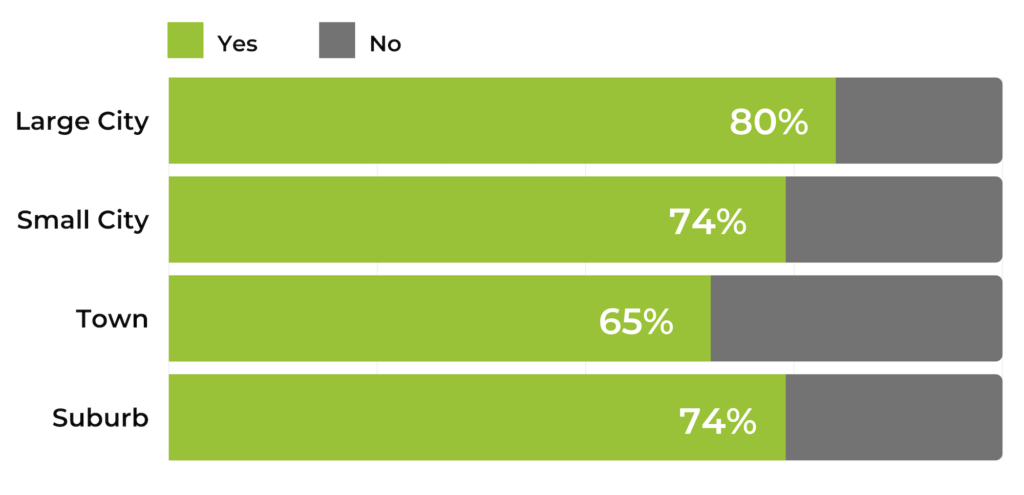

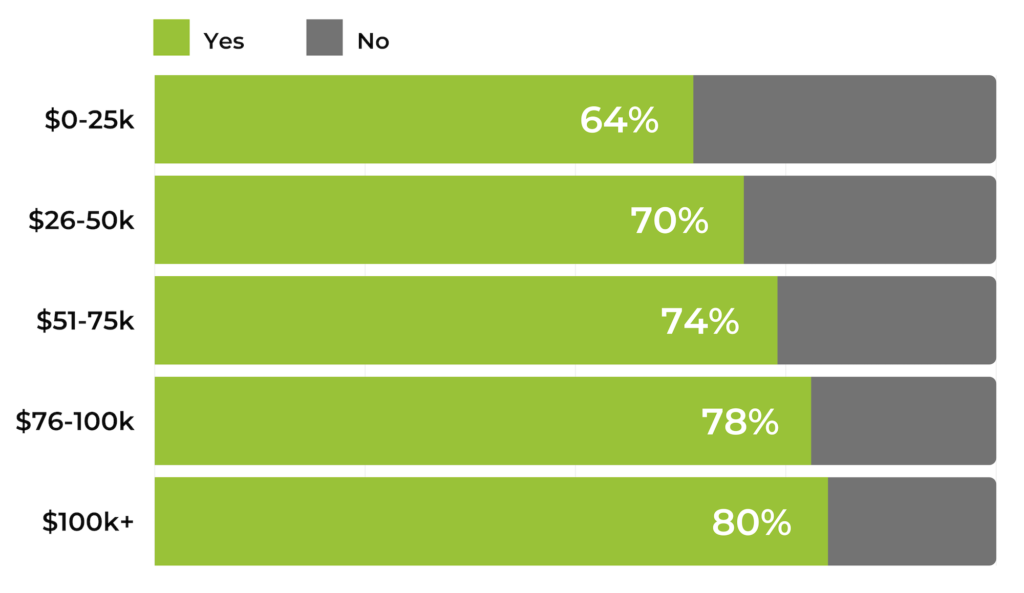

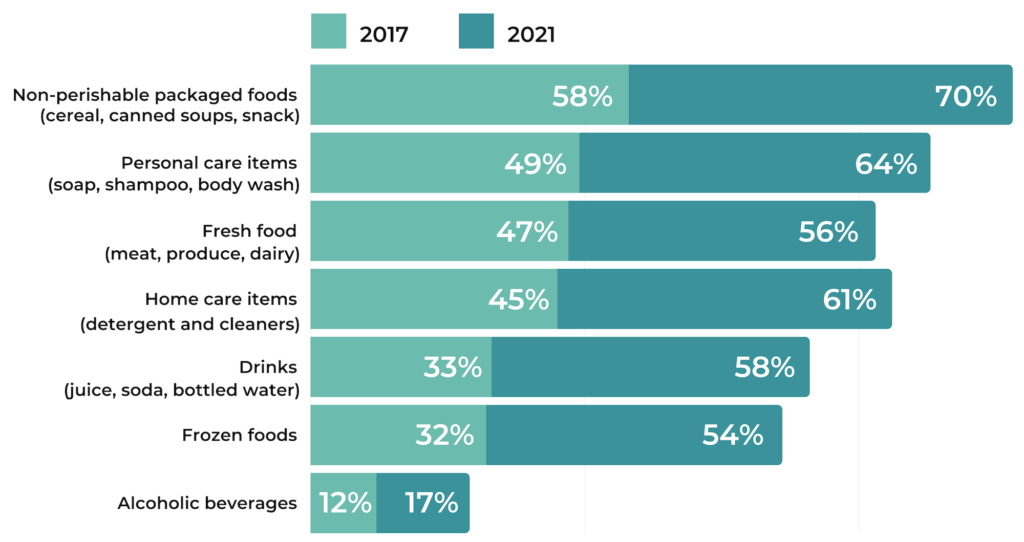

- 73% of consumers had purchased grocery items online within the most recent three months of being surveyed, compared to 17% when we asked the same question in 2017. This represents growth of 4.3x.

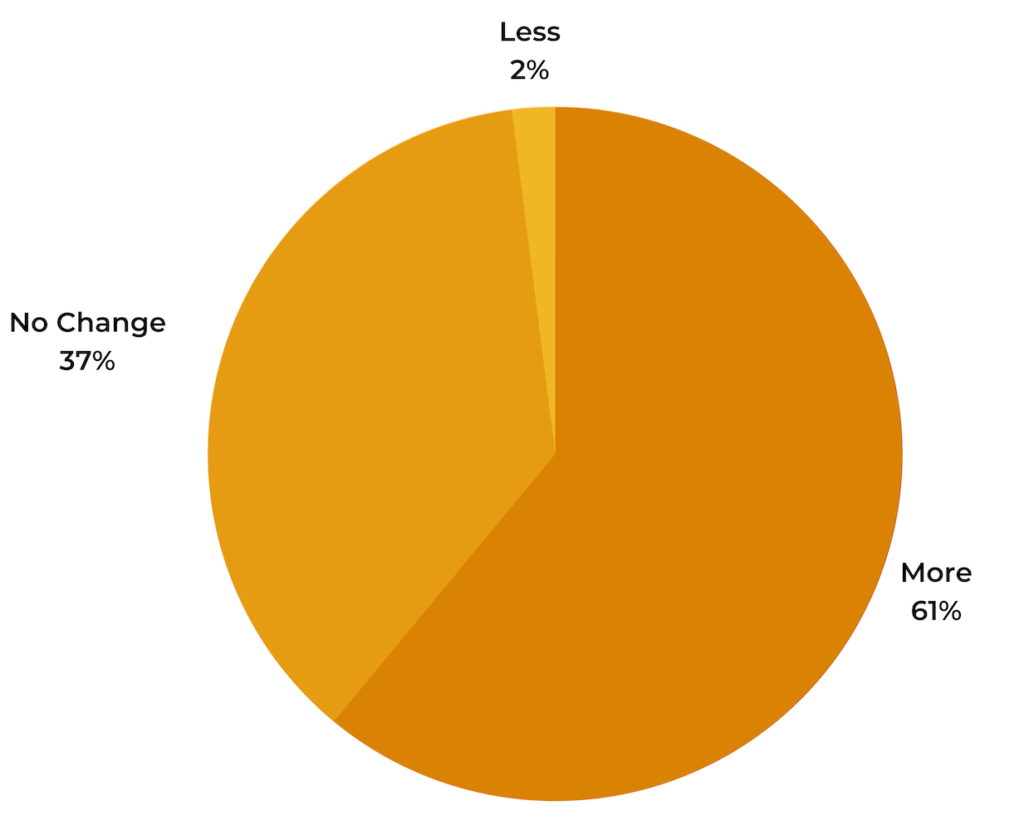

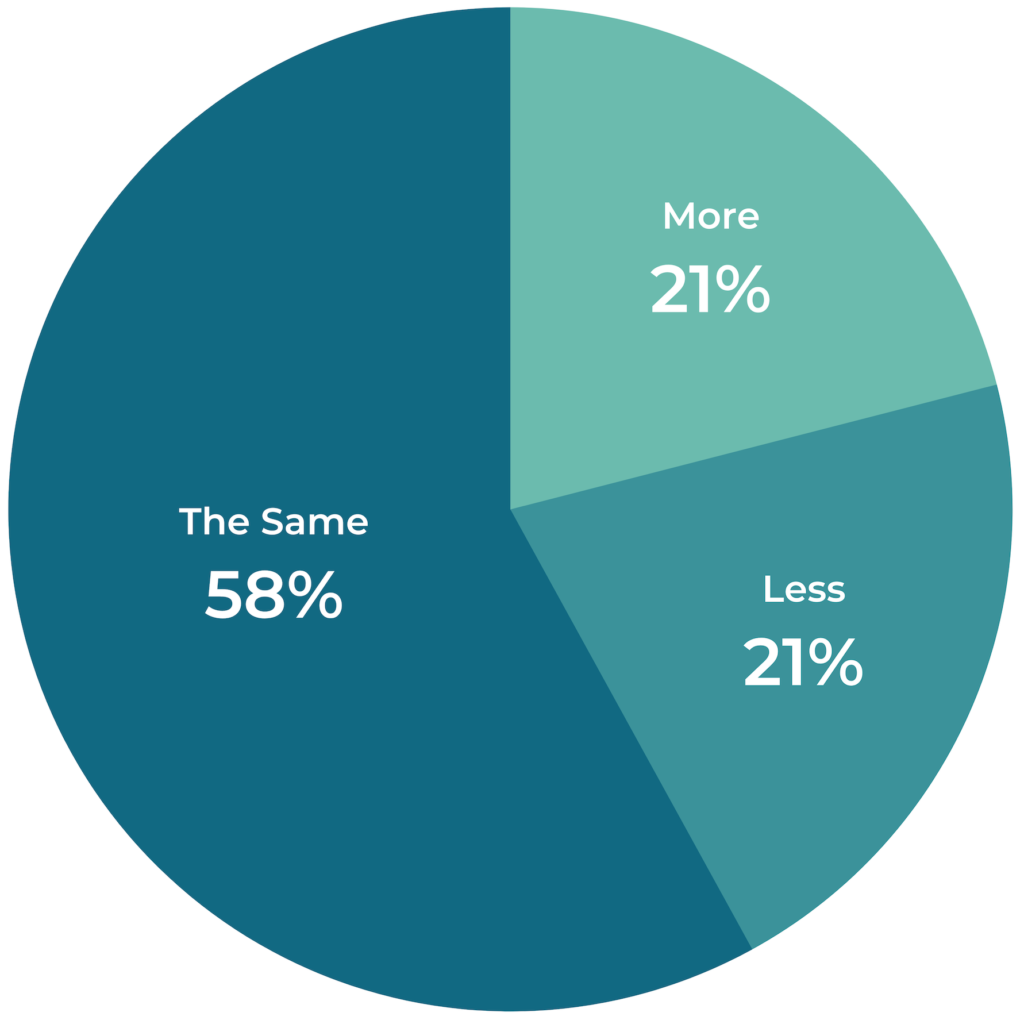

- 61% of consumers shop for groceries online more now than they did pre-COVID.

- Top reasons for online shopping include time savings (59%), personal safety (49%) and avoiding impulse purchases (31%).

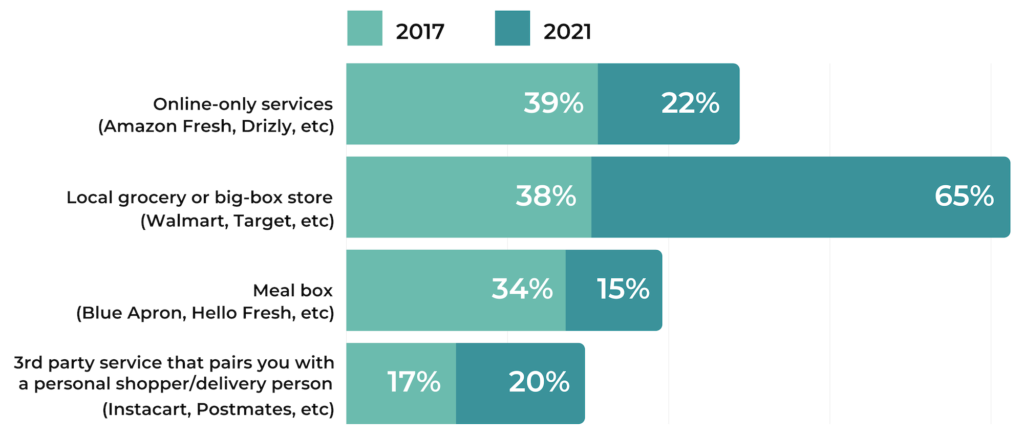

- Ordering directly from a local grocery store (as opposed to online-only ordering services such as Instacart or Amazon Fresh) is the most popular way to shop for groceries online; 65% of consumers say they’ve done this.

Brick-and-mortar grocery is alive and well

- 93% of consumers had made an in-store grocery purchase within the most recent three months of being surveyed.

- 95% of consumers who shopped for groceries online have also made an in-store grocery purchase within the same time period.

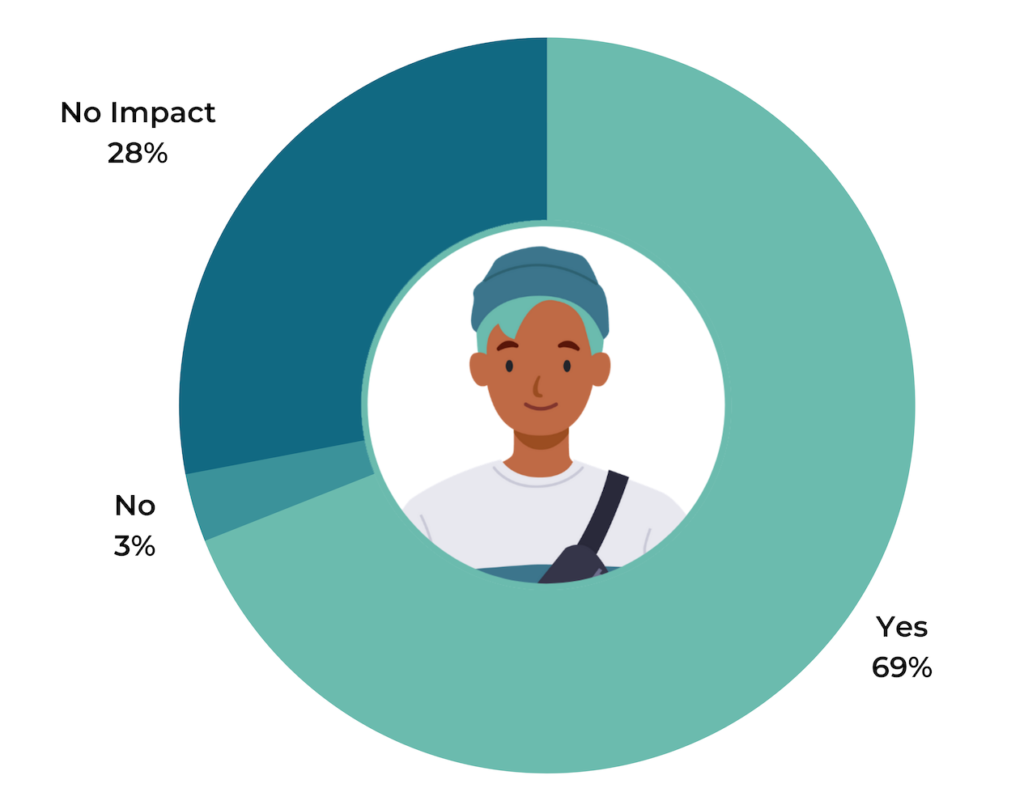

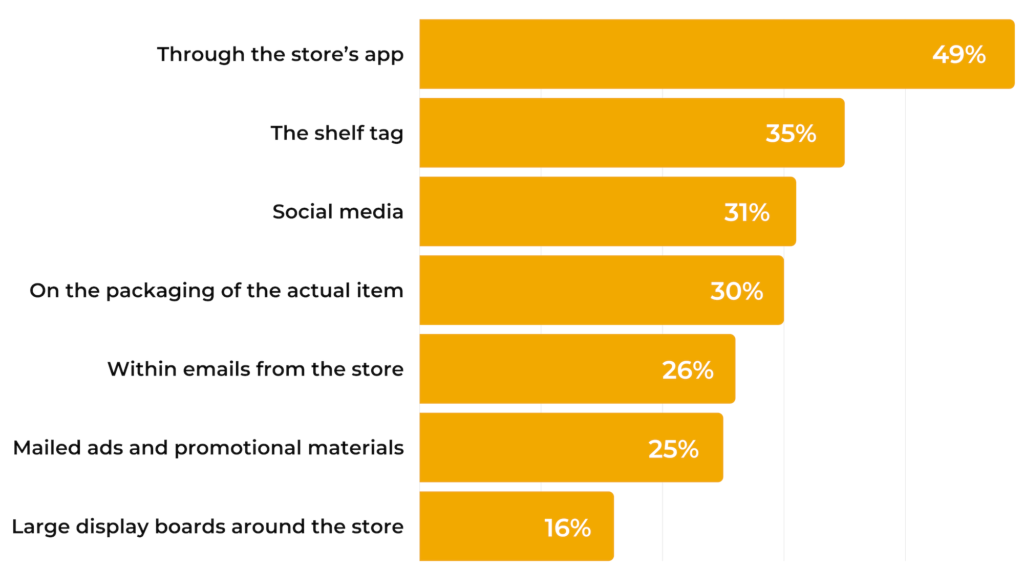

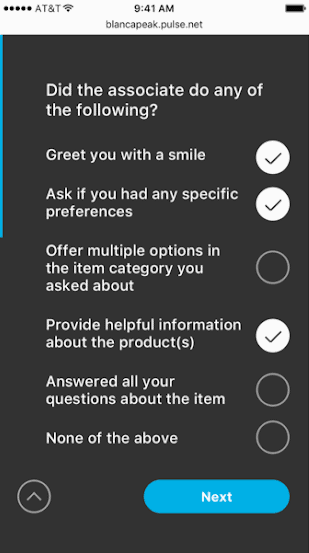

Ratings and reviews positively impact the behavior of both online and in-store grocery shoppers.

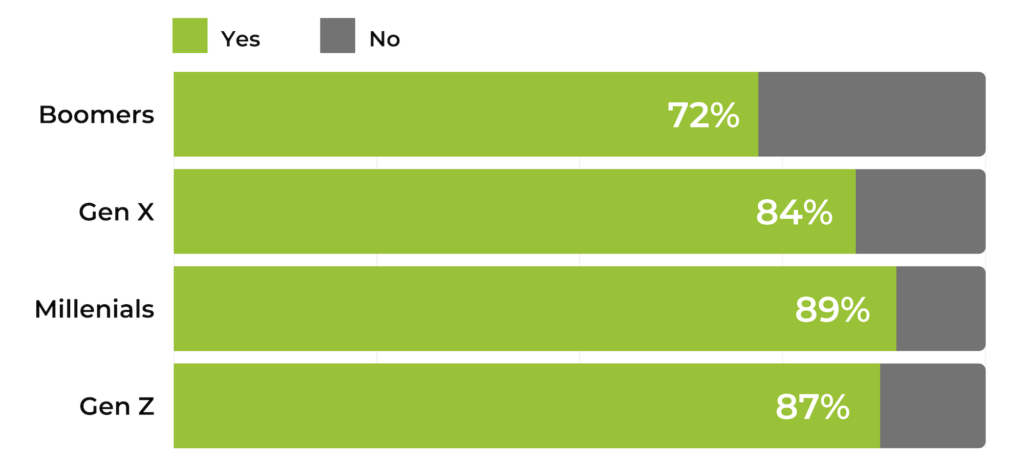

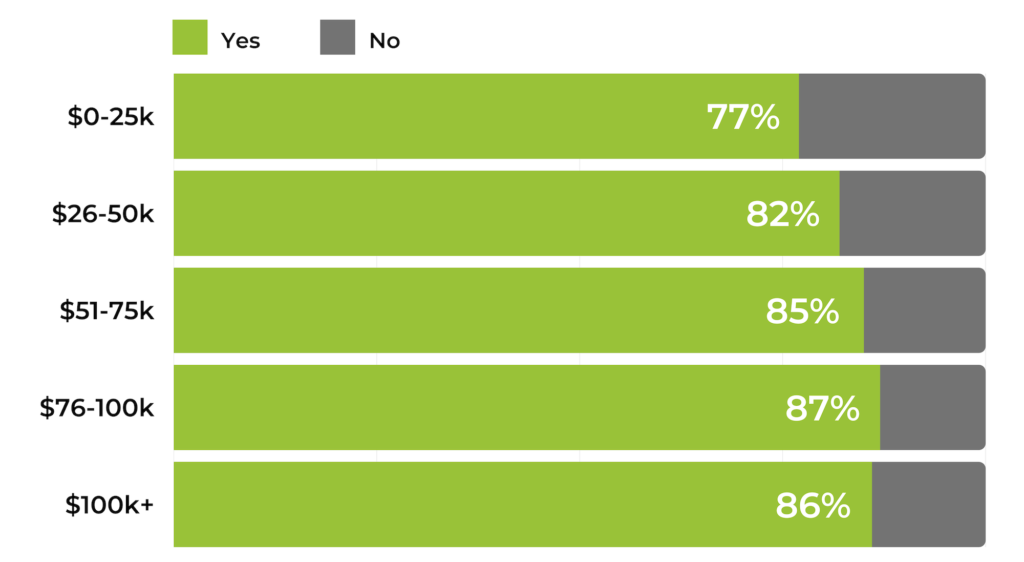

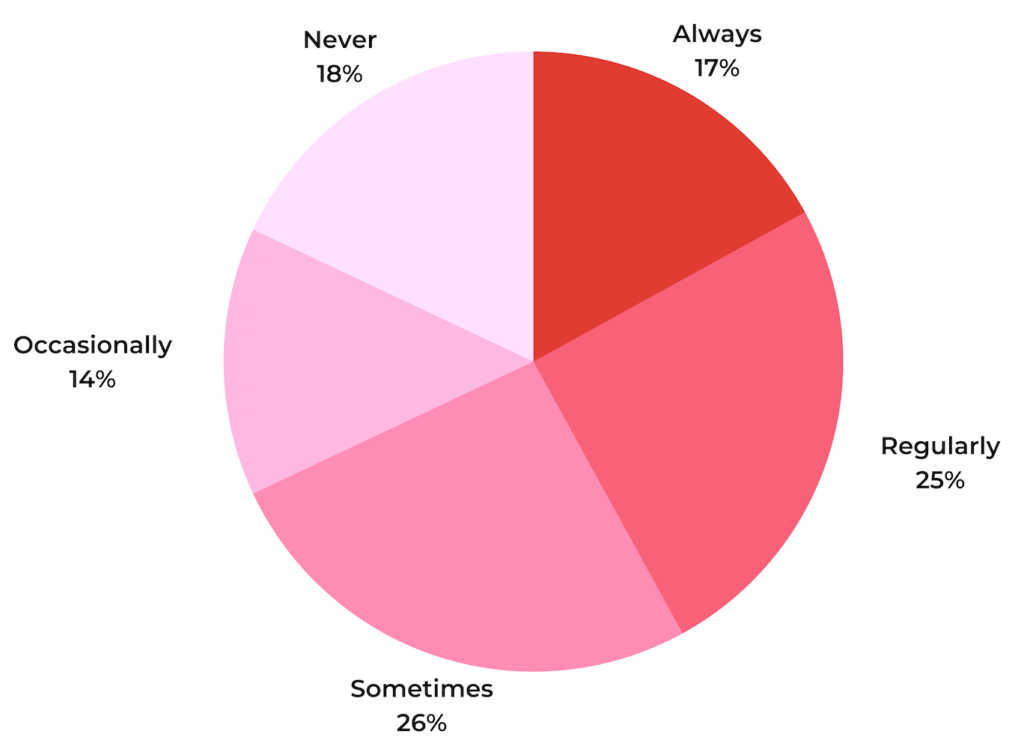

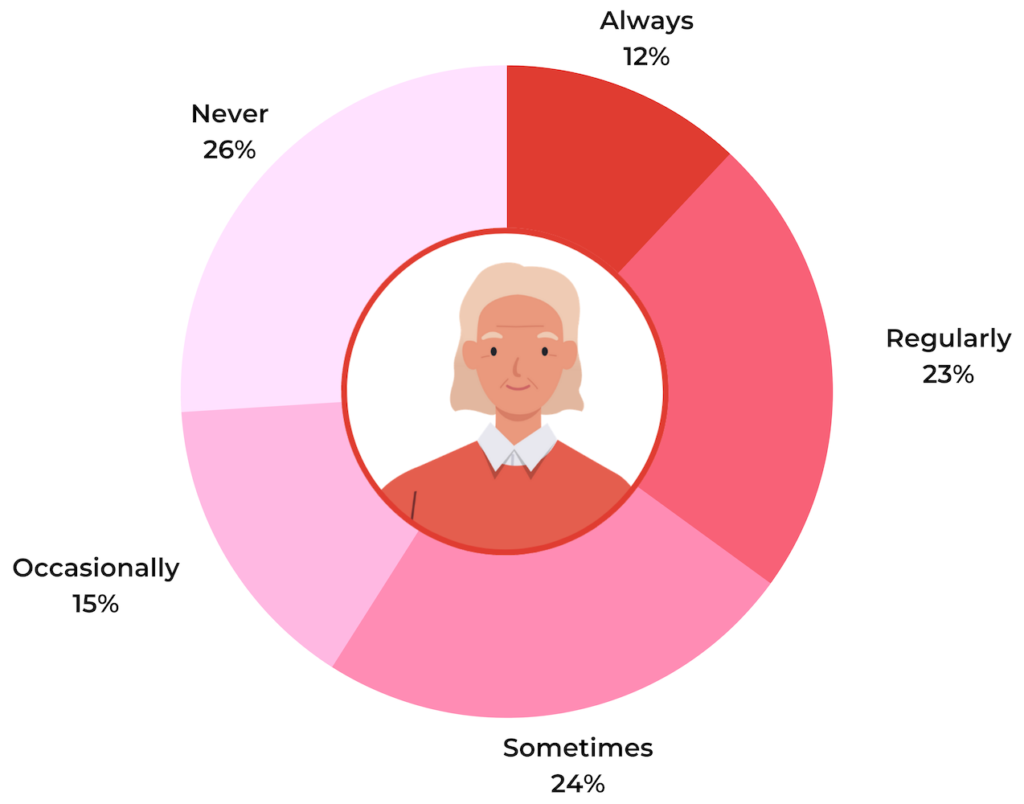

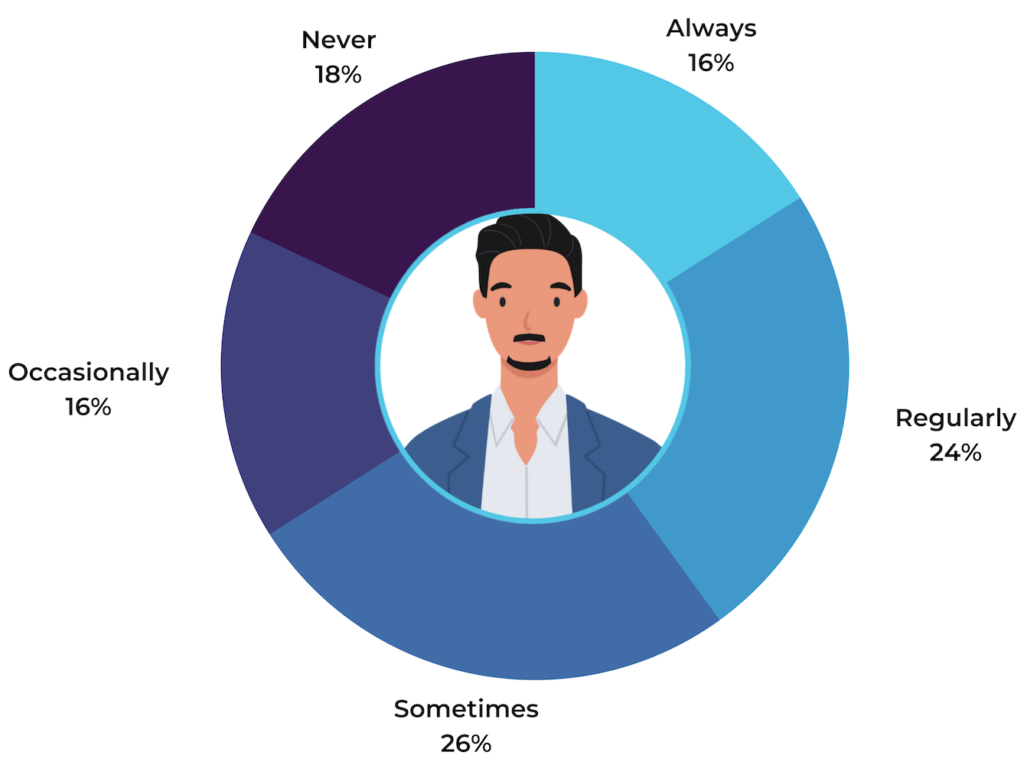

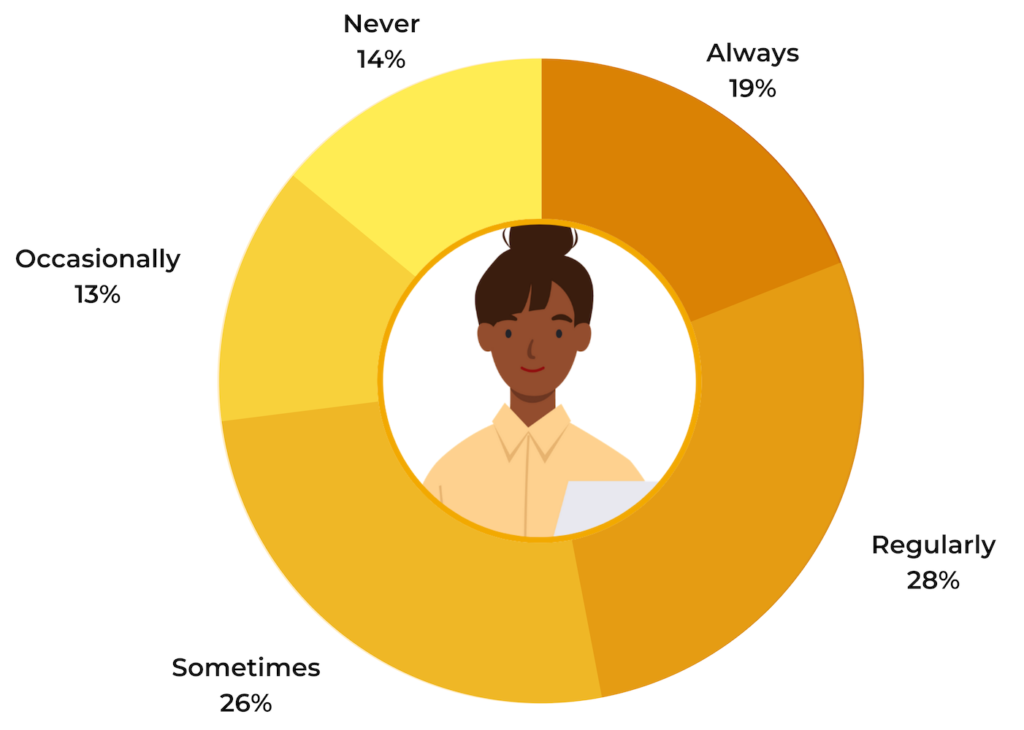

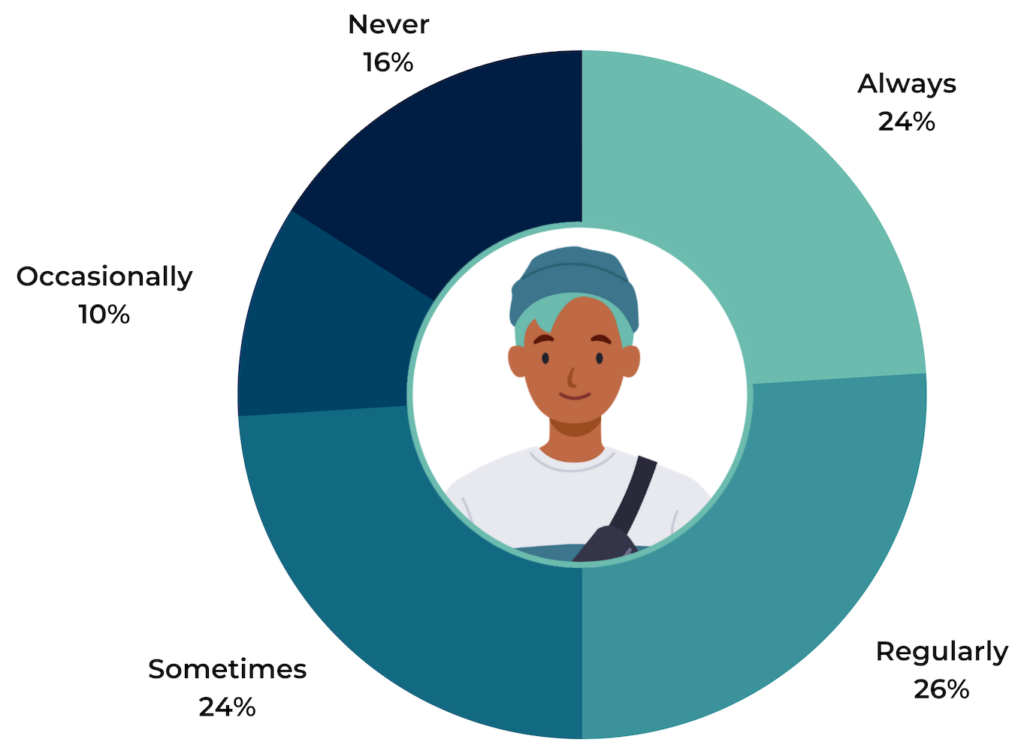

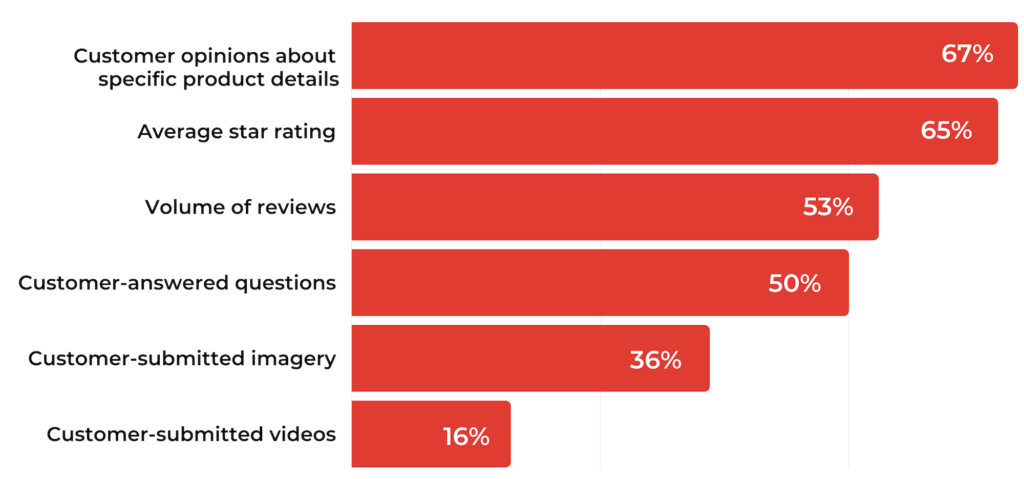

- 82% of online grocery shoppers say they read reviews at least occasionally.

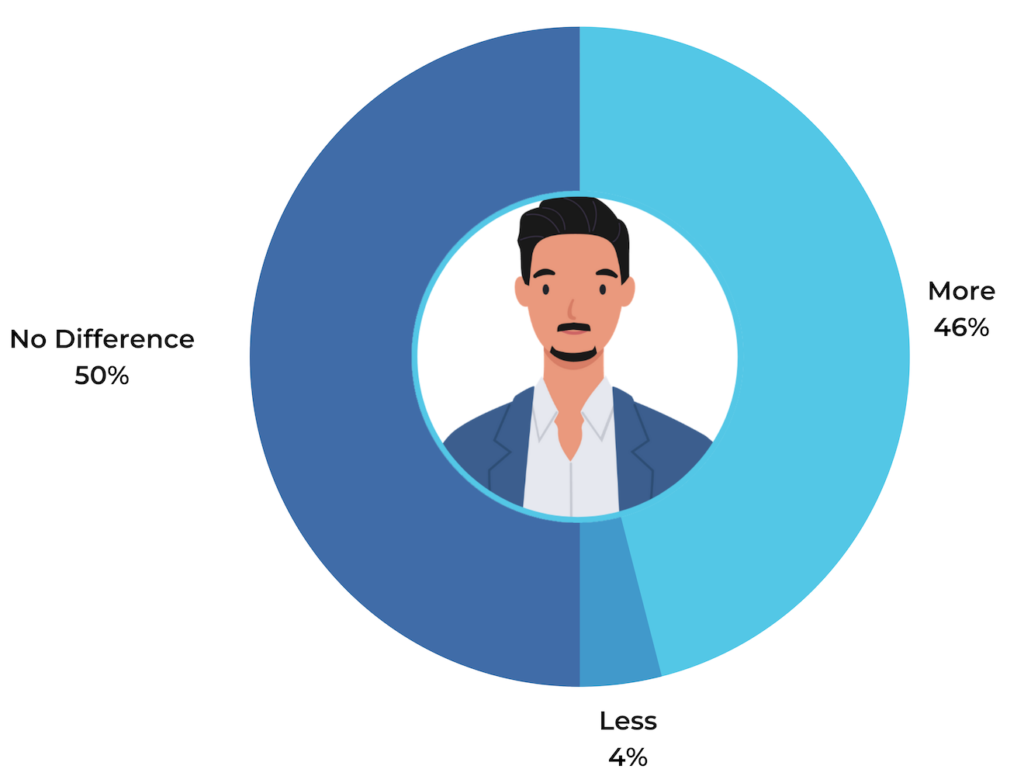

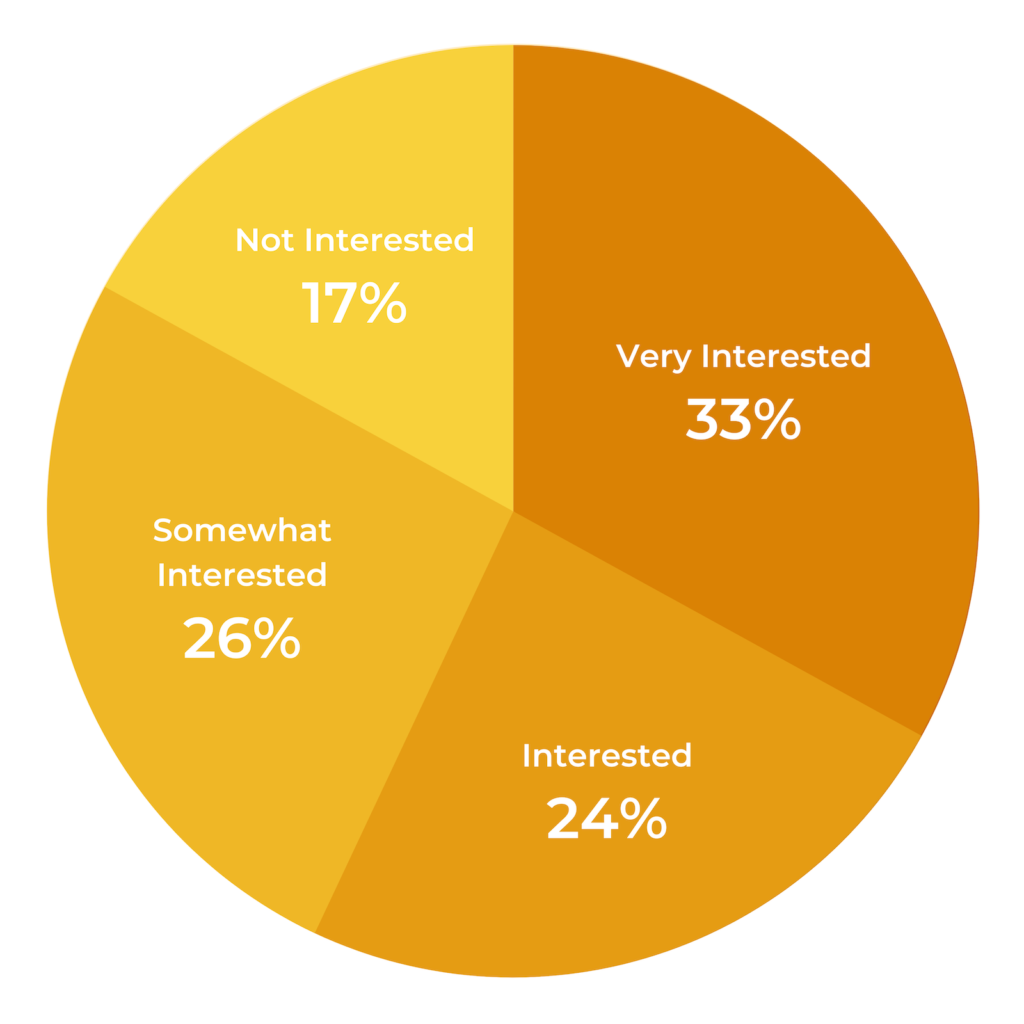

- 83% of consumers are at least somewhat interested in accessing product ratings and reviews when they’re considering a new product while shopping in a brick-and-mortar grocery store.

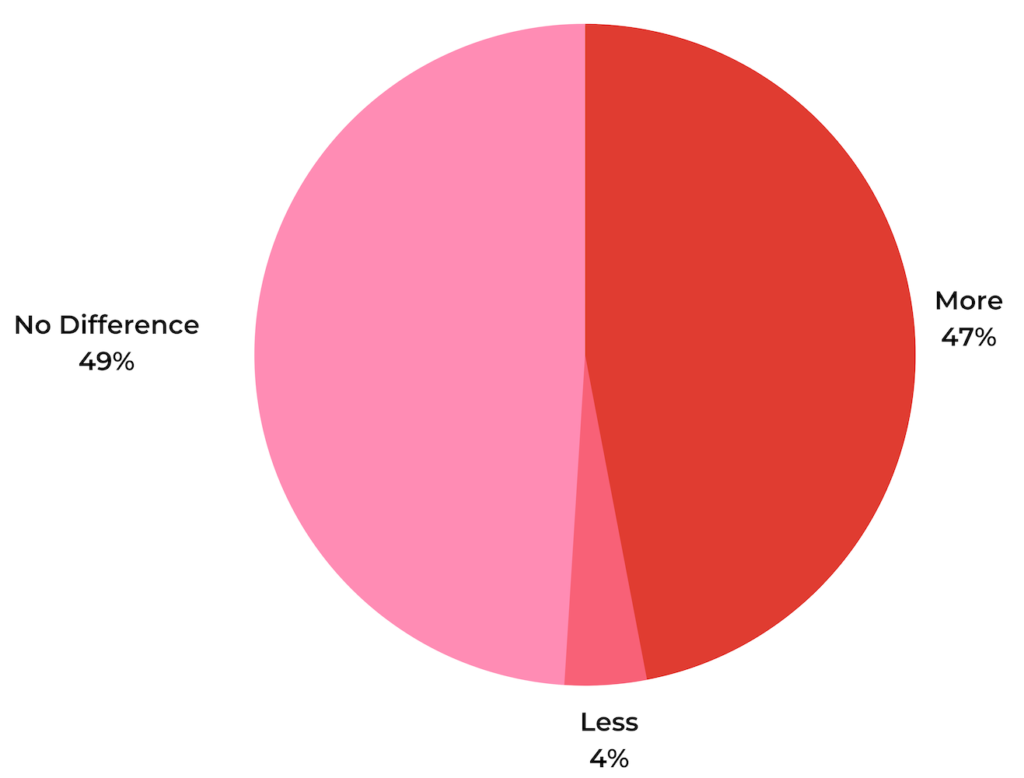

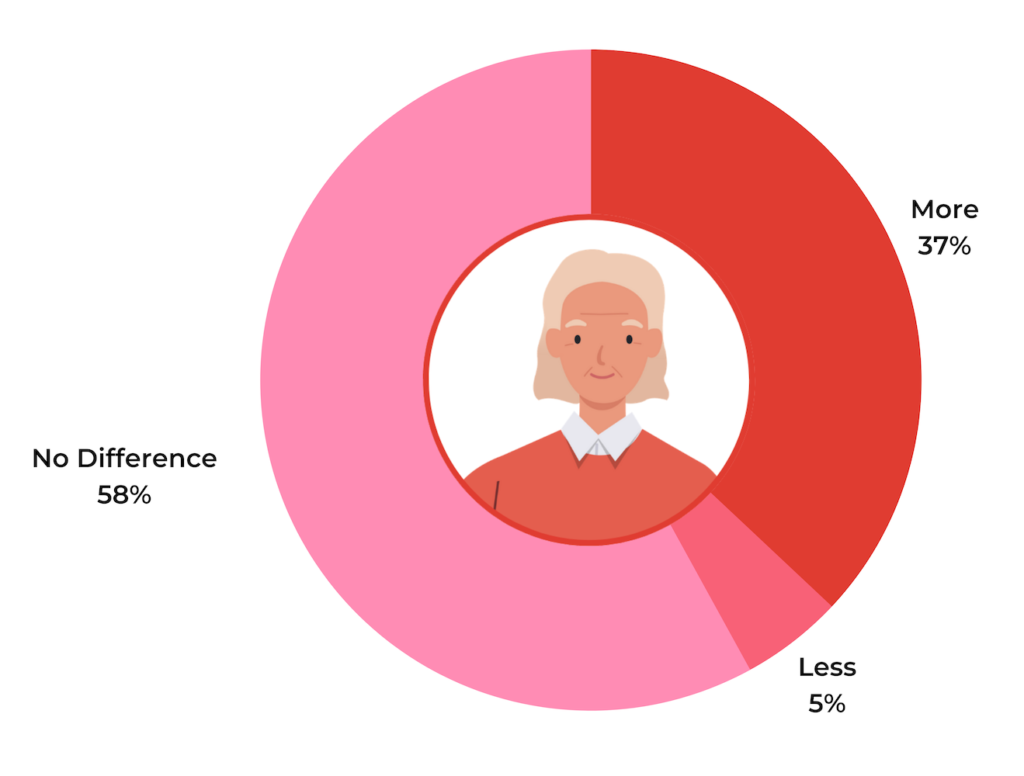

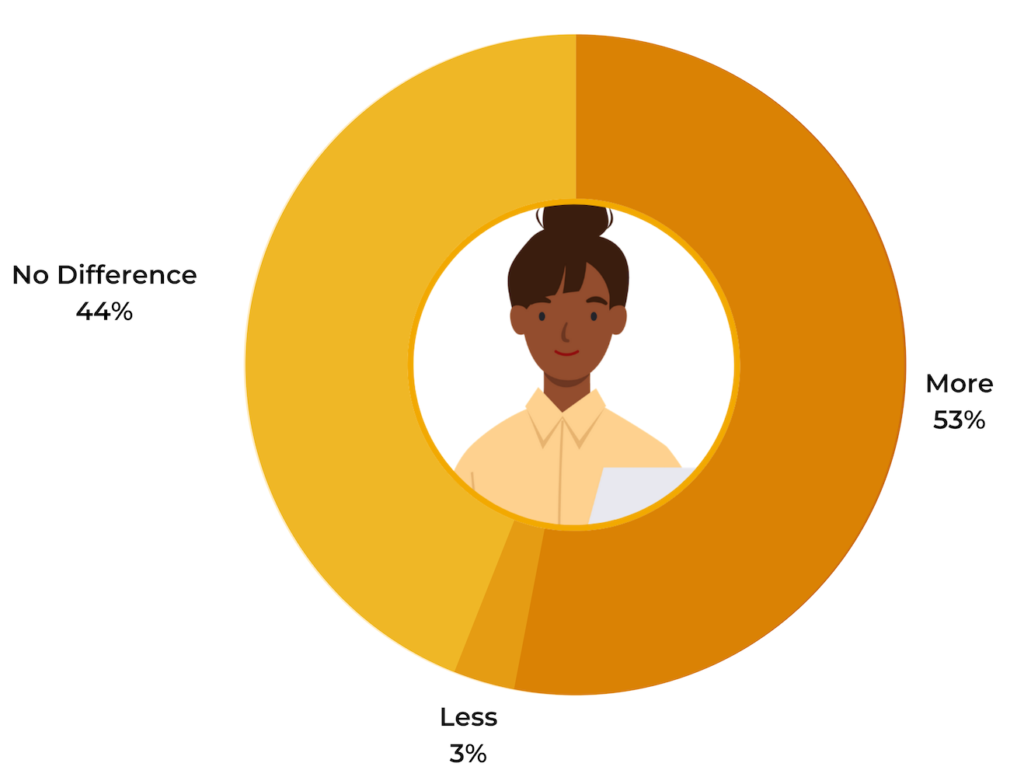

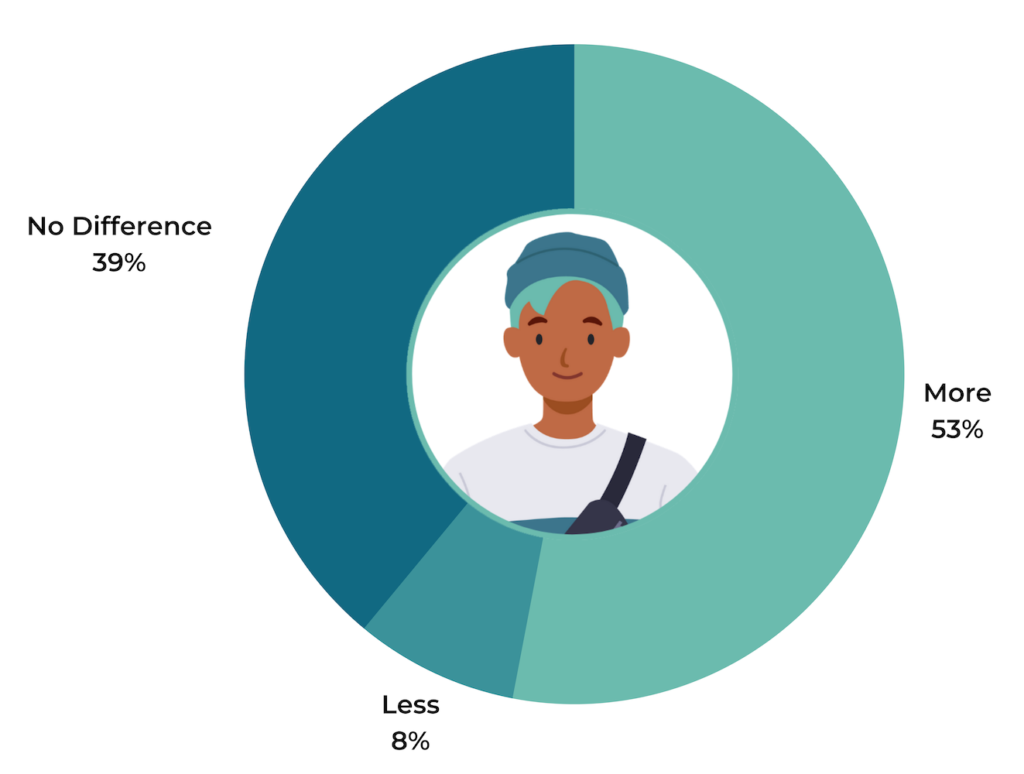

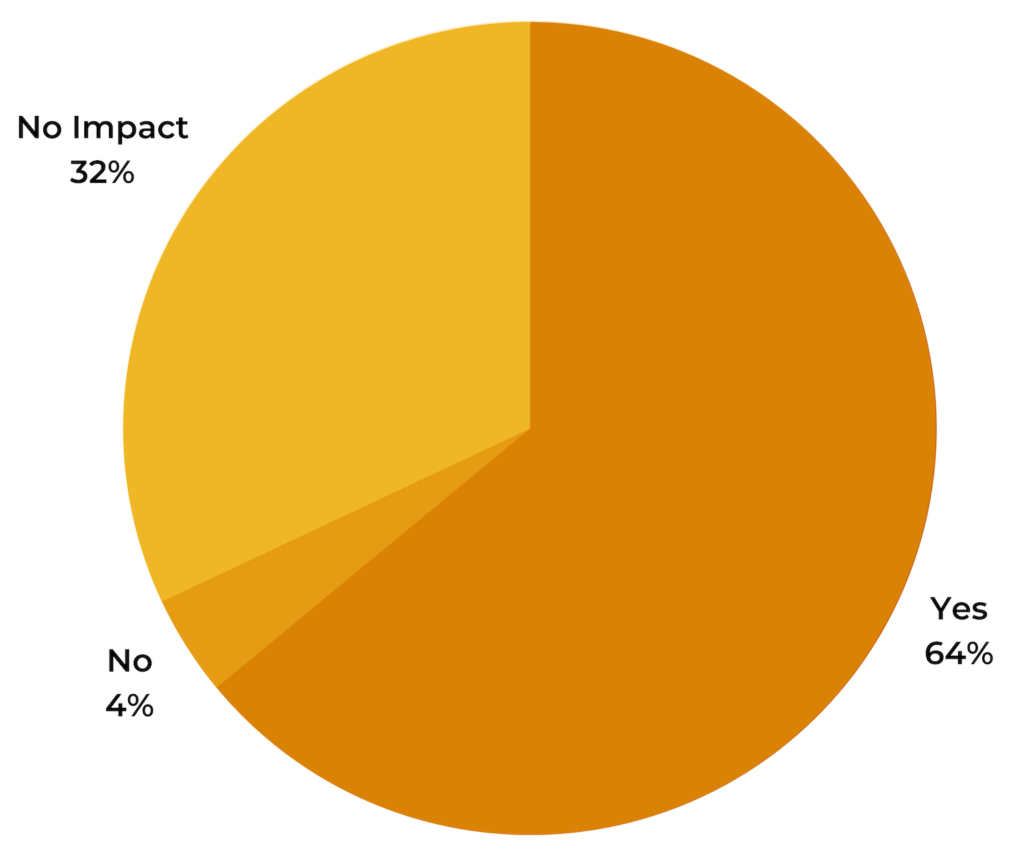

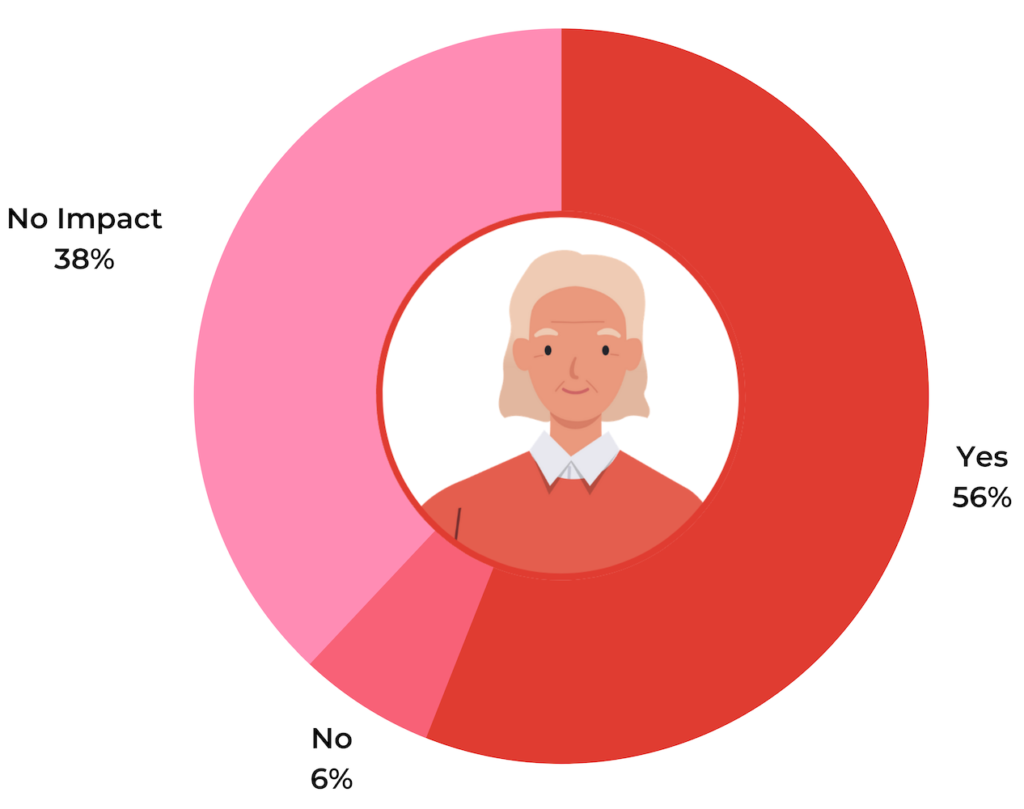

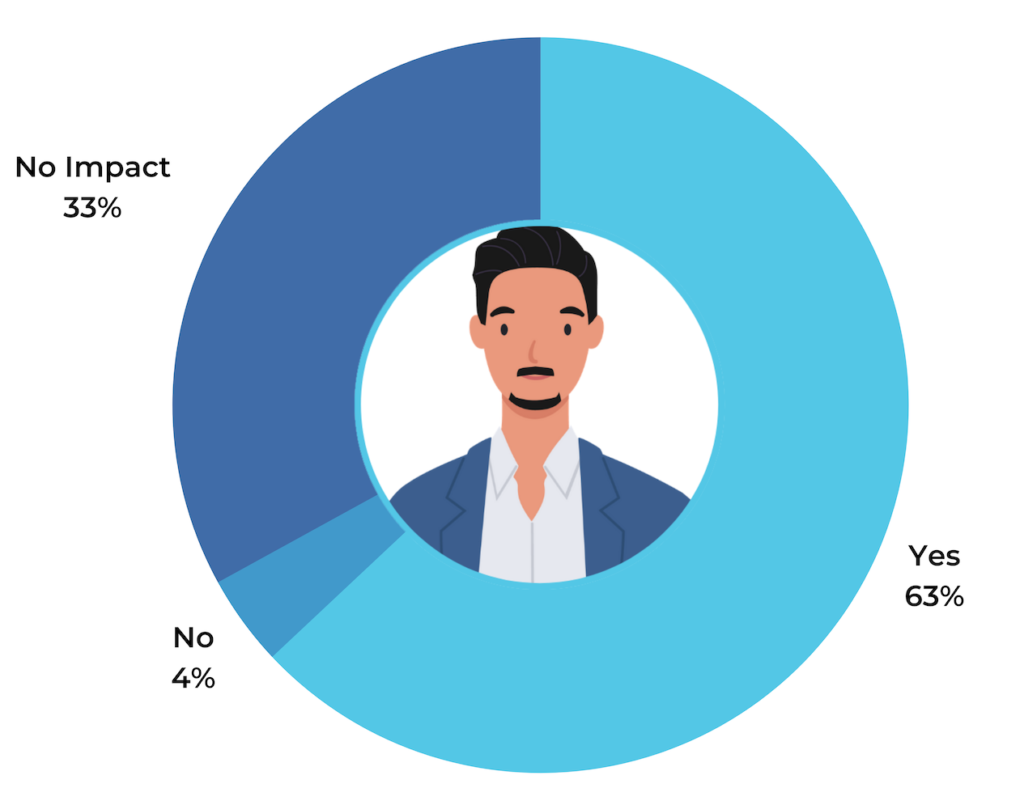

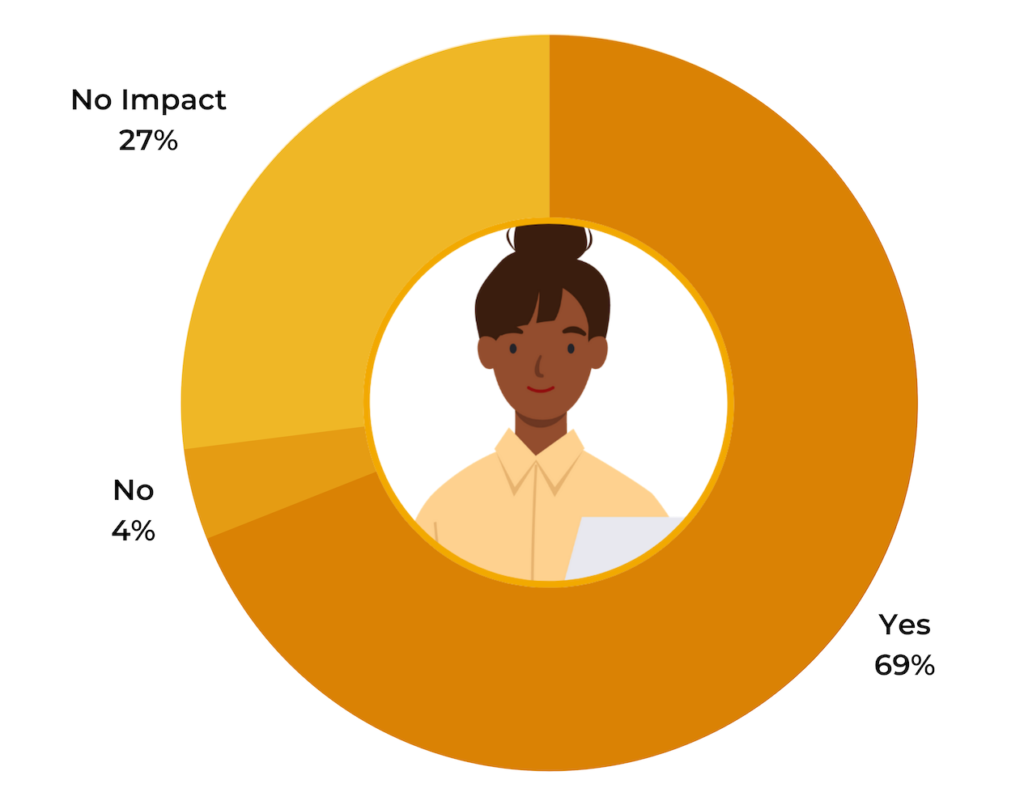

- 78% of online grocery shoppers are more likely to purchase a new grocery item if customer reviews exist for that product. The figure is 64% among in-store shoppers.

Andrew Smith – VP, Marketing at PowerReviews, says:

“Although consumer shopping behaviors have shifted online over the past year at an unprecedented rate, grocery was one vertical where consumers always seemed to place more value on the store over online.

“Our results show this is still the case to a certain extent, but shoppers are clearly more comfortable doing their grocery shopping online today than pre-Covid. The fact that consumer convenience is the biggest reason for this is indicative that this trend will continue long after the pandemic is behind us.

“Trends evident in other shopping verticals are mirrored in the grocery sector. Shoppers are relying more on validation from existing shoppers when making buying decisions in the form of user-generated content. Ratings and reviews are key to providing the buyer confidence necessary for grocery consumers to convert — according to our survey, whether shopping online or instore.”

Read the full survey results on the PowerReviews website.

Research Methodology

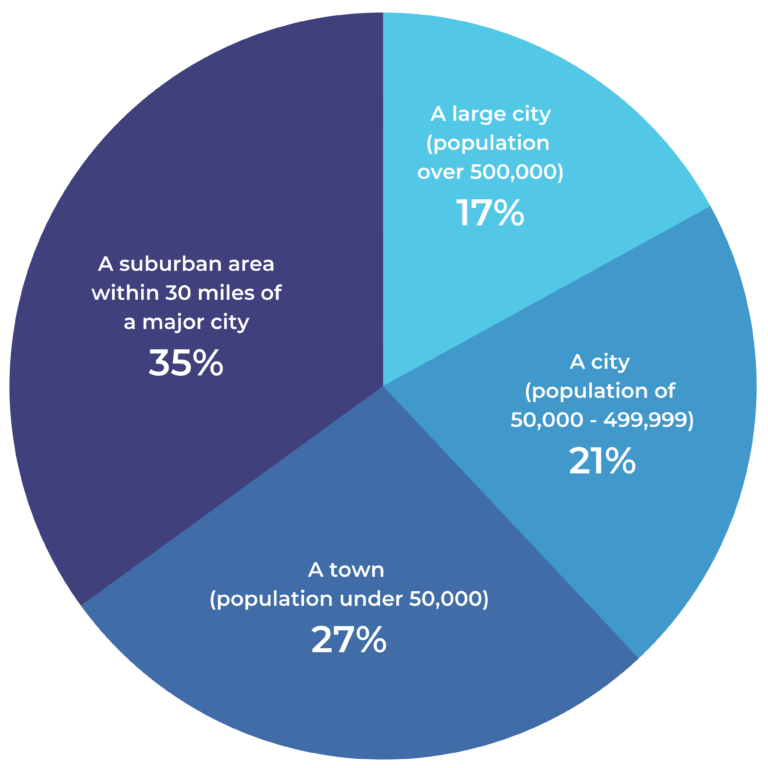

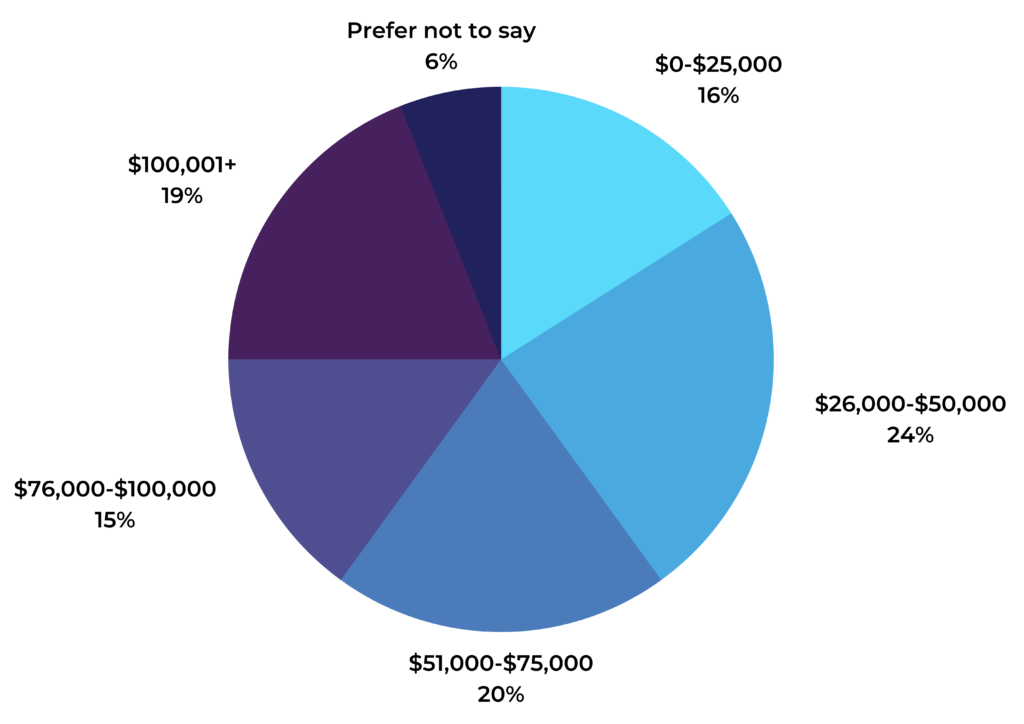

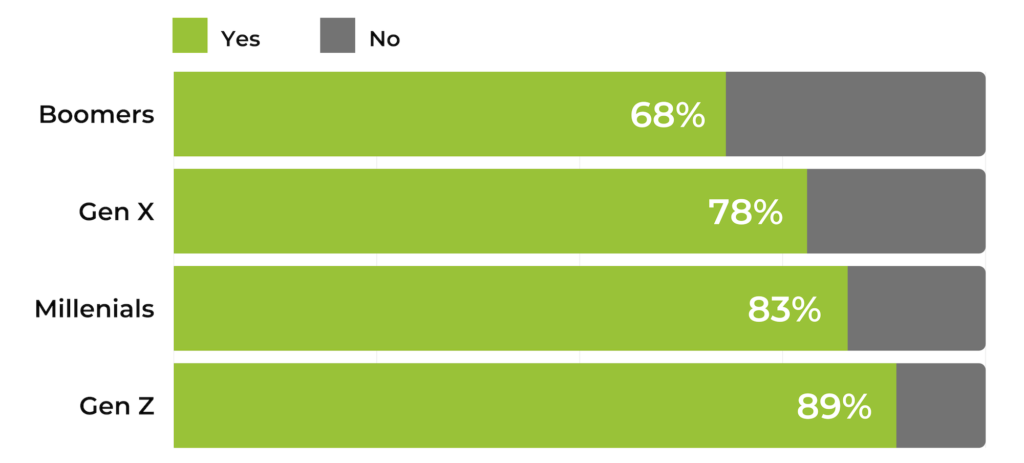

The PowerReviews Evolution of the Modern Grocery Shopper consumer survey draws on responses from 7,916 active grocery shoppers across the United States who have opted in to offers and discounts from retailers. The survey took place in February and March 2021. Throughout the survey, we defined Boomers as born in the years 1946 to 1964 (aged 56-74 on Dec 31, 2020), Gen X as born in the years 1965 to 1980 (aged 40-55 on Dec 31, 2020), Millennials as born between 1981-1996 (aged 23-38 on Dec 31, 2020) and Gen Zers born in or after 1997 (ages 22 and younger on Dec 31, 2020).

ABOUT POWERREVIEWS

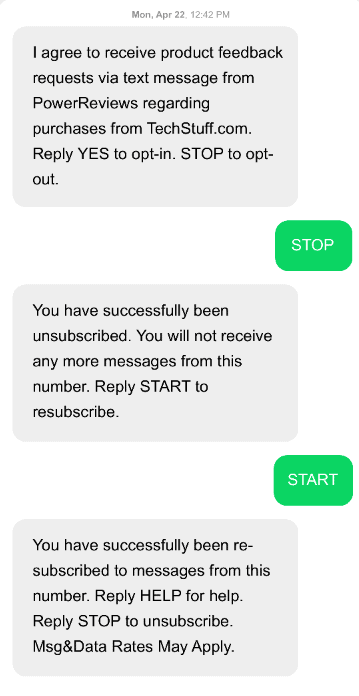

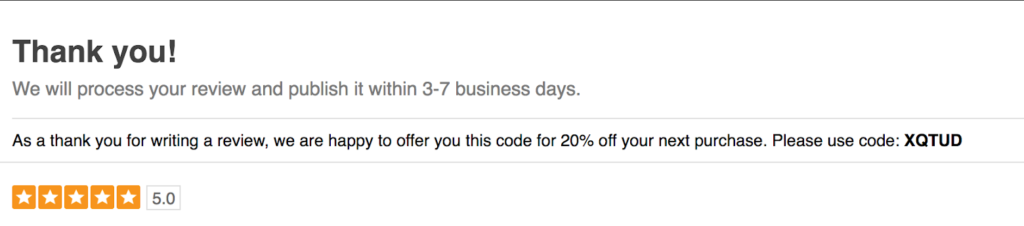

PowerReviews (PowerReviews.com) is a conversion-first UGC vendor obsessed with helping brands and retailers grow their businesses. PowerReviews enables these organizations to generate better quality customer product ratings and reviews in larger volumes and then analyze and benchmark all this data to optimize their UGC programs for conversion, while improving product quality and customer experience.

PowerReviews is headquartered in Chicago, IL, USA.

Media Contact

Erin Lutz

Lutz Public Relations (for PowerReviews)

erin@lutzpr.com

949-293-1055