Power Points:

- Reviews are made to be read, on your product pages and anywhere else they can help you sell.

- Repurpose your reviews, and you can enjoy more engagement, more clicks, and more sales.

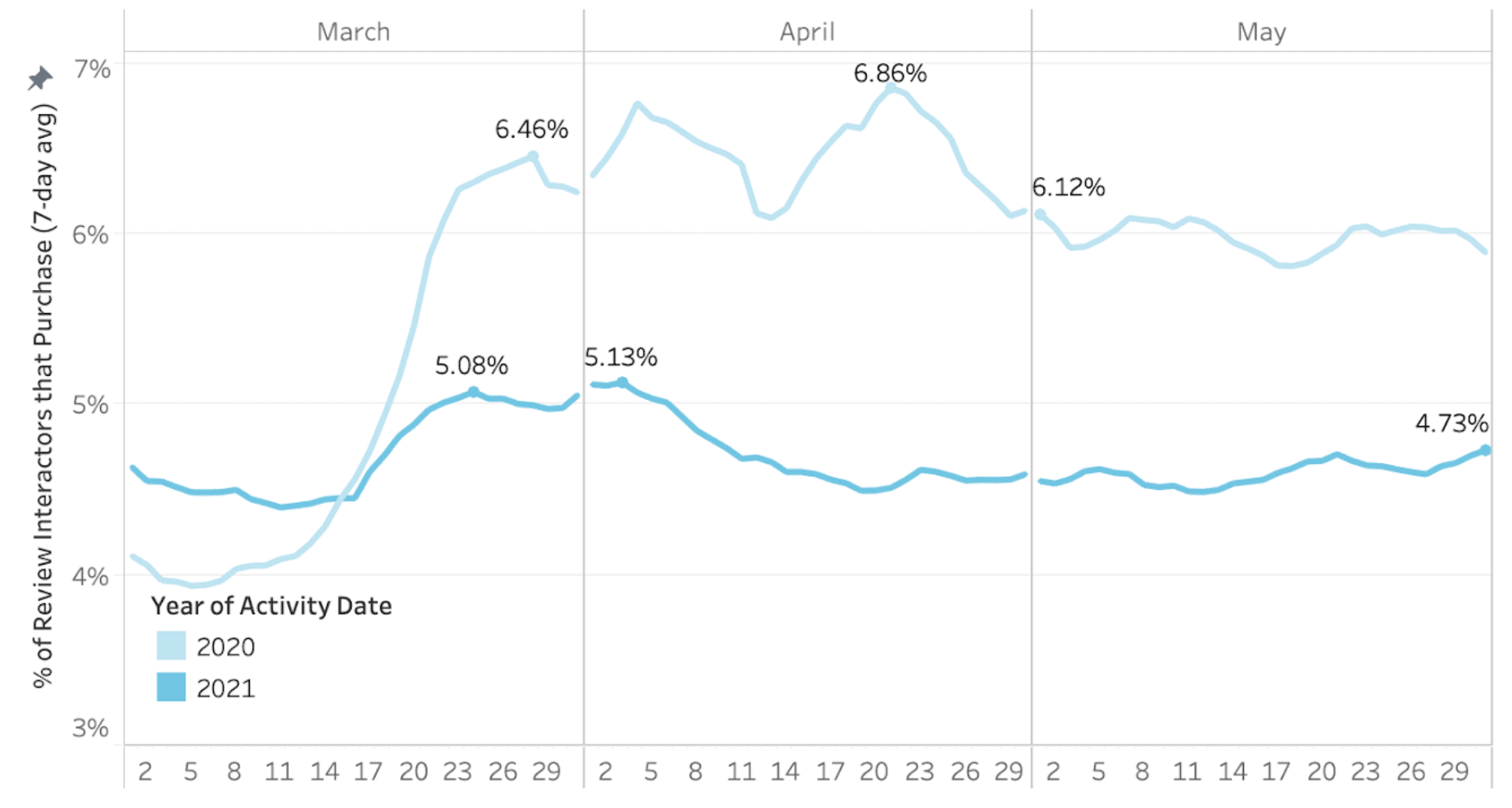

Reviews – by their very nature – are immensely powerful validation of a product or service from someone who has actually used it. They therefore typically have way more credibility than any marketing in your own words.

As a result, brands and retailers are increasingly recognizing the conversion value of review content above and beyond the product page.

In fact, customer reviews are commonly now used in marketing emails, social media posts, throughout company websites — and even on in-store displays and product packaging.

Which – at the risk of repeating myself – makes a ton of sense given the inherent credibility and validity that comes with feedback from your customers in their own words.

If you’re not currently using review content left by customers in your marketing, this article is for you. But even if you are, read on to see how other brands and retailers are doing it to perhaps get your creative juices flowing.

Plus, it’s highly likely that at least some of these ideas will be brand new to you. Many of the brands and retailers we work with are getting super creative with how they use reviews in their marketing, and they’re enjoying tons of positive customer feedback as a result.

So, without further ado, here are 21 fresh ways to use reviews in your marketing this year.

Email marketing

Emails and reviews go together like PB&J. Here are five of the best real-world examples of using reviews in email campaigns that we’ve seen recently.

1. Use reviews to hype holiday promotions

Which is more interesting: A generic email telling you about a holiday promotion, or one that features a review from a real customer raving about what a great gift your product was?

We love this example from LobsterGram because they use the review as the sales copy for a holiday email promotion. This is a super-efficient approach because not only do you save your marketing team the trouble of creating new copy, you probably end up being more persuasive as a result.

The holidays are coming, so now is an ideal time to start thinking about how you can repurpose reviews in your holiday content. And remember, you can use this technique for any holiday — back to school, Halloween, New Year’s — you name it.

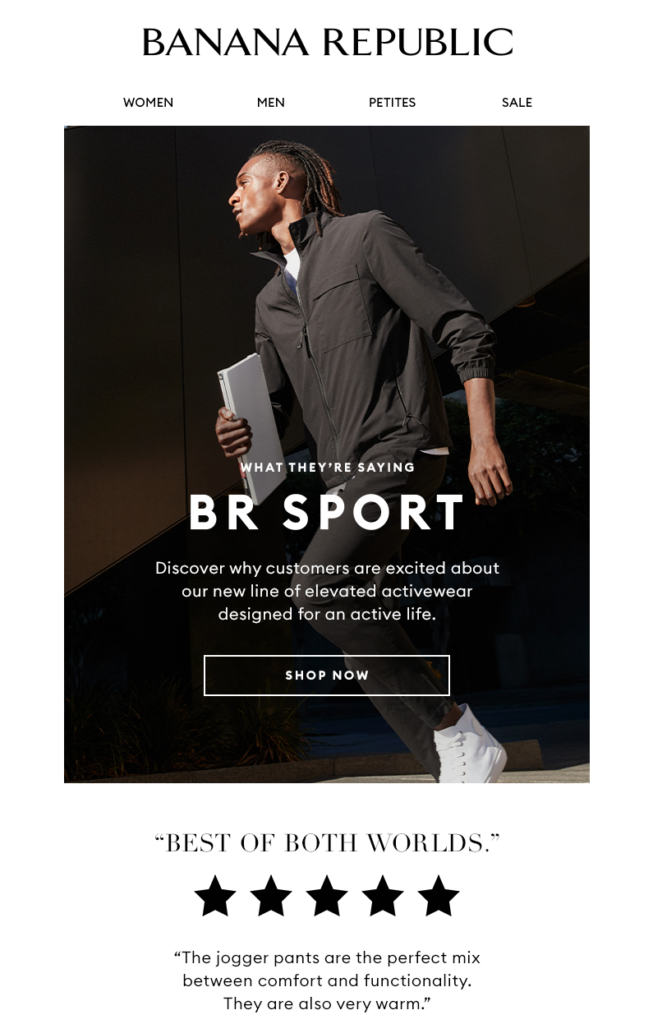

2. Support your latest product launch

Incorporating reviews in your product launch is a great way to get buy-in. Get customers excited about your new product by telling them what other people think, like this example from Banana Republic.

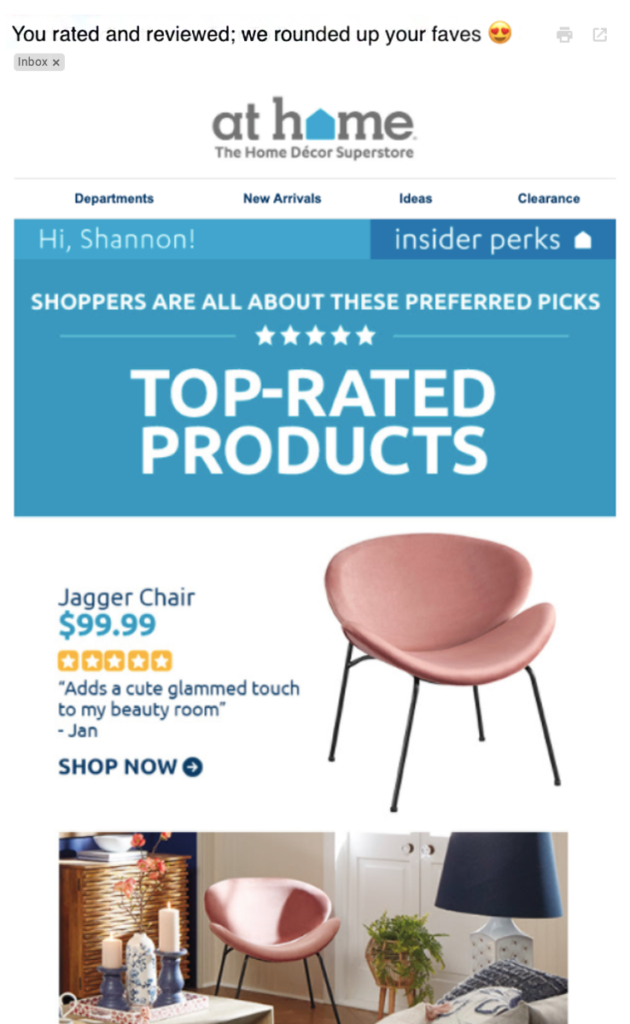

3. Make reviews the main event

Need some inspiration for your next email campaign? Elevate reviews to be the star of the show.

This example from At Home is one of our favorites. They sent out an email with a subject line that read “You rated and reviewed; we rounded up your faves.” Talk about building intrigue! The call-to-action-based subject line invites people to open the email and take a look. The email itself featured top-rated products with star ratings and snippets from 5-star reviews.

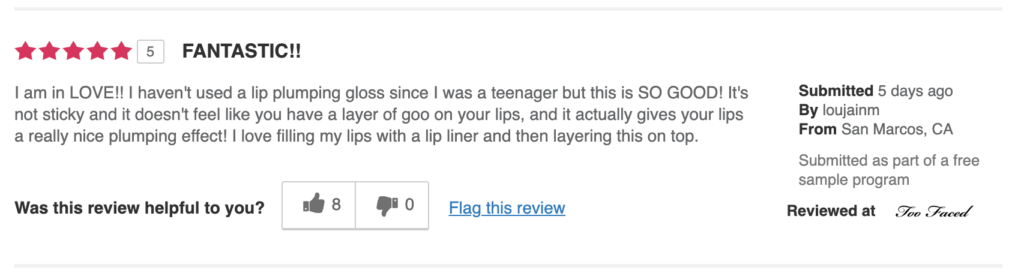

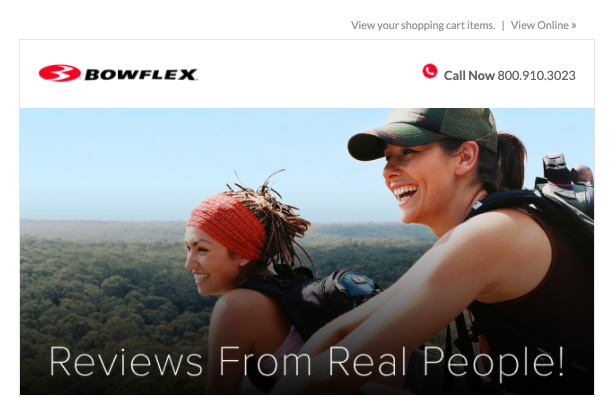

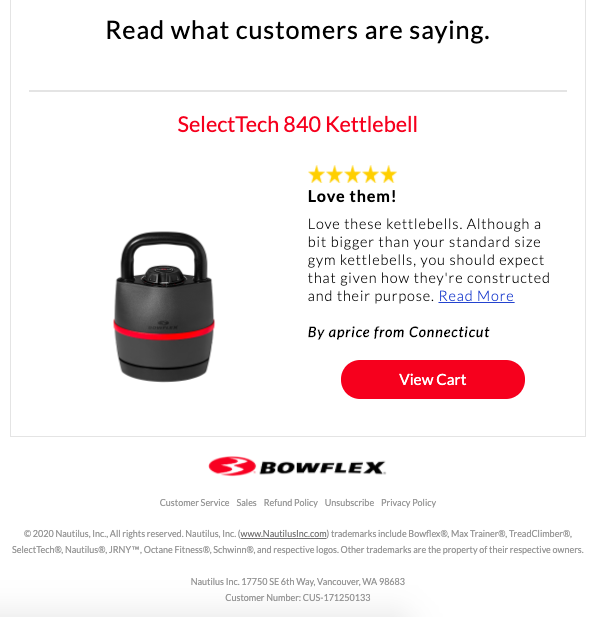

4. Add to cart abandonment emails

The average cart abandonment rate hovers around 70%. Bring that number down by including reviews in your cart abandonment emails.

For some shoppers, a visual reminder of the items they had in their cart might be enough to convince them to come back and buy. But many shoppers will need something more persuasive — like a 5-star review from a real customer. Here’s an example from Bowflex.

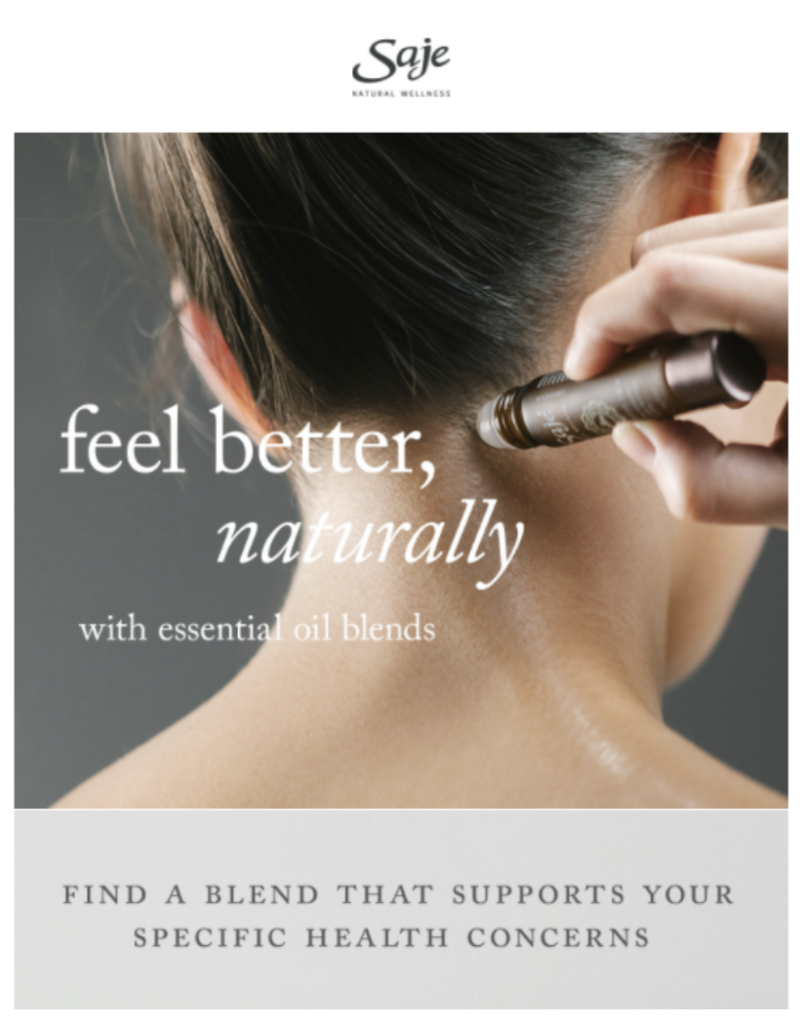

5. Augment broader campaigns and messaging

Do your emails feel like they’re missing something? If you’ve got some extra space, include a recent positive review in your marketing emails.

It’s the perfect opportunity to highlight something positive about one of your products, build a sense of community among your customers, and, of course, remind people to leave their own reviews! Here’s an example from Saje:

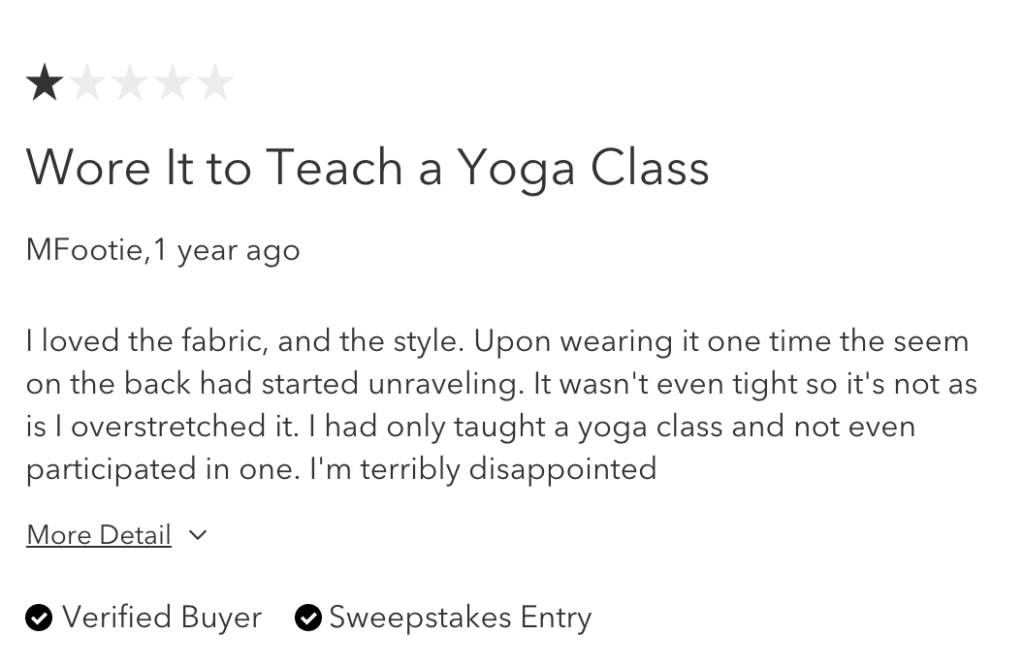

Your website

Reviews don’t deserve to be siloed on your product pages. Feel free to repurpose them throughout your website. Here are four ideas to try.

6. Add reviews to your homepage

Your homepage is a centerpiece of your entire marketing strategy. Your messaging and presentation of that message needs to be highly impactful but also attention-grabbing and succinct.

Your customers are generally more persuasive than your marketing team and often talk in blunter terms that are more likely to directly resonate. Take a cue from Suja and highlight snippets from your reviews on the homepage.

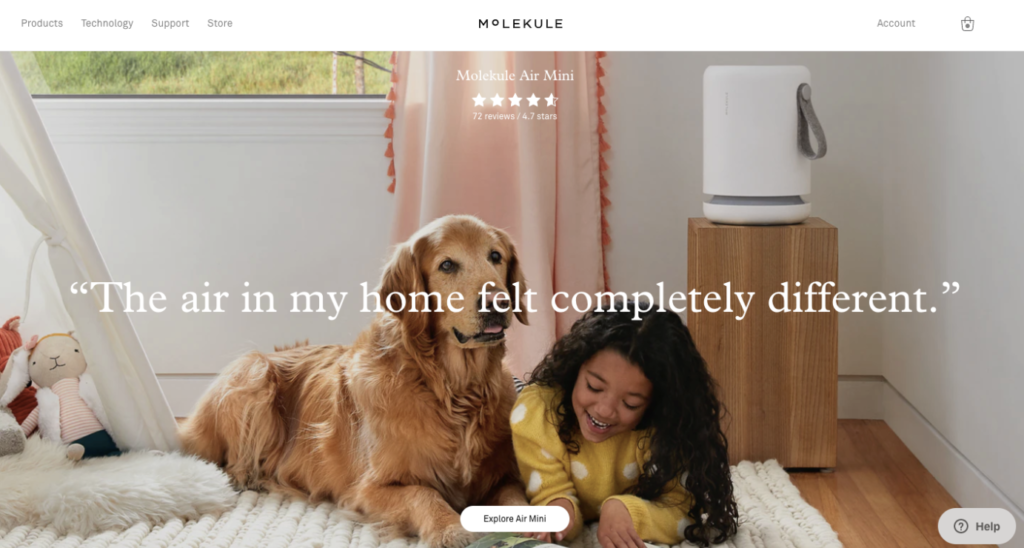

7. Turn reviews into headlines

Your website is no doubt made up of a ton of headlines across category pages, product pages, landing pages, and so on.

Struggling to come up with something that hits the mark?

Turn to your reviews like Molekule did. We love this approach because it’s unique, and it brings a sense of authenticity to the brand.

Whether you have a small marketing team or you just need a little inspiration, look to your reviews to see if you can pull anything from there.

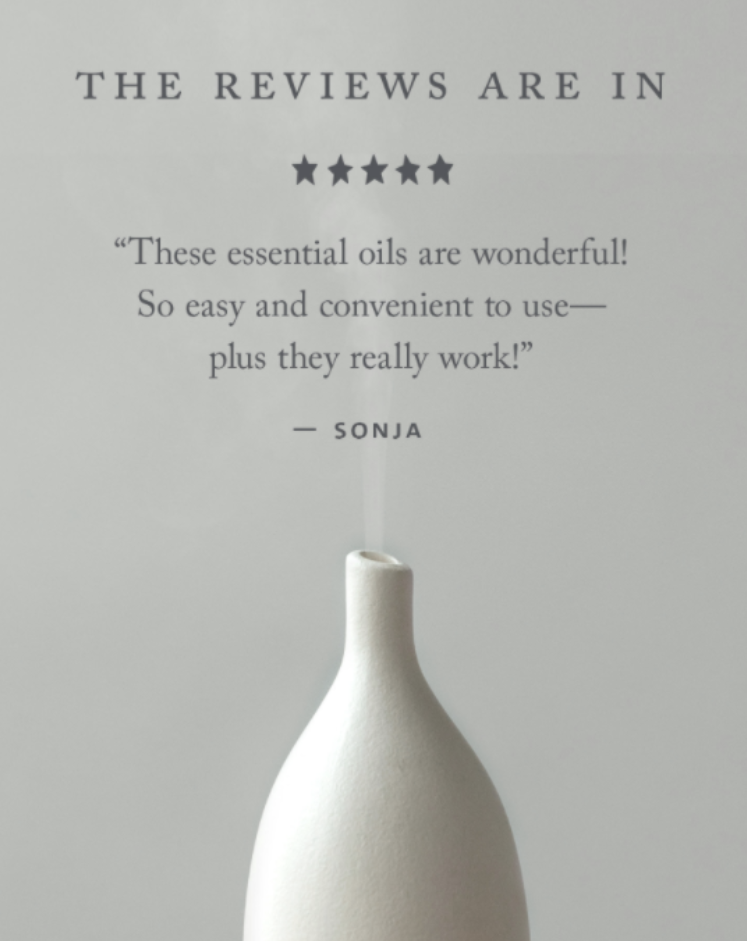

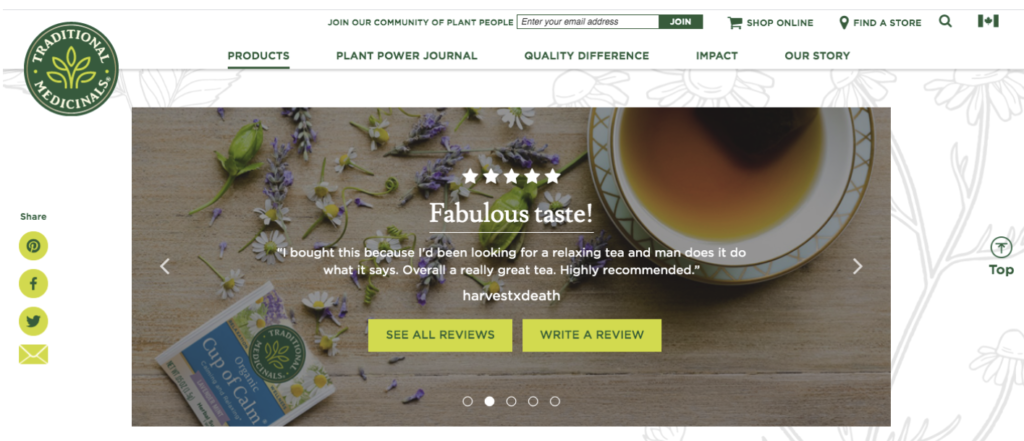

8. Include review snippets in sliders

Traditional Medicinals features reviews in their image carousels (this example is taken from the homepage). We love this example because not only do they show the star rating with the review, but they also include a call-to-action.

If the person is a new shopper, they can click to read more. If they’re a returning customer, there’s a subtle reminder to write their own review.

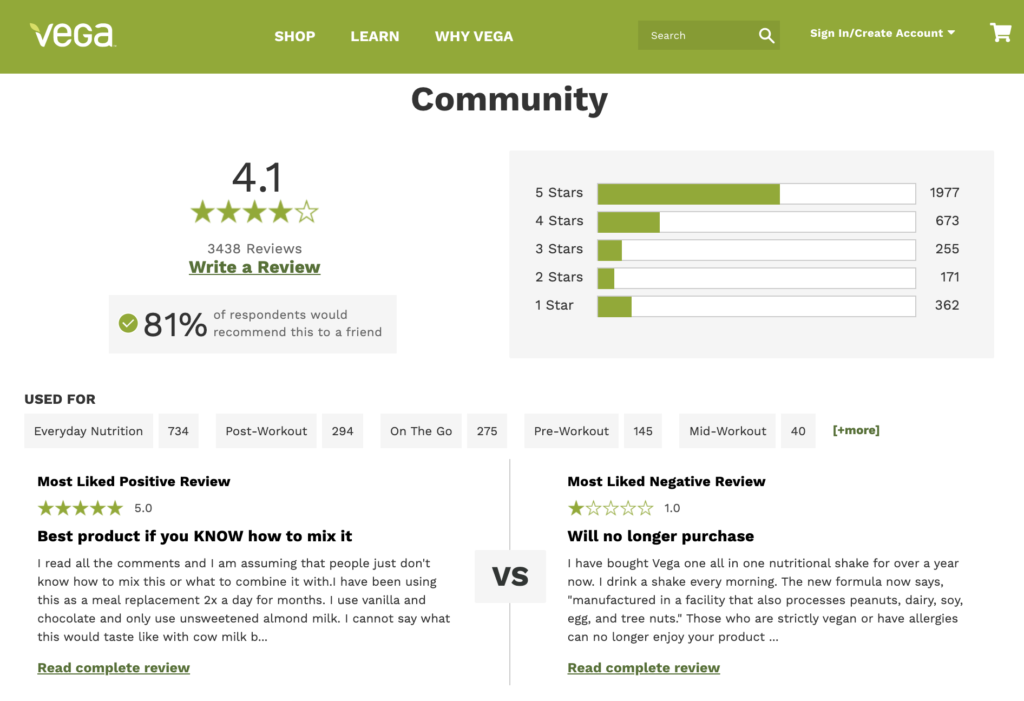

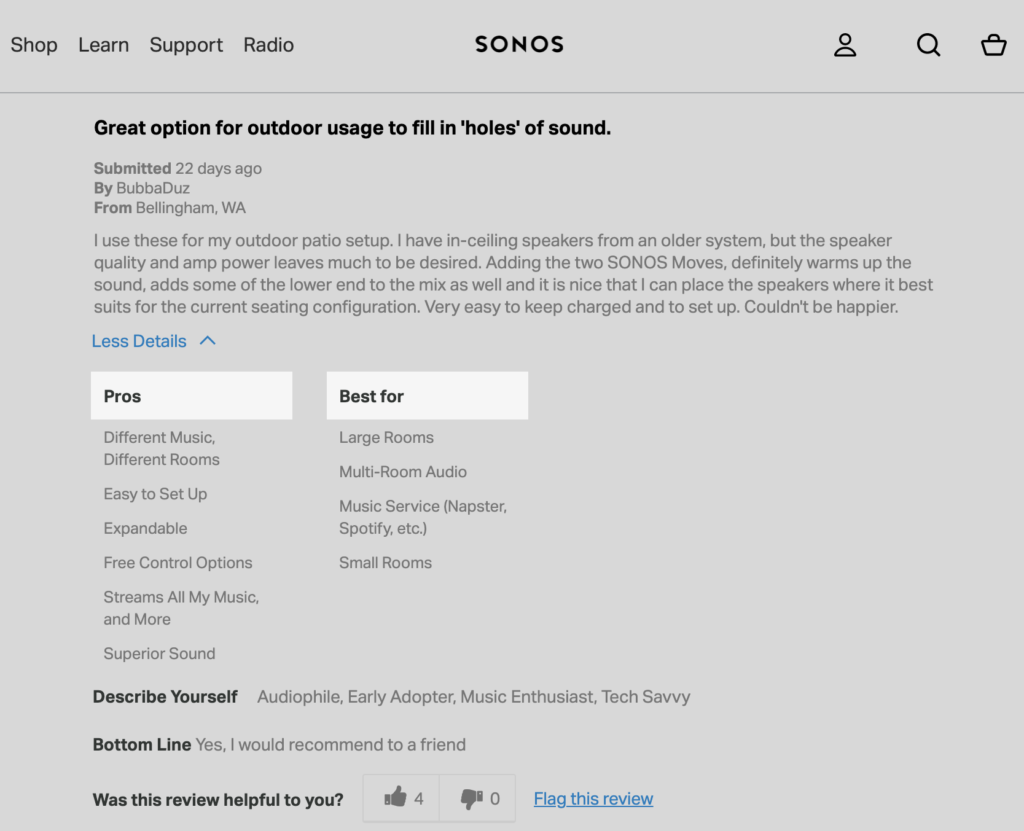

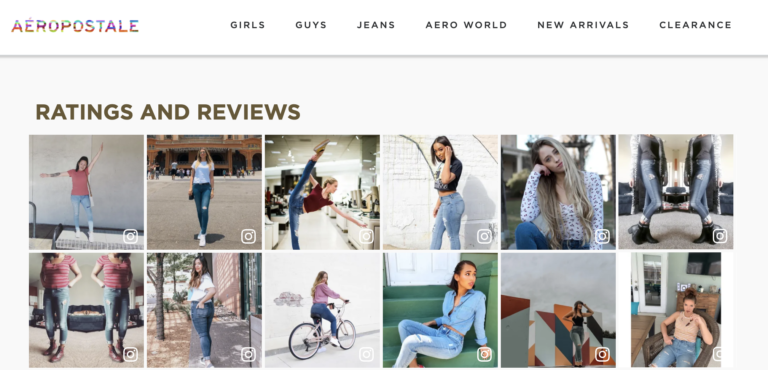

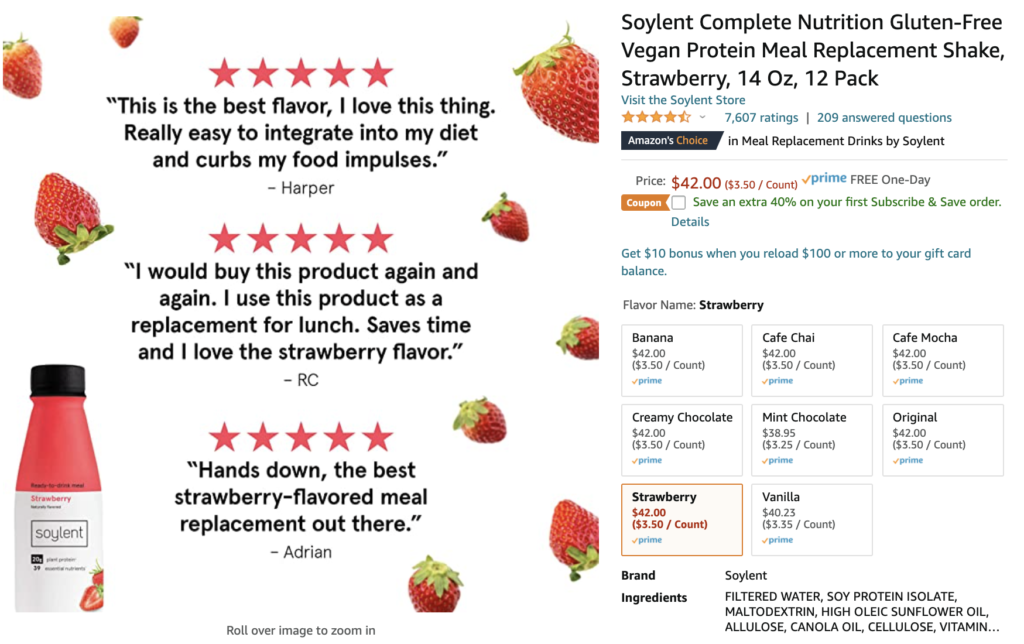

9. Transform reviews into images

We’re starting to see clients utilize reviews as an alternate image in product photo galleries.

Pop your best reviews into your favorite graphic design tool and transform them into a graphic. You can use them as graphics in your own product gallery as well as on other retailer websites.

Here are two examples from Soylent:

Social media

Social media is all about conversation. Why not use this marketing channel to promote all the wonderful things customers have to say about your brand? Here are five ways to get started.

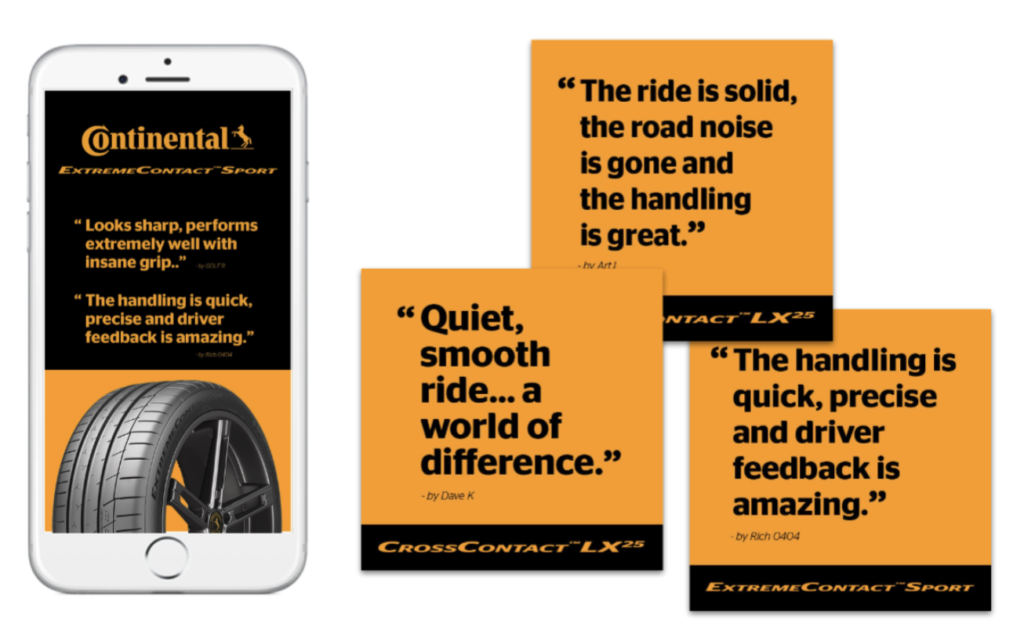

10. Include reviews in your Instagram Stories

It’s tough to think up new Instagram Stories content daily — let alone multiple times a day. Give yourself a break and showcase your customers’ voices, like Continental Tires does.

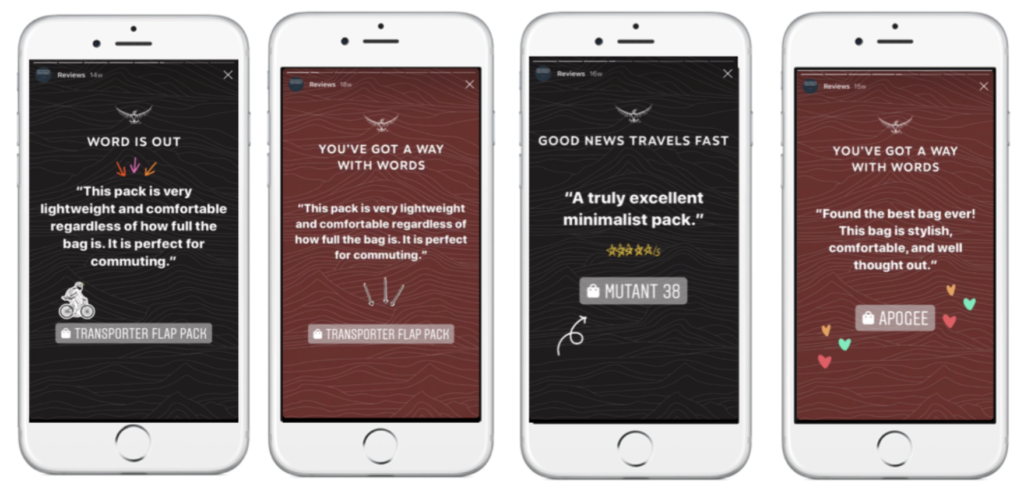

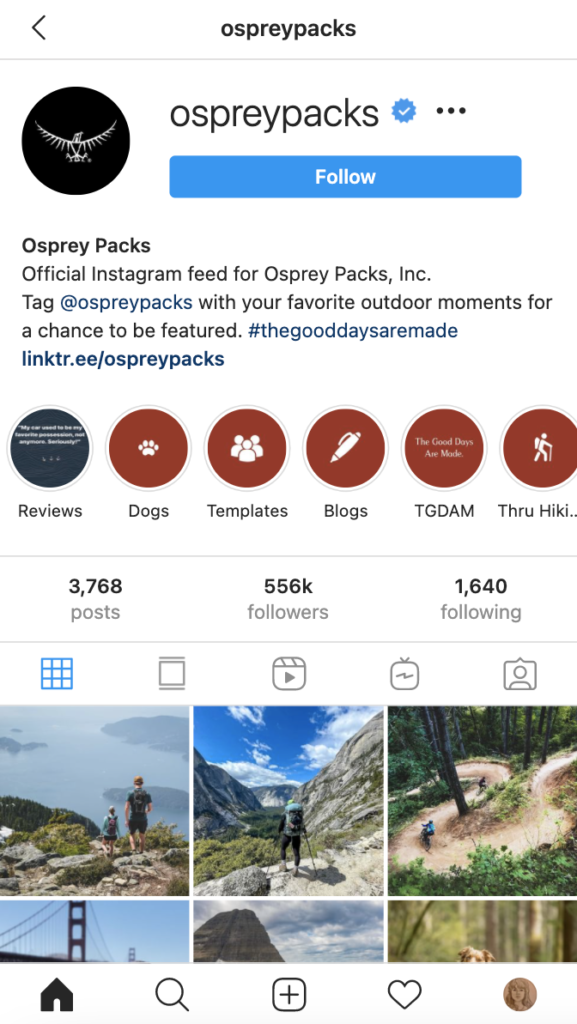

11. Add them to your Instagram Story Highlights

After you share the reviews in your Instagram Stories, save them to your Story Highlights so customers can see them forever. Here’s what to do:

- Create a Story Highlight and name it “Reviews.”

- Then, whenever you post Stories featuring reviews, save the Story to this Highlight.

Check out how Osprey Packs and Shindigz are doing it:

12. Feature reviews in your social media posts

You can also show off your reviews in your traditional social media posts, like Healthy Choice does. We love how they paired the review with a delicious photo of one of their meals!

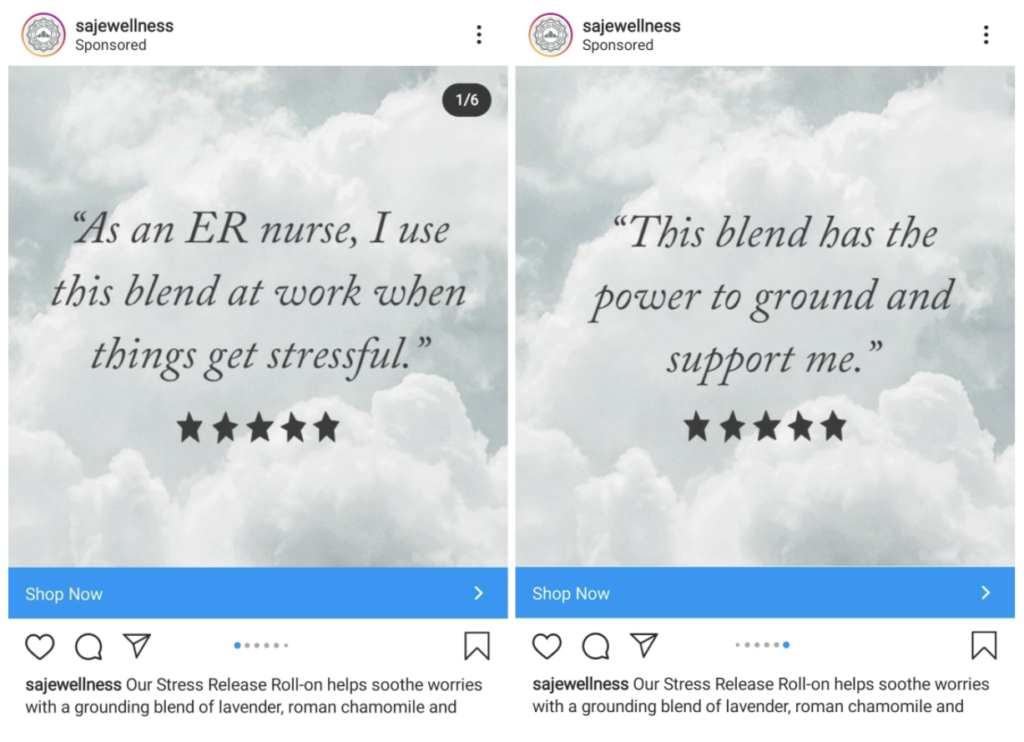

13. Give your ads a boost

Reviews sell, so why not include them in the content you’re creating specifically to sell? (We’re talking about social media ads.) Saje Wellness shows how it’s done:

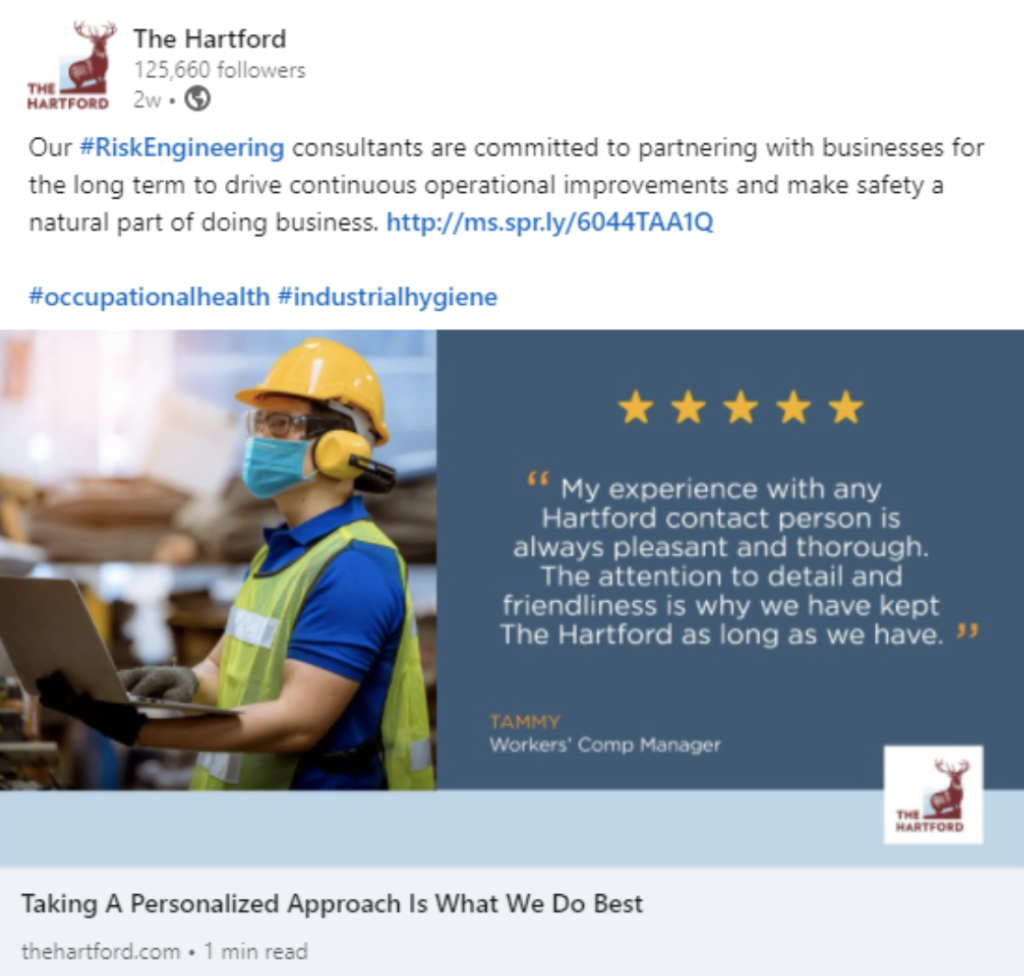

14. Highlight reviews on LinkedIn

That’s right. You can even use reviews on LinkedIn. Just take a cue from The Hartford.

Insurance can be a dry topic, but they keep it interesting by using reviews in their social media posts. They replace the auto-generated thumbnails for their LinkedIn posts with a positive customer review instead.

The five gold stars capture attention on the busy news feed and get people to read their reviews. Brilliant!

Other marketing communication

Our clients have even found creative ways to leverage reviews in their other marketing communications, including print communications and product packaging. Check it out.

15. Go from online to offline

Customer reviews offer more context to your product descriptions. Consider how you can incorporate them into your print catalogs and marketing materials.

This example from Trek Bikes is fantastic because it leverages social proof in two forms: industry awards and customer reviews.

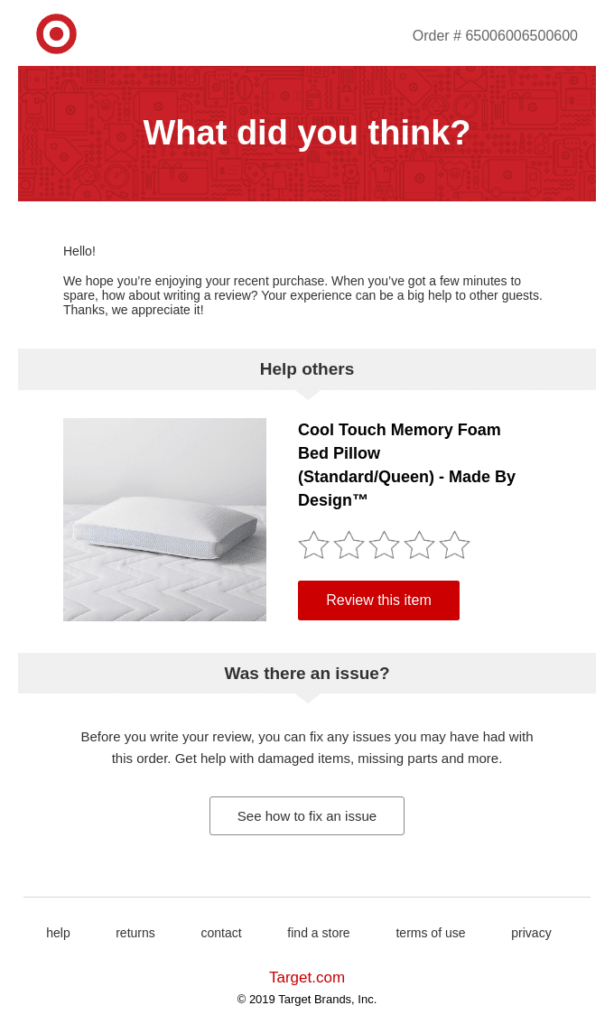

16. Add reviews to product packaging

Make your product packaging multipurpose: highlight customer satisfaction while also boosting review volumes at the same time. Here’s an example from Derma E.

On the front side of their product insert, they include a QR code asking recipients to leave a review. On the flipside, they feature a positive review alongside instructions for using the product.

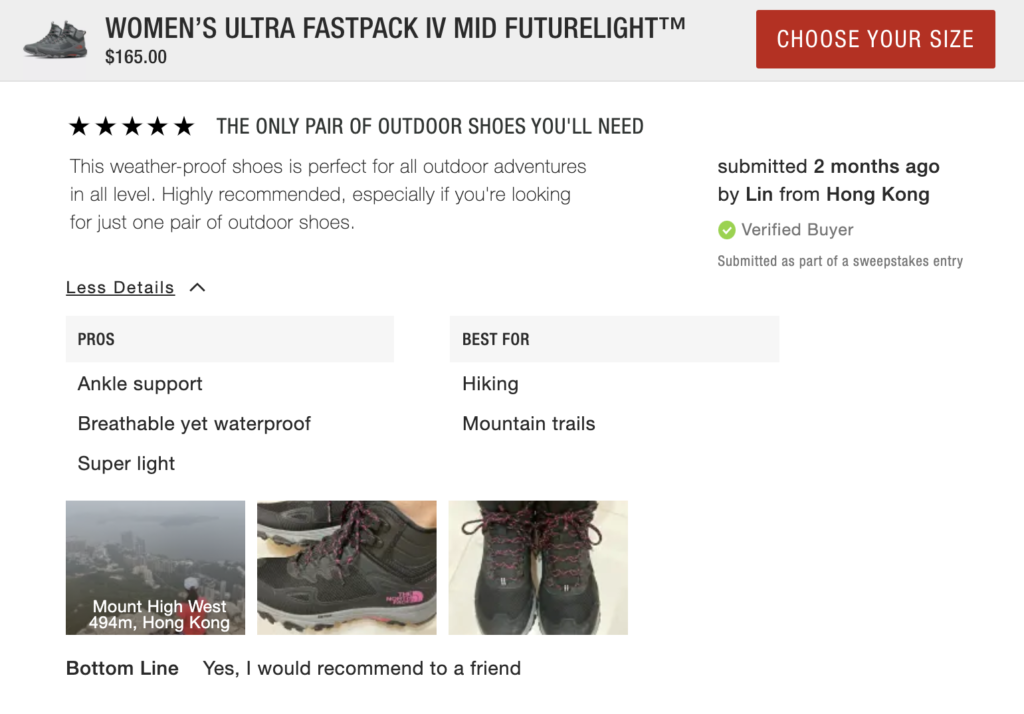

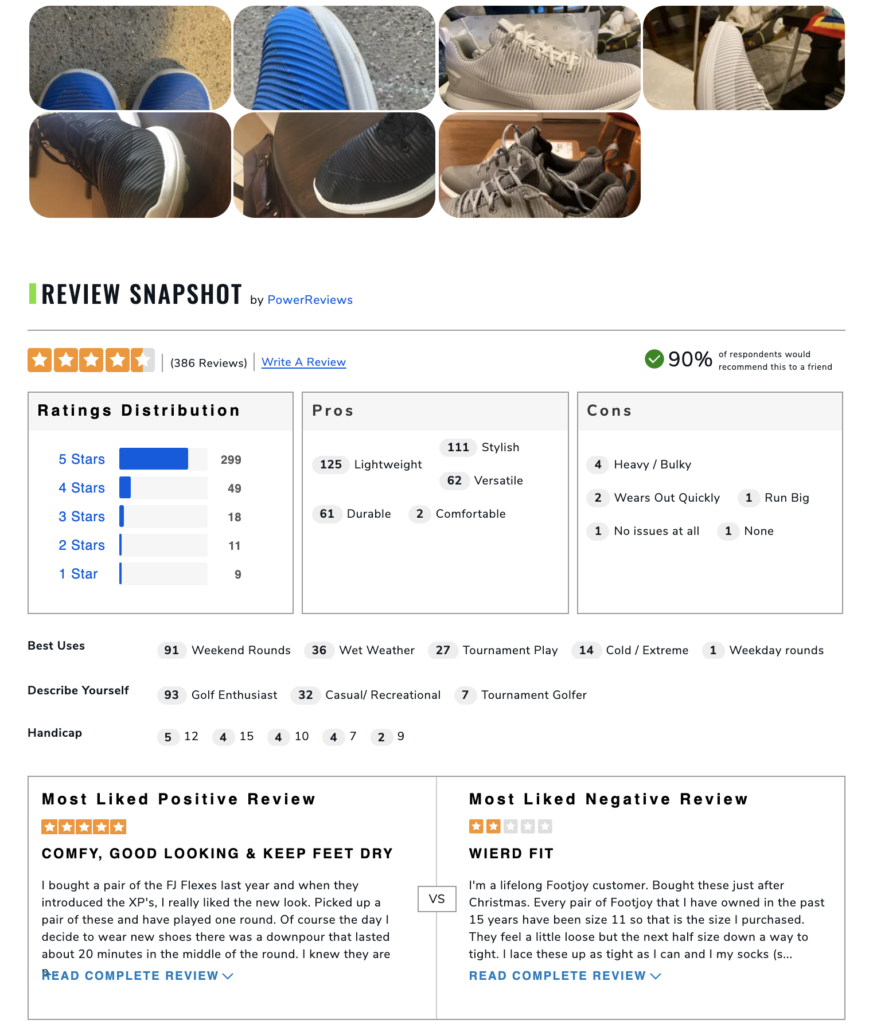

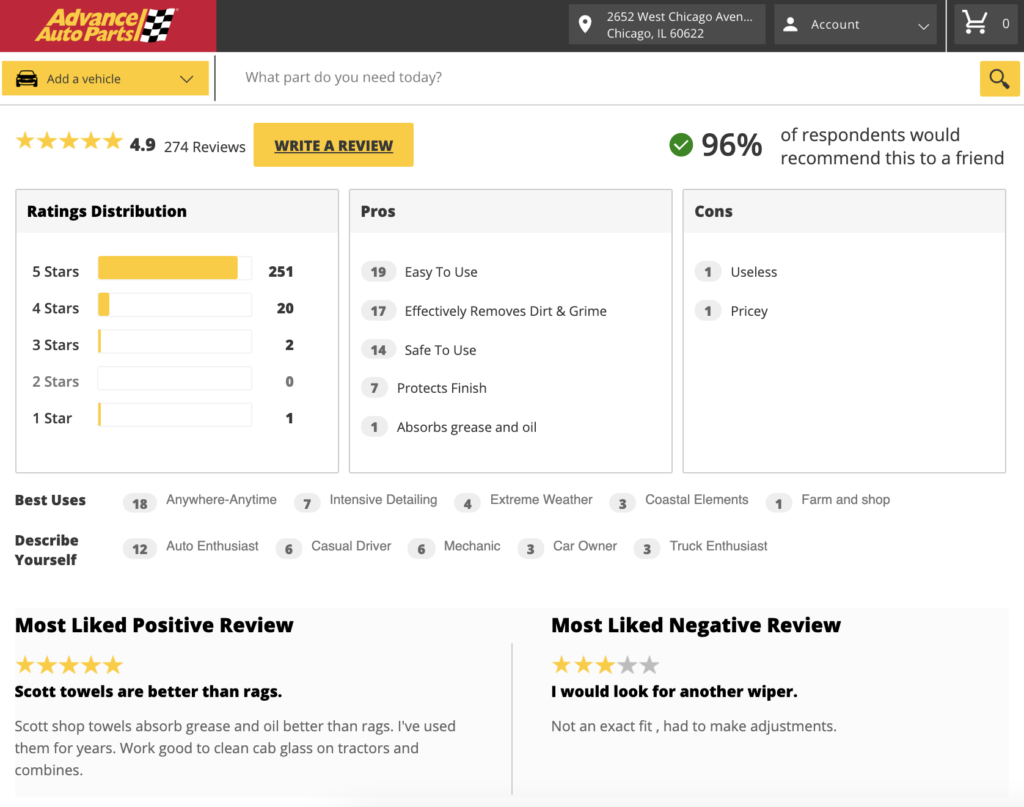

17. Augment with more specific directional detail

If you have extra space, give customers additional information to guide them in their research.

Hook them in with glowing review content, and then provide specific detail to help them identify whether the product is right for them (e.g. key specs like product dimensions or top-rated use cases). Here’s an example from Topo Athletic.

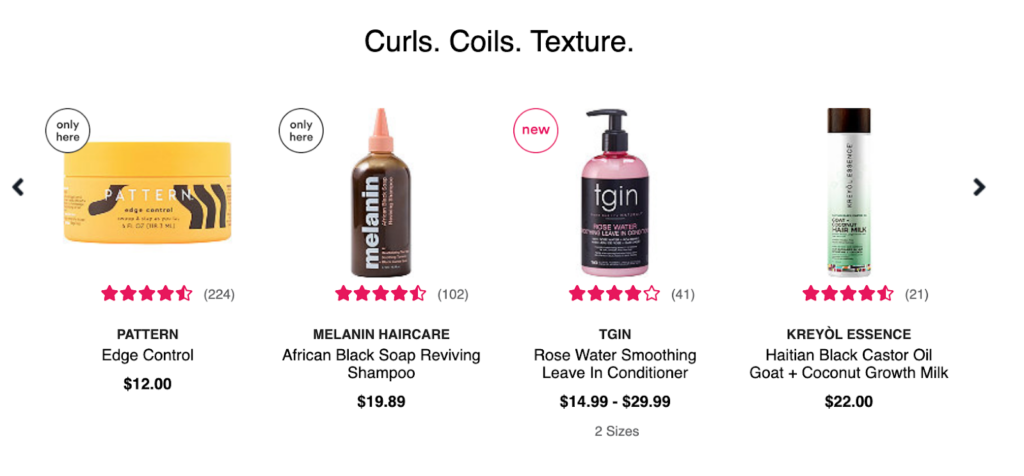

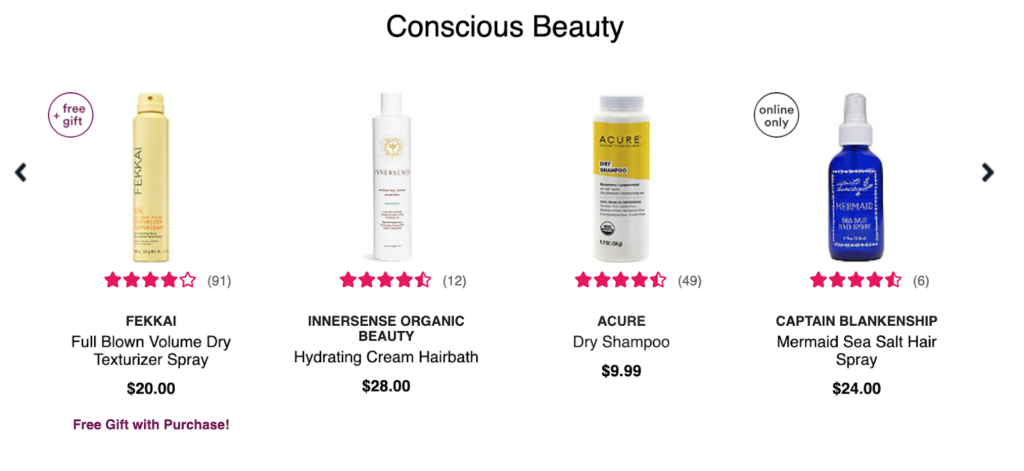

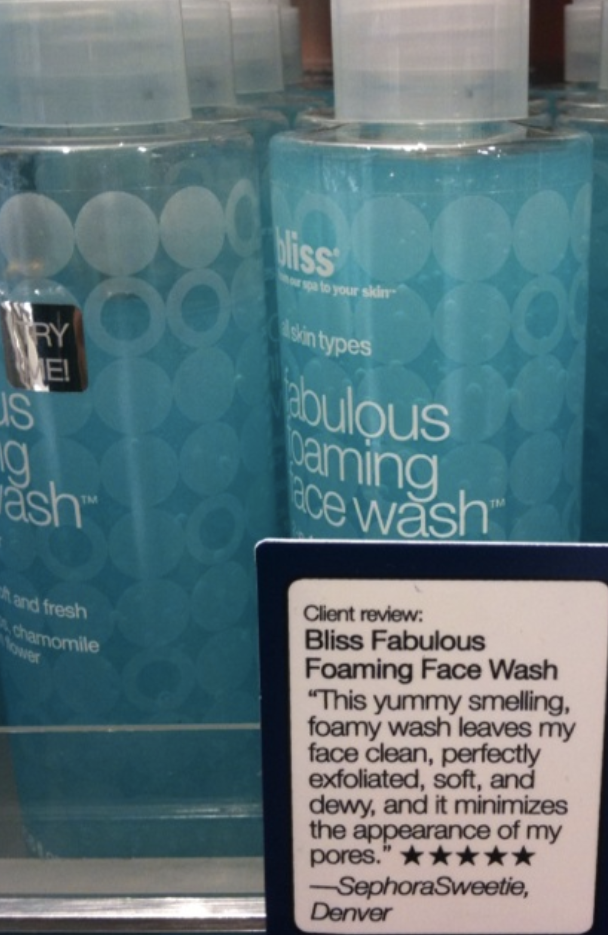

In-store

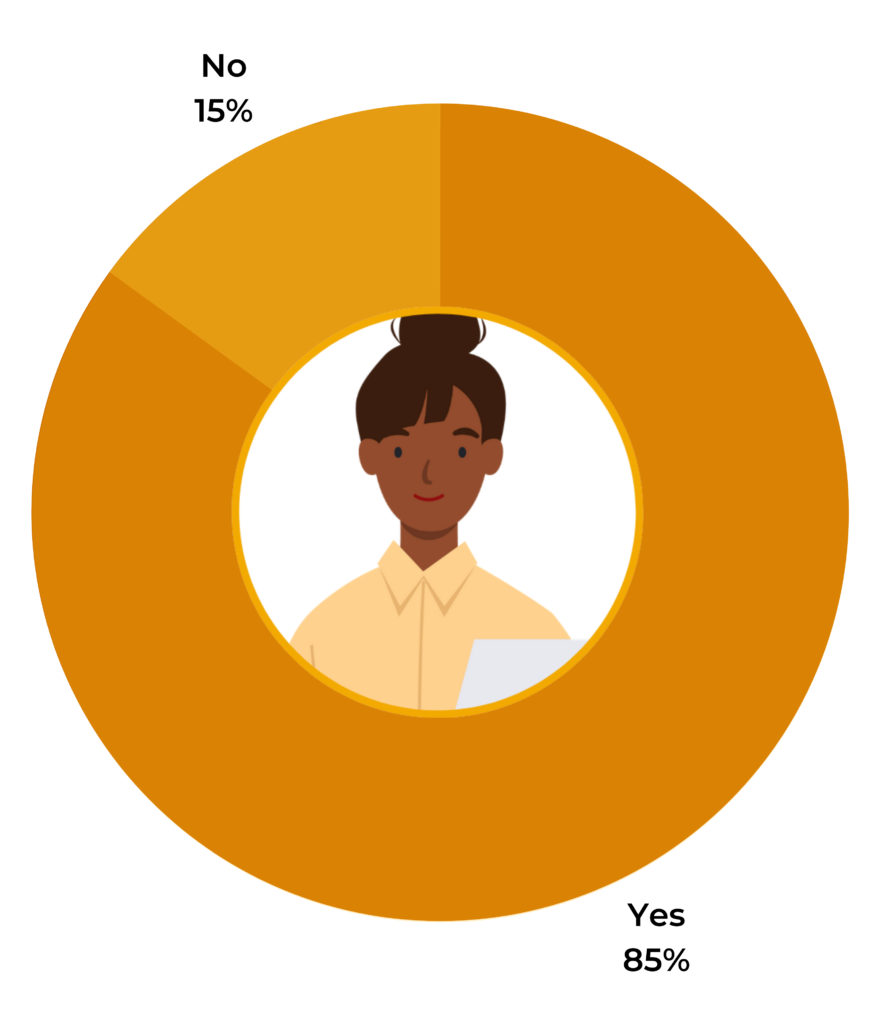

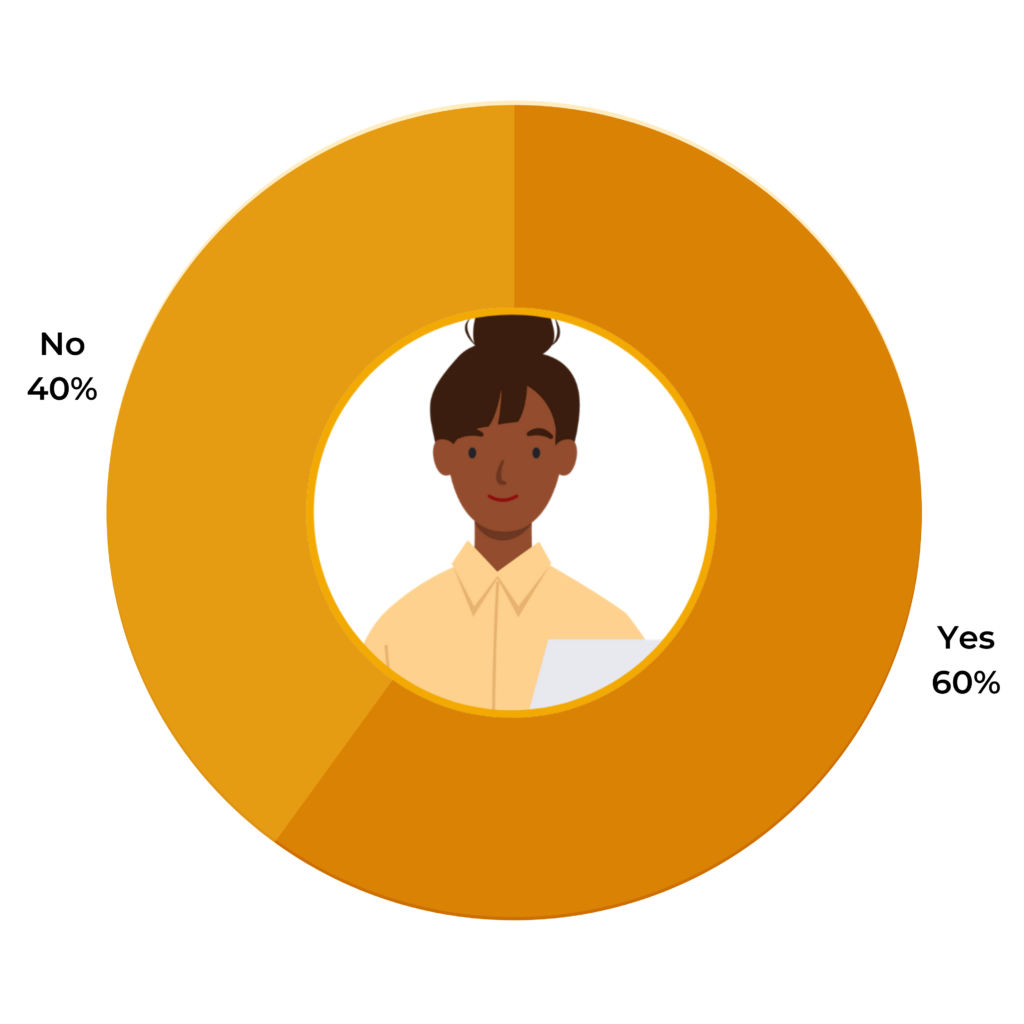

Did you know 70% of consumers want to access product ratings and reviews while they’re in store? Here’s how to give the people what they want.

18. Stand out in the product aisle

NYX Cosmetics includes star ratings in their standup display at a Target. The star icons arrest attention, and instantly convey that your product is trusted by shoppers.

19. Display reviews on the shelf

Instead of listing out product benefits generated by their marketing team, Benefit Cosmetics displays stats generated from real people, like “94% said eyes look more wide open”

20. Use a QR code

You can only fit so many reviews on a shelf display. Invite shoppers to read more reviews by scanning a QR code. Just follow this example from Sensodyne.

21. The product itself

Finally, you can always include reviews in the spot that’s so obvious you might have missed it — the product itself! Here’s an example from Yeti:

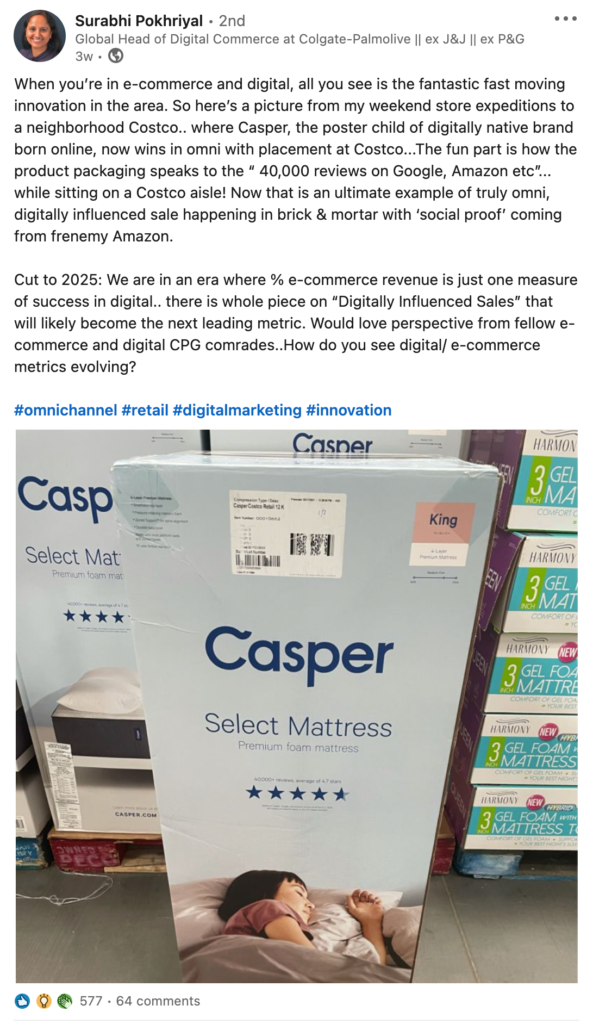

This example I found in a post by Surabu Pokhriyal, Global Head of Ecommerce at Colgate Palmolive, on LinkedIn. This was from her own personal shopping experience in Costco – she actually provides a super interesting take on this in terms of the blurring of store and digital channels and how they work together in the customer journey.

But from a reviews perspective, I love the way the packaging cites 40,000 reviews from a range of different locations. This builds exceptional credibility.