Today, nearly all consumers rely on user-generated content such as ratings and reviews, Q&A, and customer-submitted photos and videos to make informed purchase decisions. In fact, our research found that a whopping 97% of consumers consult product reviews prior to making a purchase. And 88% seek out photos and videos from other shoppers before buying.

Consumers purchasing food and beverages are no exception.

In this post, we’ll explore why leading food and beverage brands are making user-generated content a priority and how your food and beverage brand can leverage UGC to attract and convert more shoppers, boost loyalty and improve products.

Why Food and Beverage Brands are Prioritizing User-Generated Content

Traditionally, food and beverage purchases took place within the four walls of a brick-and-mortar store. And today, the majority of these purchases still happen in physical stores.

But food and beverage ecommerce is certainly growing. A study from TABS found that in 2019, 56% of US consumers made at least one grocery purchase online, compared to 38% in the prior year.

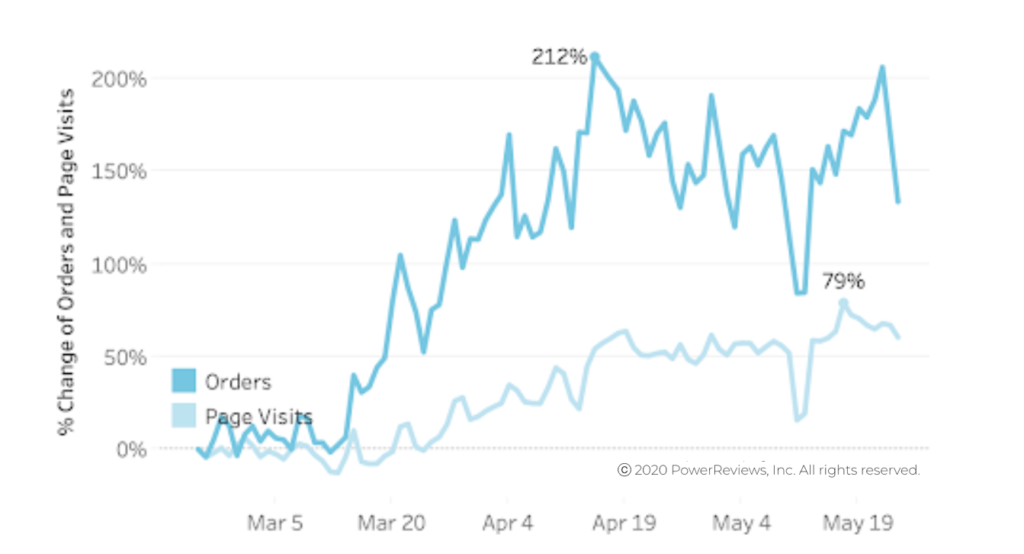

The COVID-19 pandemic has only sped up this growth. A report from Fabric predicts that online share of grocery sales will approach (or even exceed) 10% this year. That’s four years sooner than previously forecasted.

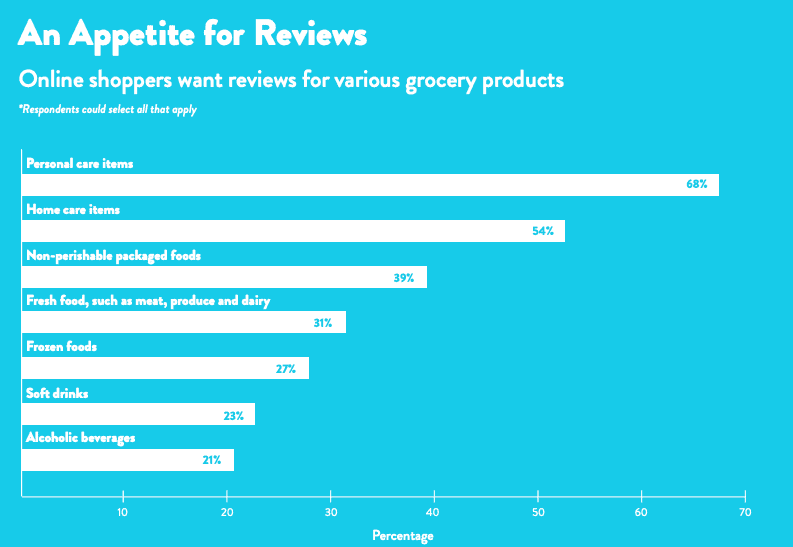

Online shoppers are actively seeking out user-generated content for various food and beverage products. And this content is positively impacting their purchase behavior. Our own research found that 72% of online grocery shoppers are more likely to purchase a grocery item they’ve never bought before if there are reviews for that product.

Food and beverage shoppers are also turning to user-generated content when they’re making purchases in a brick-and-mortar store — especially when they’re considering an unfamiliar product. Our research found that 52% of in-store shoppers are more likely to purchase a grocery item they’ve never purchased before if there are reviews for that product.

User-generated content gives both online and in-store food and beverage shoppers the confidence they need to try new (or new to them) products. And collecting and displaying this content has a positive impact on the brands that sell these products, too.

UGC Increases Traffic to Food and Beverage Product Pages

In an ideal world, a shopper would navigate right to your website when they were in the market for a food or beverage product you sell. But the reality is, 70% of shoppers start the purchase journey on Google or Amazon.

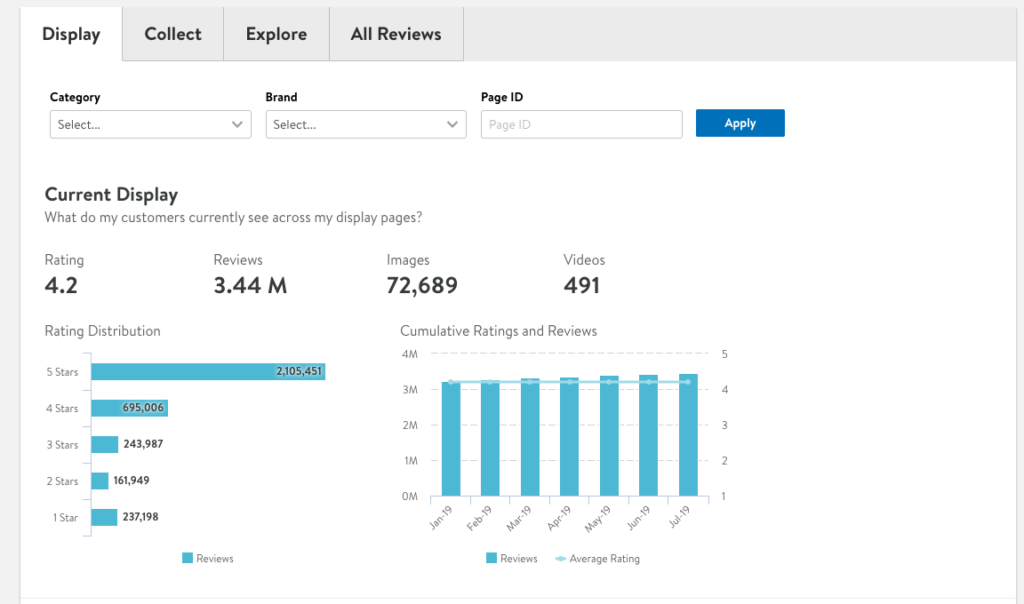

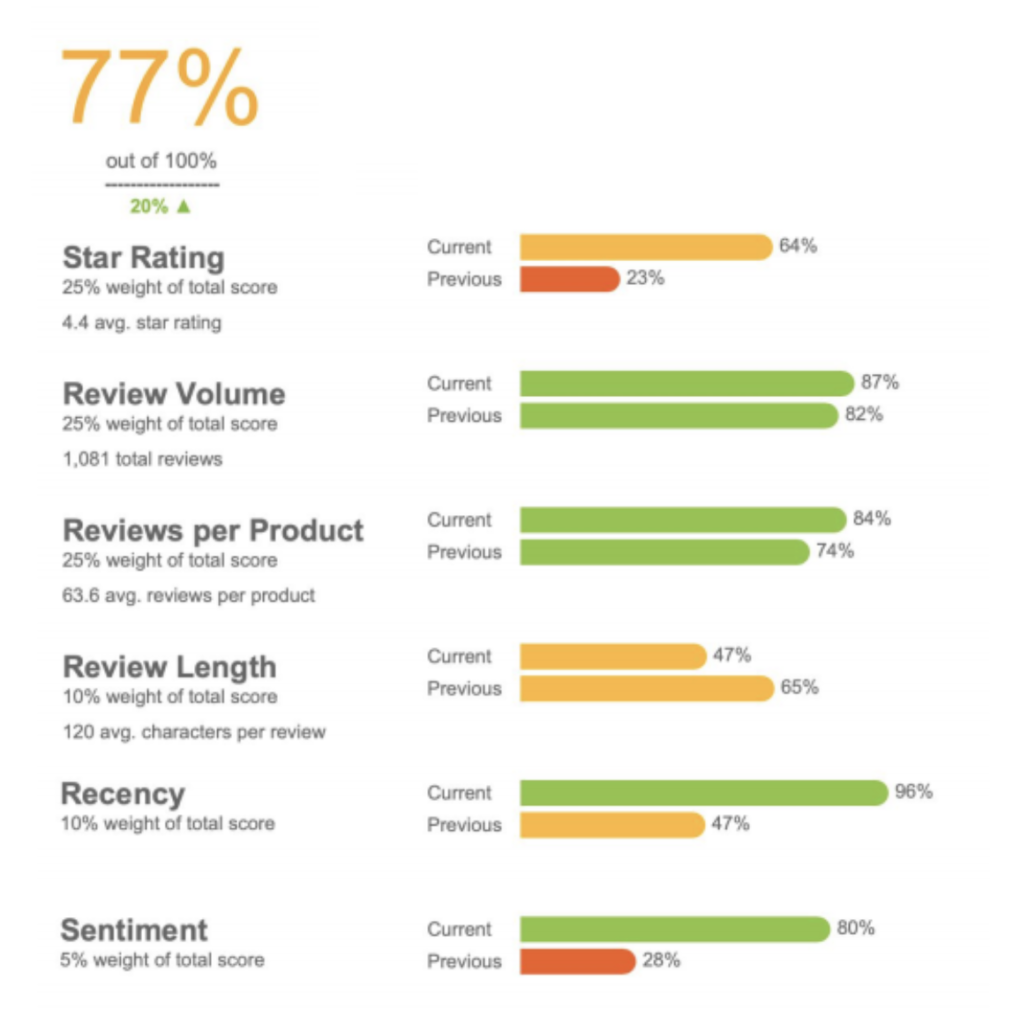

The good news is, user-generated content like reviews and Q&A makes it easier for shoppers to find your product pages, even when they’re not starting their search on your website. By continuously collecting user-generated content, your site’s content remains fresh and relevant with keyword-rich, permanent assets on your product pages. Search engines can crawl this content, which helps more shoppers find it. At PowerReviews, we’ve found that brands experience a 20% traffic lift from organic search when displaying user-generated content.

UGC Boosts Sales of Food and Beverage Products

Once a shopper lands on a food or beverage product page, user-generated content (or the lack thereof) helps determine what happens next. If there’s user-generated content on the page, the shopper is more likely to purchase the product in question.

At PowerReviews, we’ve found that brands can experience a 65% increase in conversion when reviews are displayed on a product page. And they can expect a 6X sales lift when a customer’s question is answered via Q&A.

UGC Enables you to Better Serve Customers

The content your shoppers submit is full of insights that can help you improve not only your products, but the overall experiences your shoppers have with your brand. This, in turn, will boost loyalty — and sales.

For example, perhaps you notice many shoppers rave about the taste of an energy drink, but many complain about the cap being difficult to open. This could be an opportunity to work with your supplier to improve the packaging. You can also respond to reviews mentioning the tricky cap to let shoppers know you care about their feedback and are taking action to resolve the issue.

How Food and Beverage Brands can Leverage UGC to Boost the Bottom Line

User-generated content helps food and beverage shoppers make confident purchase decisions. And it helps food and beverage brands attract and convert more shoppers.

Let’s explore a few ways you can leverage UGC to boost your business results.

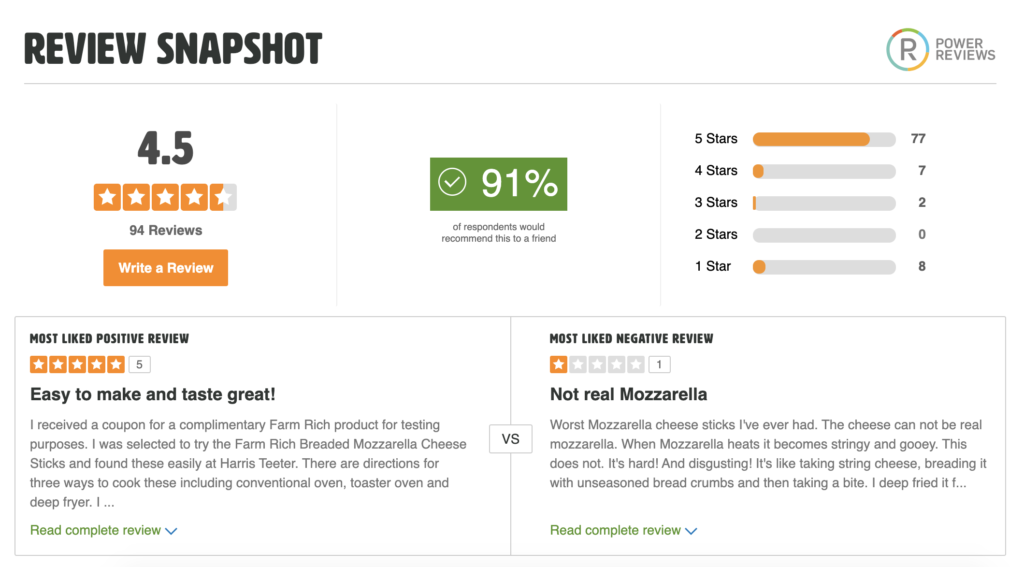

Collect and Display Reviews

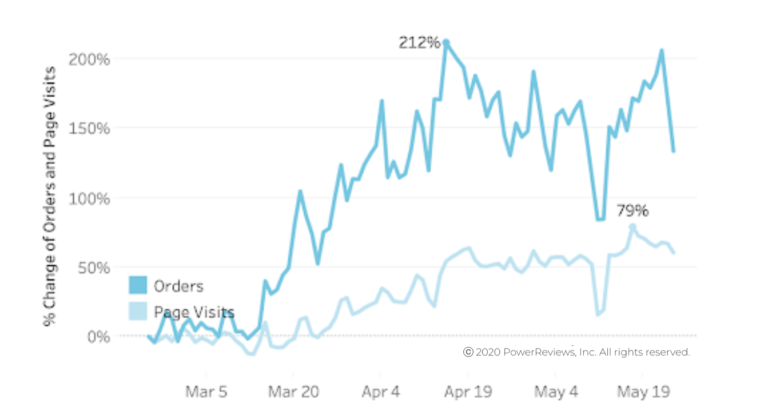

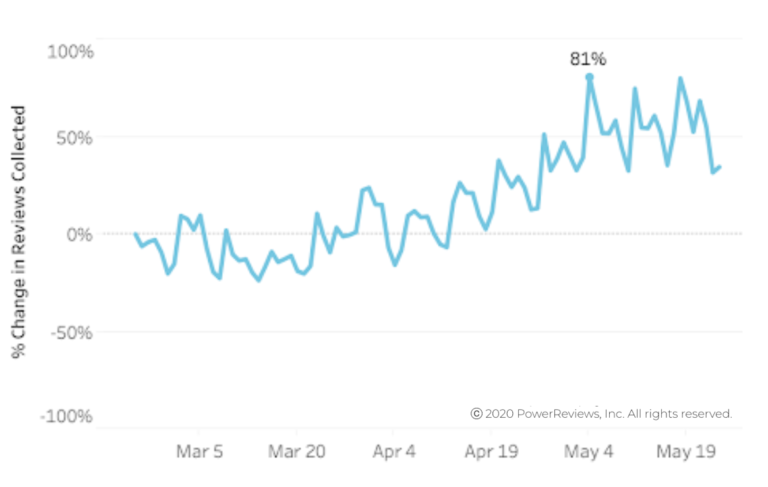

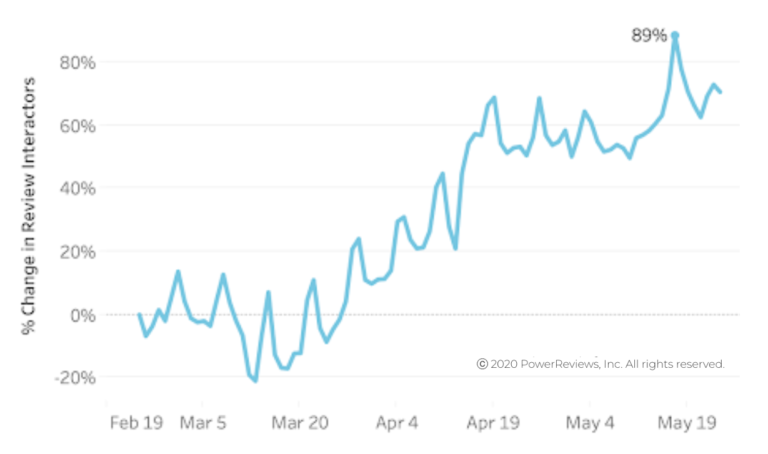

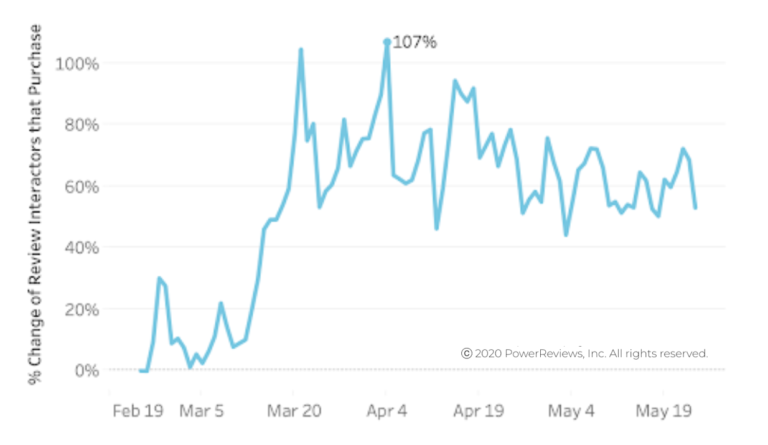

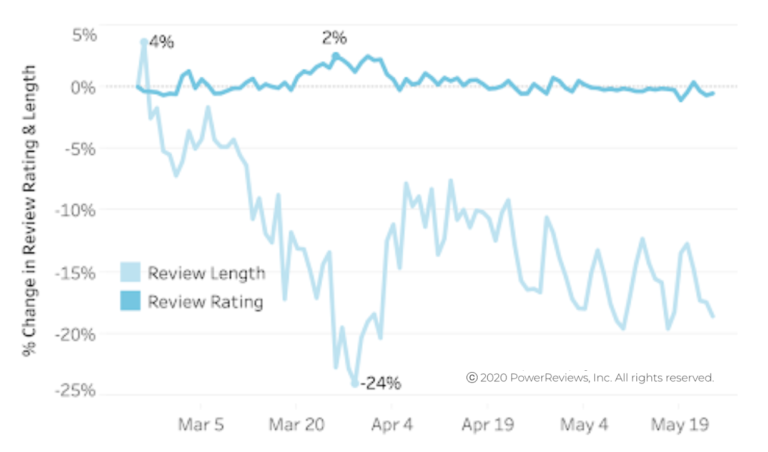

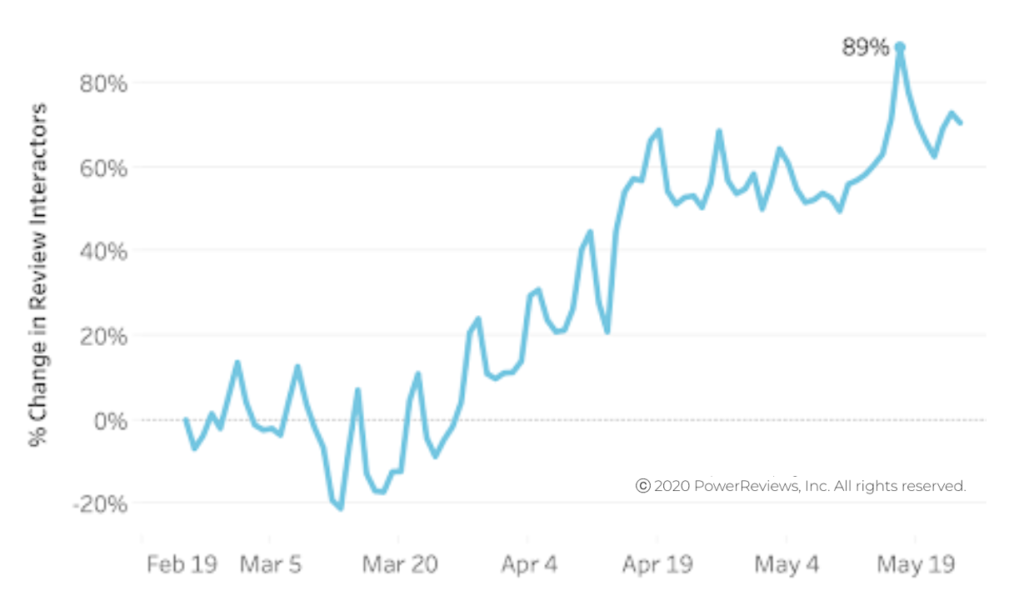

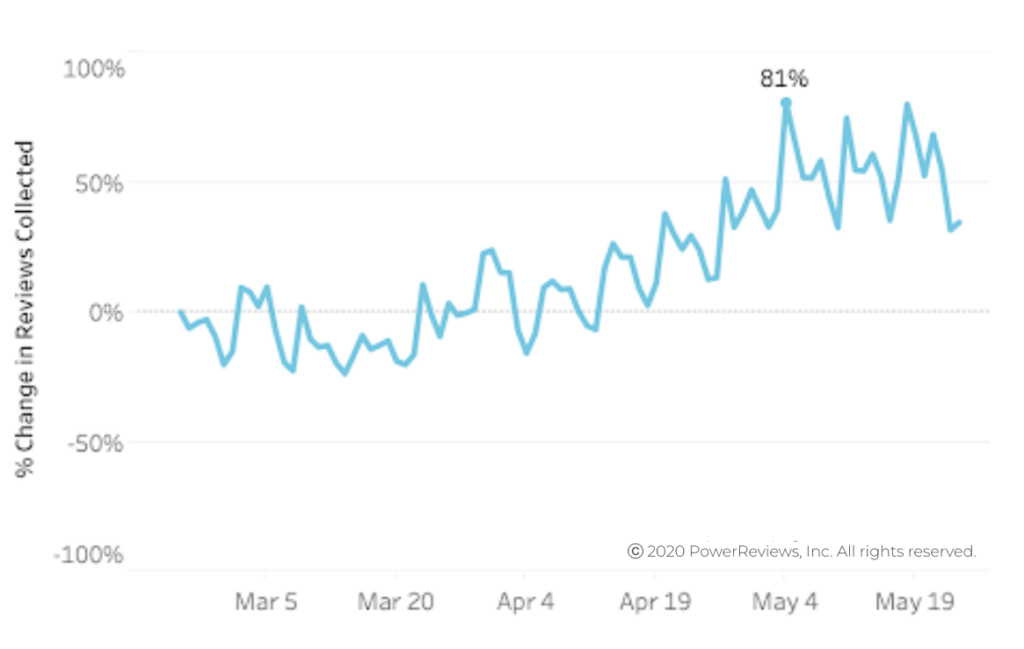

Reviews are important at the best of times. But in the wake of COVID-19, consumers rely on reviews even more. Our recent analysis found that consumer interaction with online reviews (think sorting, filtering, etc.) has almost doubled compared to pre-pandemic levels.

If you’re not already, now’s the time to start collecting product reviews from your shoppers. The most effective way to do this is to send a follow-up email to your shoppers asking them to submit reviews. Also, be sure the entire collection process is easy for your shoppers to compete on any device.

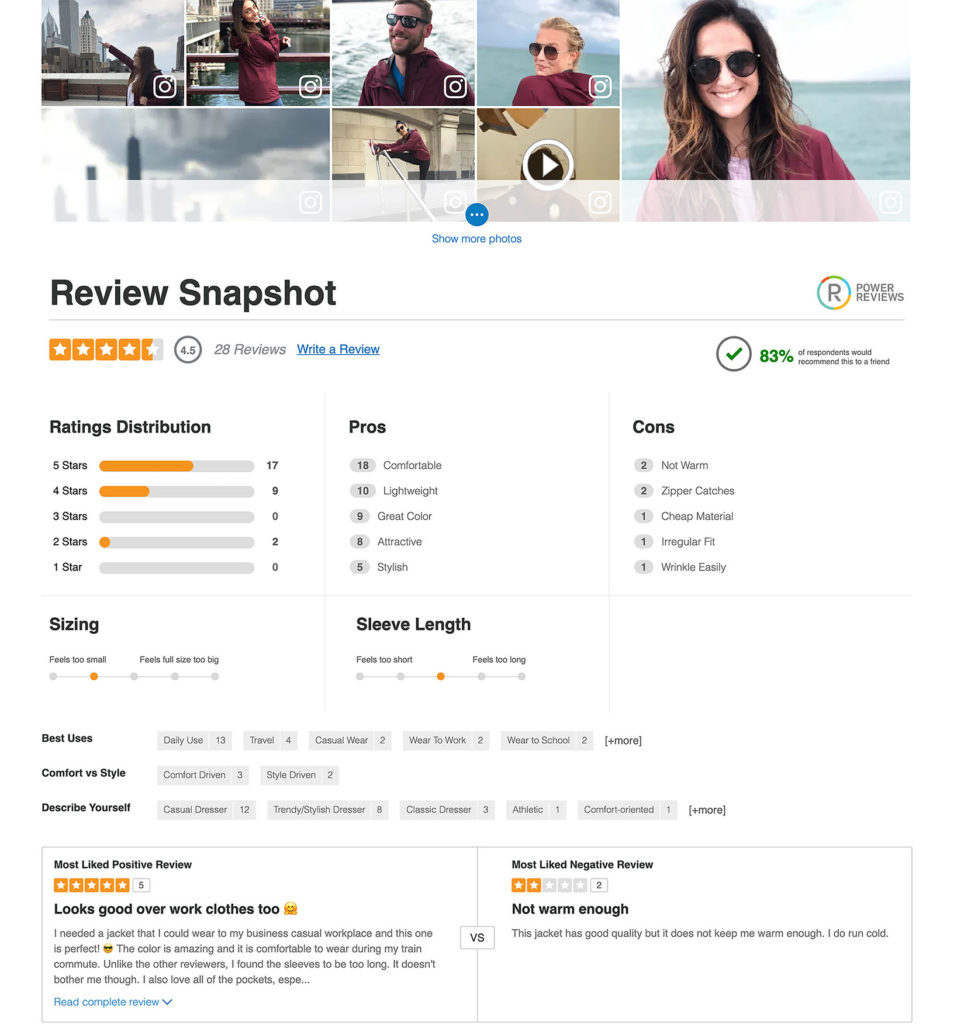

Once you’ve started collecting reviews, display this content in a way that’s easy for shoppers to find and consume. Make reviews front and center on your product pages and throughout your website.

Collect and Display Customers’ Photos and Videos

Professional photos and videos of your products are important. But for many shoppers, they’re not enough. As mentioned earlier, our research found that 88% of shoppers specifically seek out visual content like photos and videos submitted by other customers before making a purchase.

Food and beverage shoppers use customer-submitted visual content to better understand product characteristics like size and texture — and to discover new ways to use a product. For example, Canyon Bakehouse collects customer-photos and videos, many of which show unique ways shoppers are using their gluten-free bread products.

Start collecting visual content both natively and through Instagram. Then, display this content on your product pages and throughout your website to engage and inspire your shoppers.

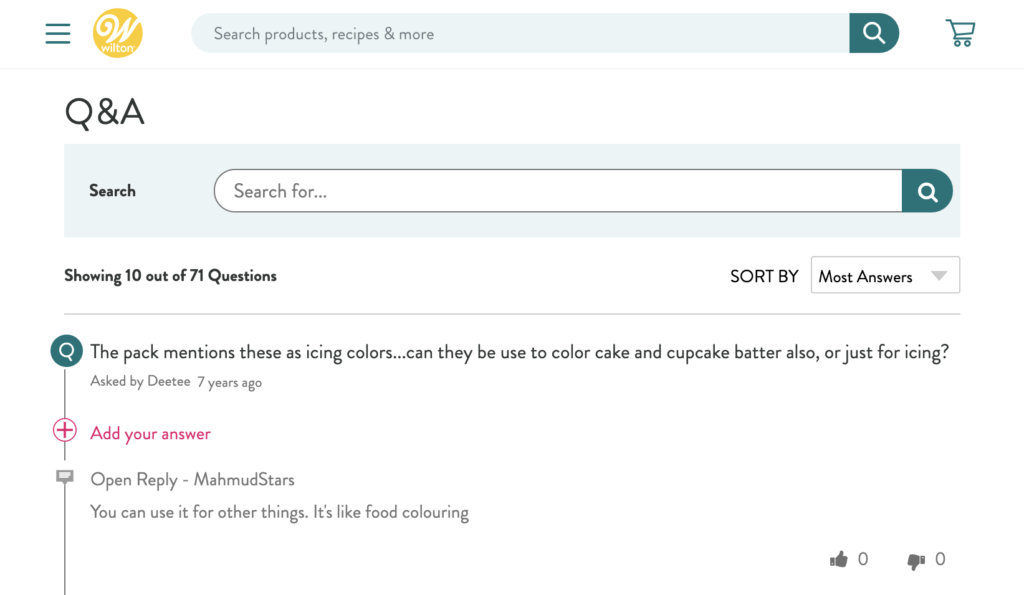

Empower Food and Beverage Shoppers to Ask Questions

No matter how comprehensive your product descriptions, shoppers will still have questions. Consider adding a Q&A tool to your website so shoppers can get answers to their purchase-blocking questions right on your product pages.

Make sure your Q&A is searchable so future shoppers can see if their question has already been asked and answered.

Syndicate Content to Your Retail Partners

If you’re like most food and beverage brands, you sell your products through a variety of different channels. If so, be sure you’re syndicating your user-generated content, including ratings and reviews, Q&A, and consumer-submitted photos and videos. That way, content submitted on your own website will also appear on product pages on your retail partners’ websites.

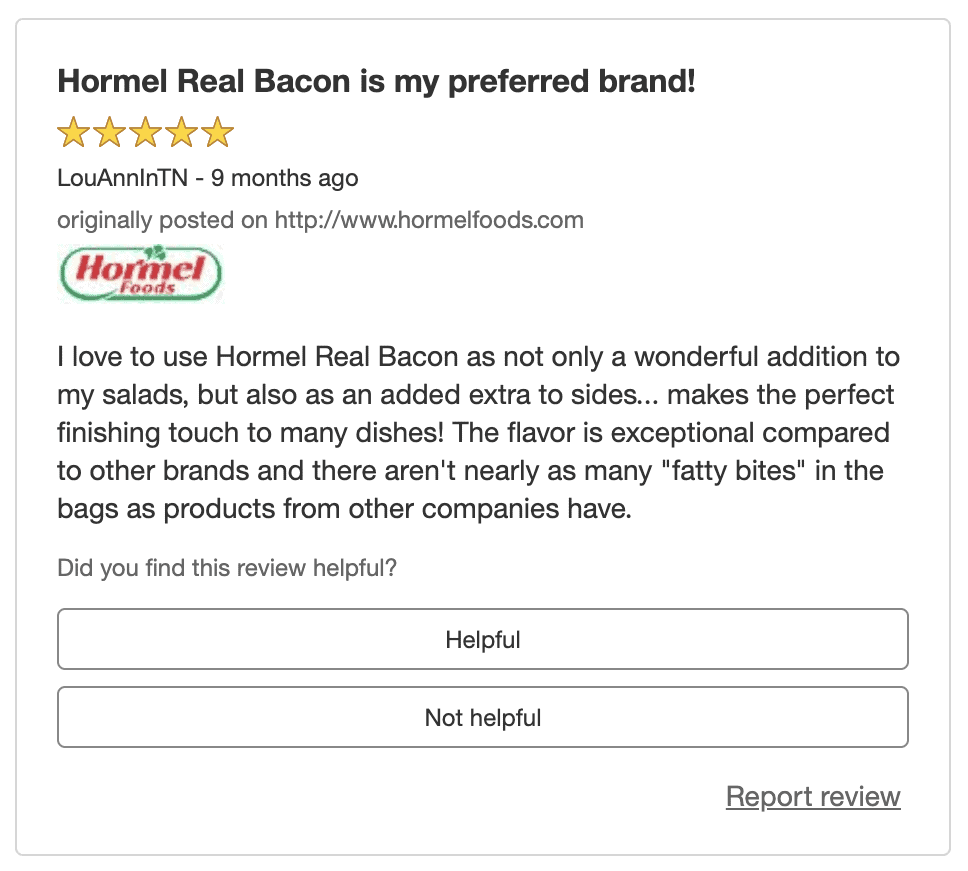

For example, this review for Hormel’s real crumbled bacon was originally submitted on the brand’s website. But thanks to content sharing, it also appears on the product page on Target.com.

By sharing your review content, consumers can find the content they’re looking for, regardless of where they’re shopping for your products.

Highlight User-Generated Content on Amazon

Today, many shoppers start their purchase journey on Amazon. Ensure they can find all of the information they’re looking for — including social proof in the form of user-generated content.

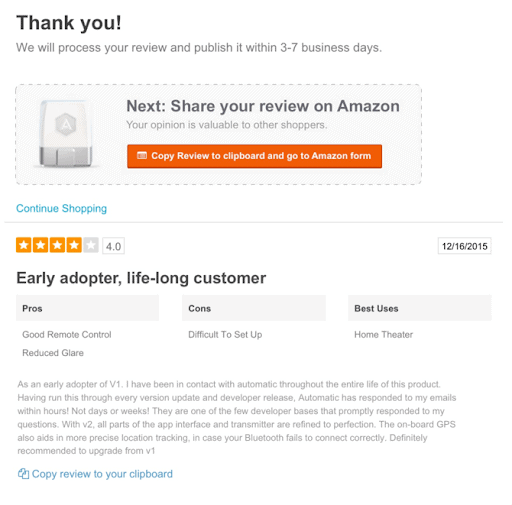

Of course, it’s important to collect user-generated content natively on Amazon. But to maximize review coverage, you’ll also want to ask your ratings and reviews provider if they make it easy for those who write reviews to share that content on Amazon.

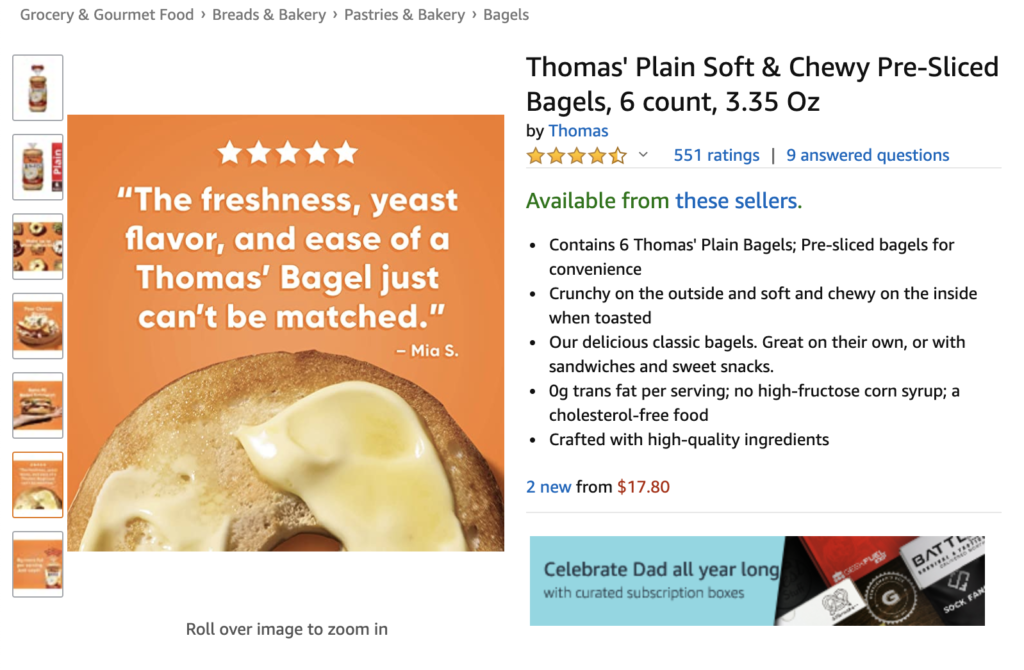

In addition, look for unique ways to highlight user-generated content on your Amazon product pages. For example, you can create an image that includes text from a positive review and add it to your image carousel to entice shoppers to learn more.

Showcase UGC in Your Other Marketing Channels

Food and beverage shoppers trust the opinions of others like them. So look for ways to enhance your marketing initiatives — including emails, organic and paid Instagram and Facebook posts, and retargeting ads — with user-generated content like star ratings, excerpts from reviews, and photos taken by your shoppers.

For example, Brew Dr. Kombucha regularly showcases photos taken by shoppers on their own Instagram page.

And Silk uses the text of a customer review in one of their Instagram posts.

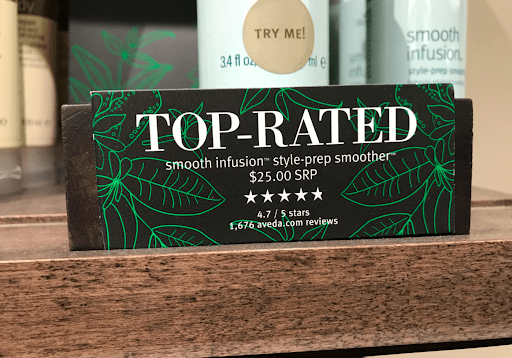

Make User-Generated Content Accessible In-Store

A PowerReviews survey found that 70% of consumers are interested in accessing product ratings and reviews in-store. And as mentioned earlier, the presence of this content makes a shopper more likely to try a new food or beverage product.

Ensure the reviews, Q&A, photos and videos on your website are easy to consume on a mobile device. And look for opportunities to enhance in-store displays, product signage and product packaging with star ratings, excerpts from reviews or even photos submitted by your customers.

Leverage Insights to Improve Your Business

User-generated content is chock full of valuable insights that can fuel better business decisions for food and beverage brands. But far too often, these insights remain untouched.

Start leveraging the insights from your user-generated content to identify ways to improve your food and beverage products and your customers’ overall experience with your company.

You can start by monitoring the overall sentiment for a specific product, or example, a new iced tea you just released. If you notice it’s mostly negative, you can dig into the content more to identify specific ways to improve the product — or even pull it altogether.

You can also acknowledge negative feedback from shoppers, which can help you turn negative situations around and show shoppers you are a brand that cares about its customers. This builds loyalty, which then drives sales.

Start Leveraging User-Generated Content to Drive Food and Beverage Sales

Today, food and beverage shoppers depend on user-generated content to make informed business decisions and gain the confidence they need to try new products. This is true regardless of whether a consumer opts to purchase food and beverages online or within the four walls of a brick-and-mortar store.

Food and beverage brands that effectively leverage user-generated content have a big opportunity to drive traffic and sales, uncover actionable insights, and build a reputation as a customer-centric business.