Study of 7,528 consumers reveals how online shoppers rely heavily on Q&A content when making buying decisions

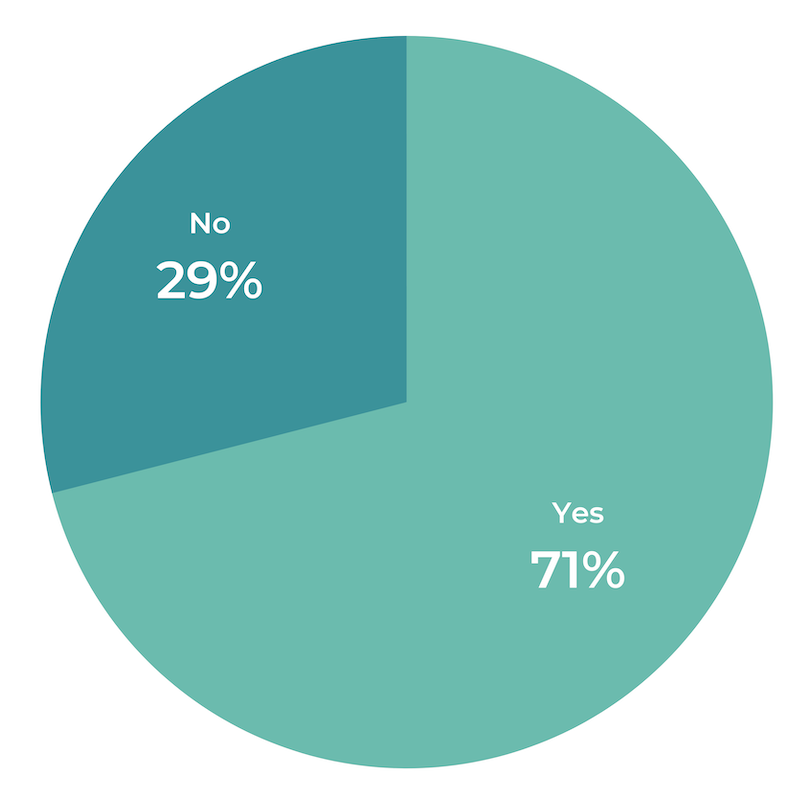

AUGUST 24, 2021—CHICAGO—Question & Answer (Q&A) content on website product pages eliminates uncertainty, boosts ecommerce sales, and positively impacts purchase behavior, and not having Q&A can be a costly misstep for brands, according to a new survey of more than 7,528 consumers across the US conducted by PowerReviews.

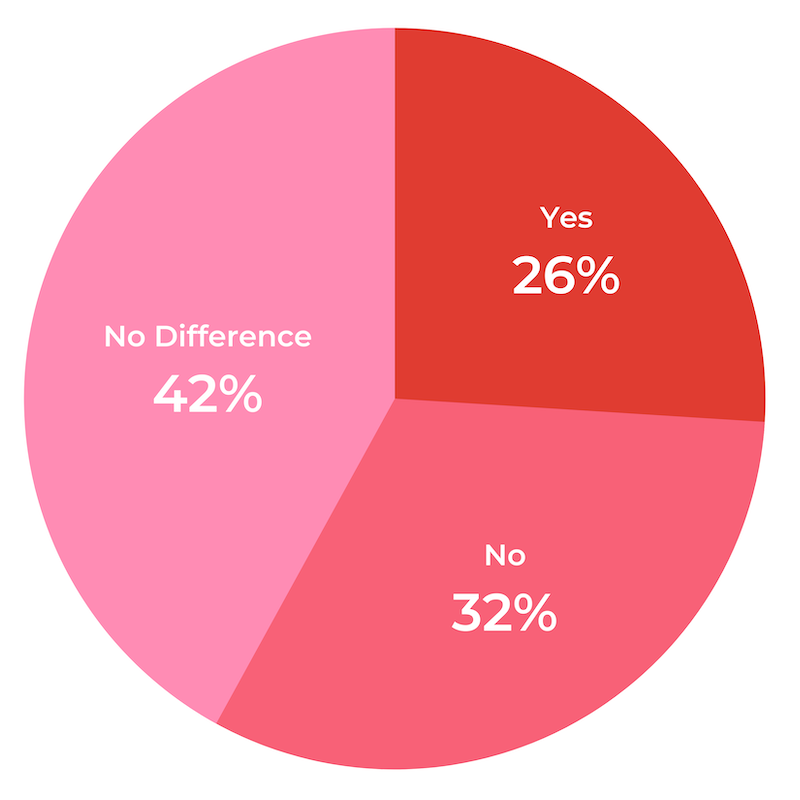

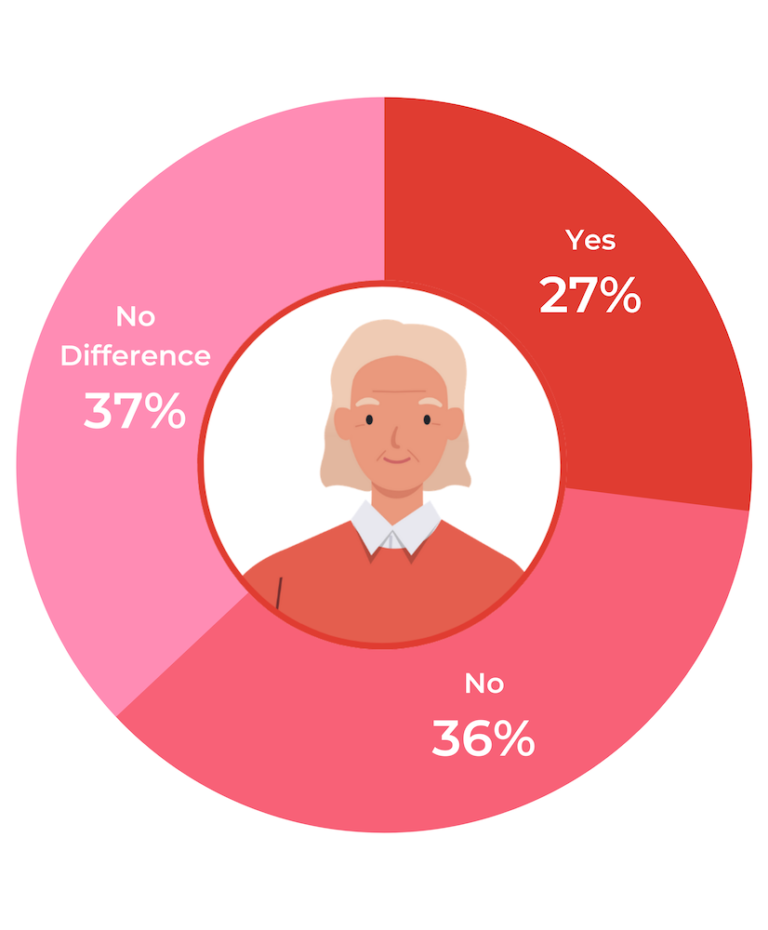

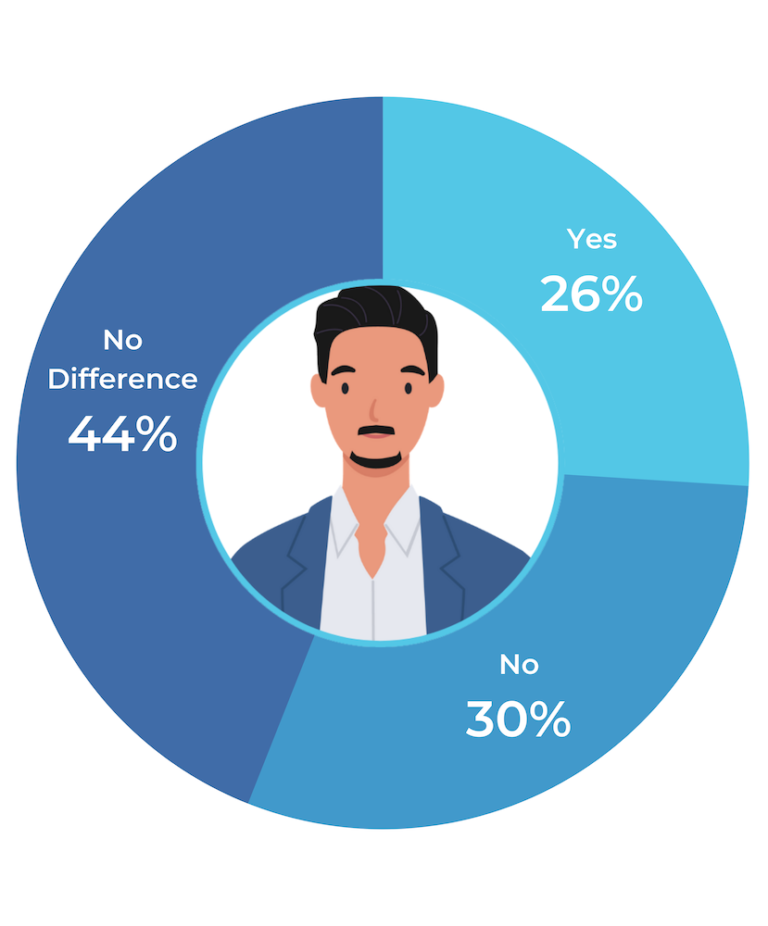

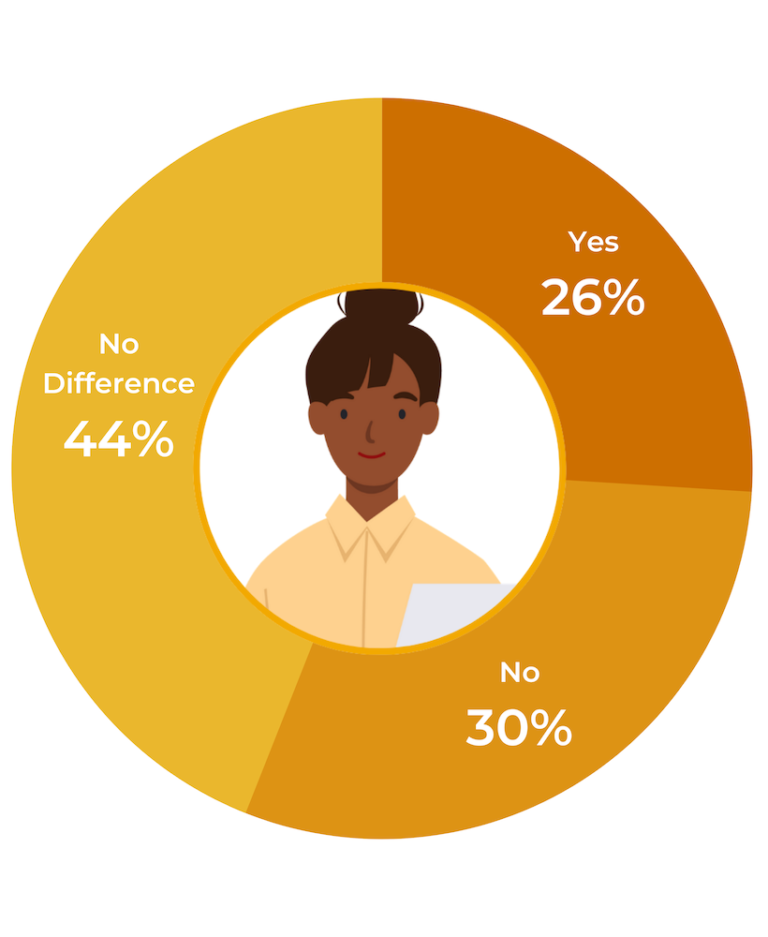

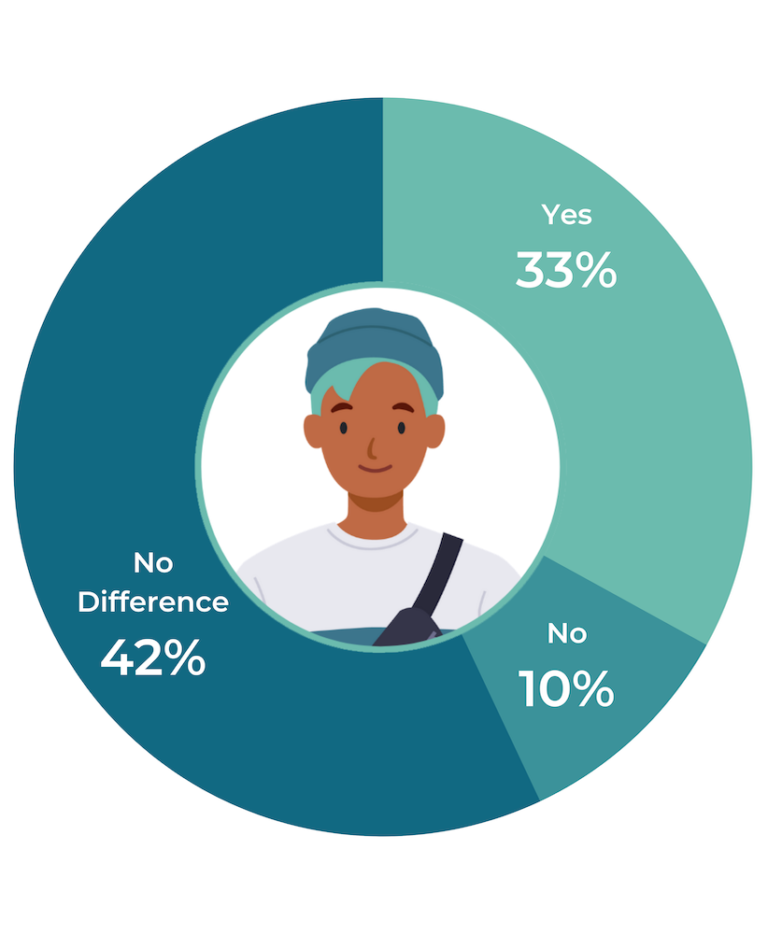

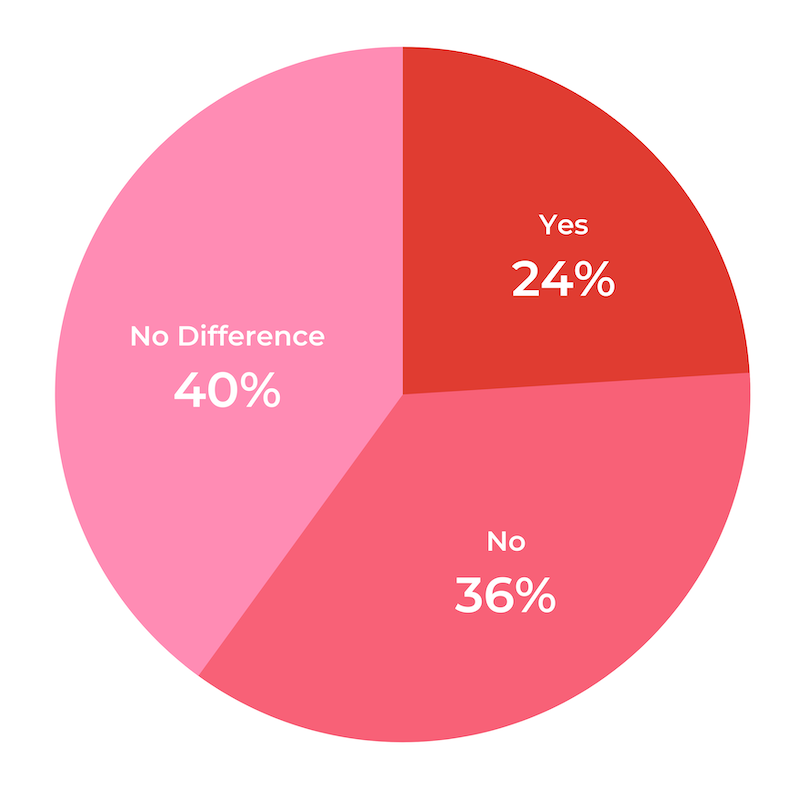

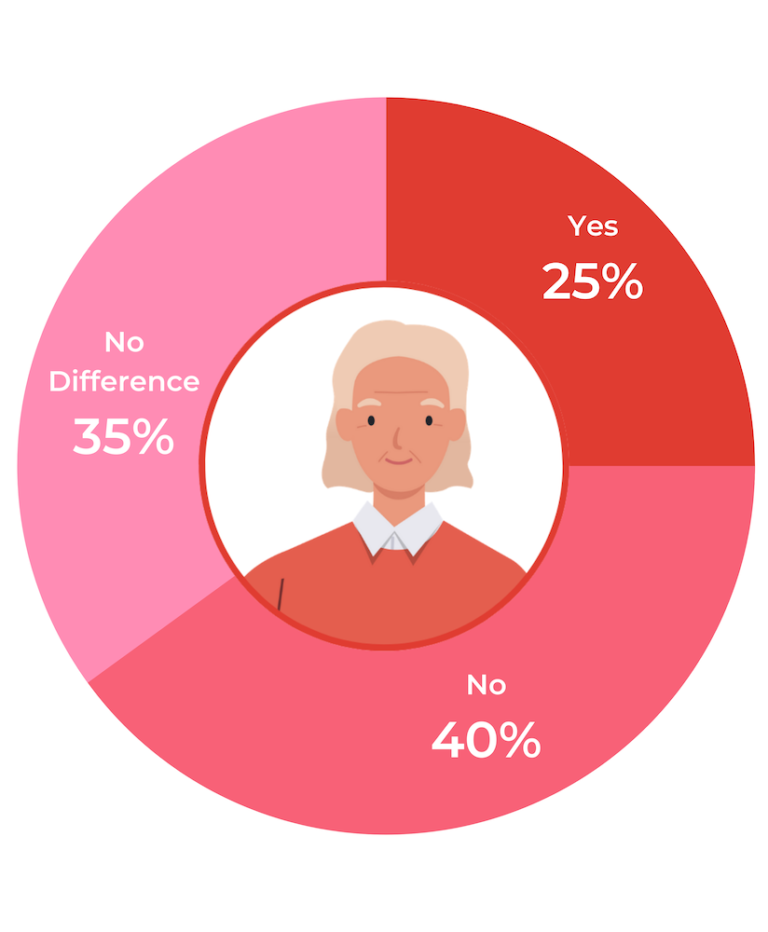

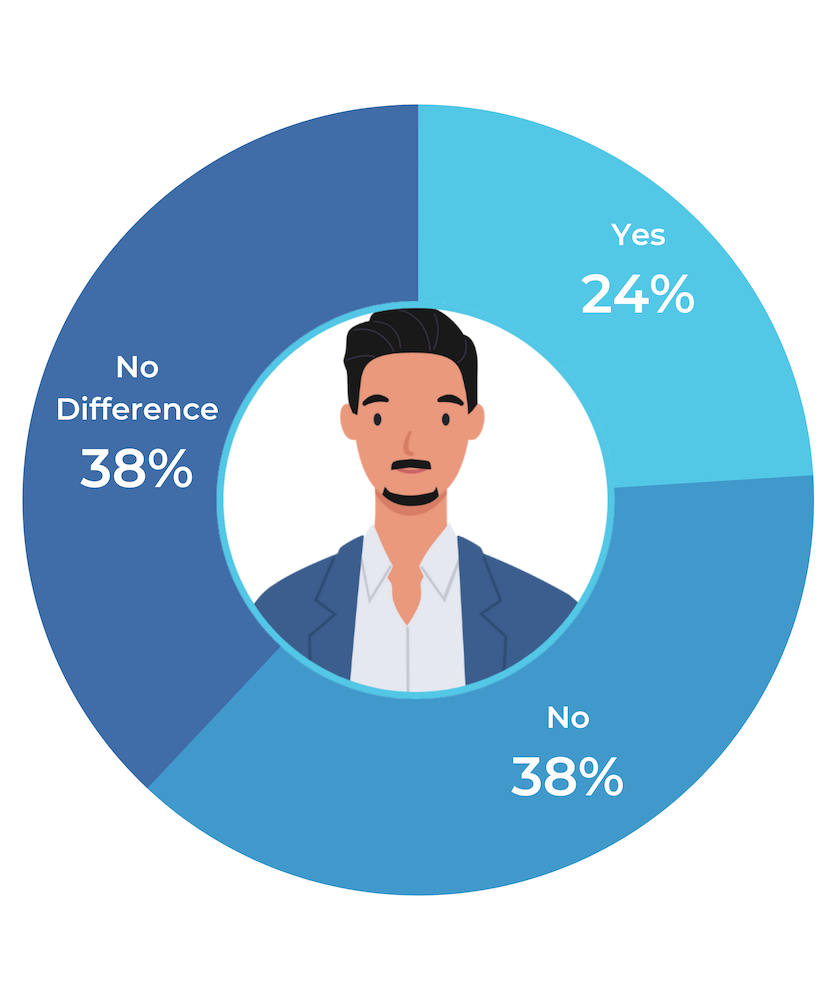

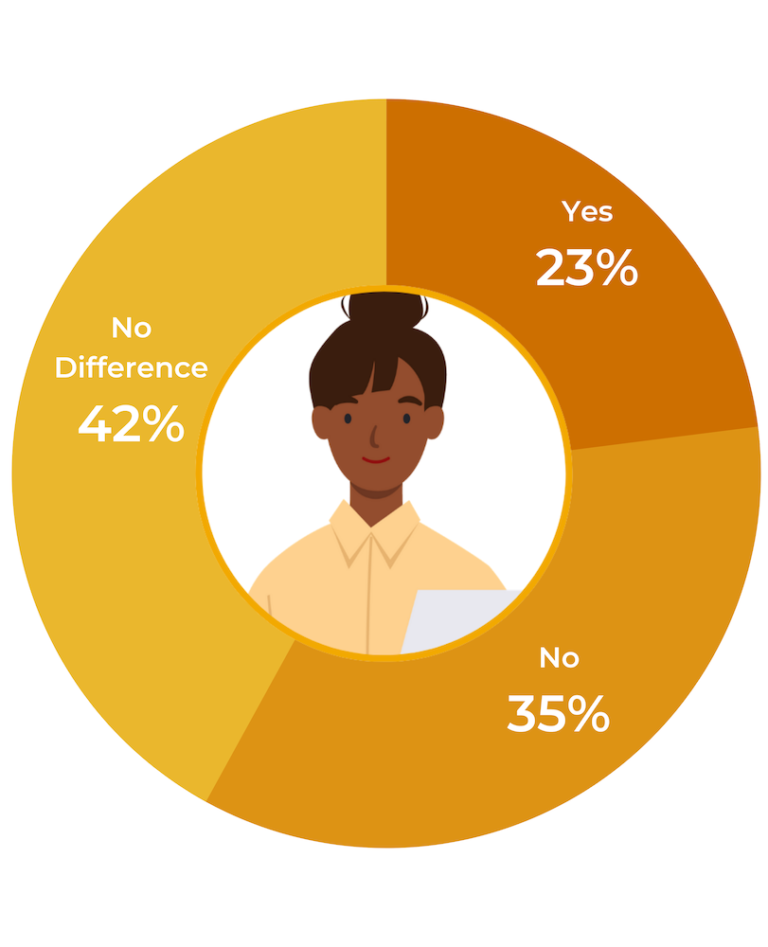

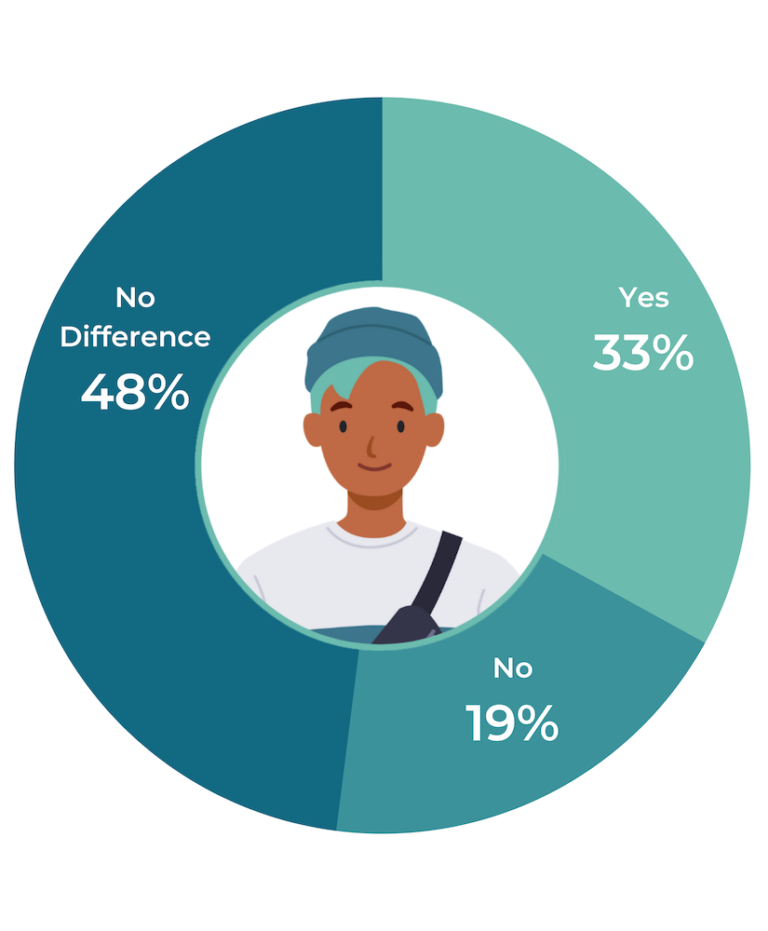

One in four (26%) of shoppers say they are more suspicious about product or brand quality if a product page doesn’t have a Q&A section, and 33% of Gen Z shoppers say they’re less likely to purchase without a Q&A section on the product page. This aligns with research from Forrester, which indicates 55% of shoppers will abandon an online purchase if they can’t find quick answers to their questions.

PowerReviews has long studied the impact of user-generated content on website conversion; a recent complementary analysis found a 157.1% lift in conversion when visitors interact with Q&A, but this is the first time the company has studied the negative sales impact for brands forgoing this content.

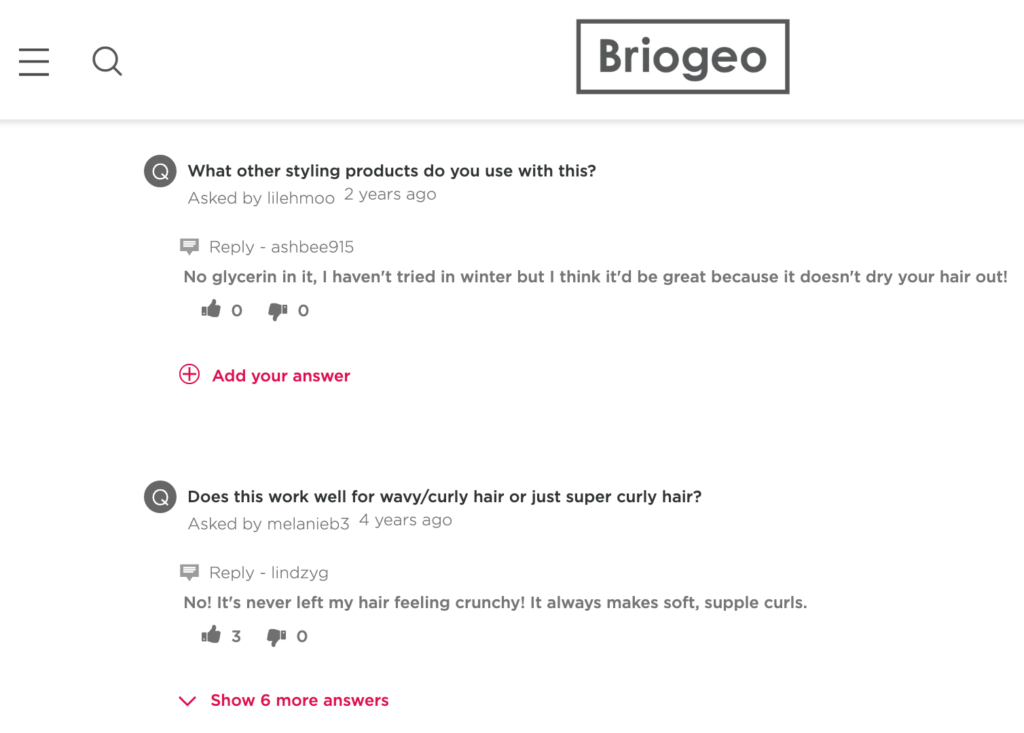

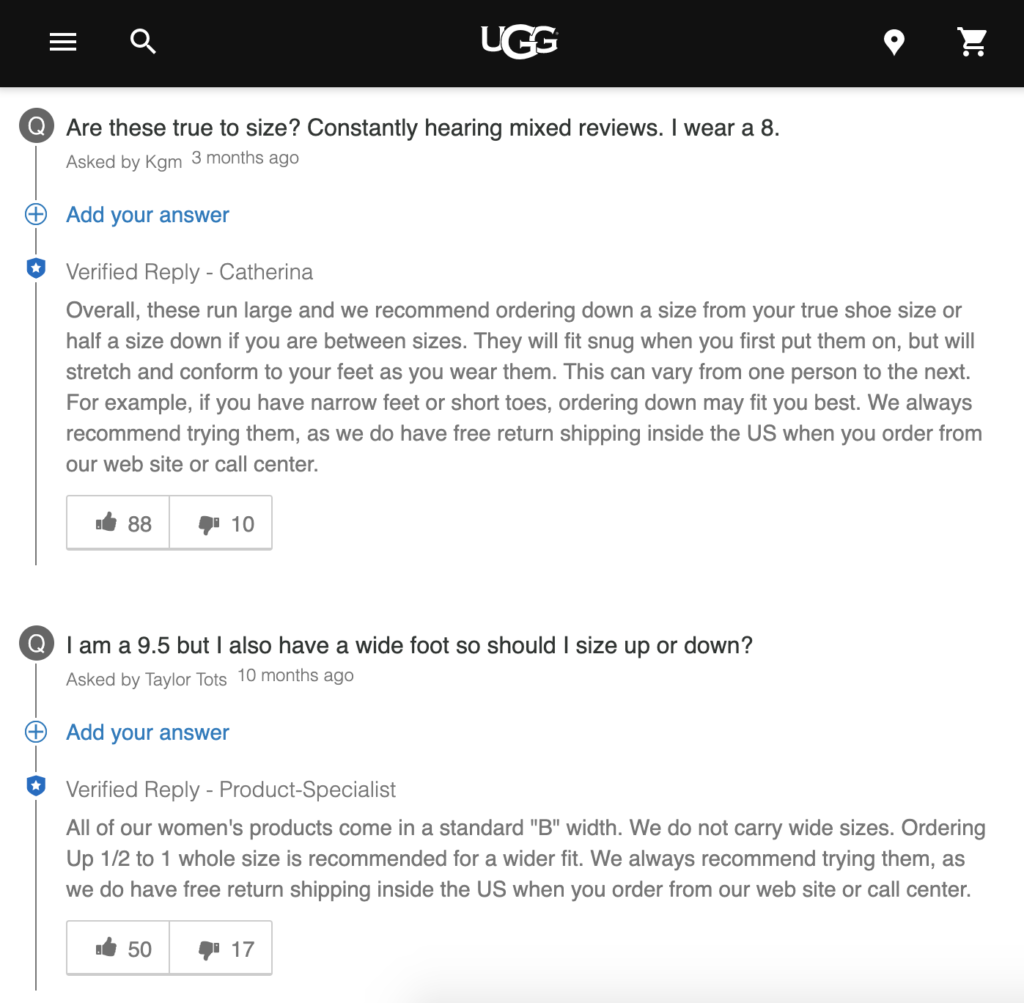

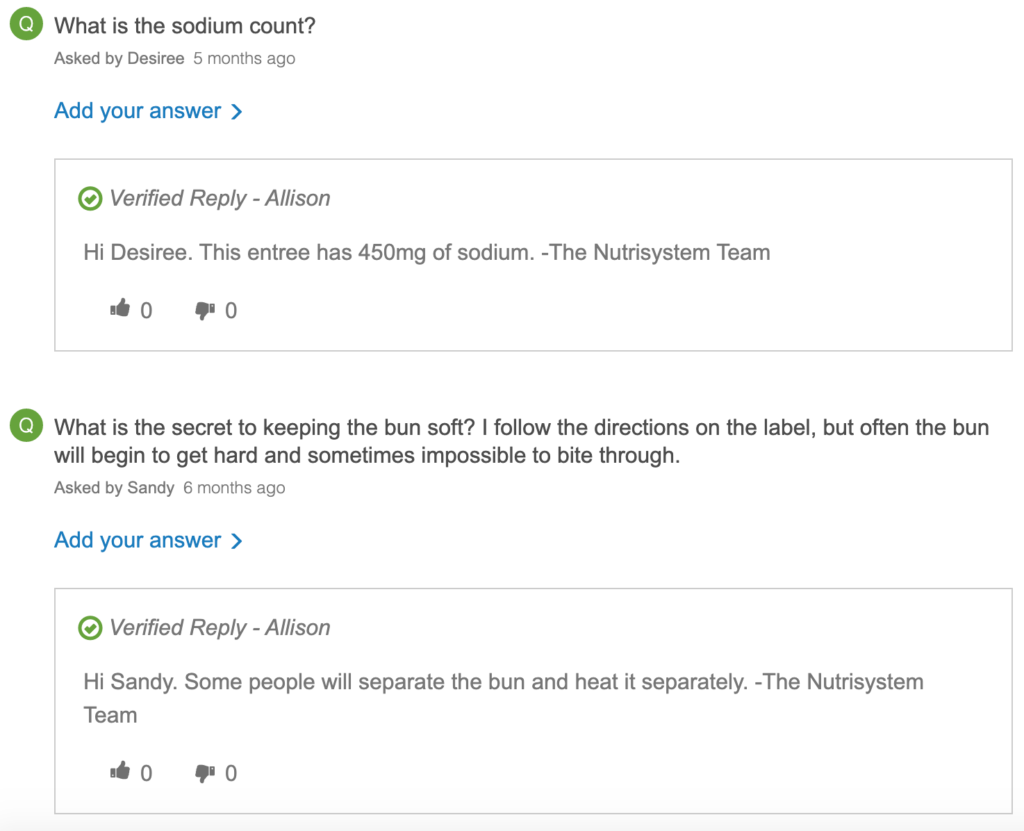

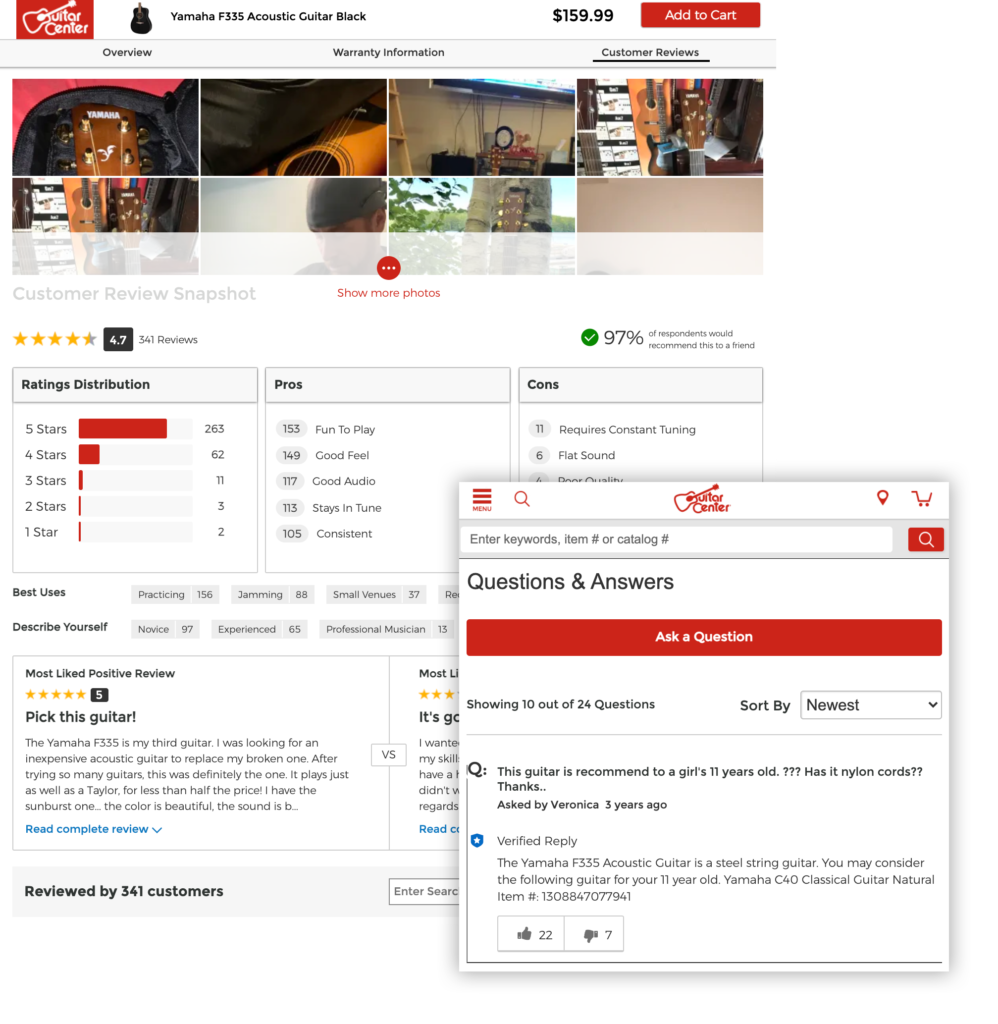

Q&A – the capability for consumers to ask questions on product pages of websites – is a critical tool for brands and retailers in the post-pandemic era, when ecommerce volume is exploding. When shopping in a brick-and-mortar store, consumer questions can be answered simply by seeing and touching the product live. And if they still have questions, they can seek out a sales associate to get answers. When consumers shop online, they rely heavily on Q&A in lieu of physical and in-person due diligence.

Additional findings from the PowerReviews “How Q&A Eliminates Uncertainty” survey include:

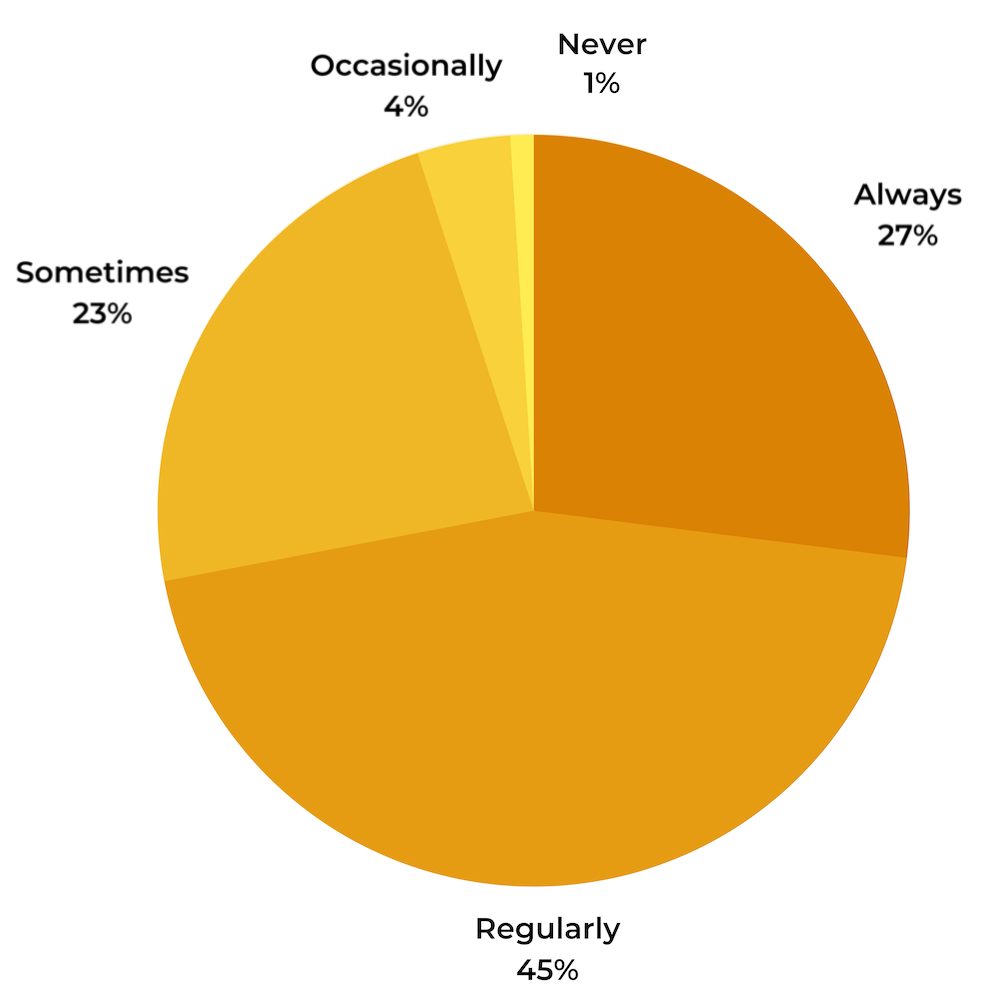

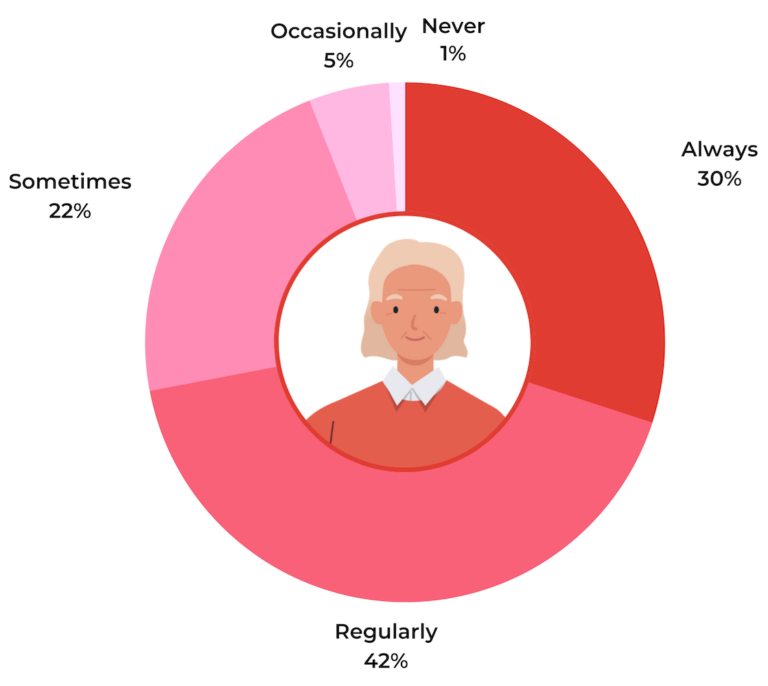

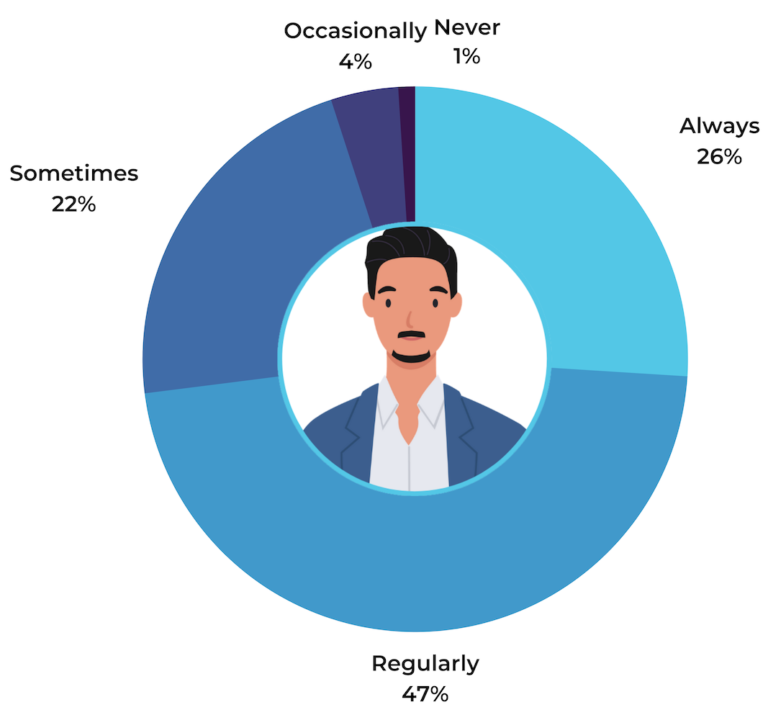

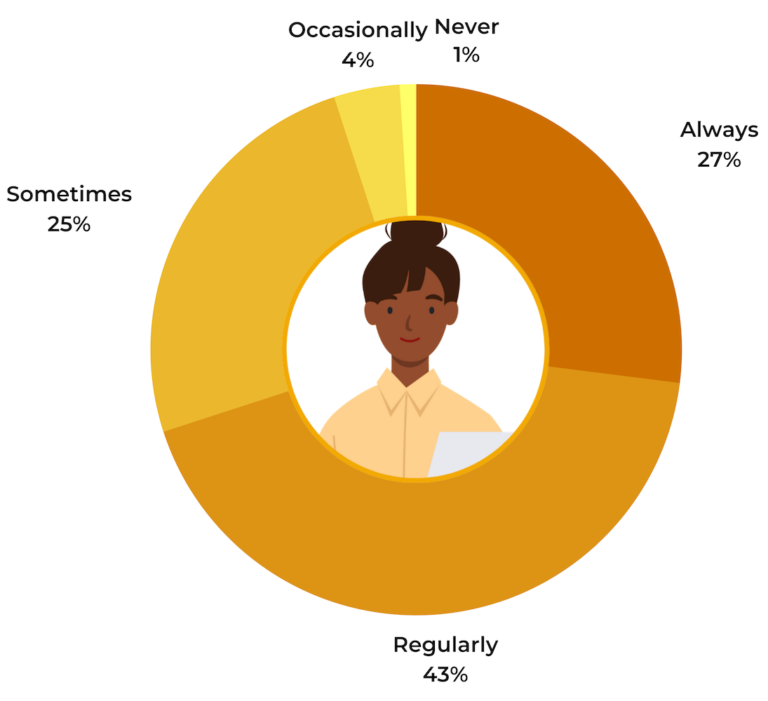

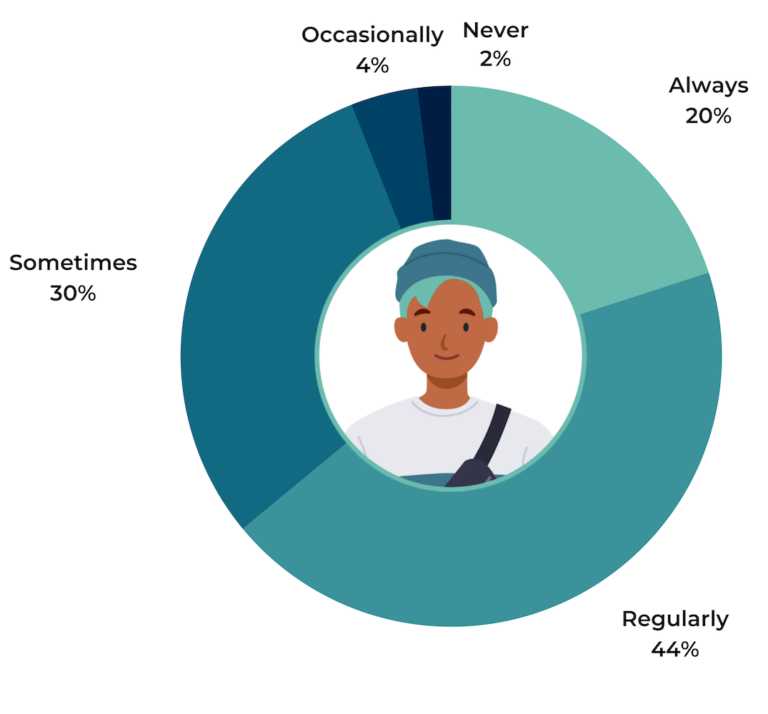

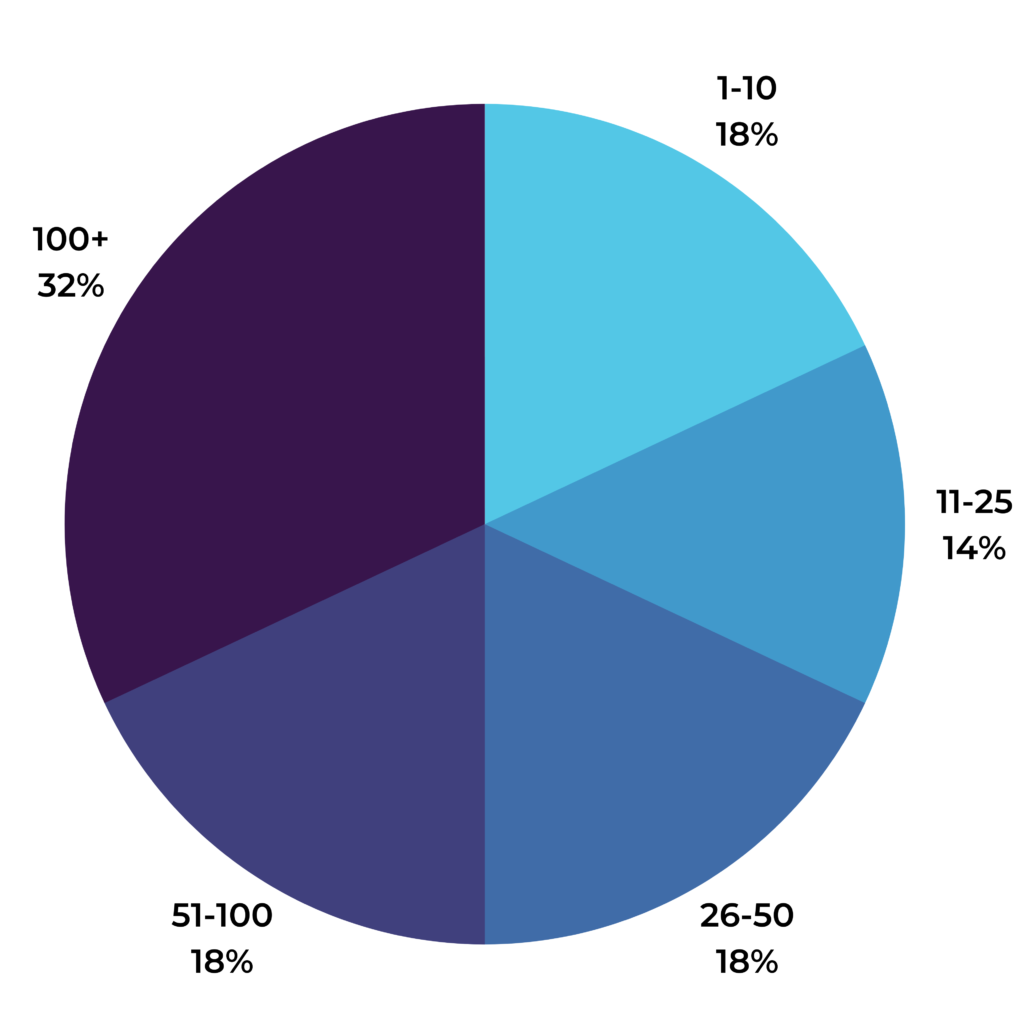

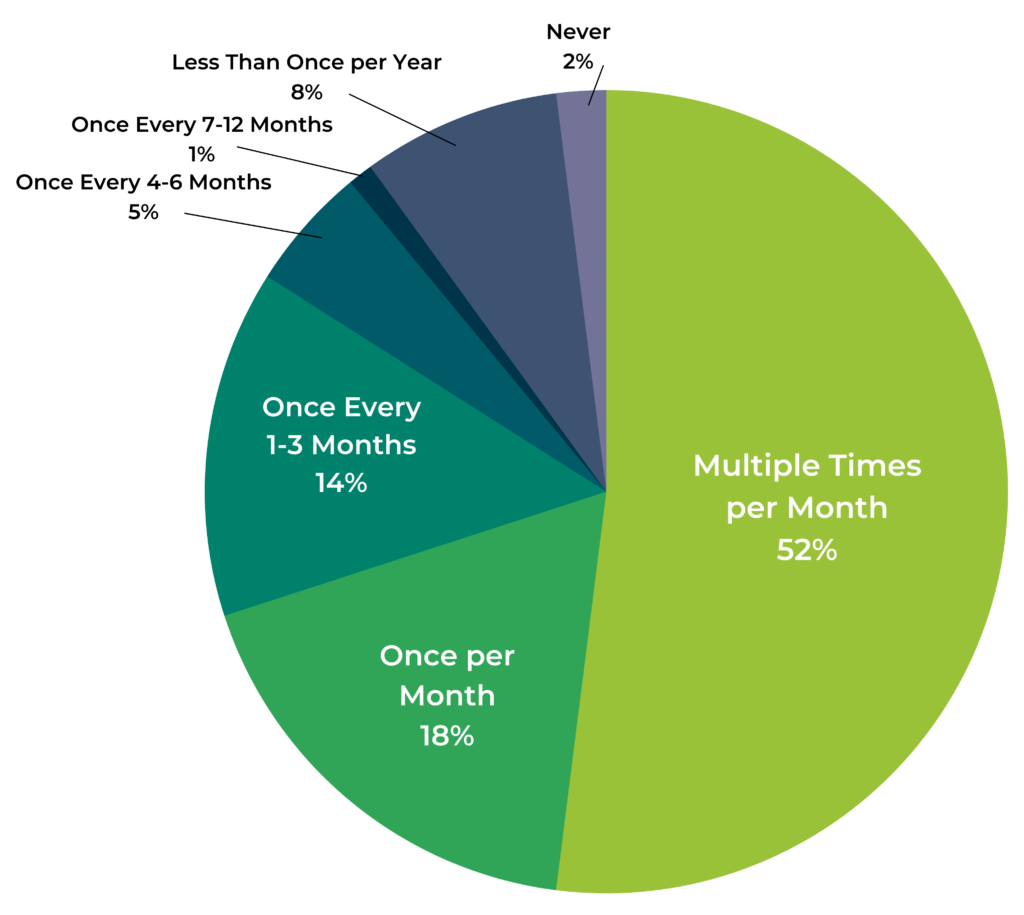

- Key research material: 99% of consumers read Q&A at least occasionally; nearly three-quarters (72%) read Q&A always or regularly.

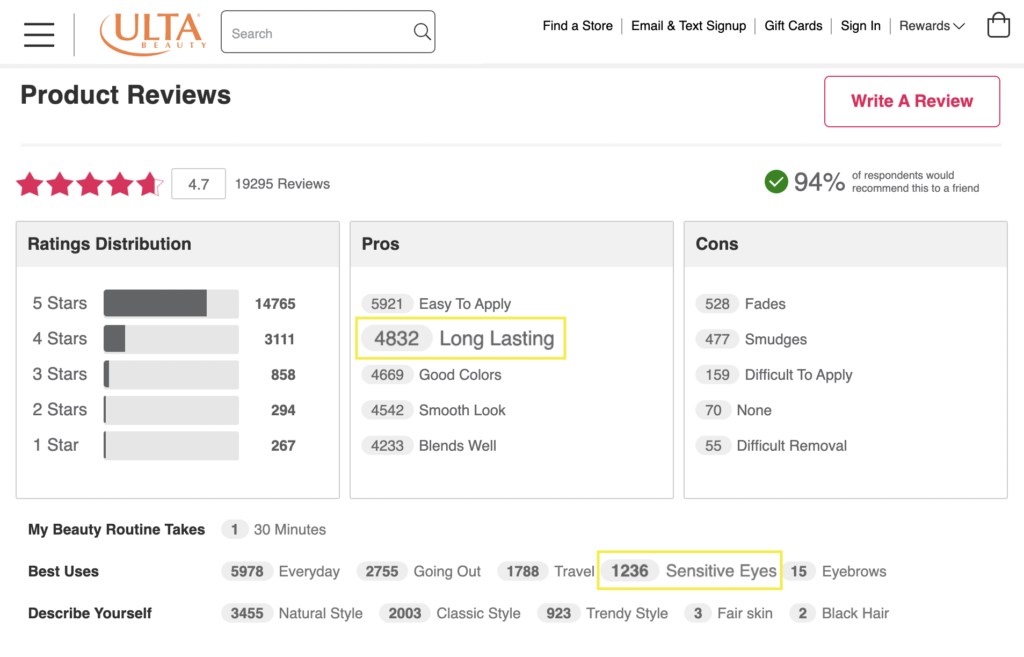

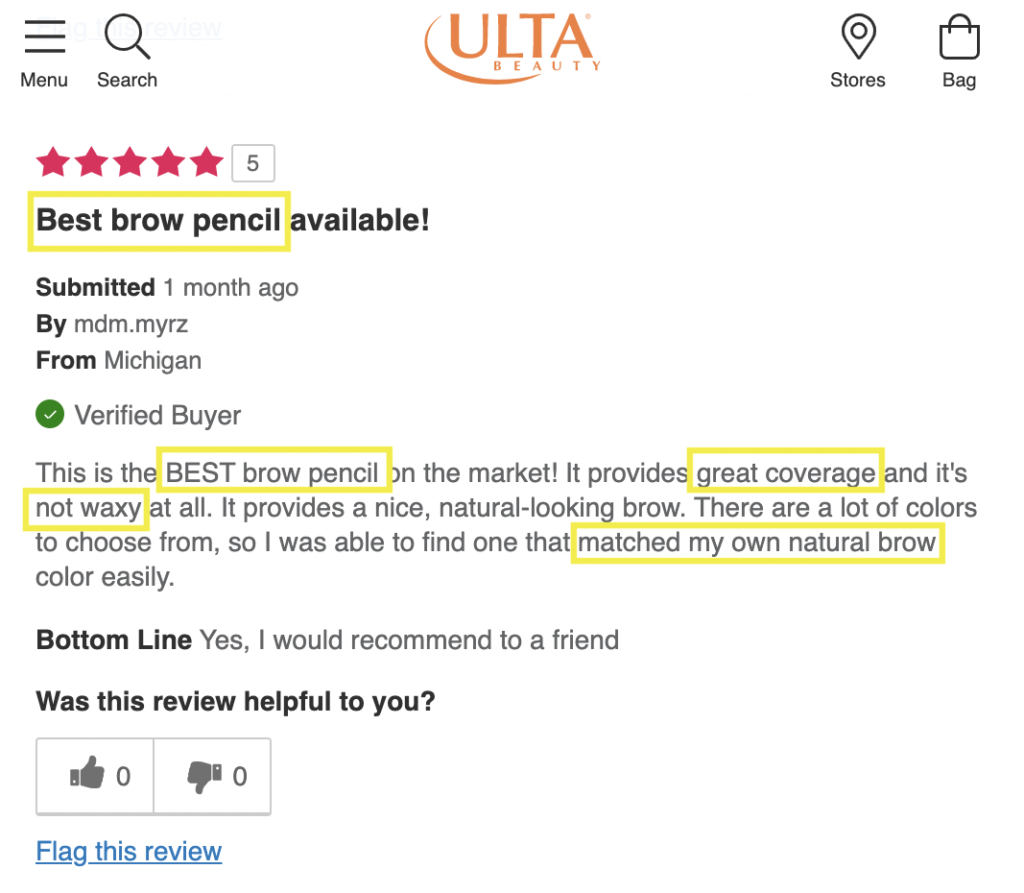

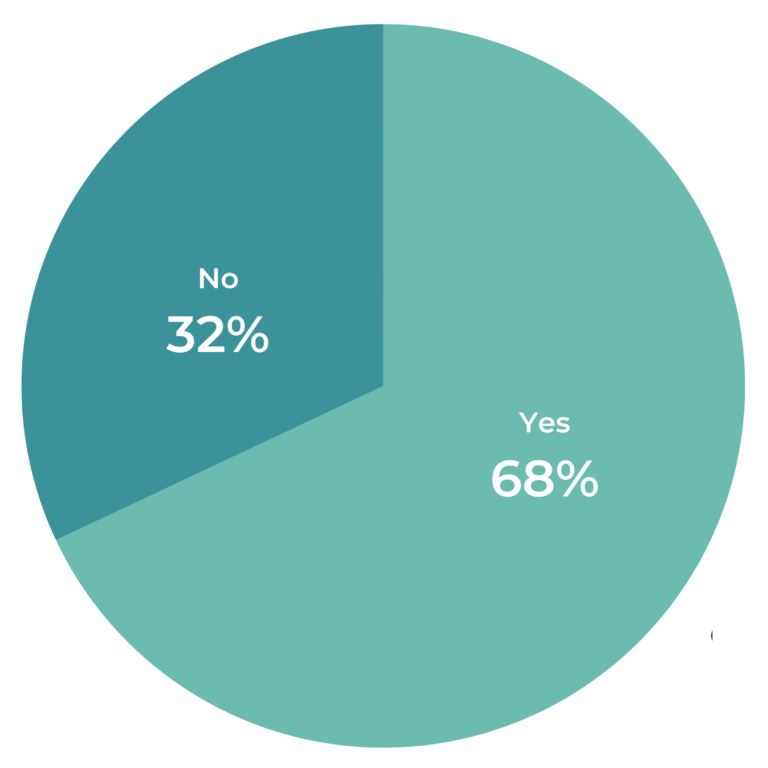

- Q&A content complements ratings and reviews: Of consumers who read Q&A, 98% do so in conjunction with reading reviews.

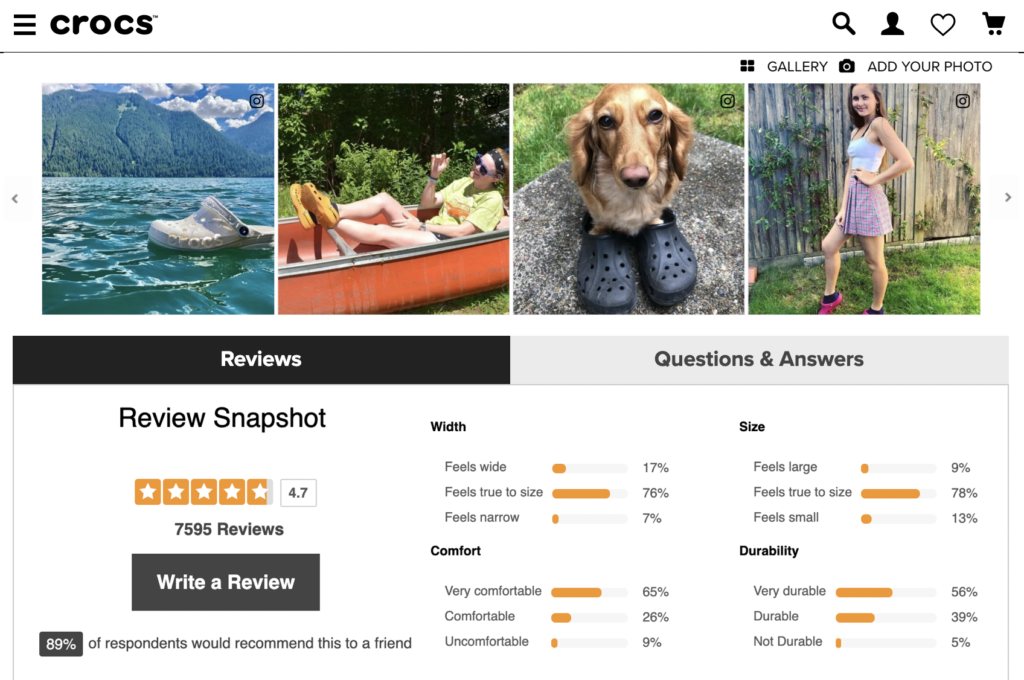

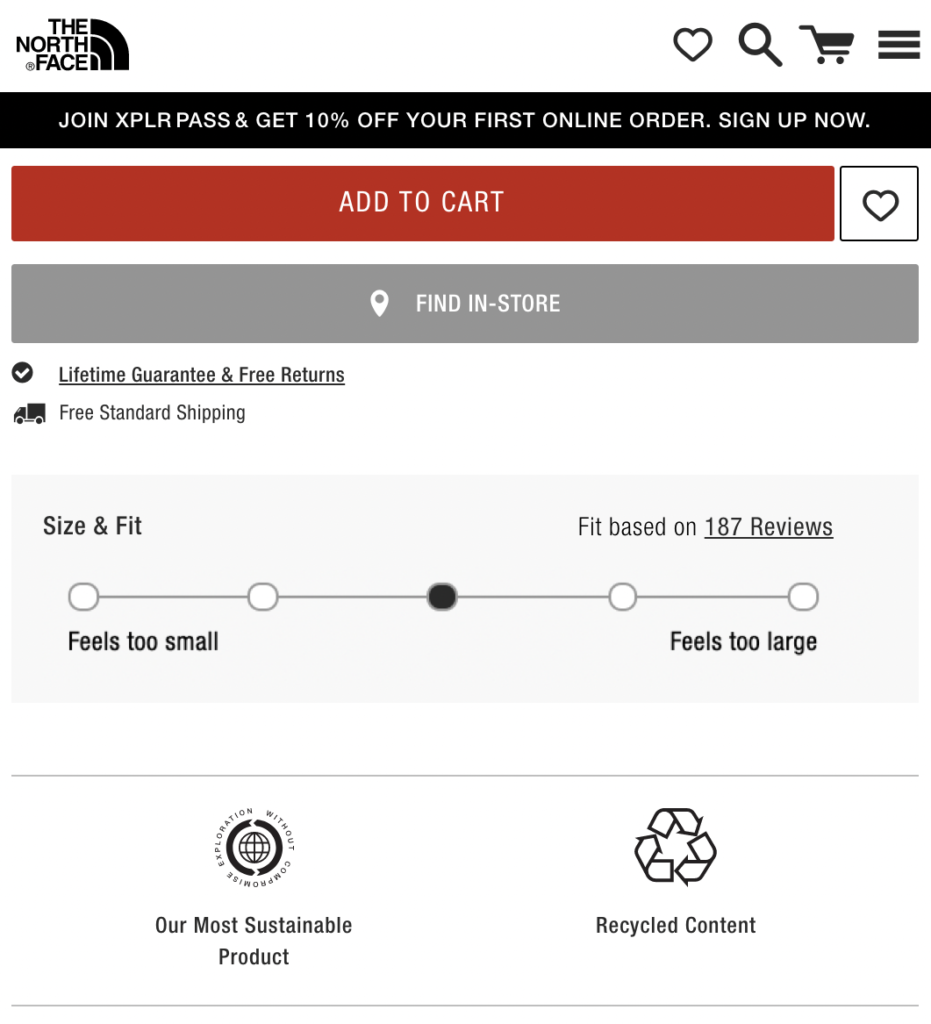

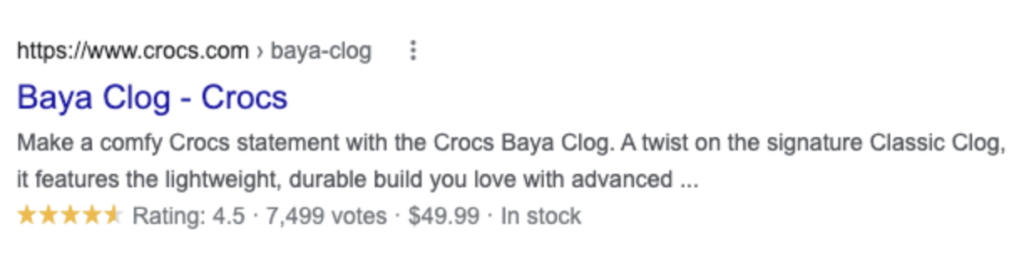

- Q&A addresses many needs: 58% consult Q&A to get a better sense of size/sizing – this is particularly relevant for apparel/footwear purchases. Many rely on Q&A to understand other shoppers’ experiences with product aspects including product warranty (28%) and shipping (23%).

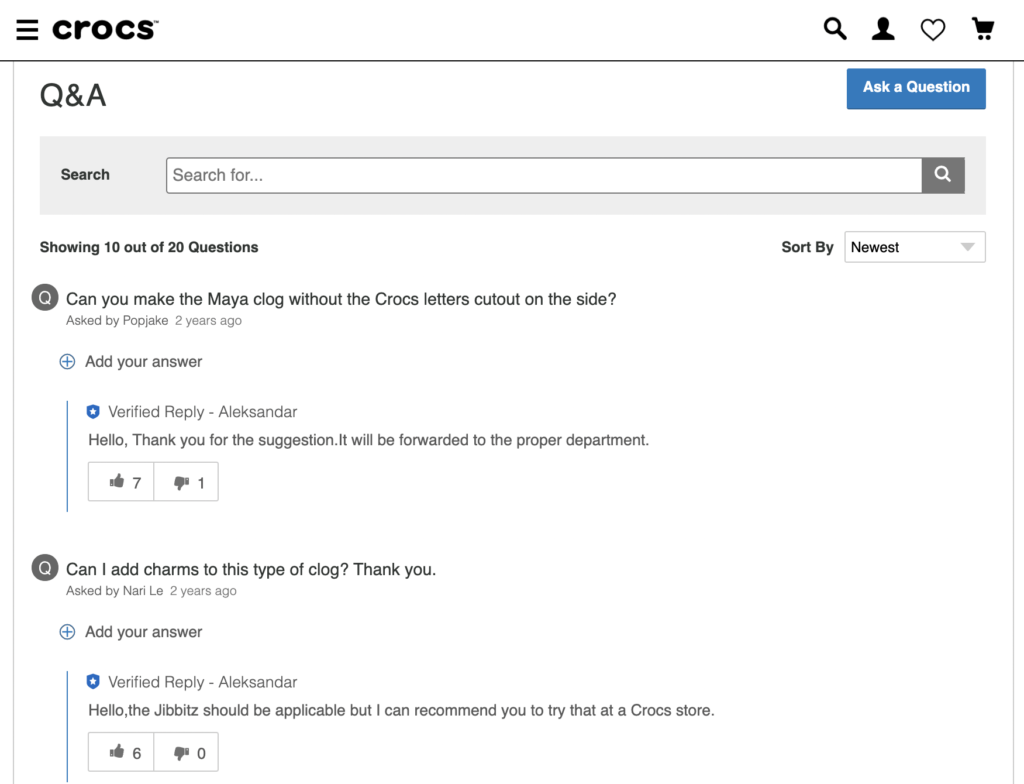

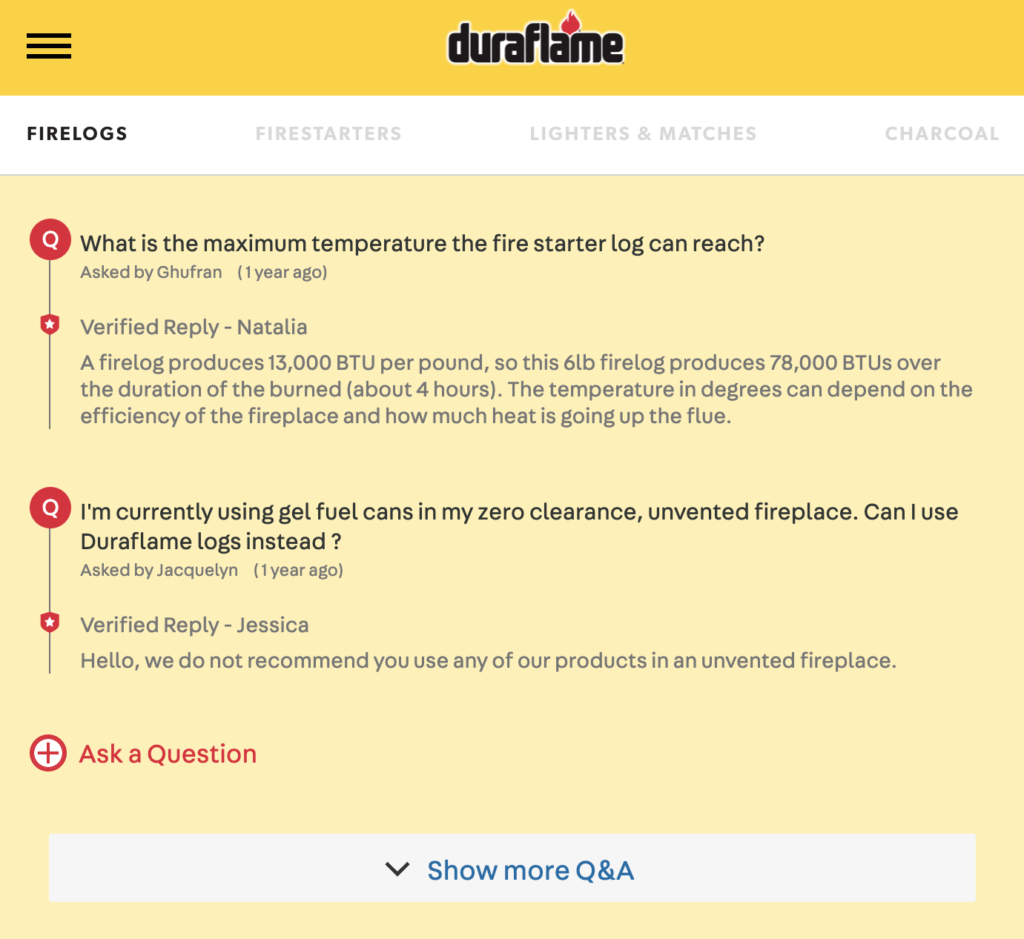

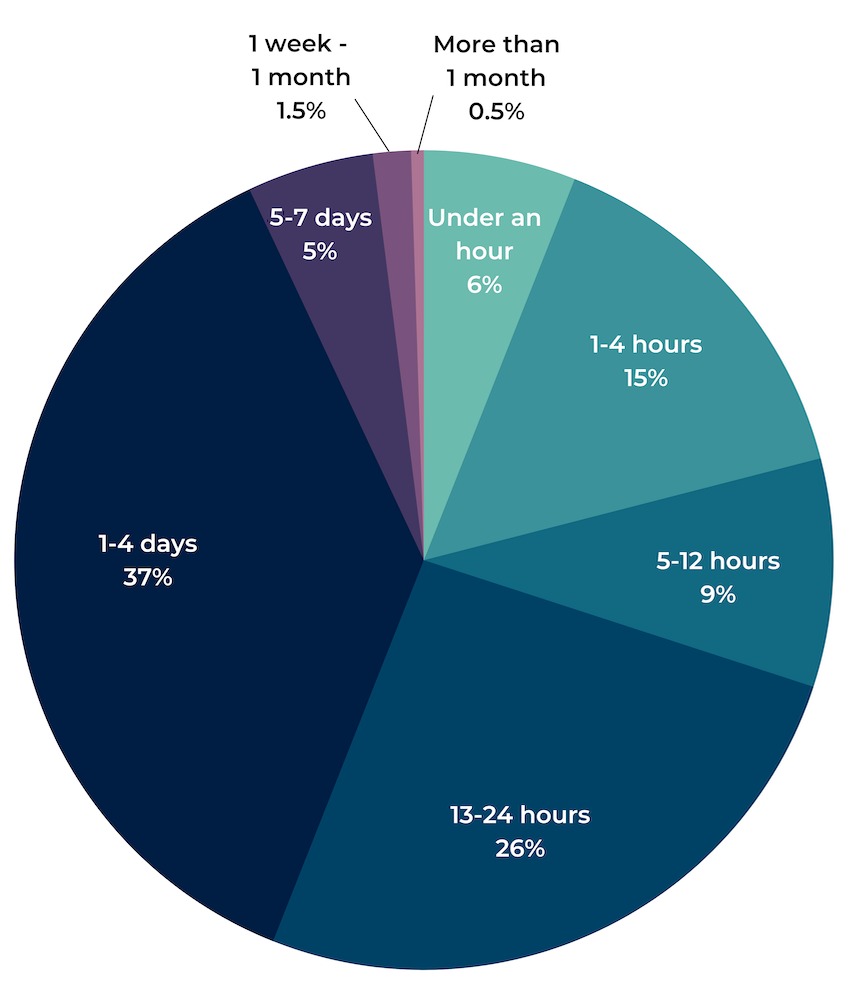

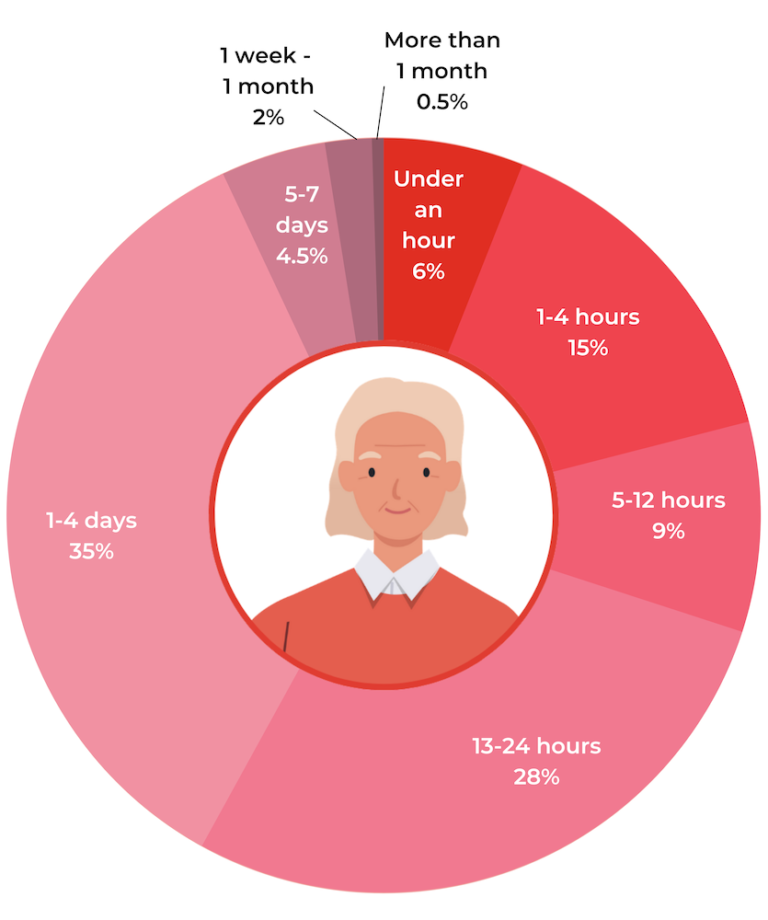

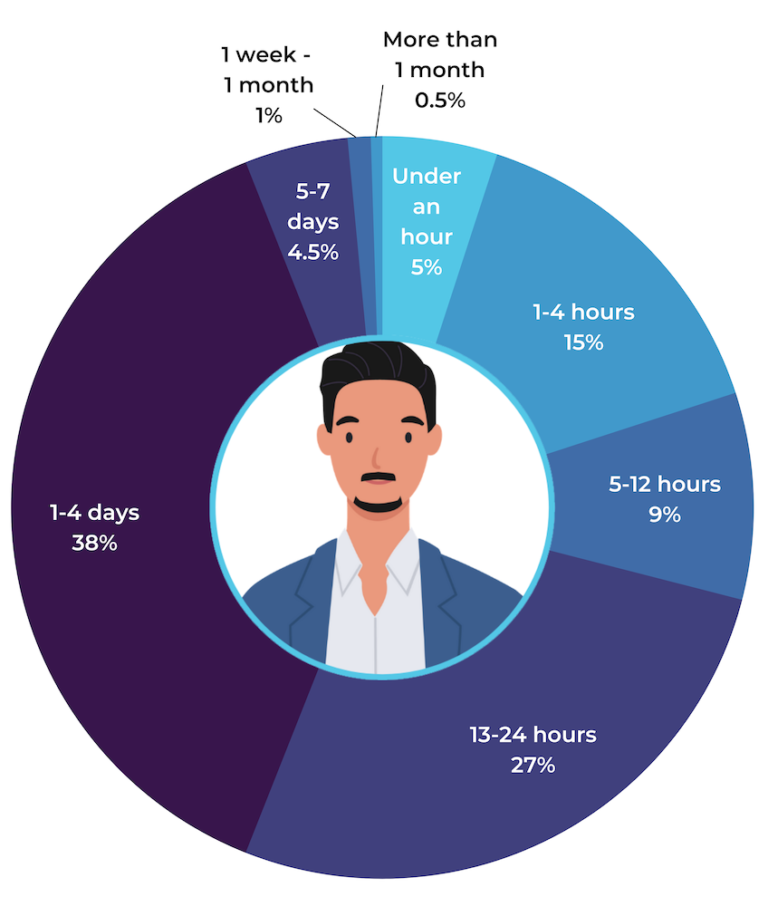

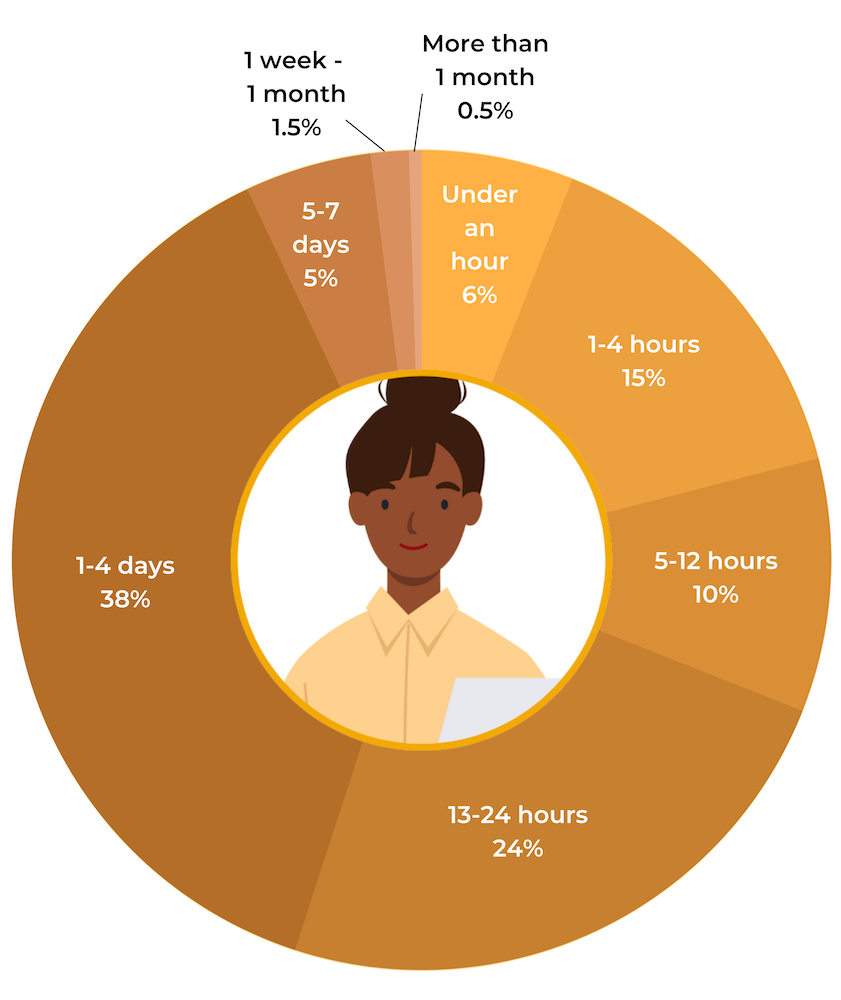

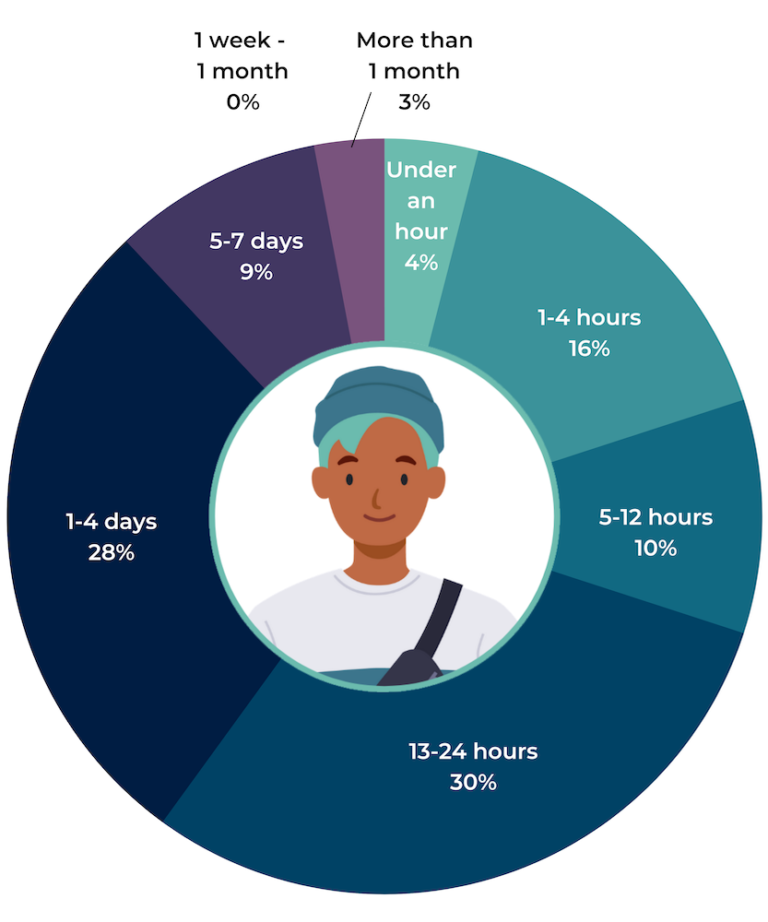

- Consumers expect fast responses to their questions: 56% expect to get an answer within 24 hours, and 21% expect an answer in four hours or less.

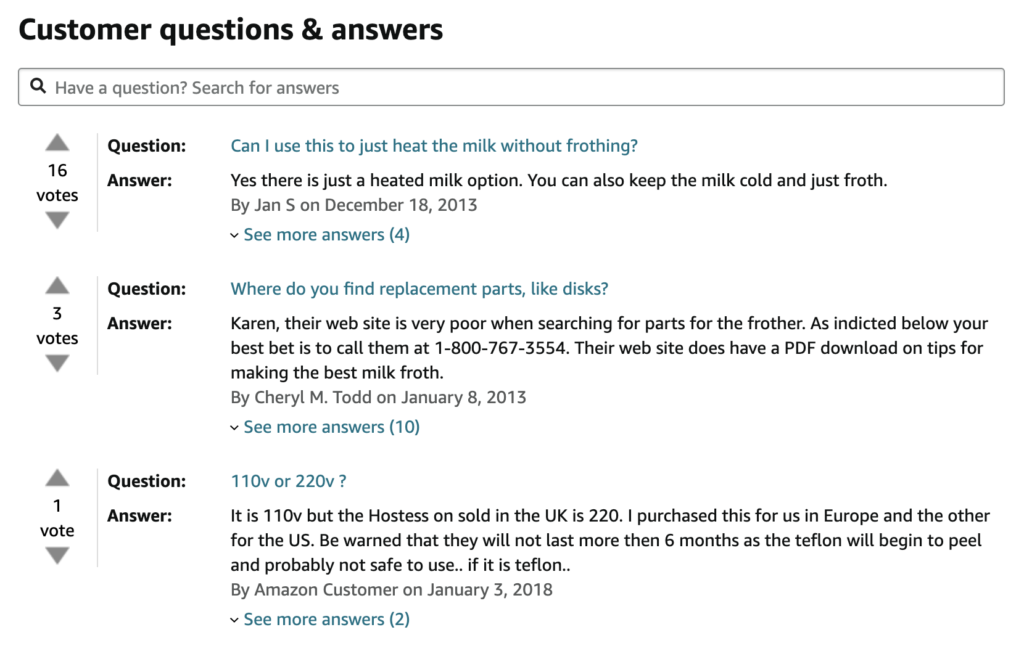

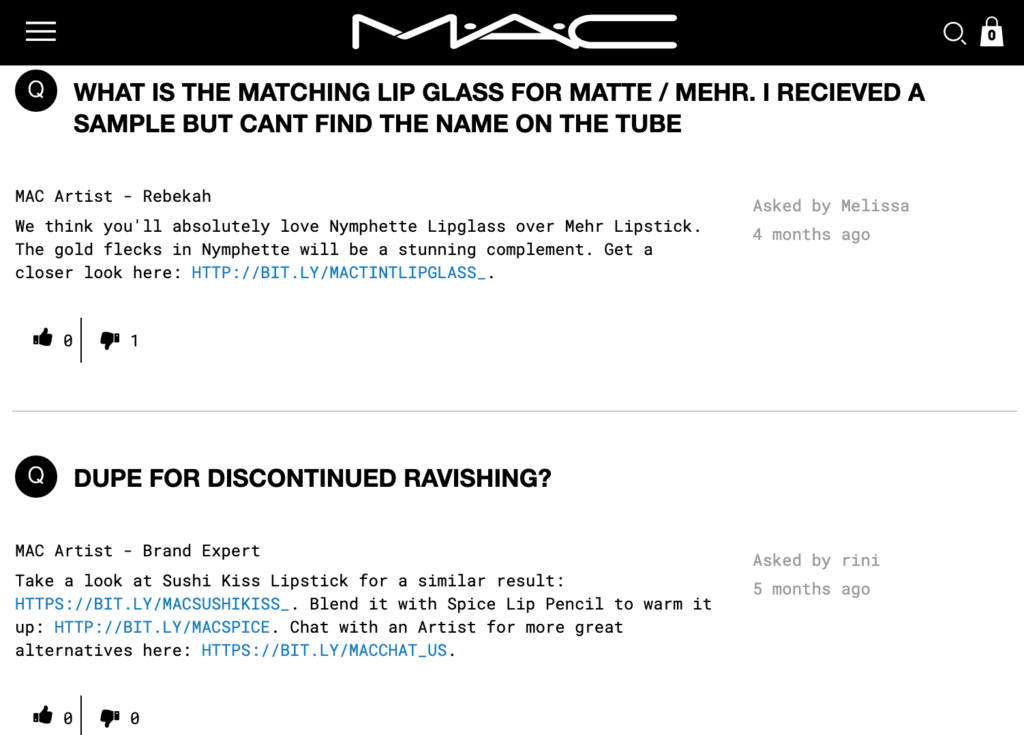

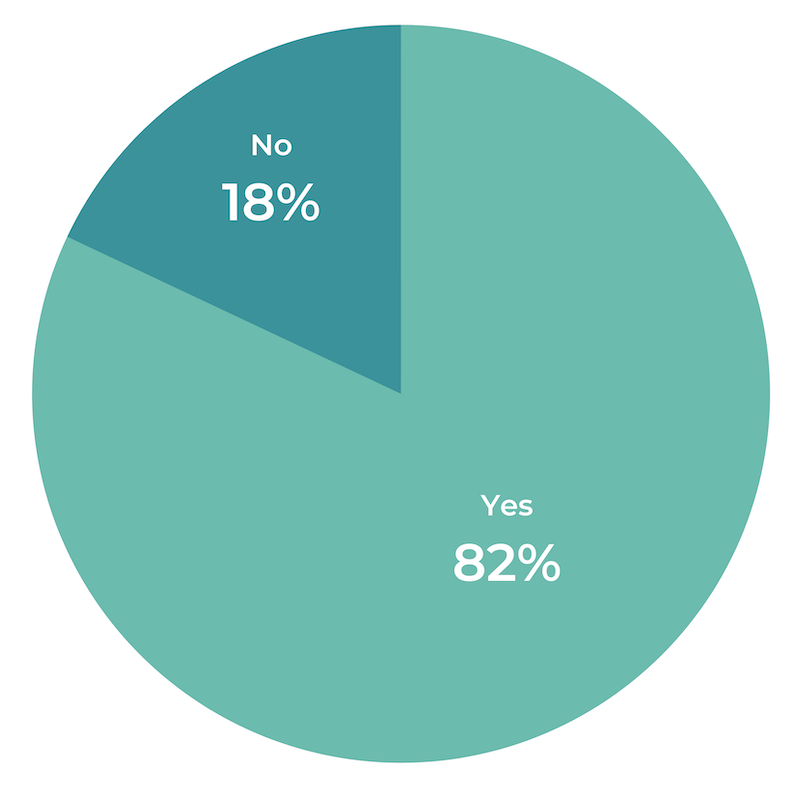

- The answerer matters: When browsing Q&A content on product pages, 82% say they pay attention to the small print detailing who provided the answer response.

Andrew Smith – VP, Marketing at PowerReviews, says:

“Many brands and retailers fail to prioritize Q&A and – based on our survey data – that is a massive mistake. No matter how comprehensive your product pages are, there’s no way to anticipate each and every question customers will have. It’s imperative to provide shoppers with a mechanism for getting any additional information they seek.

“Engagement with Q&A is a strong signal of purchase intent. If shoppers are compelled to ask a question, they have a high interest in the product, so it’s not surprising that consumers interacting with this content are so likely to convert.

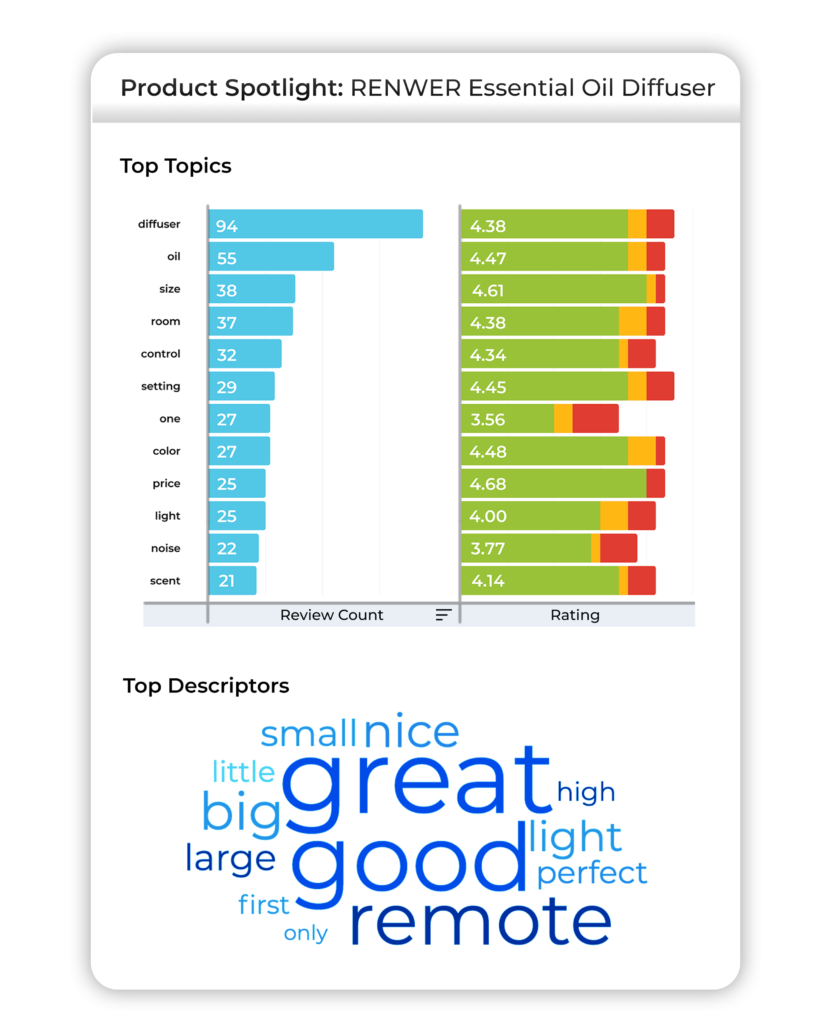

“Outside of the online conversion benefits, product Q&A is a fantastic resource of consumer sentiment. Analyze this content to better understand how to position the product or how to develop it to match customer need, while gaining an oversight of new and emerging trends in the marketplace.”

Research Methodology

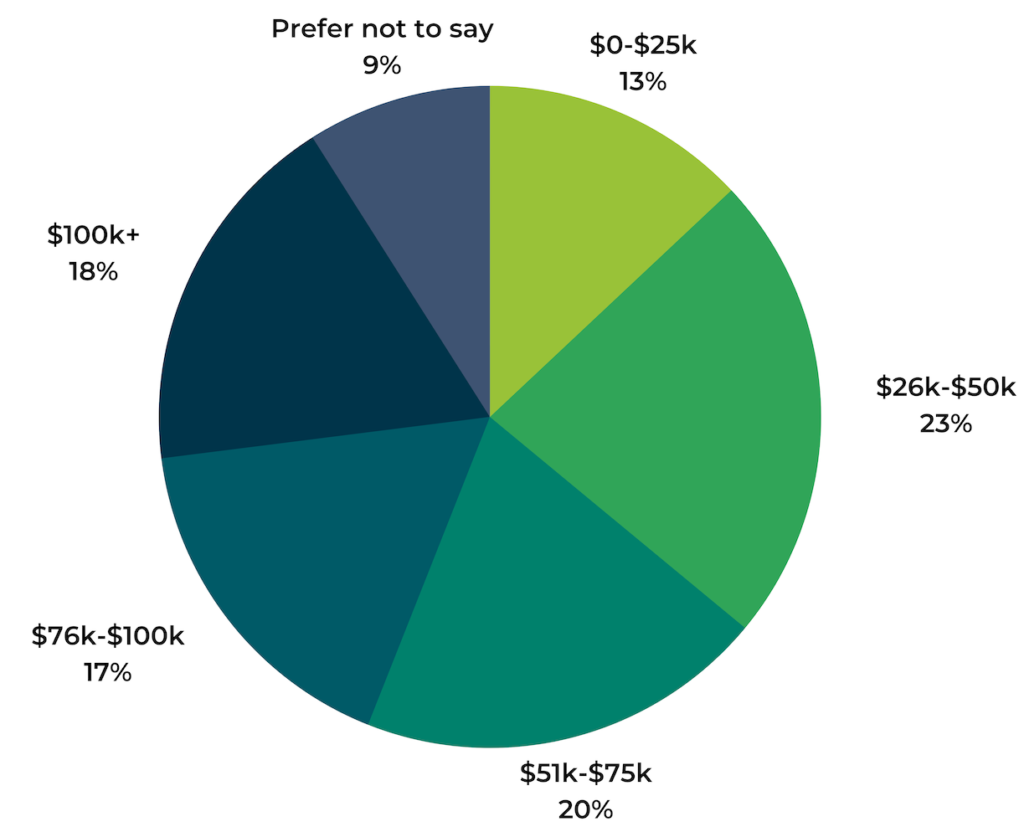

The PowerReviews How Q&A Eliminates Uncertainty consumer survey draws on responses from 7,528 shoppers across the United States who have opted into offers and discounts from retailers. The survey took place in June 2021. Throughout the survey, we defined Boomers as born in the years 1946 to 1964 (aged 56-74 on Dec 31, 2020), Gen X as born in the years 1965 to 1980 (aged 40-55 on Dec 31, 2020), Millennials as born between 1981-1996 (aged 23-38 on Dec 31, 2020) and Gen Zers born in or after 1997 (ages 22 and younger on Dec 31, 2020).

ABOUT POWERREVIEWS

PowerReviews (PowerReviews.com) is a conversion-first UGC vendor obsessed with helping brands and retailers grow their businesses. PowerReviews enables these organizations to generate better quality customer product ratings and reviews in larger volumes and then analyze and benchmark all this data to optimize their UGC programs for conversion while improving product quality and customer experience.

PowerReviews is headquartered in Chicago, IL, USA.

Media Contact

Erin Lutz

Lutz Public Relations & Marketing (for PowerReviews)

erin@lutzpr.com

949.293.1055